NFT Asset Management: 7 Powerful Ways to Avoid Costly Mistakes

Navigating the New Frontier of Digital Collectibles

NFT asset management refers to the tools, strategies, and practices used to securely store, track, and optimize a portfolio of non-fungible tokens. If you’re looking to manage your NFT assets effectively, here’s what you need to know:

- Definition: A system for organizing, securing, and maximizing the value of NFT holdings

- Key Components: Wallets, portfolio trackers, security protocols, and marketplace integrations

- Primary Benefits: Improved security, simplified tracking, and optimized investment decisions

- Common Challenges: Multi-chain complexity, valuation difficulties, and security risks

The market for NFTs has experienced remarkable growth, with the cap hitting $430 million by March 2021—a staggering 1,785% increase since the beginning of that year. Despite this explosive growth, managing these unique digital assets comes with distinct challenges that traditional investment platforms simply weren’t designed to handle.

Unlike conventional cryptocurrencies such as Bitcoin or Ethereum, NFTs represent ownership of specific items—digital art, collectibles, virtual real estate, and more. Each token has its own unique characteristics, history, and potential utility that must be tracked individually. This uniqueness is precisely what makes NFT asset management both challenging and necessary.

As creators and brands explore this new frontier, the need for specialized management solutions becomes increasingly apparent. Without proper systems in place, tracking provenance, monitoring value fluctuations, and maintaining security across multiple blockchains can quickly become overwhelming.

I’m Samir ElKamouny from Avanti3, and I’ve helped numerous businesses implement effective NFT asset management strategies that transform digital tokens from speculative holdings into valuable, strategically managed assets that build community and drive revenue.

Quick look at NFT asset management:

– Digital asset management

– Innovative digital assets

– Interactive brand experiences

What Is NFT Asset Management?

Think of NFT asset management as the art and science of taking care of your digital treasures. It’s like having a sophisticated system for your physical art collection, but for those unique tokens living across various blockchains.

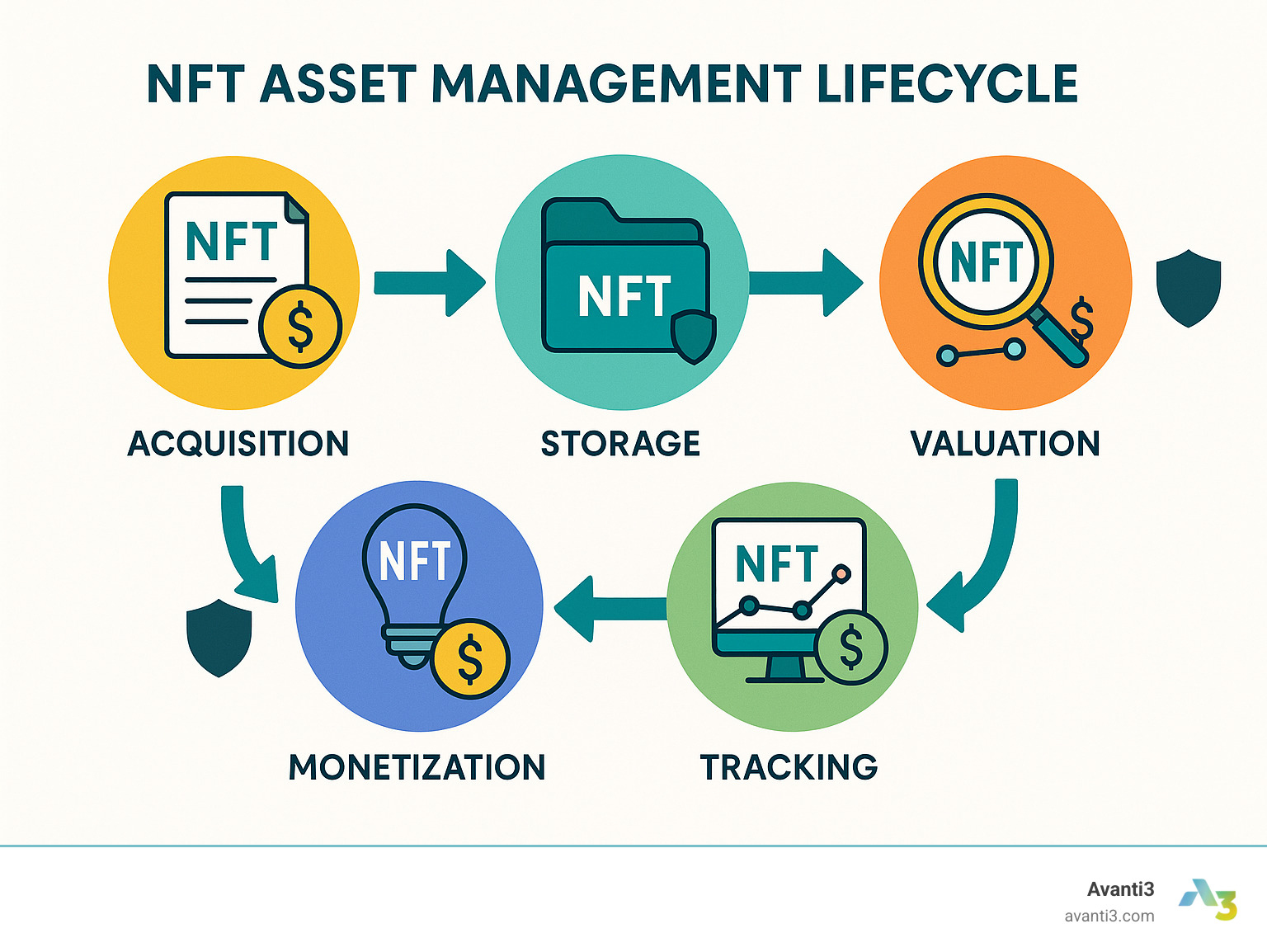

At its heart, NFT asset management is about keeping track of your digital assets throughout their entire journey—from the moment you acquire them to when you eventually sell or transfer them to someone else.

Unlike regular cryptocurrencies where one Bitcoin is identical to another, NFTs are unique snowflakes. Each has its own story, characteristics, and even different technical foundations (like ERC-721 or ERC-1155 standards). This uniqueness is what makes managing them both fascinating and challenging.

Good NFT asset management involves several key elements:

First, there’s portfolio oversight—knowing exactly what you own across multiple wallets and blockchains. It’s surprisingly easy to forget about that random NFT you bought on a whim six months ago!

Then there’s understanding the token standards that govern your digital assets. Think of these as the DNA of your NFTs, determining what they can and can’t do.

Provenance verification is crucial too—maintaining clear records of where your NFT came from and who owned it before you. This history often affects an NFT’s value and authenticity.

With NFTs living on different blockchains like Ethereum, Solana, and Tezos, multi-chain coordination becomes essential. Each blockchain has its own quirks and features that affect how you manage your assets.

And let’s not forget security protocols. With the average NFT price having dropped nearly 70% from its peak in 2021, protecting your valuable assets from theft and fraud isn’t just nice—it’s necessary.

Behind every NFT is a smart contract—self-executing code that automatically enforces rules when certain conditions are met. Understanding these contracts is fundamental to effective NFT asset management, especially when dealing with royalties or fractional ownership.

Why NFT Asset Management Matters for Investors & Brands

For investors navigating the wild NFT marketplace, proper NFT asset management is like having a compass and map in uncharted territory.

The NFT market has seen breathtaking growth—1,785% in early 2021 alone. But with great growth comes great volatility. Remember when that single NFT sold for $91.8 million? Yet many collections that were once hot have since cooled dramatically. This boom-bust cycle makes professional management not just helpful but essential.

Good management helps investors track floor prices in real-time, understand how rare their NFTs truly are, and get alerts when the market makes significant moves. It also helps calculate those creator royalties (typically around 5%) that might affect your profits when selling.

For brands, NFT asset management serves a different but equally valuable purpose. It’s about:

Building stronger connections with customers through token-gated experiences and exclusive content. Imagine offering your most loyal fans access to special events or merchandise just because they hold your brand’s NFT.

Creating innovative loyalty programs that track how customers interact with your digital assets. These programs can offer rewards that feel more personal and engaging than traditional points systems.

Developing new revenue streams by monitoring secondary sales royalties. Every time your NFT changes hands, you can earn a percentage—if you’re tracking it properly.

Understanding your community better by analyzing holder data to inform your marketing strategies. Who are your biggest fans? What do they value? Good management provides these insights.

The financial impact speaks for itself—brands with proper NFT management have generated over $130 million in revenue through NFT sales and campaigns.

Core Components of an NFT Asset Management System (TMS)

A robust NFT Token Management System (TMS) brings together several critical pieces:

Wallet integration connects your system securely to various wallet types, whether that’s MetaMask, Coinbase Wallet, or hardware wallets like Ledger. This creates a seamless experience across your entire digital asset portfolio.

Cloud dashboards provide user-friendly interfaces where you can visualize and manage your collection from anywhere with an internet connection. No more jumping between different platforms to see what you own.

Analytics modules track the issuance, redemption, and location of tokens, giving you powerful insights into performance and trends. These tools help answer questions like “Which of my NFTs are gaining value?” or “Where are my collectors located?”

Escrow holders add an extra layer of security by verifying transactions before they’re completed. Think of them as a trusted middleman ensuring everything goes according to plan.

QR redemption systems bridge the gap between physical experiences and digital tokens. Imagine attending an exclusive event by simply scanning a QR code that verifies you own a specific NFT.

The best systems—like what we’ve built at Avanti3—don’t just look at on-chain data (what’s happening on the blockchain) but also incorporate off-chain information like marketplace activities and social media sentiment. This comprehensive approach gives you the full picture of how your NFTs are performing and where opportunities might lie.

A complete TMS makes it possible to create, issue, transfer, redeem, and trade NFT tokens through built-in exchanges, all while providing real-time analytics that help you make smarter decisions about your digital assets.

Building Your NFT Portfolio Tech Stack

Creating a solid foundation for your NFT asset management journey doesn’t have to be overwhelming. Think of it like building your dream home – you need the right tools, secure locks, and smart connections to make everything work seamlessly together.

Choosing the Right Wallet & Custody Model for NFT Asset Management

The first big decision in your NFT asset management journey is who holds the keys to your digital kingdom. This choice shapes everything that follows:

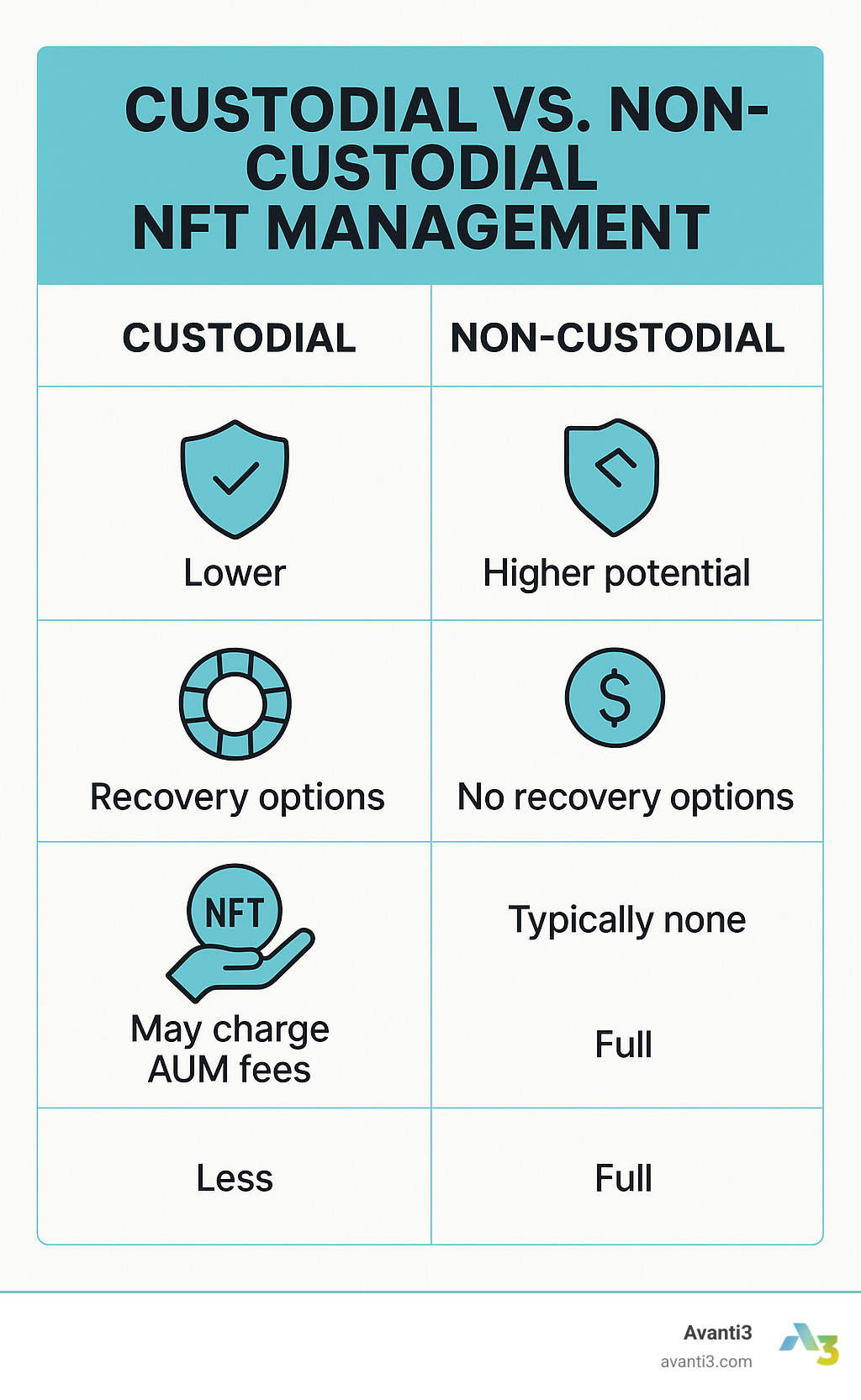

When you opt for a custodial solution, you’re essentially handing your house keys to a trusted friend. These services manage your private keys for you, offering peace of mind with password recovery options if you forget your credentials. Many include insurance against theft, which is reassuring when you’re building a valuable collection. The tradeoff? They typically charge fees based on your assets under management. Popular options include certain exchange wallets and specialized NFT platforms.

On the flip side, non-custodial solutions put you firmly in control. You hold your private keys – no middlemen involved. This approach offers potentially stronger security, but remember: with great power comes great responsibility. If you lose those keys, there’s no recovery option. The upside? You’ll generally avoid those asset-based fees. MetaMask and hardware wallets like Ledger are popular choices here.

For those seeking improved security, consider these advanced approaches:

Multi-Party Computation (MPC) custody feels like splitting your house key into pieces and giving them to different trusted friends – no single person can enter alone. Platforms like atato Custody use this technology to provide bank-grade security without making access complicated.

Multi-signature (Multisig) wallets require multiple approvals for transactions – perfect for corporate NFT asset management. It’s like requiring both you and your business partner to sign off before any money leaves the company account.

Hardware wallets provide cold storage by keeping your private keys offline – imagine storing your valuables in a safe rather than leaving them on the kitchen counter. These physical devices connect to your computer only when needed, significantly reducing exposure to online threats.

Your choice ultimately depends on your comfort with technology, the value of your collection, and how you plan to use your NFTs. Valuable collections generally warrant hardware wallet storage with multisig capabilities, while smaller collections might be perfectly secure with software wallets.

Integrating Marketplaces, Wallets & DeFi Protocols

A truly effective NFT asset management system connects all the places where your digital assets live and work:

Marketplace Connectors bring everything together, allowing you to browse OpenSea, place bids on Rarible, or check out Magic Eden – all without jumping between different tabs and platforms. It’s like having a universal remote for your entire NFT collection.

API Bridges work behind the scenes to feed real-time data into your dashboard. These technical connections ensure you always see current values, listings, and opportunities across all platforms where your NFTs exist.

DeFi Protocol Integration open ups new possibilities for your NFTs beyond just collecting. Your digital art or collectibles can work for you through staking in liquidity pools, serving as collateral for loans, or participating in yield farming with NFT-backed tokens. This turns static collections into dynamic financial tools.

At Avanti3, we’ve built solutions that tie together multiple marketplaces and DeFi protocols, giving our clients a unified command center for their entire NFT ecosystem. This integration is essential for comprehensive NFT Marketplace Development that supports sophisticated asset management.

Your risk tolerance should guide your tech stack decisions. Just like you wouldn’t keep your life savings under a mattress or invest it all in a single stock, your NFT portfolio deserves a thoughtful approach to custody and management that matches your unique needs.

Best Practices for Securing, Tracking & Valuing NFTs

Let’s talk about how to keep your digital treasures safe and growing in value. NFT asset management isn’t just about collecting—it’s about protecting what you’ve built and understanding what it’s worth.

Security Best Practices

Protecting your NFT collection starts with solid cybersecurity habits. Think of your digital wallet like your home—you wouldn’t leave the doors open uped, right? Use unique passwords for every platform (I know, it’s a pain, but it’s worth it), and always enable two-factor authentication. For serious collectors, consider having a dedicated device just for your high-value NFT transactions.

Your private keys are essentially the master keys to your digital kingdom. Store your seed phrases offline—I like to use metal backups that won’t burn or fade—and split them between different physical locations. And please, never share these digitally, no matter how trustworthy the person seems.

If your collection has grown beyond $10,000 in value, it’s time to consider a hardware wallet. These little devices might seem expensive at first, but they’re a tiny fraction of what you’re protecting.

The NFT insurance market is also evolving quickly. Several companies now offer policies specifically for NFT theft protection. Just be sure to read the fine print and document your collection thoroughly—screenshots of your holdings can be invaluable if you ever need to file a claim.

Tracking Methods

NFT asset management becomes so much easier with a good tracking system. A comprehensive portfolio dashboard should show you everything you own across multiple blockchains, alert you when prices make significant moves, and help you monitor the floor prices of your collections.

The tax implications of NFT trading catch many collectors by surprise. Keep detailed records of every purchase and sale, including the cost basis and those pesky gas fees. Your future self will thank you when tax season arrives!

Valuation Approaches

Valuing NFTs is both art and science. Rarity tools help you understand how your asset compares to others in its collection. Is your NFT one of only three with a specific trait combination? That matters for value.

The most sophisticated NFT asset management platforms now incorporate machine learning to predict price movements. These AI systems analyze thousands of data points—from trait rarity to social media buzz—to estimate where values might be heading.

When assessing an NFT’s value, consider the creator’s reputation (a Beeple piece has different value dynamics than an unknown artist), the scarcity mechanics, utility beyond the artwork itself, and the strength of the surrounding community. A vibrant, engaged community often signals long-term value potential.

At Avanti3, we’ve developed valuation models that blend on-chain data with social sentiment analysis, giving our clients a more complete picture of their collection’s worth.

NFT Asset Management Mistakes to Avoid

Even seasoned collectors make mistakes. Phishing attempts are rampant in the NFT space—always double-check marketplace URLs before connecting your wallet, and view every unexpected airdrop with healthy skepticism.

Gas fees can eat into your profits if you’re not careful. I’ve saved thousands by simply timing my non-urgent transactions for low-congestion periods. Layer-2 solutions can also dramatically reduce these costs if you’re an active trader.

Creator royalties are a beautiful aspect of NFTs—artists can earn from secondary sales, unlike traditional art. Factor these royalties (typically 5-10%) into your profit calculations, and consider supporting platforms that honor these royalties.

Don’t forget about the metadata! Your beautiful NFT might just be pointing to a file on a centralized server. If that server goes down, you could be left with a broken link instead of art. Solutions using decentralized storage like IPFS offer better long-term security.

NFT asset management gets especially tricky when you’re dealing with multiple blockchains. Each has its own security considerations, fee structures, and marketplace dynamics. What works on Ethereum might not apply to Solana or Tezos.

Analytics & Reporting Tools That Drive Decisions

Smart collectors make data-driven decisions. Real-time floor price tracking across marketplaces helps you spot buying opportunities or know when it might be time to sell. Portfolio performance analytics show you which collections are performing well and which might be dragging down your returns.

Tax reporting tools are worth their weight in gold. They can automatically generate the transaction histories you need for tax compliance, calculate your capital gains, and often integrate directly with popular tax software.

Don’t underestimate the power of social sentiment analysis. The value of many NFTs is tied closely to community perception. Tools that track mentions and engagement across social platforms can help you spot emerging trends before they impact prices.

These analytics capabilities are core to the NFT Engagement Tools we’ve built at Avanti3. We believe that informed collectors make better decisions, and better decisions lead to stronger portfolios.

Future Trends, Regulations & Innovations

The world of NFT asset management is evolving at breakneck speed, opening exciting new frontiers for collectors and brands alike. Let’s peek into what’s coming around the corner!

Emerging Ownership Models

Remember when owning high-value art was only for the ultra-wealthy? Those days are fading fast. Fractional ownership is democratizing access to premium NFTs by letting multiple investors own pieces of valuable assets. Instead of needing millions to own a Beeple, you might soon own 1% of one alongside hundreds of other collectors. This creates fascinating new communities but also introduces challenges around governance and profit-sharing.

Decentralized Autonomous Organizations (DAOs) are taking collective ownership to the next level. These digital collectives use blockchain voting systems to make decisions about jointly-owned NFT portfolios. Imagine being part of a group that decides together whether to buy that rare CryptoPunk or sell that valuable virtual land parcel. DAOs represent a fundamental shift from individual to community-based NFT asset management.

Technical Innovations

Gone are the days when NFTs were static images. Dynamic NFTs that evolve based on real-world events or external data are capturing collectors’ imagination. Think of a digital sports card that updates with player statistics, or artwork that changes with the weather. These evolving assets require more sophisticated tracking systems that can display state changes and history in real-time.

Environmental concerns about blockchain energy usage are being addressed through carbon-friendly chains. Proof-of-stake networks like Ethereum 2.0 and layer-2 solutions dramatically reduce the carbon footprint of NFT transactions. At Avanti3, we’re committed to helping our clients steer toward more sustainable NFT asset management practices that align with broader environmental goals.

Regulatory Developments

The regulatory landscape is rapidly taking shape, with the big question being: when is an NFT actually a security? Regulators worldwide are applying frameworks like the Howey Test to determine if certain NFTs—particularly those with profit-sharing or fractionalized ownership—should fall under securities regulations.

Research on NFT regulations shows that compliance requirements are evolving globally, with each country taking its own approach. Soon, NFT asset management might include navigating:

- KYC verification for high-value transactions

- Anti-money laundering protocols for marketplace activities

- More stringent tax reporting for creators and traders

- Formalized intellectual property rights enforcement

We’re constantly monitoring these developments at Avanti3 to ensure our solutions stay ahead of regulatory changes, keeping your digital assets both compliant and secure.

Multi-Chain & Cross-Platform NFT Asset Management

Remember when managing NFTs meant just watching your Ethereum wallet? Those simple days are behind us. Today’s collectors often own assets across Ethereum, Solana, Tezos, Flow, and more. Effective NFT asset management now requires a holistic approach to cross-chain portfolio visualization.

Interoperability is becoming essential as collectors need to track assets across multiple blockchains, monitor bridges for tokens in transit, and apply appropriate security protocols for each network’s unique architecture. Gas optimization becomes more complex but also more important when managing assets across chains with varying fee structures.

Layer-2 solutions and rollups are making transactions faster and cheaper on popular NFT blockchains. While these scaling solutions create opportunities for more efficient portfolio management, they add another layer of complexity to tracking and security protocols.

The future of NFT asset management will likely feature unified dashboards that seamlessly track assets across dozens of blockchains. Imagine AI-powered tools that suggest the perfect time to mint, buy, sell, or transfer based on gas prices, market conditions, and your personal goals—all from a single interface that handles the complexity for you.

At Avanti3, we’re building these next-generation tools today, helping collectors and brands steer the increasingly complex multi-chain NFT ecosystem with confidence and ease.

Frequently Asked Questions about NFT Portfolios

What risks are unique to NFT asset management?

When diving into digital collectibles, you’ll face challenges that traditional investors rarely encounter.

Smart contract vulnerabilities represent one of the biggest concerns in NFT asset management. Think of smart contracts as the digital foundation your NFT is built upon – if there’s a crack in that foundation, your entire asset could be at risk. Before making significant investments, it’s worth having these contracts professionally audited, much like you’d inspect a house before buying it.

The illiquidity of NFT markets can also catch newcomers by surprise. Unlike stocks or cryptocurrencies that trade 24/7, many NFTs have thin markets with few buyers. You might own a digital masterpiece, but without interested buyers, its practical value remains locked up. This is why diversifying across collections with different liquidity profiles is such a smart move – you’re not putting all your digital eggs in one basket.

Intellectual property questions hover over many collections too. Who actually owns the rights to the artwork in your NFT? The creator? The platform? You? These uncertainties can dramatically impact value, making thorough IP due diligence an essential part of proper NFT asset management.

There’s also the issue of digital permanence. Your NFT might be forever recorded on the blockchain, but what about the artwork it points to? NFTs that link to centralized servers risk losing their associated media if those servers ever go offline. It’s like owning a treasure map where the treasure might disappear! Smart collectors verify their assets use decentralized storage solutions like IPFS.

Finally, market manipulation runs rampant in some NFT circles. Wash trading (where sellers essentially trade with themselves to create fake volume) can artificially inflate prices. Good analytics tools help you spot these suspicious patterns before you overpay.

How do I report taxes on NFT trades?

Tax season becomes a whole new trip when NFTs enter the picture! Let me walk you through the essentials of staying compliant.

First, establish your cost basis for each NFT. This isn’t just the purchase price – don’t forget to include those pesky gas fees too! This total represents your starting point for calculating gains or losses when you eventually sell.

When you do sell an NFT, you’ll need to calculate your capital gain or loss by comparing your sale price against that original cost basis. The tax rate applied to these gains depends partly on your holding period – assets held less than a year face higher short-term rates, while those held longer benefit from lower long-term capital gains rates.

Creator royalties add another wrinkle to the tax picture. In some jurisdictions, these ongoing payments to the original artist might be deductible from your capital gains, potentially lowering your tax bill.

Rather than tracking all this manually (talk about a headache!), specialized software like CoinTracker, TokenTax, or Koinly now includes NFT transaction tracking features that can save you hours of spreadsheet agony.

NFT asset management includes planning ahead for tax time. Keep comprehensive records throughout the year rather than scrambling when April approaches. And given how rapidly tax regulations around digital assets are evolving, connecting with a tax professional who understands this space is worth every penny.

Can NFTs serve as collateral in DeFi?

Yes! Your digital art collection isn’t just for looking at – it can actually work for you in the growing DeFi ecosystem.

NFT-backed loans have emerged as a fascinating option for collectors who need liquidity without selling their prized pieces. Platforms like NFTfi and Arcade connect borrowers and lenders, allowing you to use your valuable NFTs as collateral while borrowing cryptocurrency. These loans typically offer 30-50% of the NFT’s value – not quite as generous as traditional collateral ratios, but a reflection of the market’s volatility.

Beyond simple loans, some protocols now enable NFT staking, where you can earn yield simply by locking up your assets in specialized liquidity pools. It’s like earning interest on your art collection – something traditional collectors could only dream about!

Fractionalization represents another frontier, with services like Fractional.art allowing you to divide your NFT into smaller fungible tokens. These fragments can then be used across various DeFi protocols or sold to investors who want partial ownership of high-value items.

Before jumping into these opportunities, understand the risks involved. Using NFTs as collateral carries liquidation risk – if your NFT’s value drops below certain thresholds, you could lose your prized collectible. Effective NFT asset management means carefully weighing these DeFi opportunities against potential downsides, including temporary loss of access to your NFTs.

The intersection of NFTs and DeFi continues to evolve rapidly, creating new possibilities for collectors to open up value from their digital holdings while still maintaining long-term ownership – truly the best of both worlds when managed thoughtfully.

Conclusion

Let’s be honest – managing NFTs isn’t just about collecting digital art anymore. It’s evolved into something much more sophisticated, and if you’ve read this far, you’re clearly serious about doing it right!

As someone who’s helped countless clients steer these waters, I’ve seen how proper NFT asset management transforms digital tokens from risky collectibles into strategic assets that deliver real value.

The future belongs to those who can bring everything together in one place. Think about it – wouldn’t it be nice to wake up and see your entire digital portfolio at a glance? That’s why unified dashboard management has become so essential. No more jumping between different platforms just to check what you own!

Security is non-negotiable in this space. I still remember helping a client who nearly lost a six-figure NFT collection to a phishing attack. The relief in their voice when we implemented proper multi-layered protection was palpable. Your security approach should always match the value of what you’re protecting.

The most successful NFT investors I’ve worked with share one common trait – they make decisions based on data, not hype. They track floor prices, monitor community engagement, and time their moves strategically. In a market this volatile, analytics aren’t just helpful – they’re essential.

Regulations are coming (and in many places, they’re already here). Staying compliant might seem tedious now, but trust me – it’s much easier than dealing with unexpected tax bills or legal complications down the road. Being regulation-ready isn’t just smart – it’s necessary.

Perhaps most exciting is how NFTs continue connecting with new opportunities. From DeFi integration to real-world utility, the possibilities keep expanding. The NFTs that maintain their value won’t just be pretty pictures – they’ll be access keys to experiences, communities, and financial tools.

At Avanti3, we’ve built our NFT asset management solutions specifically to address these challenges. We help brands and creators transform their NFT strategies from speculative experiments into powerful engines for engagement, loyalty, and sustainable revenue.

Whether you’re managing your personal collection or implementing an enterprise-scale NFT initiative, the fundamentals remain the same: secure it properly, see it clearly, and optimize it strategically.

Ready to lift your NFT strategy? Our NFT Marketplace Development services can create solutions custom specifically to your unique needs.

The NFT journey is just beginning, and it’s those with thoughtful, comprehensive management systems who will steer the inevitable ups and downs most successfully. The digital asset revolution isn’t waiting – and with the right approach to NFT asset management, you won’t have to either.