NFT marketplace platforms: 10 Powerful Trends Shaping 2025

Why NFT Marketplace Platforms Are Reshaping Digital Commerce

NFT marketplace platforms are digital venues where creators mint, sell, and trade non-fungible tokens representing unique digital assets. Although branding varies, these venues generally fall into three broad categories:

- Universal marketplaces that operate like giant online bazaars and usually charge low, single-digit fees to encourage high-volume trading.

- Curated art galleries that accept only a fraction of artist applications to maintain scarcity and grant higher perpetual royalties.

- Gaming & multi-chain hubs engineered for real-time, low-fee transactions on high-throughput or Layer-2 blockchains, often integrating directly with game engines.

The NFT marketplace landscape has evolved dramatically since 2017. What started as experimental digital collectibles has grown into a $7.4 billion market with hundreds of thousands of active users engaging daily across a variety of platforms.

The “boom-bust-build” cycle of 2021-2024 has separated serious platforms from purely speculative experiments. Today’s survivors focus on real utility—from gaming assets and music rights to membership tokens and brand experiences.

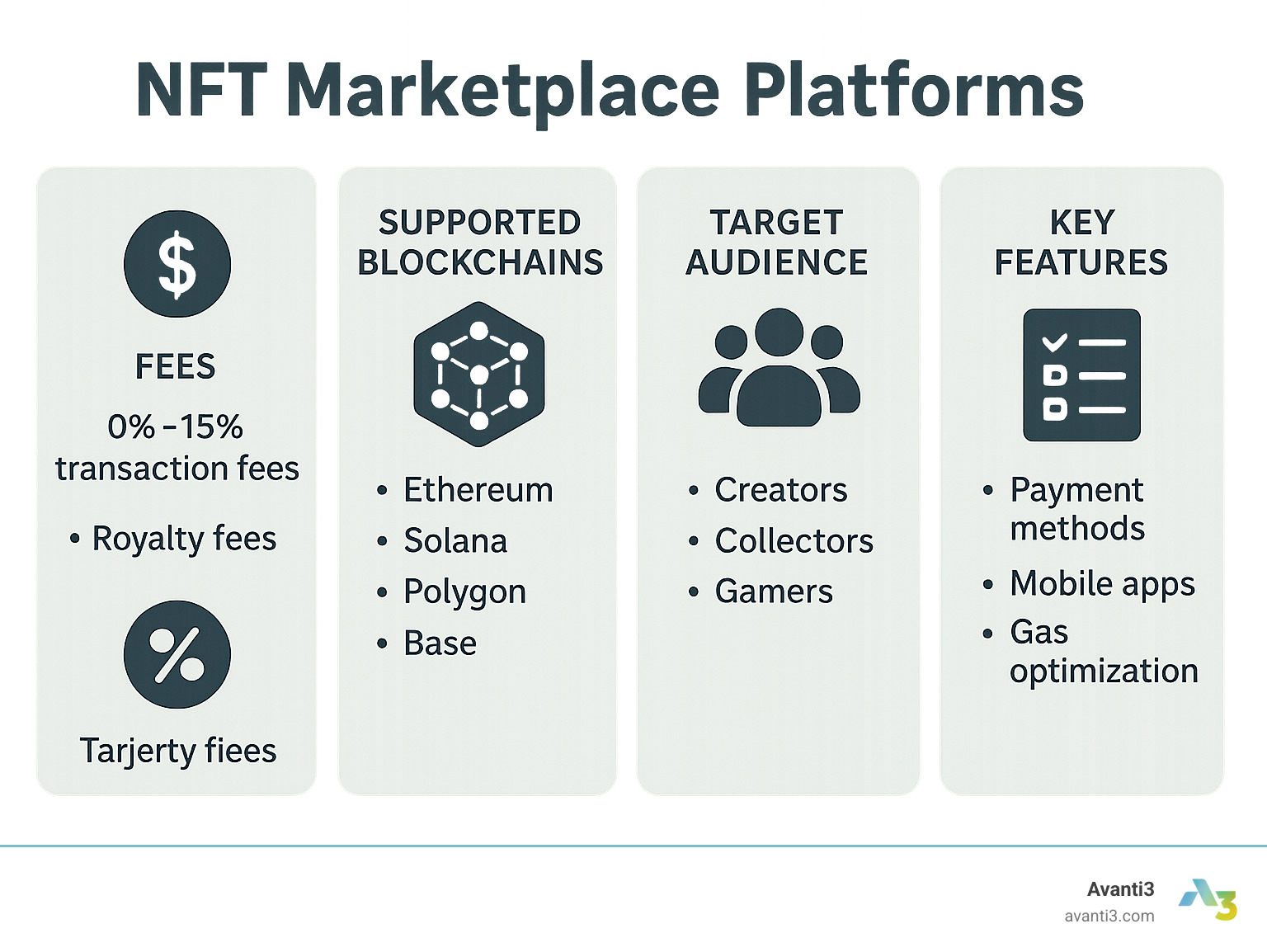

Modern marketplaces compete on three fronts: fees (0 %–15 %), supported blockchains (Ethereum, Solana, Polygon, Base), and user experience (gas optimization, mobile apps, fiat on-ramps).

As Samir ElKamouny AV, I’ve helped countless creators and brands steer the complex NFT marketplace ecosystem to build engaged communities and open up new revenue streams. My experience scaling businesses through strategic Web3 implementations has shown me how the right NFT marketplace platforms can transform digital engagement and monetization.

The choice between platforms depends on your goals, audience, and technical preferences—but understanding the landscape is crucial for success.

NFT marketplace platforms basics:

– blockchain creator economy

– blockchain for artists

– blockchain payment systems

NFT Marketplace Platforms 101

Think of NFT marketplace platforms as the digital equivalent of art galleries mixed with eBay – places where creators showcase their work and collectors find unique digital treasures. The story began back in 2017 when CryptoPunks and CryptoKitties first proved that pixelated characters could be worth real money. Who knew that digital cats would pave the way for a multi-billion-dollar revolution?

These platforms run on smart contracts – think of them as digital robots that never sleep, never make mistakes, and automatically handle every aspect of buying and selling. When you purchase an NFT, you’re not actually buying a JPEG file. Instead, you’re getting a blockchain token that acts like a digital certificate of authenticity, proving you own that specific piece.

The marketplace world splits into two main types of sales. Primary sales happen when creators first mint their NFTs – like buying directly from an artist’s studio. Secondary sales occur when collectors trade with each other, and here’s where things get exciting for creators.

Modern NFT marketplace platforms connect seamlessly with digital wallets like MetaMask, Phantom, and Coinbase Wallet. Your wallet holds your cryptocurrency and NFTs, acting like a digital purse that talks to the marketplace. Many platforms now offer fiat on-ramps, meaning you can use your credit card or PayPal instead of wrestling with crypto exchanges.

The game-changer for creators is royalties. Unlike traditional art where artists only get paid once, NFT creators can earn 2.5 % to 15 % every time their work resells. It’s like getting a tiny thank-you payment forever – not a bad deal for digital artists who historically struggled with ongoing income.

How NFT marketplace platforms work

Behind the scenes, NFT marketplace platforms operate like sophisticated auction houses with digital order books tracking every listing, bid, and sale. When you list an NFT, the platform creates an order containing your price, how long the sale lasts, and payment terms. This information lives either on the blockchain itself or in the platform’s secure database.

The bidding system works like a silent auction where collectors can make offers below your asking price. Smart contracts hold these bids in escrow – a digital safety deposit box that automatically releases funds when deals complete. No handshake agreements or trust issues here.

Metadata is the secret sauce that makes your NFT more than just a token number. This includes the artwork’s name, description, image location, and special traits. Platforms store this data either directly on the blockchain (expensive but permanent) or through decentralized storage systems that keep your digital art accessible forever.

Listing an NFT involves connecting your wallet, selecting the piece from your collection, setting your price, and signing a blockchain transaction. Gas fees apply for most interactions, though some platforms offer clever workarounds like lazy minting where the NFT only gets created when someone actually buys it.

Universal NFT marketplace platforms

Universal marketplaces are the shopping malls of the NFT world, selling everything from digital art and collectibles to gaming weapons and virtual real estate. These Ethereum-based hubs offer the biggest crowds and most diverse collections, making them ideal launching pads for new creators.

Multi-chain aggregators solve a growing problem – blockchain fragmentation. Instead of jumping between different platforms for different blockchains, these smart systems let you browse and buy NFTs from multiple networks through one interface. It’s like having a universal remote for your entire NFT collection.

Royalty enforcement varies dramatically across platforms. Some automatically honor creator-set royalties, while others make them optional – leading to heated debates about fair compensation. This inconsistency remains one of the biggest challenges facing the industry.

The beauty of universal platforms lies in their massive user bases and findy potential. New creators benefit from existing traffic, while collectors enjoy one-stop shopping. The downside? Standing out in a sea of millions of NFTs requires serious marketing savvy.

Niche NFT marketplace platforms

Specialized marketplaces focus on specific communities, offering curated experiences that universal platforms can’t match. Premium art-focused venues act as exclusive galleries, sometimes accepting only a small percentage of artist applications to maintain prestige and value.

Gaming asset marketplaces have exploded alongside play-to-earn games, handling everything from magical swords to virtual land plots. These platforms offer features like bulk trading and direct game integration, where your NFT sword actually functions in the game world.

Music rights platforms let artists tokenize their songs and royalty streams, creating new funding models where fans can literally invest in their favorite musicians. It’s crowdfunding meets intellectual property, disrupting how the music industry traditionally operates.

Domain NFT marketplaces trade blockchain addresses like .eth and .sol names. These digital real estate markets see wild speculation, with memorable domains selling for hundreds of thousands based on their commercial potential and brandability.

Types of NFT Marketplaces & Their Blockchains

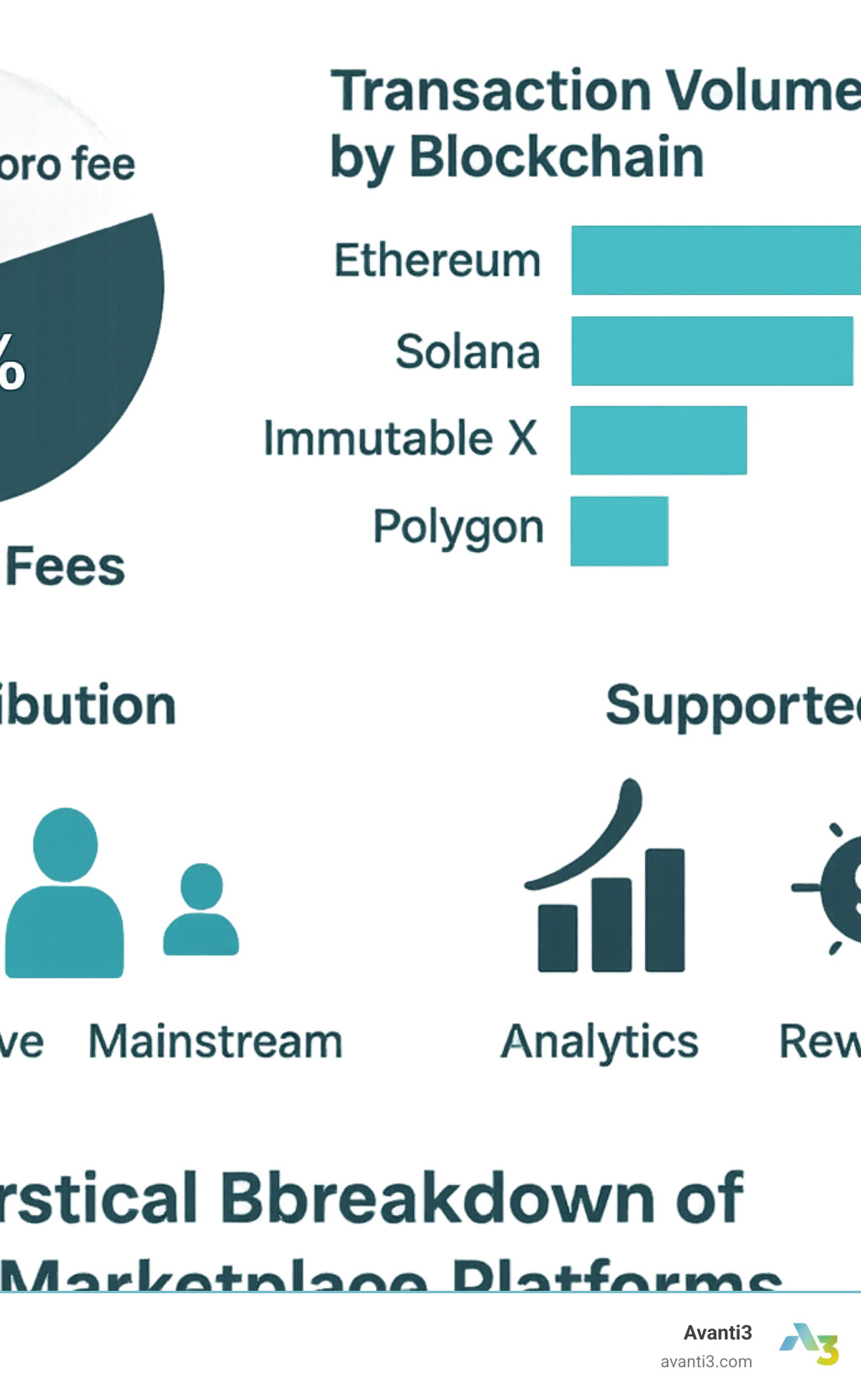

The world of NFT marketplace platforms has grown far beyond Ethereum’s original home base. Think of it like the early internet – what started on one network has blossomed into a diverse ecosystem of interconnected blockchains, each with its own personality and strengths.

EVM-compatible chains like Polygon, Avalanche, and Base have become popular alternatives that speak Ethereum’s language but with much friendlier price tags. These networks offer the same smart contract functionality that made Ethereum famous, but transactions that cost pennies instead of dollars. For creators just starting out, this difference can mean the world.

Solana has emerged as Ethereum’s scrappy younger sibling, processing transactions in seconds rather than minutes. Solana-based marketplaces have captured serious market share, especially in gaming where players need lightning-fast trades. The network’s speed makes it perfect for high-frequency trading scenarios that would be impossible on slower chains.

Tezos took a different approach entirely, positioning itself as the environmentally conscious choice. Using proof-of-stake consensus, Tezos consumes 99% less energy than Bitcoin while maintaining robust security. This green narrative has attracted environmentally aware artists and collectors who want to create without the carbon guilt.

The newest kid on the block? Bitcoin Ordinals. This development lets people create NFT-like inscriptions directly on Bitcoin’s ultra-secure network. While purists debate whether this belongs on Bitcoin, the market has spoken – these “digital artifacts” command premium prices thanks to Bitcoin’s best permanence and security.

Layer-2 solutions like Immutable X and Polygon represent the best of both worlds – Ethereum’s battle-tested security with dramatically lower costs. These clever systems process transactions off-chain before settling batches on Ethereum’s main network. It’s like having express lanes that still connect to the main highway.

Cross-chain bridges are starting to connect these different blockchain islands, though they’re still a bit like early ferry services – functional but requiring extra care. As the technology matures, moving NFTs between networks should become as simple as sending an email.

| Network | Average Gas Cost | Transactions Per Second | Carbon Footprint |

|---|---|---|---|

| Ethereum | $5-50+ | 15 TPS | High (PoW transitioning) |

| Solana | $0.001 | 3,000+ TPS | Low (PoS) |

Curated vs. open marketplaces

The NFT marketplace platforms world splits into two camps that couldn’t be more different in philosophy. Curated platforms act like exclusive art galleries, carefully screening every artist and maintaining strict quality standards. These digital gatekeepers create scarcity and often higher prices, but they also lock out many talented creators who don’t fit their specific mold.

Open marketplaces welcome everyone with open arms – no approval needed, no committees to impress. This democratic approach encourages wild experimentation and gives unknown artists their shot at success. The downside? Navigating through thousands of projects to find the real gems can feel like searching for treasure in a digital junkyard.

Quality control varies wildly across platforms. Some rely on community voting (wisdom of crowds), others use algorithmic filtering (robot curators), and many blend both approaches. The most successful platforms have cracked the code on balancing accessibility with findability.

The findability problem affects everyone in the ecosystem. Open platforms struggle with spam and copycat projects, while curated ones might miss the next breakthrough artist who doesn’t fit traditional categories. Smart platforms are developing hybrid approaches – offering multiple tiers of curation within single marketplaces.

Gas fees & transaction costs impact

Gas fees remain the biggest party crasher in the NFT world. During busy periods, Ethereum transactions can cost more than the actual NFT you’re trying to buy. Imagine paying $100 in shipping for a $20 item – that’s the reality many users face during network congestion.

Layer-2 solutions have become the heroes of cost-conscious creators and collectors. Polygon transactions typically cost under a penny, while some gaming-focused platforms offer completely free trading. These savings open up entirely new possibilities – suddenly, micro-transactions and small-value digital assets make economic sense.

Batching tricks help savvy users optimize their gas spending on expensive networks. Some platforms let you list multiple NFTs in a single transaction or bundle purchases to share costs among multiple buyers. Lazy minting takes this further by delaying blockchain interaction until someone actually buys the NFT, eliminating upfront costs for creators.

Strategic timing can save serious money for those willing to plan ahead. Network congestion follows predictable patterns – weekends and late-night hours typically offer relief from peak pricing. Smart traders monitor gas trackers and time their moves like surfers waiting for the perfect wave.

The cost equation affects every decision in the NFT space, from which blockchain to choose to how to price your work. Understanding these dynamics helps creators and collectors make smarter choices about when and where to transact.

For more insights on optimizing blockchain costs and distribution strategies, explore our guide on Blockchain Content Distribution.

Comparing Key Features of NFT Marketplace Platforms in 2024

The world of NFT marketplace platforms has grown up quite a bit since those wild early days. What we’re seeing now is a much more mature landscape where platforms have found their unique voices and specialties.

Fee structures tell an interesting story about platform strategy. Some platforms have gone completely fee-free to attract high-volume traders, while others charge premium rates of 10-15% in exchange for serious curation and marketing muscle. Most platforms have settled into that sweet spot around 2.5% – enough to keep the lights on without scaring away users.

The royalty enforcement debate has become one of the hottest topics in the space. It’s basically a philosophical divide: some platforms automatically enforce creator royalties through smart contracts (protecting artists), while others make them optional (appealing to traders who want cheaper deals). Your choice here really depends on whether you prioritize creator sustainability or trading flexibility.

Supported file types have exploded beyond simple JPEGs. Today’s leading platforms handle everything from interactive 3D models to augmented reality experiences. The most exciting development? Dynamic NFTs that actually change based on real-world data – imagine artwork that evolves with the weather or sports stats.

Payment options make or break accessibility. Crypto-native platforms still require wallet connections and token holdings, but the smart ones have added credit cards, PayPal, and even bank transfers. This isn’t just convenience – it’s about opening doors for people who aren’t ready to dive into the crypto deep end yet.

For the latest details on how platform fees stack up across the industry, the latest research on platform fees provides comprehensive comparisons.

Feature snapshot: analytics, sweeps, rewards

The feature race among NFT marketplace platforms has gotten seriously competitive. Portfolio dashboards have evolved into sophisticated command centers that track your holdings in real-time, calculate profit and loss, and break down collection performance. It’s like having a personal financial advisor for your digital assets.

Sweeping tools have become a game-changer for serious collectors. Instead of clicking through dozens of individual listings, you can now buy multiple NFTs at floor prices across entire collections with just a few clicks. It’s especially popular with traders who need to move fast on opportunities.

Token incentive programs are where platforms get creative with user loyalty. Many distribute their own tokens based on how much you trade, list, or participate in the community. These rewards often cover transaction fees and create a sense of ownership in the platform itself.

The analytics features range from simple rarity rankings to complex market trend analysis. Professional traders rely on detailed historical charts and market indicators, while newcomers appreciate clean, simple metrics that highlight potential opportunities without overwhelming them.

Staking mechanisms let you lock up platform tokens in exchange for reduced fees, voting rights, or bonus rewards. It’s a clever way for platforms to align their interests with their most active users while building sustainable revenue streams.

Payment methods & wallet support

Wallet compatibility can make or break your experience on NFT marketplace platforms. MetaMask dominates the Ethereum world, while Phantom rules Solana. Multi-chain platforms face the complex challenge of supporting multiple wallet types without confusing users.

Credit card integration has become absolutely essential for bringing in mainstream users. Yes, there are usually extra fees and identity verification requirements, but the convenience factor wins out for people who just want to buy something cool without setting up crypto exchanges first.

PayPal integration represents a huge milestone for NFT accessibility. When major platforms started accepting PayPal, it opened the floodgates for users who were comfortable with traditional online payments but intimidated by cryptocurrency wallets.

Custody options offer different levels of control and responsibility. Self-custody means you control your private keys (more secure, but you’re responsible if you lose them), while platform custody simplifies things but centralizes control. The smartest platforms offer hybrid approaches – easy custodial onboarding with the option to graduate to self-custody as you learn.

Mobile wallet support isn’t optional anymore. With most people browsing on their phones, platforms that don’t optimize for mobile browsers and mobile-first wallets are missing huge chunks of potential users.

Security, privacy & authenticity

Smart contract audits form the bedrock of trustworthy NFT marketplace platforms. The best platforms undergo regular security reviews by respected firms to catch vulnerabilities before they become expensive problems. It’s like having a building inspector check the foundation before you move in.

Escrow mechanisms solve the age-old problem of trusting strangers on the internet. Smart contracts hold funds until all conditions are met, so neither buyer nor seller can get cheated. It’s automated trust that works 24/7 without coffee breaks.

Two-factor authentication adds crucial security layers, though it’s worth remembering that blockchain’s decentralized nature means lost private keys are gone forever. Platforms walk a careful line between security and usability.

Copyright protection tools help creators fight back against unauthorized copying of their work. Some platforms use image recognition technology to spot potential theft, while others rely on community reporting. It’s an ongoing arms race between creators and copycats.

License embedding tackles one of the biggest sources of confusion in NFTs: what rights does ownership actually give you? By embedding usage rights directly in the NFT metadata, creators can specify exactly what buyers can and can’t do with their purchase.

For businesses looking to implement robust authentication systems, our Blockchain Art Authentication services provide comprehensive solutions for protecting digital assets and creator rights.

Choosing the Best NFT Marketplace for Creators & Collectors

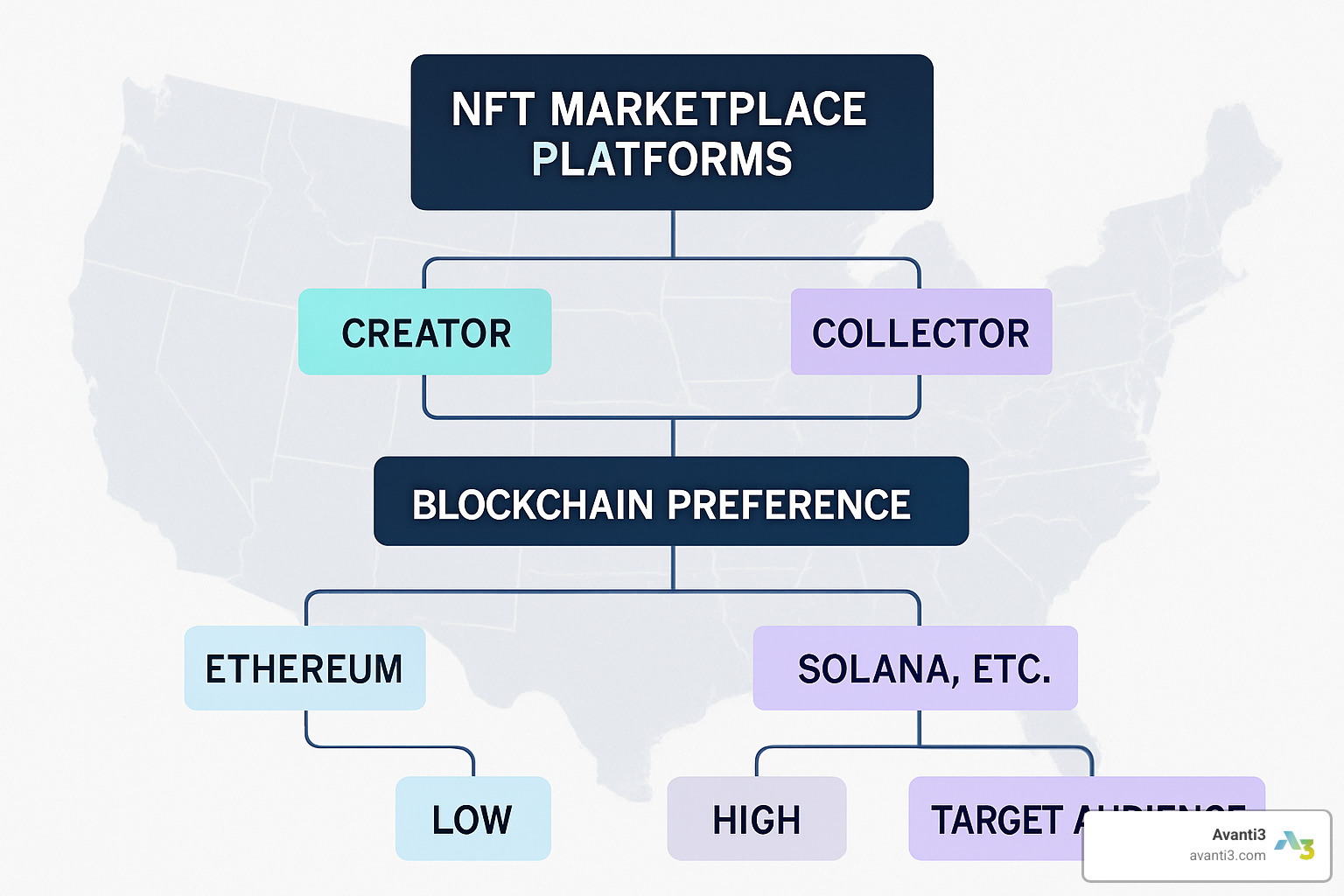

Finding the right NFT marketplace platform feels overwhelming at first, but breaking down the decision into key factors makes the choice much clearer. Think of it like choosing where to open a physical store – location, audience, and costs all matter tremendously.

Goal mapping starts with honest questions about what you’re trying to achieve. Are you an artist seeking maximum exposure for your work? A collector hunting for undervalued gems? A brand building community engagement? Different platforms excel in different areas, so knowing your primary objective guides everything else.

Audience analysis determines where your people actually spend time. Art collectors browse curated galleries, gamers hang out on specialized gaming platforms, and mainstream users prefer simple interfaces with credit card payments. Following your audience beats fighting for attention in the wrong place every time.

Chain familiarity affects both your costs and user experience significantly. If your collectors already use Ethereum wallets, launching on Solana creates unnecessary friction. But if Ethereum’s gas fees would price out your target audience, alternative chains make perfect sense.

Fee tolerance varies dramatically across different user groups. Professional traders obsess over every basis point of fees, while casual collectors happily pay extra for better customer support and educational resources. Match the platform’s fee structure to your audience’s expectations.

UI/UX preferences reflect how comfortable people are with technology. Advanced traders want detailed analytics and bulk operations, while newcomers need hand-holding and simple interfaces. Choose platforms that match your audience’s comfort level, not your own.

Community culture impacts long-term success beyond any technical features. Some platforms foster collaborative, supportive environments where creators help each other succeed. Others emphasize competitive trading and quick profits. Aligning with compatible communities dramatically improves engagement and retention.

Checklist for creators

Creating successful NFTs on NFT marketplace platforms involves way more than just uploading art and hoping for the best. Smart creators evaluate platforms systematically across multiple dimensions.

Minting pathways range from simple drag-and-drop interfaces to complex smart contract interactions. If you’re not technically inclined, platforms with user-friendly minting tools save time and reduce stress. More advanced creators might prefer platforms offering granular control over metadata and smart contract parameters.

Royalty settings determine whether you’ll earn ongoing income from your work. Some platforms guarantee creator royalties through smart contract enforcement, while others make them optional to attract traders. This difference can dramatically impact your long-term earnings, especially if your work gains value over time.

Marketing reach encompasses both the size of the platform’s audience and the promotional tools available. Massive platforms offer huge potential audiences but intense competition. Smaller, niche platforms provide more targeted reach with less noise. Consider whether the platform offers featured listings, social media integration, or other promotional opportunities.

Secondary liquidity affects how easily collectors can resell your NFTs. Platforms with active trading communities and multiple sale formats – auctions, fixed pricing, and offers – create better liquidity for collectors. This increased liquidity often translates to higher demand for your original work.

NFT engagement tools enable ongoing relationships with collectors beyond the initial sale. Features like open upable content, token-gated communities, and dynamic NFTs create lasting value and deeper connections with your audience.

For advanced creator tools and engagement strategies, explore our NFT Engagement Tools.

Checklist for collectors

Collectors face different priorities when choosing NFT marketplace platforms, focusing on findy, analysis, and portfolio management capabilities rather than creation tools.

Liquidity pools determine how easily you can buy and sell NFTs when opportunities arise. Platforms with high trading volumes and active communities offer better entry and exit opportunities. Smaller platforms might have unique gems but limited liquidity when you want to sell.

Rarity tools help identify valuable assets within large collections where manual analysis becomes impossible. Advanced platforms provide trait analysis, rarity rankings, and historical sales data to inform purchasing decisions. These tools become essential for serious collectors managing diverse portfolios.

Portfolio trackers enable comprehensive asset management across multiple platforms and blockchains. The best tools aggregate all your holdings, calculate profit and loss automatically, and provide tax reporting features for professional collectors. Managing NFTs across different platforms without good tracking tools quickly becomes a nightmare.

Gas optimization features reduce transaction costs through batching, Layer-2 integration, and strategic timing tools. For active traders, these optimizations save significant money over time and make smaller purchases economically viable.

Future trends shaping NFT marketplace platforms

The evolution of NFT marketplace platforms continues accelerating, driven by technological advances and changing user expectations. Several key trends are reshaping the entire landscape in exciting ways.

AI-generated collections are becoming increasingly sophisticated, with platforms developing specialized tools for algorithmic art creation and curation. This trend democratizes art creation while raising fascinating questions about creativity and value attribution. Soon, anyone might create professional-quality collections with AI assistance.

Dynamic NFTs represent the next evolution beyond static images, incorporating real-world data feeds, interactive elements, and programmable behaviors. These “living” NFTs create ongoing engagement and utility far beyond simple ownership. Imagine sports cards that update with player statistics or art that changes with weather conditions.

Embedded AR/VR experiences transform NFTs from 2D images into immersive digital objects you can actually interact with. As metaverse adoption grows, platforms are integrating spatial computing capabilities to display and interact with NFTs in virtual environments. Your digital art might soon decorate virtual homes or offices.

Real-world asset tokenization bridges physical and digital ownership through NFTs representing property, commodities, and financial instruments. This trend expands NFT utility beyond digital collectibles into practical applications like fractional real estate ownership or supply chain tracking.

Compliance frameworks like the EU’s MiCA regulation will standardize NFT marketplace operations. While this might reduce some innovation in the short term, it will likely increase mainstream adoption through regulatory clarity and consumer protection. Expect more traditional institutions to enter the space as regulations clarify.

Frequently Asked Questions about NFT Marketplace Platforms

What’s the difference between minting and buying on a marketplace?

Think of minting like being the first person to print a brand new photograph, while buying is like purchasing that photo from someone else later. When you mint an NFT, you’re creating something completely new on the blockchain – you become the very first owner of that digital asset.

Buying on a marketplace means you’re purchasing an NFT that already exists from another collector or creator. It’s like shopping at a digital art gallery where previous owners have listed their pieces for sale.

The costs work differently too. Minting typically involves gas fees plus any platform charges, but you’re creating something from scratch. Buying includes the NFT’s listed price, platform fees, and transaction costs. Some NFT marketplace platforms now offer gasless minting to help new creators get started without upfront costs.

Timing plays a big role in both processes. Minting during busy network periods can get expensive fast, while buying gives you more flexibility to wait for better gas prices. Popular collection drops often create time pressure, but secondary market purchases let you take your time and compare options.

How are creator royalties enforced across chains?

Here’s where things get interesting – and a bit complicated. Creator royalties work differently depending on which NFT marketplace platforms and blockchains you’re using. Some platforms automatically honor the royalty percentages creators set, while others have made them optional to attract traders who want lower costs.

Ethereum-based platforms generally handle royalties better thanks to established standards like EIP-2981, though enforcement still isn’t guaranteed across all marketplaces. Solana platforms have tried various approaches, from creator-controlled enforcement to platform-specific standards.

The shift toward optional royalties has created quite a debate in the NFT community. Traders appreciate lower costs, but creators worry about losing sustainable income from their work. This makes platform choice crucial – some guarantee royalty payments while others leave it up to buyers’ goodwill.

Smart creators often research platform policies before minting. Understanding how your chosen marketplace handles royalties can significantly impact your long-term earnings from secondary sales.

Can I avoid high gas fees when trading NFTs?

Absolutely! High gas fees don’t have to be a barrier to enjoying NFT marketplace platforms. Layer-2 solutions like Polygon and Immutable X offer the best of both worlds – Ethereum’s security with transaction costs measured in pennies instead of dollars.

Alternative blockchains provide another smart approach. Networks like Solana and Tezos process transactions quickly and cheaply, though you’ll be accessing different communities and collections than Ethereum-based platforms.

Timing your transactions can save serious money on expensive networks. Gas fees fluctuate based on network congestion – weekends and off-peak hours typically offer much better rates. Gas tracking websites help you spot these optimal windows.

Batching transactions when possible spreads costs across multiple actions. Some platforms let you list several NFTs at once or make bulk purchases, reducing the per-item expense for active traders.

The key is matching your strategy to your needs. Casual collectors might prefer Layer-2 platforms for affordable experimentation, while serious traders often monitor gas prices and time their moves strategically.

Conclusion

The journey through NFT marketplace platforms reveals a landscape that’s matured far beyond its speculative origins. What started as digital trading cards has evolved into sophisticated infrastructure powering the creator economy, gaming ecosystems, and brand engagement strategies.

Your success in this space hinges on understanding that platform choice isn’t just about features—it’s about finding where your audience lives and thrives. Highly curated art galleries cater to a different group of creators compared with fast, gaming-centric ecosystems built on high-throughput or Layer-2 networks, and both differ from mainstream platforms that prioritize simple fiat on-ramps.

The multi-chain reality we live in today offers unprecedented opportunities. Ethereum provides the security and liquidity that serious collectors trust, while Solana delivers the speed and cost-efficiency that gaming communities demand. Layer-2 solutions bridge these worlds, offering Ethereum’s security without the prohibitive gas fees that price out emerging creators.

But here’s what really matters: the most successful participants in this ecosystem understand that NFT marketplace platforms are relationship-building tools, not just trading venues. Whether you’re a creator building a sustainable income through royalties or a brand creating memorable experiences for your community, the technology serves human connections.

The innovation we’re seeing in dynamic NFTs, AR integration, and real-world asset tokenization points toward a future where digital ownership becomes as natural as physical ownership. The platforms that win will be those that make this transition seamless and meaningful for everyday users.

At Avanti3, we’ve watched countless creators and brands transform their digital engagement by choosing the right combination of marketplace strategy and community building. Our experience shows that success comes from authentic value creation rather than chasing trends or speculation.

The infrastructure is ready. The audiences are engaged. The question isn’t whether NFT marketplace platforms will reshape digital commerce – they already have. The question is how you’ll use them to create genuine connections and lasting value for your community.

Ready to turn this knowledge into action? Explore our comprehensive Web3 Platform Solutions and find how we can help you build meaningful digital experiences that go far beyond simple transactions.