NFT staking rewards 2025: Unlock passive income

What is NFT Staking and How Does It Work?

NFT staking rewards are earnings you collect for locking your non-fungible tokens (NFTs) in a smart contract that can put them to work on a Web3 platform. Ownership stays with you, but the protocol uses the NFT for access-gating, liquidity, or game play and compensates you in return.

Typical payouts include:

- Cryptocurrency: the platform’s native token or established coins such as ETH or SOL.

- New NFTs: bonus mints, future airdrops, or commemorative collectibles.

- Exclusive access: whitelists, memberships, or voting rights.

- Yield (APY): variable rates that rise for rarer, higher-value NFTs.

Staking turns idle collectibles into productive assets in line with the engagement solutions Avanti3 builds for brands and creators.

Think of staking as depositing art in a digital vault: you keep ownership, the vault creates value, and you receive a share. NFT staking is an emerging concept that solves the liquidity problem of non-fungible assets and introduces a passive income stream for holders.

The Core Concept of Staking NFTs

NFT staking means locking your NFTs into a protocol to earn rewards while retaining ownership—almost like DeFi yield farming, but with unique digital assets.

The Step-by-Step Staking Process

- Set up a compatible crypto wallet.

- Connect it to a staking platform.

- Select eligible NFTs.

- Approve the smart-contract transaction (gas fees apply).

- Choose a lock-up period.

- Monitor rewards on the dashboard.

- Unstake after the minimum period or when you’re ready.

NFT Staking vs. Traditional Cryptocurrency Staking

| Aspect | NFT Staking | Traditional Crypto Staking |

|---|---|---|

| Purpose | Adds utility to collectibles | Secures blockchain networks |

| Asset Type | Non-fungible tokens | Fungible tokens |

| Reward Calculation | Rarity & individual value | Uniform rate by amount staked |

| Platform Type | Project-specific | Blockchain-native |

| Liquidity | Collection-dependent | Broad token availability |

| Risk Profile | Higher volatility | More predictable |

This streamlined overview keeps the essentials while cutting repetition.

Understanding and Calculating NFT Staking Rewards

When you explore NFT staking rewards you’re really asking two questions: what can I earn, and how is that number set? Every platform has its own formula, but they all revolve around a few shared principles.

What Kind of NFT Staking Rewards Can You Earn?

- Cryptocurrency—liquid tokens you can trade or restake.

- Governance tokens—your vote in the project’s future.

- Whitelist spots & early mints—first access to new drops.

- New NFTs—bonus collectibles delivered to your wallet.

- In-game items / currency—weapons, skins, or gold in play-to-earn titles.

- Exclusive community access—private Discord channels, events, or merch.

Avanti3’s digital reward system and NFT engagement tools help creators weave these perks into compelling programs.

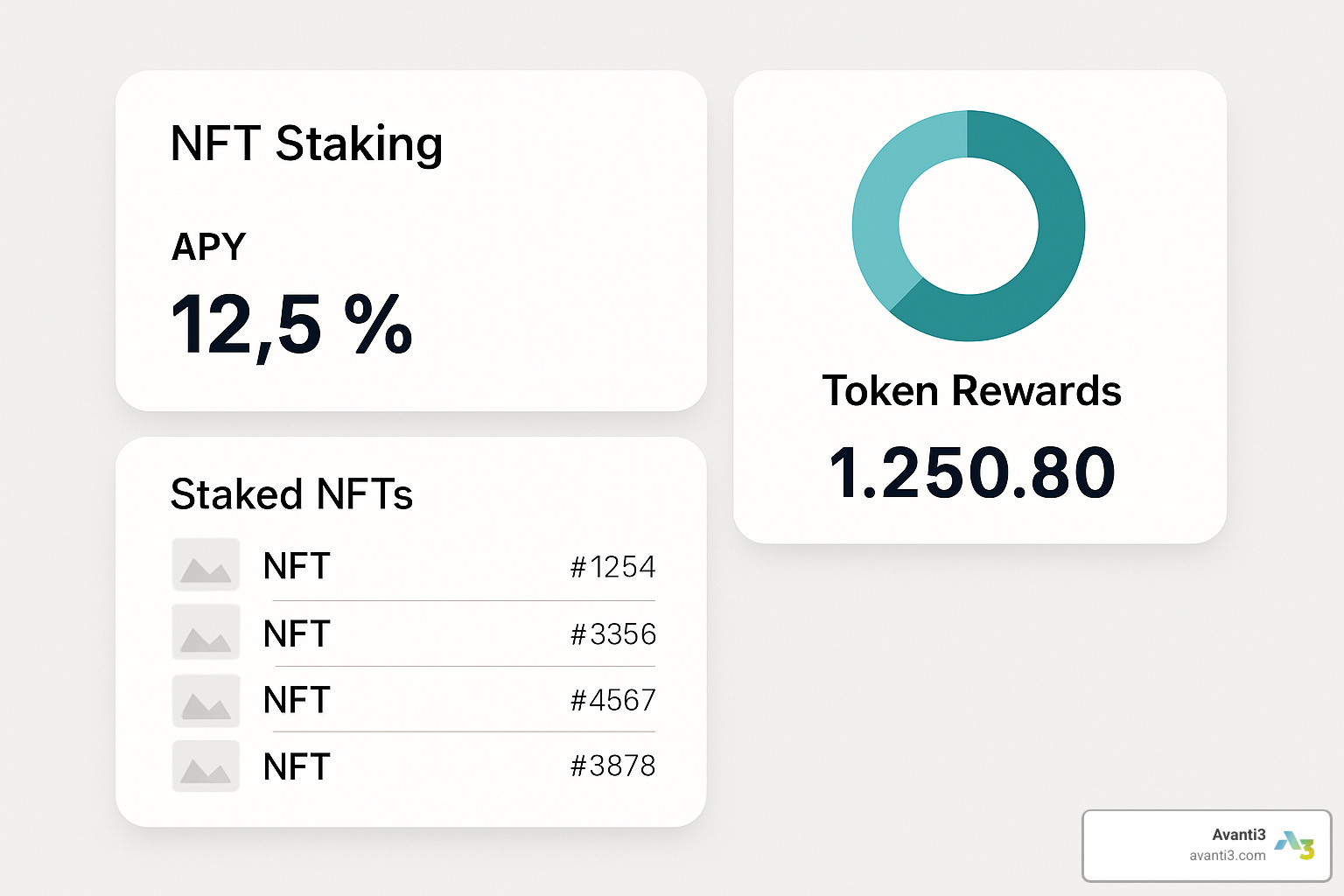

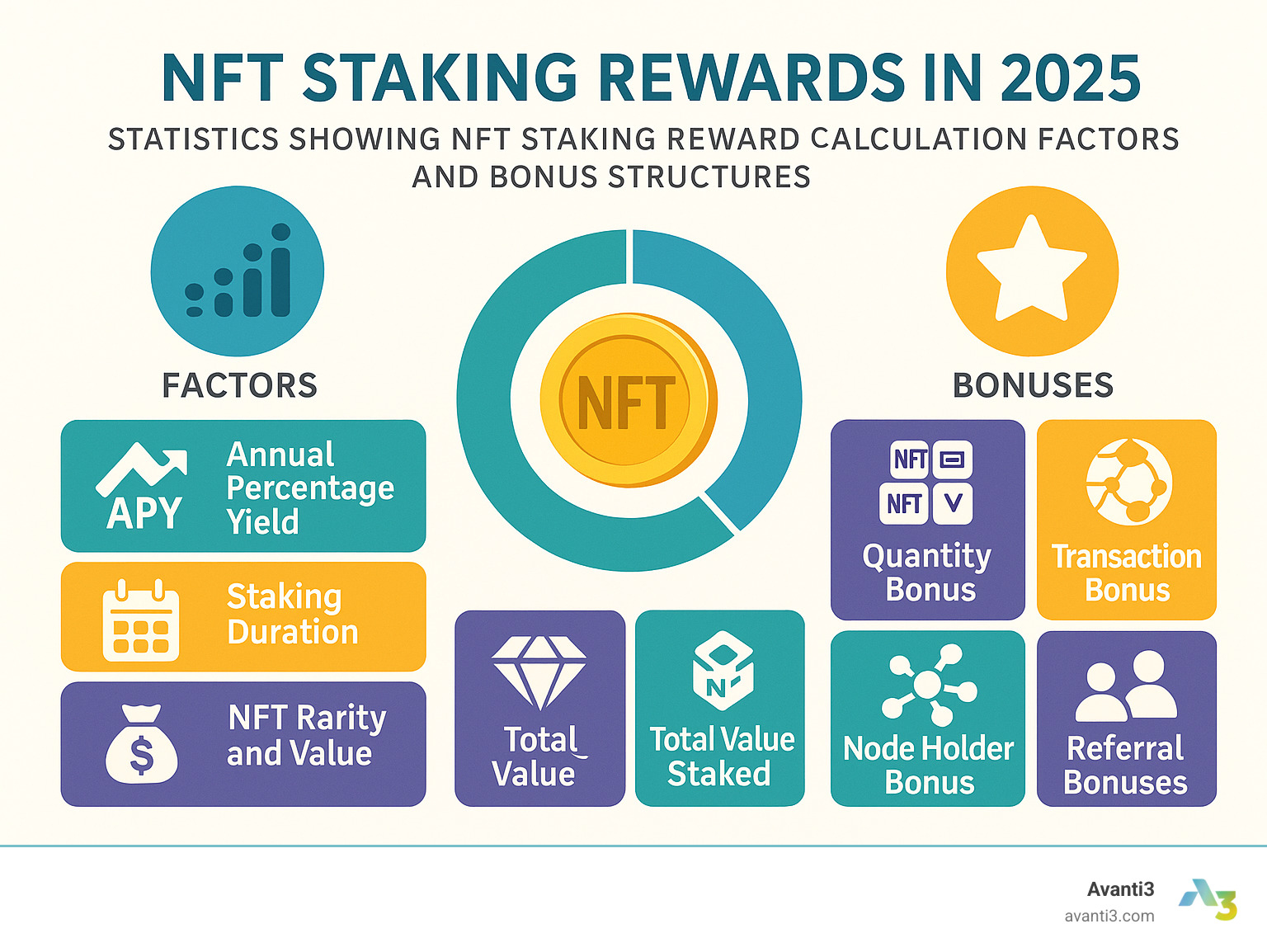

How Are NFT Staking Rewards Calculated?

- Annual Percentage Yield (APY): estimated yearly return.

- Staking duration: longer locks usually mean higher rates.

- NFT rarity & floor price: scarce or high-value pieces earn more.

- Total Value Staked (TVS): rewards are split among all participants.

- Platform bonuses: extra yield for holding multiple NFTs, transacting often, or owning special “node” tokens.

Some protocols get creative—for example, staking $888-$8,888 can add 0.88 % APY, while whale tiers above $88,888 open up 28.88 %.

Knowing which levers a platform uses lets you forecast returns and pick opportunities that match your risk profile.

Weighing the Benefits and Risks of Staking Your NFTs

Before diving into NFT staking rewards, it’s important to understand both sides of the coin. Like any investment strategy, staking your digital assets comes with exciting opportunities alongside real risks that deserve careful consideration.

Think of NFT staking as putting your digital collectibles to work for you. But just like hiring someone to manage your investments, you need to weigh whether the potential benefits outweigh the risks for your specific situation.

The Upside: Key Benefits of NFT Staking

Passive income generation is the most compelling reason people stake their NFTs. Instead of watching your digital art sit in your wallet hoping it appreciates in value, you can earn regular rewards while keeping ownership. It’s like renting out a property while still owning it.

Increased NFT utility transforms your static collectibles into productive assets. This added functionality can make your NFT collection more valuable and gives you more reasons to hold during market downturns. When your NFTs have real utility beyond just looking cool, they become harder to dismiss as mere speculation.

Improved liquidity for illiquid assets solves one of the biggest problems with NFT ownership. Since you can’t easily sell half an NFT or trade small portions, staking lets you extract value without selling your entire position. This is especially valuable if you own high-value pieces that you want to keep long-term.

Strengthening community engagement often comes as a bonus with staking programs. Many platforms grant governance rights and exclusive access to community events, creating deeper connections between holders and projects. This stronger engagement typically leads to more resilient communities that weather market storms better.

Governance participation gives you a voice in the future direction of projects you’re invested in. When you can vote on important decisions, you’re not just a passive holder – you’re an active participant in shaping the project’s success. This democratic participation can potentially increase long-term value.

At Avanti3, we understand how powerful these engagement opportunities can be. Our community loyalty programs are designed to create meaningful connections that benefit both creators and their communities, going beyond simple transactions to build lasting relationships.

The Downside: Inherent Risks to Consider

Market volatility remains the elephant in the room. NFT prices can swing wildly, with some collections losing over 90% of their value in short periods. While you retain ownership of your staked NFTs, their underlying value can fluctuate dramatically during the staking period. Your rewards might be solid, but if your NFT’s value crashes, you could still face significant losses.

Smart contract vulnerabilities represent a technical risk that many newcomers overlook. Staking requires trusting smart contracts with your valuable NFTs, and bugs or exploits in these contracts could potentially result in permanent loss of your assets. While many platforms undergo security audits, the risk never completely disappears. You can view an example of a staking smart contract to understand the complexity involved.

Platform risk means putting faith in the company or protocol managing your staked assets. If the staking platform fails, gets hacked, or simply shuts down, you could lose access to your NFTs or accumulated rewards. This concern is particularly relevant for newer or less established platforms without proven track records.

Asset illiquidity during lock-up can leave you stuck at the worst possible moment. Once staked, your NFTs are locked for a predetermined period. If market conditions change rapidly or you face a personal financial emergency, you may not be able to access your assets without significant penalties.

Impermanent loss in NFT vaults occurs when platforms pool NFTs and return different (but theoretically equivalent) NFTs when you unstake. While you receive an NFT of similar value, you might not get back the exact piece you originally staked. This can be particularly frustrating if you had emotional attachment to a specific NFT.

Early withdrawal penalties can be surprisingly harsh. Many platforms impose significant penalties for early withdrawal – some charge up to 88% of earned yield for breaking your staking commitment early. If you’ve earned substantial rewards, these penalties could actually reduce your principal below what you originally invested.

The key to managing these risks effectively is thorough research and smart diversification. Never stake more than you can afford to lose, and always verify that smart contracts have been audited by reputable security firms. Due diligence isn’t just recommended – it’s essential for protecting your digital assets in this evolving space.

Getting Started: Platforms and Popular NFTs for Staking

Ready to start earning NFT staking rewards? The exciting world of NFT staking offers opportunities across art, gaming, and collectibles. But knowing where to look and what to avoid can make the difference between success and disappointment.

Where to Find NFT Staking Opportunities

The NFT staking landscape has grown into a diverse ecosystem with opportunities everywhere you look. The key is knowing where to start your search.

Project-native staking represents the most common entry point for newcomers. These are staking opportunities built directly into NFT projects themselves. Play-to-earn games lead this category, where you can stake character NFTs, virtual land parcels, or powerful in-game items to earn game currency or open up new assets. It’s like putting your gaming gear to work while you sleep.

Art collections have acceptd staking as a way to reward loyal collectors. Many digital art projects now offer staking programs where you can earn governance tokens or get early access to future artist releases. This transforms static art pieces into active investments that appreciate your support.

Collectible projects often implement staking to reward long-term holders with exclusive benefits. These might include special edition NFTs, community privileges, or even physical merchandise. It’s their way of saying “thanks for sticking with us.”

Third-party protocols offer a different approach entirely. NFT vaults allow you to deposit NFTs from various collections into collective pools, earning a share of trading fees and platform revenues. Think of it as a mutual fund for your digital collectibles.

Cross-platform staking services accept NFTs from multiple collections and offer standardized reward structures. This can be particularly useful if you own NFTs from projects that don’t have their own staking programs.

Fan token platforms focus specifically on entertainment and sports-related NFTs. These platforms offer staking rewards in the form of fan tokens that open up voting rights, exclusive content, or merchandise from your favorite teams and celebrities.

The integration with decentralized finance (DeFi) has opened up even more possibilities. Some DeFi protocols now accept NFTs as collateral for lending or liquidity provision, creating another avenue for earning from your digital assets.

At Avanti3, we understand the importance of creating meaningful staking experiences. Our NFT engagement tools help creators build robust staking ecosystems that benefit both project founders and their communities. We also specialize in NFT digital art sales that can seamlessly integrate with staking mechanisms.

What to Look For in an NFT Project Before Staking

Before you stake your valuable NFTs, doing your homework can save you from costly mistakes. Here’s what separates the winners from the projects that disappear overnight.

Project roadmap and vision should be your first stop. Look for projects with clear, achievable goals and a long-term vision that makes sense. Projects that constantly evolve and add real utility are more likely to maintain value over time. If a roadmap looks too good to be true or lacks specific details, that’s a red flag.

Team reputation and transparency can make or break a project. Research the team behind the project thoroughly. Do they have experience in blockchain development? Have they delivered on previous promises? Transparent teams that regularly communicate with their community through social media, Discord, or development updates are generally more trustworthy than anonymous teams making big promises.

Community strength and activity often reflects a project’s health better than any marketing material. Look for engaged Discord servers with active daily conversations, regular social media interactions, and community events that people actually attend. A passionate community can carry a project through difficult times.

Tokenomics and reward structure need to make mathematical sense. Understand exactly how rewards are generated and distributed. Are they sustainable long-term, or is the project just printing tokens without underlying value creation? Projects with clear revenue streams supporting their reward systems are much more likely to succeed.

Smart contract audits are non-negotiable for serious staking. Always verify that the staking smart contracts have been audited by reputable security firms. Look for publicly available audit reports and check if any identified issues have been properly resolved. Your NFTs’ safety depends on these contracts working correctly.

Long-term value proposition separates real projects from temporary hype. Consider whether the project solves genuine problems or provides ongoing value beyond speculation. Projects with real utility and practical applications are more likely to survive market downturns.

Market performance and stability can provide clues about a project’s resilience. While past performance doesn’t guarantee future results, projects with relatively stable floor prices and consistent trading volume may present lower risks for staking.

The NFT space moves at lightning speed, and what’s popular today might be forgotten tomorrow. Diversifying across multiple projects and staying informed about market trends is essential for successful NFT staking rewards. Start small, learn from experience, and gradually increase your staking activities as you become more comfortable with the process.

Frequently Asked Questions about NFT Staking Rewards

Is NFT staking a worthwhile investment?

It can be—especially if you were already planning to hold the NFTs long term. Staking adds a passive-income layer, but market volatility and lock-up periods mean it’s not ideal for flippers or anyone who needs instant liquidity. Research the collection, understand the platform, and never stake more than you can afford to lose.

Can I lose my NFT if I stake it?

Technically you retain ownership, but risks remain. Smart-contract exploits, platform failures, or severe price drops can all wipe out value. Vault-style platforms may return a different NFT of similar value, which could matter if you’re attached to specific traits. Start small and stick to audited, reputable protocols.

Are NFT staking rewards subject to taxes?

Yes. Most jurisdictions treat staking rewards as ordinary income when you receive them, based on the fair-market value at that time. Later disposals usually trigger capital-gains calculations on any price difference. Keep detailed records of dates, values, and fees, and consult a tax professional who understands digital assets. Learn more about crypto taxes.

Conclusion: The Future of Earning with Digital Assets

NFT staking rewards have opened up a whole new world of possibilities for digital asset owners. What started as simple collectibles sitting in wallets has evolved into a sophisticated ecosystem where your NFTs can actually work for you.

The change is remarkable when you think about it. Just a few years ago, buying an NFT meant hoping it would appreciate in value. Now, you can earn passive income while holding onto your favorite pieces. This shift addresses one of the biggest criticisms of NFTs – that they were just expensive digital art with no real utility.

The evolution is just getting started. We’re seeing exciting developments on the horizon that will make NFT staking even more accessible and rewarding. Cross-chain staking will let you move your NFTs between different blockchains to find the best rewards. More sophisticated reward mechanisms are being developed that go beyond simple token payouts to include real-world benefits and experiences.

Integration with broader DeFi ecosystems means your NFTs might soon serve as collateral for loans or provide liquidity in decentralized exchanges. The possibilities are expanding rapidly, and the technology is becoming more user-friendly every day.

But here’s the reality check: success in NFT staking isn’t about chasing the highest APY or jumping on every new platform. It requires patience, research, and a healthy dose of skepticism. The space moves fast, and what looks promising today might not deliver tomorrow.

The smart approach is diversification. Don’t put all your valuable NFTs into one staking platform. Spread your risk across multiple projects and platforms. Do your homework on each project’s team, roadmap, and community before committing your assets.

At Avanti3, we understand the importance of building sustainable reward systems. Our customizable digital reward systems help creators design staking mechanisms that provide real value to their communities. We’re not just about flashy features – we focus on creating lasting engagement that benefits everyone involved.

Whether you’re a creator looking to add utility to your NFT project or a collector wanting to maximize your digital assets, understanding NFT staking rewards is becoming essential knowledge. The key is approaching it with both excitement and caution, knowing the opportunities are real but so are the risks.

The future of digital asset ownership is here, and it’s more dynamic than ever. As Web3 technology continues to mature, NFT staking will likely become as common as earning interest on a savings account. The difference is that instead of boring bank statements, you’ll be earning from your favorite digital art, game items, or collectibles.

We’re witnessing the birth of a new economy where creativity, technology, and community come together to create value in ways we never imagined. The future of earning with digital assets isn’t just about making money – it’s about building stronger connections between creators and their communities while rewarding loyalty and engagement.

The journey is just beginning, and the possibilities are endless.