NFT market development: 7 Powerful Trends Shaping 2025 Success

The Evolution of Digital Ownership: NFT Market Trends in 2024

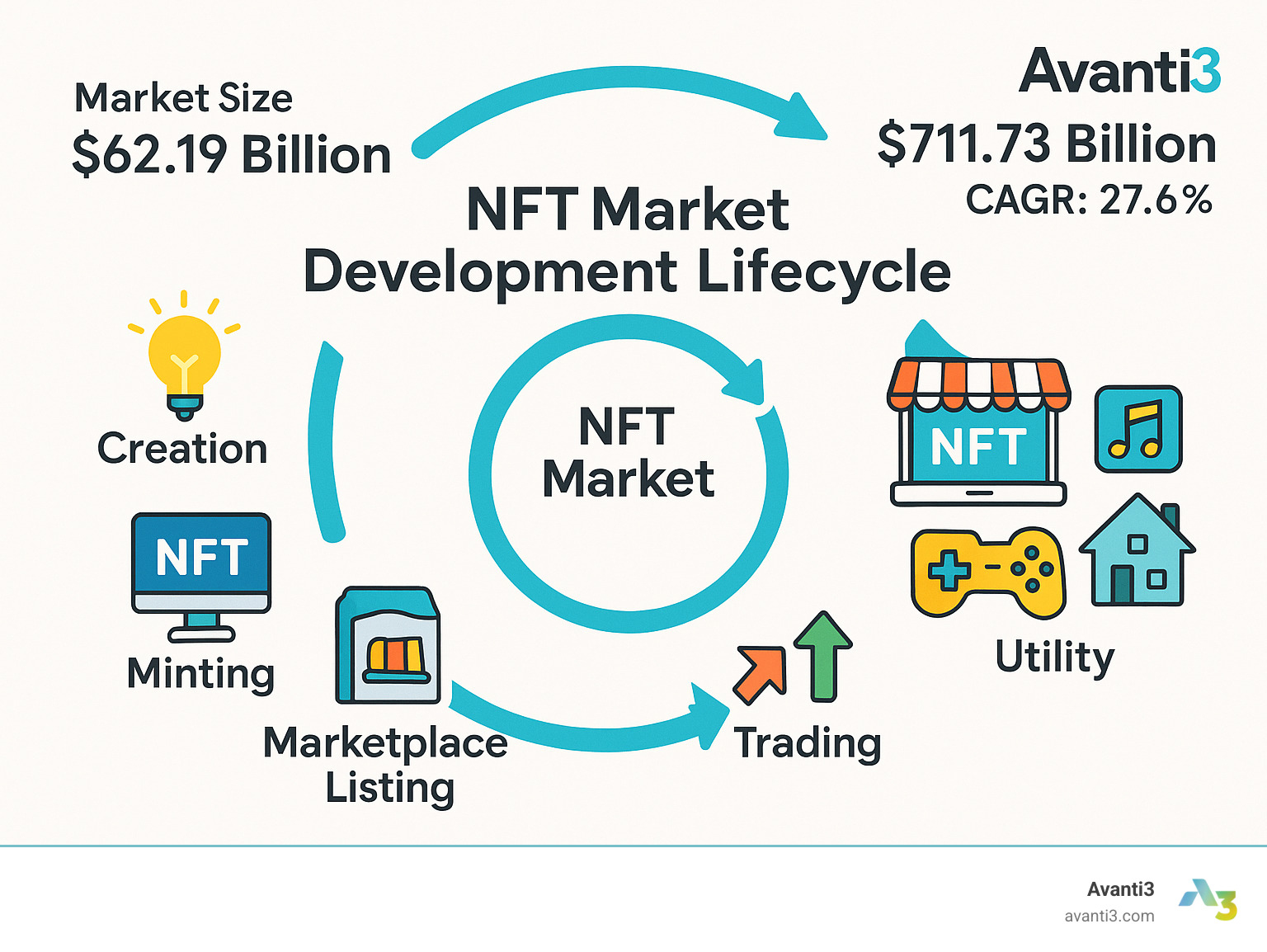

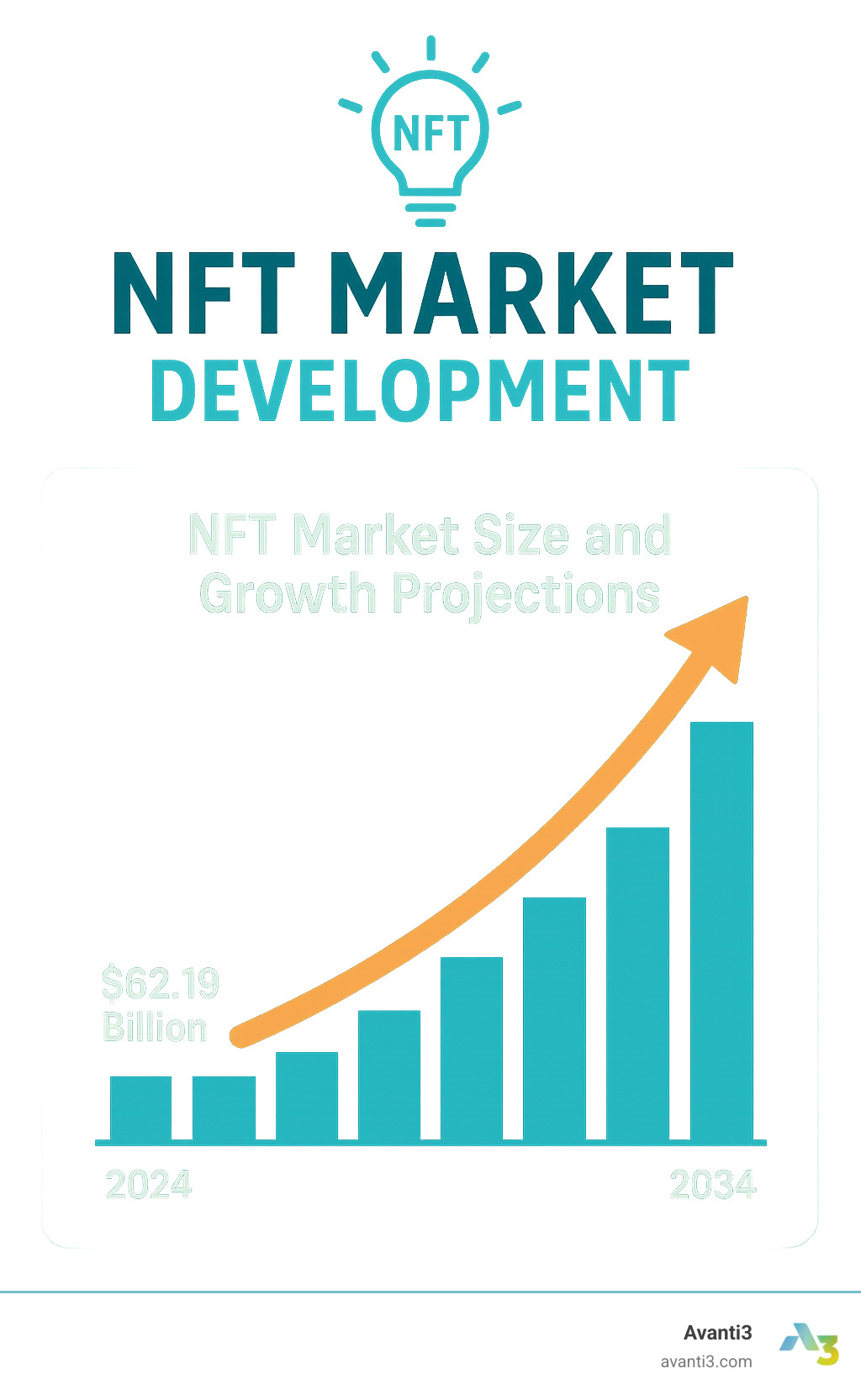

NFT market development is experiencing significant growth, with projections showing expansion from $62.19 billion in 2024 to $711.73 billion by 2034, at a compound annual growth rate (CAGR) of 27.60%. This resurgence follows the market’s boom-and-bust cycle from 2021-2022.

Key NFT Market Development Trends in 2024:

1. Hybrid NFTs combining digital and physical assets

2. Real-world asset (RWA) tokenization for real estate and art

3. Gaming NFT expansion with true digital ownership

4. Bitcoin-based NFTs through Ordinals protocol

5. Multi-chain compatibility reducing transaction fees and improving scalability

The non-fungible token landscape has evolved dramatically from its initial art-focused beginnings, with NFT marketplaces now supporting diverse verticals including digital collectibles, virtual real estate, music rights, and in-game assets. While North America currently holds the largest market share, Asia-Pacific regions are showing the fastest growth rates due to higher digital adoption.

I’m Samir ElKamouny, entrepreneur and marketing expert at Avanti3, where I’ve guided numerous businesses through successful NFT market development strategies that drive engagement and create new revenue streams. My experience has shown that the most successful NFT implementations focus on utility and community-building rather than speculation.

Common NFT market development vocab:

– Blockchain-based rewards

– Fan engagement tools

Global Snapshot of NFT Market Development

The world of NFTs is booming in ways that even industry insiders couldn’t have predicted just a few years ago. In 2024, we’re looking at an NFT market development size of approximately US$2,378.0 million, with steady growth expected at a 9.10% annual rate through 2028. If this trend continues, we could see the market reach US$3,369.0 million by that time.

Some forecasts are even more bullish, suggesting the market could expand from USD 79.35 billion in 2025 to a staggering USD 711.73 billion by 2034. That’s a compound annual growth rate of 27.60% – the kind of growth that has investors and creators alike paying close attention.

What’s driving this growth? People – lots of them! User adoption is climbing steadily, with projections showing NFT users reaching 19.71 million by 2028. Currently, each user generates about US$138.8 in revenue on average.

Bitcoin’s recent entry into NFTs through the Ordinals protocol has added fresh energy to the market. As one analyst put it, “Bitcoin Ordinals embed digital artifacts in satoshis, expanding NFT use beyond Ethereum and creating new opportunities for creators and collectors alike.” This innovation has opened doors for Bitcoin enthusiasts who previously watched the NFT revolution from the sidelines.

Regional Revenue Leaders

When we look at the global map of NFT market development, some clear patterns emerge:

The United States stands tall as the current revenue champion, generating an estimated US$1,122 million in 2024 alone. North America’s dominance isn’t surprising – high digital literacy, abundant venture capital, and early adoption by celebrities and major brands have created a perfect storm for NFT growth.

The APAC Surge is perhaps the most exciting regional story. Asia-Pacific markets are growing at breakneck speed, with Singapore, Hong Kong, and China leading the charge. As one industry report noted, “Asians, as ‘digital natives,’ are particularly receptive to new technical deployments and digital products.” The Philippines deserves special mention – approximately 32% of Filipinos own NFTs, which is three times the global average!

Europe is steadily building its presence in the NFT world, particularly in traditional art and collectibles markets. Established auction houses and galleries are embracing the technology, bridging the gap between centuries of art history and cutting-edge blockchain innovation.

Market Segmentation Overview

The NFT market development landscape breaks down into several important segments:

By Offering, business strategy formulation dominates, accounting for nearly 45-50% of NFT market revenue. This includes consulting services that help brands steer their entry into the NFT space – exactly the kind of expertise we provide at Avanti3.

By End-User, media and entertainment claimed the largest share in 2022. This broad category includes digital art, music, film, and gaming applications. Gaming deserves special attention, as play-to-earn models continue to gain traction and redefine what’s possible in the gaming industry.

By Region, as we’ve explored, North America leads in overall market share, with Asia-Pacific showing the fastest growth. Europe, Latin America, and the Middle East follow with varying adoption rates based on local regulatory environments and digital infrastructure.

By Enterprise Size, both giants and upstarts are finding success. Large enterprises often use NFTs for brand engagement and loyalty programs, while smaller businesses carve out niches with specialized applications that serve particular communities or interests.

As the NFT market development continues to mature, these segments will likely evolve, with new use cases emerging and existing applications becoming more sophisticated. At Avanti3, we’re excited to help businesses of all sizes steer this dynamic landscape and find the NFT strategy that’s right for them.

Key Drivers & Innovations Shaping 2024

The NFT market development landscape is being transformed by several groundbreaking innovations that are expanding use cases beyond simple digital collectibles. These innovations are not only driving market growth but also addressing some of the limitations that hampered earlier NFT adoption.

NFT Market Development: 2024 Growth Drivers

Several key factors are propelling the NFT market forward in 2024:

Celebrity Influence: High-profile endorsements continue to drive mainstream awareness and adoption. As one notable example, when Elon Musk temporarily changed his Twitter profile picture to a Bored Ape NFT (though later joking about it), the floor price for the collection surged by approximately 10 ETH. These moments of visibility, even when fleeting, demonstrate the powerful impact of celebrity engagement.

Metaverse Integration: Major tech platforms are developing metaverse initiatives that incorporate NFTs as fundamental building blocks for digital ownership. Virtual real estate, wearables, and identity assets are becoming increasingly valuable as metaverse adoption grows. As one industry expert noted, “NFTs serve as the property deeds of the metaverse, enabling true ownership in virtual worlds.”

Mainstream Brand Adoption: Established brands from fashion, sports, and entertainment are launching NFT strategies to engage fans and create new revenue streams. For example, a major music festival partnered with blockchain platforms to release controllable digital collectibles recorded on a public blockchain, driving both engagement and secondary market activity.

Utility-Driven NFTs: The shift from purely speculative collectibles to NFTs with genuine utility is perhaps the most significant driver. Token-gated content, event access, community membership, and redeemable benefits are changing how consumers perceive value in NFTs. As one market analyst observed, “NFTs should be valued for their utility and digital ownership rather than pure speculation.”

Bitcoin-based Breakthroughs

The emergence of Bitcoin-based NFTs represents one of the most significant developments in recent NFT market development:

Ordinals Protocol: Launched in early 2023, Ordinals enable the inscription of data directly onto individual satoshis (the smallest unit of Bitcoin), effectively creating NFTs on Bitcoin’s blockchain. This innovation challenges the perception that Bitcoin is too inflexible for NFT applications.

Satoshi Inscriptions: By mid-2023, over 1.19 million Ordinals had been minted, with trading volumes exceeding $20 million. A notable auction of a 300-piece Bitcoin Ordinals NFT drop achieved bids between 2.25 and 7.11 BTC, demonstrating significant market interest.

Cross-Chain Bridges: The development of bridges between Bitcoin and other blockchains is enabling greater interoperability for Bitcoin-based NFTs, expanding their utility and market reach. This cross-chain functionality is crucial for integrating Bitcoin NFTs into the broader digital asset ecosystem.

Sustainability & Compliance

As the NFT market matures, sustainability and regulatory compliance have become increasingly important considerations:

Proof-of-Stake Adoption: Ethereum’s transition to proof-of-stake has reduced energy consumption by over 99%, addressing one of the most significant criticisms of NFTs. This shift has made NFTs more palatable to environmentally conscious consumers and brands.

KYC/AML Implementation: Marketplace platforms are increasingly implementing Know Your Customer and Anti-Money Laundering protocols to comply with evolving regulations. This trend is particularly evident in platforms targeting institutional adoption.

STO Frameworks: Security Token Offerings are providing a regulatory-compliant framework for NFTs that might otherwise be classified as securities. As one report noted, “Security Token Offerings enable NFT issuers to comply with US securities regulations,” which is particularly relevant for fractional ownership and investment-focused NFTs.

Green NFTs: Beyond proof-of-stake, some platforms are implementing carbon offset programs and highlighting energy-efficient collections, creating market differentiation based on environmental impact. These initiatives are responding to consumer demand for more sustainable blockchain applications.

Building a Successful NFT Marketplace

Creating a thriving NFT marketplace isn’t just about the technology—it’s about crafting an experience that delights creators and collectors alike. As NFT market development continues to evolve, today’s successful marketplaces need to balance technical robustness with genuine user-friendliness.

The best NFT marketplaces feel intuitive from the moment users land on the homepage. I’ve seen countless projects where developers get caught up in blockchain complexity and forget that most users just want things to work smoothly. As one of our clients recently told us, “I don’t care how the smart contract works—I just want my customers to buy my digital art without getting confused!”

That’s why at Avanti3, we focus on building marketplaces with user-centric experiences that make the complex simple. Behind that simplicity, of course, lies sophisticated smart contract architecture that handles everything from minting to royalty distributions automatically.

Seamless wallet integration is another must-have. Nothing kills user interest faster than a clunky connection process with MetaMask or Trust Wallet. We’ve found that supporting multiple wallet options dramatically increases conversion rates for marketplace sign-ups.

Artists and creators particularly care about royalties—the ability to earn a percentage on secondary sales is often what draws them to NFTs in the first place. A well-designed royalty system that creators can trust builds marketplace loyalty that’s hard to break.

Security can’t be an afterthought either. Comprehensive security audits protect both your platform and your users. We’ve seen horror stories of marketplaces losing millions through preventable smart contract exploits. As one development expert put it, “In Web3, security isn’t just important—it’s existential.”

High gas fees can be a major turn-off, especially for newcomers. Implementing gas-fee optimization through layer-2 solutions or batch processing makes your marketplace more accessible to casual buyers who might balk at paying $50 in fees for a $100 NFT.

Finally, supporting multi-chain bridges gives your marketplace flexibility and reach. While Ethereum still dominates the NFT space, platforms that accept Polygon, Solana and other alternatives open themselves to wider audiences and varied price points.

Tech Stack Essentials

Choosing the right technical foundation determines both what your marketplace can do and how efficiently it operates. I’ve found that most successful projects start with carefully selecting the appropriate token standards.

ERC-721 remains the grandfather of NFT standards on Ethereum, perfect for one-of-one art pieces and collectibles where absolute uniqueness matters. Its younger sibling, ERC-1155, offers more efficiency by allowing both fungible and non-fungible tokens in a single contract—ideal for gaming items or editions. The newer ERC-404 standard is generating buzz for enabling fractionalized ownership, blending the divisibility of ERC-20 tokens with the uniqueness of NFTs.

For development languages, Solidity remains essential for writing Ethereum-compatible smart contracts. Most marketplace frontends rely on JavaScript/TypeScript, while Python often powers analytics and backend services. I remember one client who insisted on using an obscure programming language for their marketplace—six months and many headaches later, they wished they’d stuck with the industry standards!

Storage solutions matter tremendously in the NFT world. IPFS (InterPlanetary File System) provides decentralized storage for NFT metadata and files, ensuring your digital assets don’t disappear if a single server goes down. Arweave takes permanence even further with its “pay once, store forever” model that many collectors find reassuring.

When it comes to blockchain networks, Ethereum still boasts the largest NFT ecosystem and highest trading volumes, but alternatives are gaining ground. Polygon offers Ethereum compatibility with lower fees, Solana delivers impressive speed and affordability, Binance Smart Chain provides a familiar experience with reduced costs, and Tezos stands out for environmental efficiency. The right choice depends on your specific marketplace goals and target audience.

Development Roadmap

Building a successful NFT marketplace isn’t a sprint—it’s a thoughtful journey with distinct phases. Let me walk you through how we approach this at Avanti3.

We always begin with thorough research and planning. This means understanding not just the broader NFT landscape but your specific target audience. What are they looking for? What frustrates them about existing platforms? One marketplace we built for a client succeeded precisely because we identified an underserved niche of 3D artists who felt their work wasn’t properly displayed on general platforms.

Niche selection follows naturally from good research. While general marketplaces like OpenSea serve their purpose, we’re seeing more success with focused platforms. Whether you’re targeting digital art, gaming assets, music, or virtual real estate, a clear specialization helps you stand out and attract the right community.

The design phase is where your marketplace starts coming to life. We focus on creating interfaces that feel familiar enough to be intuitive but innovative enough to showcase the unique aspects of your platform. Smart contract architecture gets mapped out here too, with security and efficiency as guiding principles.

During the build phase, we develop and thoroughly test smart contracts before implementing front-end components that users will interact with. Wallet connections, payment gateways, and storage solutions all come together here. This phase requires patience—rushing development inevitably leads to security vulnerabilities or user experience issues down the line.

Comprehensive testing saves headaches later. We deploy on testnets first, conduct security audits, and gather early user feedback before pushing anything to mainnet. I can’t count how many times this testing phase has caught issues that would have been costly to fix post-launch.

The launch is just the beginning. We help clients monitor performance closely, establish community support channels, and make adjustments based on real-world usage patterns. The most successful marketplaces evolve continuously based on user feedback.

Finally, even the best marketplace won’t succeed without effective marketing. Content strategy, social media presence, creator partnerships, and analytics all play crucial roles in building and sustaining your user base.

Cost & Timeline

Let’s talk numbers—what does it really take to build an NFT marketplace in today’s environment?

A basic marketplace typically costs between $30,000 and $50,000. This gets you core functionality on a single blockchain with standard features for minting and trading. Think of it as a solid foundation that can grow over time.

An advanced marketplace ranges from $80,000 to $150,000, offering multi-chain support, custom design elements, and specialized features like auctions, bundles, and lazy minting (where NFTs are created only when purchased, saving gas fees). These platforms can comfortably handle significant traffic and offer more robust admin capabilities.

Enterprise solutions start around $200,000 and scale up based on complexity. These custom-built platforms integrate with existing business systems, offer advanced security features, and can handle massive transaction volumes. They’re ideal for established brands making serious commitments to the NFT space.

The white-label vs. custom development decision significantly impacts both cost and timeline. White-label solutions can get you to market in weeks rather than months, with initial investments between $10,000-$20,000. However, they limit customization and may not support your unique vision or feature requirements.

| Feature | Single-Chain Marketplace | Multi-Chain Marketplace |

|---|---|---|

| Development Cost | $30,000-$80,000 | $80,000-$200,000+ |

| Development Time | 3-6 months | 6-12 months |

| User Base | Limited to one blockchain | Expanded reach across chains |

| Transaction Fees | Dependent on single chain | Options for lower fees across chains |

| Liquidity | Limited to one ecosystem | Improved through cross-chain access |

| Complexity | Lower | Higher |

| Maintenance | Simpler | More complex |

At Avanti3, we’ve found that the most successful projects aren’t necessarily the ones with the biggest budgets—they’re the ones with the clearest vision and the most thoughtful implementation. We help clients steer these considerations to build marketplaces that align with their goals while setting them up for sustainable growth in this rapidly evolving space.

For more detailed information about how we approach NFT marketplace development, visit our dedicated service page.

Opportunities & Challenges Across Industries

The NFT market development journey has opened exciting doors across multiple industries, each finding unique ways to harness this technology. It’s fascinating to see how different sectors are reimagining ownership and value in the digital age.

The art world was the first to accept NFTs with open arms, creating new income streams for digital artists who previously struggled to monetize their work. When Christie’s auctioned Beeple’s “Everydays: The First 5000 Days” for a staggering $69 million in March 2021, it wasn’t just a sale – it was a statement that digital art had finally arrived in the mainstream. Still, artists face problems with unauthorized minting and establishing lasting value for their digital creations.

Musicians have found in NFTs a way to reclaim control over their work. By tokenizing albums, songs, and concert experiences, they’re bypassing the traditional gatekeepers who typically take the lion’s share of profits. “NFTs particularly benefit aspiring filmmakers and artists not widely recognized in traditional channels,” noted one industry analyst. The automatic royalty mechanisms are especially valuable here – ensuring artists get paid whenever their work changes hands.

Gaming might be where NFTs feel most at home. Gamers have always understood virtual assets, and now they can truly own their hard-earned in-game items. I’ve spoken with players who’ve recouped their entire gaming investment by selling rare NFT items after completing a game – something unimaginable in traditional gaming economies. This shift toward player ownership is revolutionizing how games are designed and monetized.

The fashion industry has acceptd digital wearables with surprising enthusiasm. Luxury brands are creating virtual clothing and accessories, often paired with physical counterparts. These hybrid NFTs not only generate new revenue but also help combat counterfeiting through blockchain verification – a win-win for brands and consumers alike.

Real estate tokenization through NFTs is perhaps the most transformative application, breaking down barriers to property investment. By enabling fractional ownership, NFTs allow everyday people to invest in properties that would otherwise be out of reach. “Fractional real estate ownership via NFTs necessitates complex integrations with existing property software,” explained one expert I interviewed. The potential to democratize real estate investing is enormous, though regulatory problems remain.

In the ticketing world, NFTs are solving age-old problems of fraud and scalping. Event tickets issued as NFTs can have programmable resale terms, ensuring creators get a cut of secondary sales while preventing price gouging. I recently spoke with a railway catering company that issued festival tickets as NFTs – the tickets transformed into collectible memorabilia after the event, creating lasting value beyond the experience itself.

Despite these opportunities, several challenges persist across industries:

Fractional ownership raises complex regulatory questions, particularly whether fractional NFTs constitute securities under existing laws.

Liquidity concerns remain significant, with one study revealing that “about 69% of illiquid NFT collections drop to a 0 ETH floor price within six months” – a sobering statistic for investors.

Royalty wars have created tension in the marketplace. When Blur introduced an optional royalty model, it quickly surpassed OpenSea in trading volume, highlighting the ongoing struggle between creator compensation and trader preferences.

Regulatory uncertainty continues to cast a shadow over the industry, with different jurisdictions taking varied approaches to classification and oversight.

Security & Fraud Prevention

As NFTs have grown in value, so have the efforts to exploit them. Robust security measures are no longer optional – they’re essential.

Smart contract audits by reputable security firms are the first line of defense against vulnerabilities. As one development expert told me, “Exhaustive smart contract auditing is essential to ensure marketplace security and efficiency.” This process, while time-consuming and expensive, is non-negotiable for serious platforms.

Two-factor authentication has become standard practice for reputable marketplaces, adding an extra layer of protection beyond simple passwords. This small friction in the user experience pays dividends in security.

Marketplace reputation matters enormously in this space. Users gravitate toward platforms with proven track records of security and reliability, even if they charge higher fees. Trust, once broken, is nearly impossible to rebuild.

Wash-trade detection algorithms have become increasingly sophisticated as regulators scrutinize artificial trading activity. These systems identify suspicious patterns that might indicate market manipulation – a crucial safeguard for marketplace integrity.

At Avanti3, security isn’t an afterthought – it’s woven into the foundation of every NFT solution we build. Our clients sleep better knowing their digital assets are protected by comprehensive security protocols that inspire confidence in both creators and collectors.

Scalability & User Adoption

The path to mainstream adoption is paved with technical and cultural challenges that the industry is actively addressing.

Layer-2 solutions like Polygon, Arbitrum, and Optimism have been game-changers for scalability, dramatically reducing gas fees and increasing transaction speeds. I’ve seen projects migrate from Ethereum mainnet to these scaling solutions and immediately experience a surge in activity as the barrier to entry drops.

Community building remains the secret sauce of successful NFT projects. The most resilient collections invest heavily in nurturing their communities through Discord servers, Twitter spaces, and real-world meetups. These aren’t just marketing channels – they’re the lifeblood of projects that weather market downturns.

Decentralized Autonomous Organizations (DAOs) are changing how projects govern themselves by giving collectors voting rights on future direction. This shared ownership creates deeper engagement and aligns interests in a way traditional businesses rarely achieve.

Social features integrated directly into marketplaces improve the community experience. Comments, follows, and curation tools transform transactional platforms into vibrant social spaces where collectors connect and find new work together.

Simplified onboarding remains perhaps the biggest challenge to overcome. At Avanti3, we’ve seen how reducing technical barriers through fiat payment options, user-friendly interfaces, and clear educational resources can dramatically increase conversion rates for new users entering the space.

The NFT journey across industries is just beginning, with both tremendous opportunities and significant challenges ahead. By addressing these challenges thoughtfully, we can help open up the transformative potential of this technology across every sector of the economy.

Future Outlook & Expert Predictions

The future of NFT market development points toward greater integration with mainstream applications, institutional adoption, and technological innovation. Industry experts and market analysts provide valuable insights into where the market is headed.

The metaverse economy represents one of the most exciting frontiers for NFT growth. As virtual worlds become richer and more interconnected, NFTs will serve as the building blocks for digital ownership and commerce. With the global metaverse market projected to grow at a remarkable 47.2% CAGR from 2023 to 2027, the opportunities for NFT applications will expand dramatically.

Remember those static JPEGs that kicked off the NFT craze? They’re evolving. Dynamic NFTs that change based on real-world data or user interactions are gaining traction. Unlike their static predecessors, these digital assets transform their properties, appearance, or utility over time, creating more engaging experiences that collectors actually want to interact with.

The marriage between NFTs and finance is blossoming too. NFTFi lending markets have bounced back to approximately $25 million in Q1 2023, allowing collectors to use their digital treasures as loan collateral without parting with them. As one analyst put it, “NFTs can be used as collateral in DeFi applications, expanding their financial utility beyond simple collecting.”

The suits are arriving too. Institutional adoption is accelerating, with companies like KPMG Canada adding digital art NFTs to their corporate treasury. This corporate accept signals growing mainstream acceptance and validates NFTs as legitimate business assets rather than just digital curiosities.

Looking eastward, Asia’s leadership in NFT adoption shows no signs of slowing down. The region is expected to see the fastest NFT market growth thanks to its aggressive development of metaverse platforms and gaming ecosystems. Already, Asia dominates the global NFT landscape, holding more than 35% of market share.

Despite the crypto winter that chilled NFT enthusiasm in 2022, the long-term growth trajectory remains impressive. The global NFT market is projected to grow at a CAGR of over 27% through 2034, potentially reaching a staggering $711.73 billion by that time, according to HackerNoon trend analysis.

NFT Market Development: 2030+ Predictions

Looking further ahead, several transformative trends will likely reshape the NFT landscape:

Cross-industry convergence will blur the boundaries between different NFT categories. We’ll see interoperable assets that function seamlessly across gaming, social, and financial platforms. Imagine purchasing a character NFT that you can use in multiple games, showcase on social media, and even stake for financial returns.

AI-generated assets will democratize content creation while raising fascinating questions about ownership and authenticity. The combination of AI and NFTs could spawn entirely new asset categories and creative possibilities that we can barely imagine today. We’re already seeing early experiments with AI-generated art NFTs, but this is just the beginning.

The days of juggling multiple wallets and navigating complex blockchain interactions will fade away as universal wallet standards emerge. Improved interoperability will make buying and selling NFTs as straightforward as traditional e-commerce. This standardization isn’t just nice to have—it’s essential for bringing the next million users into the space.

Governments worldwide are waking up to digital assets, and with that awakening comes regulatory clarity. As more comprehensive frameworks develop, NFTs will gain legitimacy and institutional comfort. Security Token Offerings (STOs) may become the gold standard for regulatory-compliant NFT issuance, especially for assets that blur the line between collectible and investment.

The bridge between physical and digital worlds will strengthen through physical-digital twinning. Embedded chips, QR codes, and other authentication methods will create seamless connections between tangible products and their digital NFT counterparts. Luxury brands are already pioneering this approach, but it will extend to everyday items too.

Investment & Builder Tips

For those looking to participate in the NFT ecosystem, whether as investors or creators, here are some practical strategies to consider:

Diversify chains to spread your risk and expand market opportunities. As one expert bluntly put it, “Single-chain marketplaces are becoming obsolete as users demand broader blockchain support.” Don’t tie your future to just one blockchain ecosystem.

Focus on utility rather than speculation. Projects that deliver genuine value beyond the “flip” are much more likely to survive market downturns. One analyst noted, “Focusing on practical applications rather than artificial scarcity is essential for growth.” Ask yourself: what problem does this NFT solve?

Secure partnerships with established brands, creators, and platforms to gain credibility and distribution advantages. These collaborations create win-win scenarios, expanding audience reach while leveraging technological capabilities. Even small projects can gain traction through the right partnerships.

Monitor regulation closely, as the legal landscape is evolving rapidly. Staying informed about regulatory changes can help you avoid costly mistakes and position yourself for long-term success. Proactive compliance might seem burdensome now, but it can prevent major headaches later.

At Avanti3, we help clients steer these considerations by developing future-proof NFT strategies that balance innovation with practical implementation. We believe in building sustainable growth rather than chasing short-term hype cycles, ensuring our clients create meaningful connections with their audiences through thoughtfully designed NFT experiences.

Frequently Asked Questions about NFT Market Development

What makes hybrid NFTs different from traditional NFTs?

If traditional NFTs are digital-only collectibles, hybrid NFTs are the exciting bridge connecting our physical and digital worlds. These innovative assets blend the best of both fields, creating something truly special for collectors and brands alike.

Hybrid NFTs typically leverage the ERC-404 token standard, which cleverly combines the divisibility of regular tokens with the uniqueness of NFTs. It’s like getting chocolate in your peanut butter – two great things coming together to create something even better!

The market has responded enthusiastically to this innovation. When Pandora launched as the first ERC-404 token in February 2024, it rocketed to a market cap of nearly $180 million almost overnight. People clearly see the value in this approach.

“Hybrid NFTs combine digital ownership with physical products and fractionalization, addressing liquidity issues that have plagued traditional NFTs,” as one industry analyst perfectly summarized.

In real-world applications, we’re seeing luxury fashion brands create physical products with matching digital twins, concert promoters offering tickets that transform into digital memorabilia after the show, and art galleries providing authenticated digital certificates alongside physical paintings. At Avanti3, our clients have found hybrid NFTs particularly effective for engaging customers across both their online and offline experiences.

Which blockchains are best for launching a multi-chain marketplace?

Choosing the right blockchains for your NFT market development project is a bit like picking the right ingredients for a recipe – you need the right mix for the best results!

While Ethereum remains the powerhouse (handling about 70% of all NFT trading), a truly effective multi-chain marketplace should consider these complementary networks:

Ethereum brings the largest user base and developer community, though it can get expensive during busy periods. It’s like the established neighborhood everyone knows.

Polygon offers dramatically lower fees while staying compatible with Ethereum tools. Think of it as Ethereum’s more affordable suburb with all the same amenities.

Solana shines with blazing speed (65,000 transactions per second!) and minimal fees, making it perfect for gaming NFTs where quick, frequent transactions matter.

Binance Smart Chain has built a reputation for lower costs and strong exchange support – particularly appealing to traders already in the Binance ecosystem.

Tezos stands out with its energy-efficient approach and on-chain governance, attracting environmentally-conscious artists and collectors.

Flow was purpose-built for NFTs by the CryptoKitties team, focusing on making the user experience smooth and accessible.

“Cross-chain compatibility reduces transaction fees, improves scalability, broadens user base, improves liquidity, and enables interoperability between assets,” as one development expert explained to me recently.

At Avanti3, we typically recommend starting with Ethereum and Polygon as your foundation (giving you both prestige and practicality), with Solana as a third option if your project needs higher transaction throughput. This balanced approach helps you reach different user segments without overwhelming your development team.

How do royalties work on secondary NFT sales?

Royalties are perhaps the most aspect of NFT market development, giving creators something they’ve never had before: ongoing income from their work long after the initial sale. It’s like musicians getting paid every time their song plays, but for digital art and collectibles.

Here’s the beautiful simplicity of how it works: The royalty percentage (usually between 5-10%) gets written directly into the NFT’s smart contract. When someone resells that NFT on a supporting marketplace, the smart contract automatically sends that percentage to the creator’s wallet before the seller receives their payment. No invoices, no chasing payments – it just happens.

The implementation varies across platforms, though. Some marketplaces like OpenSea and SuperRare have traditionally enforced these royalties, while others like Blur have moved to optional models to attract traders looking for lower fees.

This has created what some call the “royalty wars” in the ecosystem. As one market analysis revealed, “Blur’s optional royalty and zero gas fee model enabled it to surpass OpenSea in mid-February and match its royalty revenue, becoming the new leader in market share.”

For successful creators, these royalties can be life-changing. I spoke with one artist who earned over $7 million just from secondary sales of their collection – money that in the traditional art world would have gone entirely to dealers and collectors.

The system isn’t perfect, though. While royalties work smoothly within individual marketplaces, some traders use direct transfers or platforms that don’t enforce royalties to avoid these payments.

At Avanti3, we believe strongly in fair compensation for creators, so we implement robust royalty mechanisms in all our marketplace solutions while educating clients about the evolving landscape. A sustainable NFT market development ecosystem needs creators who can earn a living from their work.

Conclusion

The NFT market development journey has truly been a wild ride. What started as a quirky technology mostly known for pixelated art and cartoon apes has blossomed into a multi-billion-dollar ecosystem touching everything from music to real estate. The numbers tell an impressive story – projections show growth from $62.19 billion in 2024 to a potential $711.73 billion by 2034. That’s not just growth; that’s change.

Throughout my work with brands entering this space, I’ve noticed several key trends reshaping how we think about digital ownership:

First, we’re seeing a welcome shift from pure speculation to actual utility. Remember when people were buying NFTs just hoping the price would go up? Those days are fading. Today’s successful projects offer token-gated experiences, community membership, and tangible benefits that create real value beyond the hype.

Multi-chain compatibility has become non-negotiable for serious marketplace builders. When we develop platforms for clients at Avanti3, we always recommend supporting at least 2-3 different blockchains. This approach isn’t just technically superior – it’s about meeting users where they are, whether they prefer Ethereum’s security, Polygon’s low fees, or Solana’s speed.

The tokenization of physical assets has opened doors we couldn’t have imagined a few years ago. I recently worked with a real estate developer who tokenized apartment units, allowing investors to purchase fractional ownership with minimal paperwork and instant settlement. These hybrid NFTs bridging digital and physical worlds represent some of the most exciting opportunities in the space.

Gaming and metaverse integration feels like the most natural home for NFTs. The ability to truly own your in-game assets, trade them freely, and even earn income through play represents a fundamental shift in gaming economics. As one gamer told me, “For the first time, my thousands of hours in a game have created something I actually own.”

Perhaps most telling is the growing institutional adoption. When major corporations start adding NFTs to their treasuries and traditional auction houses accept digital art, it signals a legitimacy that was missing during the early speculative phase.

Of course, challenges remain. Regulatory clarity is still developing in many jurisdictions. Security concerns continue to make headlines. And let’s be honest – the user experience still isn’t where it needs to be for mainstream adoption. Too many wallets, too many steps, too much jargon.

At Avanti3, we’re committed to helping brands and creators steer through these challenges. Our approach integrates Web3 technologies like NFTs, blockchain, AR/VR, and AI to create engaging digital experiences that drive real business results. We believe the most successful implementations focus on community building and seamless user experiences rather than short-term speculation.

As this market continues to mature, I’m most excited about the creative possibilities. Whether you’re a brand looking to engage customers in new ways, a creator seeking direct relationships with your audience, or an entrepreneur building the next generation of digital experiences, the NFT ecosystem offers powerful tools to achieve your goals.

For more information about how Avanti3 can help you develop and implement effective NFT strategies, explore our augmented reality NFTs and other innovative solutions designed to create meaningful connections in the digital age.