Fintech Startups: Thriving in 2025

Why Fintech Startups Are Revolutionizing Finance

Fintech startups are changing how we handle money, making financial services faster, cheaper, and more accessible than ever before. These technology-driven companies use apps, software, and digital platforms to simplify everything from payments to investments.

Key fintech startup sectors include:

- Payments & Transactions – Digital wallets, P2P payments, B2B processing

- Lending & Financing – P2P lending, BNPL services, digital loans

- Wealth Management – Robo-advisors, micro-investing, trading apps

- Insurance Technology – Digital brokerages, AI risk assessment, automated claims

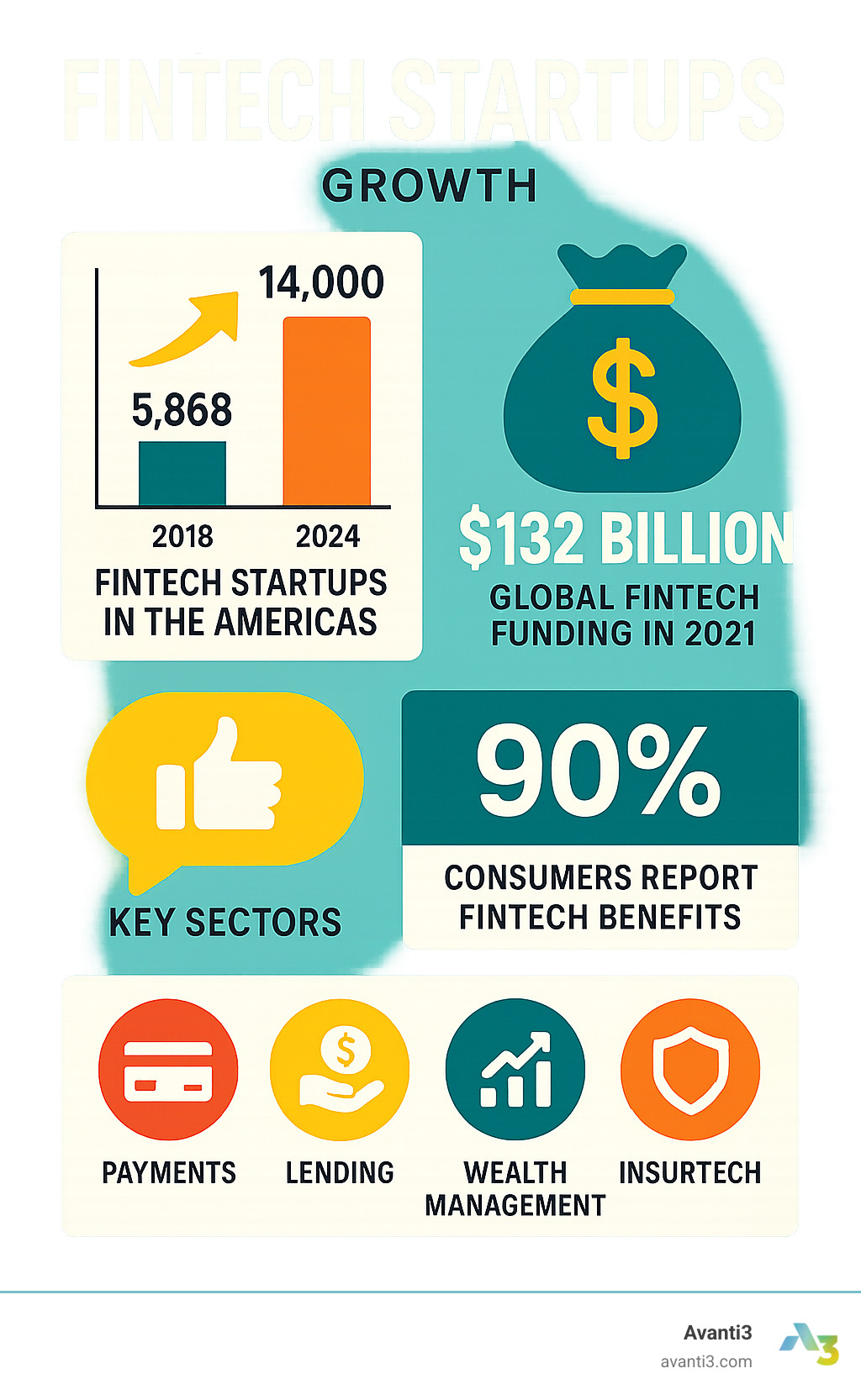

The numbers tell an incredible growth story. In the Americas alone, fintech startups jumped from 5,868 companies in 2018 to nearly 14,000 in 2024. Global funding hit a record $132 billion in 2021, showing massive investor confidence in this space.

What makes this especially relevant for creators and brands? Many fintech innovations focus on community engagement, monetization tools, and secure digital experiences – exactly what modern audiences demand from their favorite platforms and content creators.

Consumer trust is growing fast too:

- 87% feel comfortable using national banks

- 79% trust fintech companies

- 90% say fintech has helped them somehow

- 41% of Americans make all weekly payments digitally

I’m Samir ElKamouny AV, and I’ve spent years helping businesses scale through strategic marketing and innovative technology solutions, including working with fintech startups to open up new revenue streams and customer engagement opportunities. My experience spans from traditional business growth to cutting-edge digital change, giving me unique insights into how fintech startups are reshaping both finance and customer relationships.

Find more about fintech startups:

- api integrations for fintech

- banking compliance for fintech integrations

- fintech api integration systems

The Diverse Landscape of Fintech Startups: Key Sectors and Innovations

Fintech, or “financial technology,” is a revolution applying modern tech to make money management simpler, faster, and fairer. We’ve moved from bank lines to having a financial toolkit in our pockets—a digital ecosystem touching nearly every financial interaction.

The industry is booming. The number of fintech startups in the Americas soared from 5,868 in 2018 to nearly 14,000 by 2024. This rapid expansion reflects investor trust, with global funding hitting a record $132 billion in 2021. Despite a dip to $75.2 billion in 2022, the market remains strong. Fintech startups represent 20.8% of global “unicorns,” the second-largest industry for these billion-dollar companies, truly disrupting the financial world.

The number of fintech startups has grown impressively: The number of fintech startups has grown impressively.

Let’s explore the key areas where fintech startups are making the biggest splash:

Payments and Transactions

This is where most of us first experience fintech, with apps for splitting bills, buying coffee, or sending money globally in seconds. Fintech startups in this space focus on digital wallets, peer-to-peer (P2P) payment systems, B2B payment processing, and contactless hardware. These platforms are essential for online businesses, while consumer apps for sending and receiving money are now commonplace. The shift to digital is massive: non-cash transactions in North America jumped 14% from 2023 to 2024, and almost half of Americans make all their weekly payments digitally.

Lending and Financing

Fintech startups are changing how we borrow and lend. Long bank applications are being replaced by peer-to-peer lending platforms that directly connect borrowers with investors, cutting out middlemen. The “Buy Now, Pay Later” (BNPL) trend offers flexibility for purchases, while small business financing provides quicker access to capital based on real-time cash flow instead of just old credit scores. This digital-first approach expands credit access for many.

Wealth Management and Investing (Wealthtech)

Investing is no longer an exclusive club, thanks to “Wealthtech.” Robo-advisors use algorithms to automatically manage investments at a low cost. Micro-investing apps let you invest small amounts, making the stock market less intimidating. With these tools, automated portfolio management is accessible to everyone. This sector empowers individuals to take charge of their financial future, regardless of their starting capital or financial knowledge.

Insurance Technology (Insurtech)

Even the insurance industry is being modernized by “Insurtech.” Digital insurance brokerages simplify buying policies online. AI-based risk assessment leads to more personalized policies and fairer prices through smart data analysis. When you need to make a claim, claims automation speeds up payouts and reduces paperwork. Fintech startups are making insurance more transparent, efficient, and customized, moving away from a one-size-fits-all model.

The Tech Engine: How AI, APIs, and Mobile Power Fintech

What makes your favorite fintech startups so smooth and smart? It’s a powerful mix of cutting-edge technology. The backbone of these companies is their ability to aggregate massive amounts of data, deliver services at lightning speed, and push the boundaries of what’s possible in finance.

Like a high-performance car’s engine, sophisticated AI, seamless APIs, and mobile-first design work together in modern fintech startups to create experiences that feel effortless.

The innovation happening in this space is incredible. We’re seeing amazing advancements in AI Digital Marketing: More info about AI Digital Marketing.

Artificial Intelligence (AI) and Machine Learning

AI and Machine Learning are the brains behind many impressive fintech features. Fraud detection is a crucial application, with AI analyzing thousands of data points in milliseconds to verify transactions. Credit scoring is also transformed, as AI analyzes hundreds of factors beyond credit history for a more accurate picture of creditworthiness. This leads to personalized financial advice, with apps offering budgeting tips or investment options based on your habits. Finally, helpful chatbots are increasingly effective at solving problems 24/7, from checking balances to explaining fees.

AI is also revolutionizing customer engagement in ways we’re just beginning to understand: More info about AI Customer Engagement.

APIs and Open Banking

APIs are digital translators that help different apps and banks talk to each other securely. This enables open banking, a system where banks can securely share your financial data with other services with your permission. This secure data sharing allows you to see all your accounts in one budgeting app or get instant loan approvals. Third-party integration means your favorite apps work together seamlessly, creating a connected financial ecosystem that simplifies money management.

Mobile and Web Applications

Your smartphone is now your bank, investment advisor, and financial planner. The accessibility of mobile apps is game-changing, but it’s the user experience (UX) that truly sets the best fintech startups apart. They make complex financial tasks feel simple and intuitive. Real-time access to your financial information is now standard, and the shift to digital-first banking means physical branches are becoming less necessary. The average person uses three to four financial apps regularly, showing how central mobile-first solutions have become.

Why Fintech Matters: Benefits for Consumers and Businesses

Fintech startups are a big deal because they make our financial lives easier, cheaper, and more efficient. For both consumers and businesses, these companies solve real problems by improving access to financial services, lowering costs, streamlining operations, and delivering a better customer experience. It’s no surprise that 90% of consumers say fintech has helped them in some way.

For Consumers

For consumers, fintech startups offer significant advantages. Many provide services with zero fees, saving money compared to traditional banks. The convenience is incredible, with apps for instant bill splitting or investing with a few taps. This ease of use also brings greater choice, allowing users to select from a global range of specialized financial services.

More importantly, fintech improves financial accessibility, breaking down barriers for those underserved by traditional banks, including the 4.2% of American households that are “unbanked.” Fintech startups provide digital accounts and accessible services, along with financial literacy features and budgeting apps that empower users to manage their money smarter.

We’ve seen that 90% of consumers report fintech has helped them: 90% of consumers report fintech has helped them.

For Businesses

For businesses, fintech startups are equally impactful. They help streamline operations by automating tasks like accounting, payroll, and invoice management, which leads to cost savings and increased productivity. Fintech has also revolutionized access to capital, as digital lenders can quickly assess a business’s health and disburse funds faster than traditional routes. For companies expanding globally, fintech makes global payment processing simpler and more affordable. This competition from fintech companies is also pushing traditional financial institutions to improve, benefiting the entire financial landscape.

The Future is Now: Emerging Trends and Challenges

The fintech landscape is constantly changing, bringing new ways to manage money. But with this exciting innovation come real challenges and risks that the industry must face.

At Avanti3, we’re at the forefront, helping businesses explore exciting new possibilities like Web3 Platform Solutions: More info about Web3 Platform Solutions.

Key Trends Shaping the Industry

What’s next for fintech startups? One key trend is embedded finance, where financial services are woven into everyday products. Imagine getting financing directly through a bike shop’s app. This trend is set to generate $230 billion in revenue by 2025, making finance invisible and convenient.

Another shift is toward real-time payments, enabling instant, 24/7 transactions. Blockchain and cryptocurrency integration also offer improved transparency, security, and efficiency. Web3 technologies like NFTs and blockchain are creating new monetization and community-building opportunities for creators and brands.

Finally, hyper-personalization is becoming standard. Using AI and data, fintech startups offer custom-made services, from personalized financial advice to dynamic loan offers.

Embedded finance services are expected to generate $230 billion in revenue in 2025: Embedded finance services are expected to generate $230 billion in revenue in 2025.

Challenges and Risks for Fintech Startups

While the future of fintech looks bright, the journey isn’t without challenges. One of the main problems is regulatory compliance. Fintechs must steer a complex maze of laws that can be slow to adapt to new technology, potentially stifling innovation.

Data security and customer privacy are also huge concerns. As prime targets for cyberattacks, fintech startups must invest heavily in strong security and follow strict data protection rules to build and maintain customer trust.

Lastly, competition with legacy banks is tough. While fintechs are innovative, traditional banks have huge customer bases and capital. However, many banks are now partnering with or acquiring fintech startups, creating a dynamic competitive landscape. This environment also presents an opportunity for fintechs to serve the 4.2% of American households that are “unbanked,” making finance more inclusive.

The FDIC found that 4.2% of American households are “unbanked”.

Frequently Asked Questions about Fintech Startups

We often get asked common questions about the fintech world. Let’s clarify some of the most frequent ones with a warm, friendly chat!

What is a fintech unicorn?

Ever heard of a “unicorn” in the business world? It’s a special term for a private startup company that’s worth over a whopping $1 billion. So, a fintech unicorn is exactly that – a private startup in the financial technology sector that has reached this incredible valuation. These are the companies that have attracted a ton of investment because they’re seen as having huge potential to change their industries. Think of them as the rare, super valuable gems of the startup world!

As we mentioned earlier, fintech startups are truly shining, making up an impressive 20.8% of all global unicorns. That just shows how much growth and investment this sector is attracting. You might recognize some well-known names like Stripe, Klarna, and Revolut in this exclusive club.

Are fintech companies safe to use?

This is a super important question, and the answer is a resounding yes, reputable fintech companies are generally safe to use! They truly prioritize your security and compliance. Think of it this way: they’re often built from the ground up with the latest technology. This means they use advanced tools like strong encryption to keep your data scrambled and safe, and multi-factor authentication (MFA) to make sure only you can access your accounts. They also have systems constantly watching for fraud, 24/7.

Many fintech startups are regulated by financial authorities, just like traditional banks. They also follow strict global standards for information security, data protection, and handling your payment card information. While no digital service can be 100% risk-free, fintech startups often put a lot of effort into building super secure, modern systems. That makes them quite robust and reliable for your daily financial needs. Of course, it’s always smart to choose services you know and trust, just like with any financial institution.

How do fintech startups make money?

Fintech startups are pretty creative when it comes to making money, and they use a few different approaches depending on what services they offer.

For starters, many rely on transaction fees. If you’re sending money, making a payment online, or trading stocks, they might take a small percentage of each transaction. It’s a common way for payment processors or trading platforms to earn their keep.

Then there are subscription fees. Some fintech startups offer a basic service for free, but if you want extra features, improved tools, or special insights, you’ll pay a recurring monthly or annual fee. This is often called a “freemium” model – you get some free, but pay for the premium stuff!

If a fintech startup is involved in lending, their main income comes from the interest on loans they facilitate. This works much like a traditional bank, where borrowers pay interest on the money they’ve received.

You might also see interchange fees. If a fintech company issues a debit or credit card, they often get a small fee from the merchant every time you use that card.

Finally, some fintech companies might use data monetization. Now, don’t worry, this isn’t about selling your personal information! Instead, they might anonymize and group together vast amounts of user data to sell insights about market trends to other businesses. They always do this while making sure your privacy is protected and following all the rules. It’s all about finding smart, safe ways to keep innovating and serving you better!

Conclusion

The journey through fintech startups reveals something truly remarkable: we’re witnessing a complete change of how money works in our daily lives. These innovative companies haven’t just created better apps or faster payments – they’ve fundamentally changed what’s possible when technology meets finance.

Think about where we started. Just a few years ago, splitting a dinner bill meant awkward cash exchanges or complicated IOUs. International money transfers took days and cost a fortune. Investing required a broker and thousands of dollars. Insurance claims meant endless paperwork and months of waiting.

Today, fintech startups have turned these frustrations into simple taps on our phones. They’ve opened doors that were previously locked to millions of people, making financial services accessible to everyone from college students to small business owners in remote areas.

The numbers tell this story beautifully. With fintech startups growing from under 6,000 to nearly 14,000 companies in the Americas alone, and 90% of consumers saying fintech has helped them somehow, we’re clearly in the middle of something special.

But here’s what excites me most: this is just the beginning. Embedded finance will make financial services invisible parts of everything we do. Real-time payments will eliminate the waiting game entirely. Blockchain and AI will create possibilities we haven’t even imagined yet.

At Avanti3, we see these same change patterns happening across all digital experiences. Just as fintech startups revolutionized how we handle money, we’re helping creators and brands revolutionize how they connect with their communities. We integrate Web3 technologies like NFTs, blockchain, AR/VR, and AI to create the same kind of breakthrough moments – turning complex technology into simple, powerful tools that change everything.

The future of finance isn’t just about better banking. It’s about creating deeper connections, more meaningful engagement, and new ways for people to build value together. Whether that’s through a seamless payment experience or an innovative digital community platform, the goal remains the same: making technology work for people, not the other way around.