Fintech Integration Services: 5 Powerful Ways to Launch Fast

Accelerating Fintech Innovation Through Integration

Fintech integration services are specialized platforms and APIs that enable businesses to rapidly connect their applications with banking systems, payment processors, KYC/AML providers, and other financial infrastructure. These services dramatically reduce development time and costs while ensuring regulatory compliance.

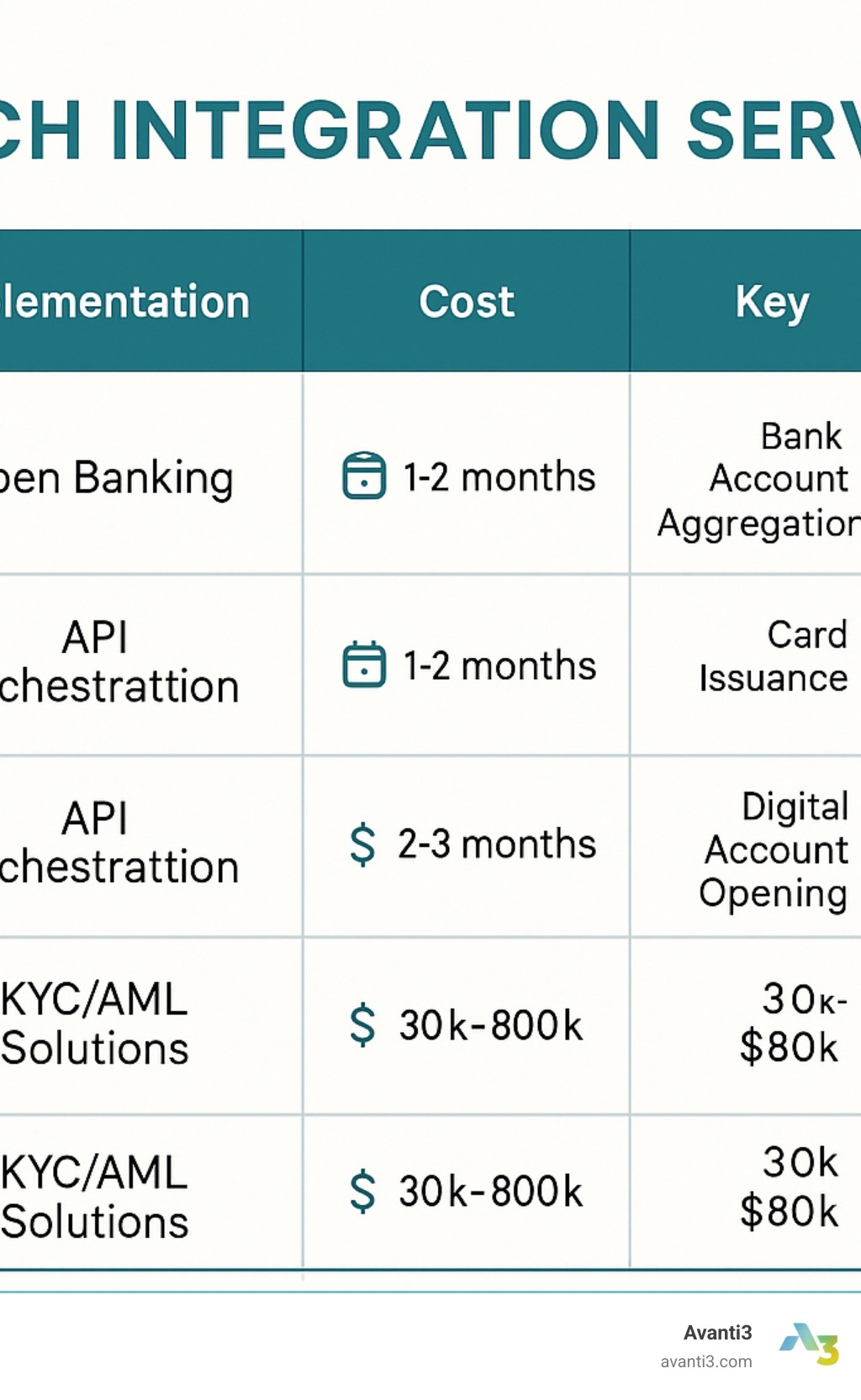

Top Fintech Integration Services at a Glance:

- API Orchestration Platforms – Streamline connections between multiple financial systems

- Payment & Card Issuance – Enable secure transaction processing and card management

- KYC/AML Solutions – Automate identity verification and compliance processes

- Open Banking Connectors – Facilitate secure data sharing between financial institutions

- Low-Code/No-Code Tools – Simplify integration development with visual interfaces

In today’s competitive financial landscape, speed-to-market is everything. Traditional financial institutions and innovative startups alike face immense pressure to launch new products quickly while navigating complex regulatory requirements. The right integration services can mean the difference between a six-month and a six-week launch timeline.

According to industry data, companies using specialized fintech integration platforms save an average of $124,488 on integration time and maintenance costs. More importantly, these services provide immediate access to established infrastructure that would otherwise take years to build internally.

“Using modern fintech integration services transformed our development timeline and dramatically improved our customer experience” – Financial Services CTO

The fintech integration ecosystem has matured significantly, with specialized providers now offering everything from unified APIs that connect to 16,000+ financial institutions to pre-built modules for specific verticals like lending, wealth management, and payments.

I’m Samir ElKamouny AV, an entrepreneur who has helped numerous businesses implement fintech integration services to accelerate their growth and expand their financial offerings. My experience has shown that selecting the right integration partners is often the most critical decision in determining a fintech project’s success.

Payment & Card Issuance APIs

Modern financial experiences thrive on smooth payment flows and creative card solutions. Payment and card issuance APIs are truly the heartbeat of many fintech applications, powering everything from simple transactions to sophisticated loyalty programs that keep customers coming back.

These powerful tools handle all the behind-the-scenes complexity that makes payments work – from card tokenization that keeps sensitive data safe, to managing cross-border transactions that connect global customers. They also ensure your business stays compliant with PCI-DSS standards (which, let’s be honest, nobody wants to build from scratch!).

For businesses looking at the bottom line, here’s a pleasant surprise: card issuance APIs open the door to interchange revenue streams that can significantly boost your profitability. It’s like getting paid while your customers pay!

At Avanti3, we see payment functionality as the cornerstone of meaningful digital engagement. Our blockchain content distribution solutions work hand-in-hand with these payment services, creating secure, transparent transaction records that build lasting trust with your users.

Why These Fintech Integration Services Cut Time-to-Market

The race to launch is real in today’s competitive landscape. Fintech integration services focused on payments and cards are your secret weapon for getting to market faster in several important ways:

Pre-built compliance frameworks save you months of development time by offering ready-made solutions that already satisfy regulatory requirements. Why reinvent the wheel when it comes to complex payment regulations?

With instant card provisioning, your users can start making transactions seconds after signup, rather than waiting days for physical cards to arrive in the mail. This immediate gratification keeps new customers engaged from day one.

Mobile wallet compatibility comes baked into leading integration services, automatically supporting popular digital payment options without requiring custom development work from your team.

The built-in fraud prevention tools these services provide are often more sophisticated than what most companies could build internally, protecting both your business and your customers from day one.

Industry data shows businesses using specialized payment fintech integration services typically launch 70% faster than those building payment infrastructure in-house. That’s the difference between launching this quarter or next year!

Key Implementation Best Practices

Getting the most from payment and card issuance APIs requires thoughtful implementation. Here’s what we’ve learned from working with industry leaders:

Always start in the sandbox. Before processing real money, thoroughly test all payment flows in a controlled environment. This helps you identify and fix issues while they’re still theoretical rather than affecting actual customers.

Fine-tune your fraud monitoring settings to find that sweet spot between security and convenience. Too strict, and you’ll frustrate legitimate customers with declined transactions; too loose, and you invite trouble.

Settlement automation is worth the effort. Setting up automated reconciliation ensures accurate accounting and timely payouts, reducing manual work and potential errors.

Build for your busiest day. Ensure your integration can handle transaction volume spikes, especially if you expect seasonal rushes or rapid growth. Nothing kills customer trust faster than payment systems that crash during peak times.

Document how you’ll handle the inevitable hiccups. Create clear procedures for managing declined transactions, network errors, and other payment issues to maintain a smooth user experience even when things don’t go perfectly.

By embracing these practices, your business can maximize the benefits of payment and card issuance APIs while minimizing risks and implementation headaches. The result? Faster launches, happier customers, and a stronger bottom line.

Open Banking & Data Aggregation Hubs

Open banking has revolutionized the financial landscape by enabling secure data sharing between financial institutions and third-party providers. Data aggregation hubs serve as central connection points, allowing fintechs to access customer financial data across multiple institutions through a single integration.

These fintech integration services do something truly magical – they provide real-time access to account information, transaction history, and financial data that was previously locked away in separate systems. Imagine being able to see all your financial information in one place, updated in real-time. That’s the power these services deliver.

What’s particularly exciting is how raw financial data transforms into actionable insights. A business can analyze cash flow patterns to make smarter lending decisions, or a personal finance app can offer custom advice based on your actual spending habits. The possibilities are endless!

At Avanti3, we’re fascinated by this approach to data. We apply similar principles to create personalized experiences that truly connect with users while keeping their information secure. For those interested in the academic foundations of these systems, scientific research on open banking frameworks provides fascinating insights into how these ecosystems continue to evolve.

Boosting UX with Fintech Integration Services Connectivity

The user experience improvements from open banking connections are truly game-changing:

When a new user joins your platform, frictionless onboarding means they can connect their existing accounts in seconds – no tedious forms or document uploads necessary. This smooth start creates an immediate positive impression.

Users also love seeing their comprehensive financial picture in one place. Rather than jumping between five different banking apps, everything appears in a single, coherent view. This holistic approach helps people understand their finances better than ever before.

With multi-bank coverage from leading providers connecting to over 12,000 financial institutions, it doesn’t matter where your users bank – the system just works. And thanks to automated data refreshes, everything stays current without requiring users to manually update anything.

The numbers speak for themselves – applications using open banking connectivity see up to 25% higher conversion rates during onboarding compared to those requiring manual setup. People recognize value when they see it!

Security & Compliance Checklist

When working with sensitive financial data, security isn’t just important – it’s everything. Here’s what responsible implementation looks like:

Strong security starts with implementing OAuth flows for authentication and authorization. This industry-standard approach ensures users control exactly what data they share and with whom.

All data must be encrypted both in transit and at rest – no exceptions. Regional data storage requirements must be honored to comply with local regulations, which often means keeping European data in Europe, US data in the US, and so on.

Clear user consent mechanisms are essential. People should always understand exactly what they’re agreeing to share. Maintaining detailed access logs for audit purposes creates accountability, while establishing proper data retention policies ensures compliance with GDPR and other privacy frameworks.

Finally, regular security audits help identify and address vulnerabilities before they become problems. This proactive approach aligns perfectly with our Web3 platform solutions at Avanti3, where we balance innovation with rigorous protection of user data.

By thoughtfully implementing these security measures, financial applications can deliver amazing experiences without compromising on the trust that forms the foundation of any financial relationship.

KYC/AML & Compliance Engines

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance aren’t just regulatory boxes to check—they’re essential safeguards that protect your business and customers. Modern fintech integration services have transformed these once-tedious processes into streamlined, powerful tools that actually improve your customer experience while keeping you compliant.

Think of these systems as your compliance superheroes, working behind the scenes to verify identities, validate documents, detect liveness (yes, confirming your users are actually human!), screen against sanctions lists, and score risk—all within seconds instead of days. The beauty is that while they’re doing the heavy lifting, your customers enjoy a smooth, quick onboarding experience.

What’s even better? These engines stay current with regulatory changes across different jurisdictions automatically. No more scrambling when compliance requirements shift—your system adapts so you don’t have to rebuild your processes from scratch.

At Avanti3, we understand the importance of balancing security with user experience, which is why our AI Digital Marketing solutions incorporate similar principles of verification and trust-building.

Reducing Fraud with Fintech Integration Services Automation

Fraud prevention becomes remarkably more effective when powered by automated KYC/AML solutions. Document OCR technology doesn’t just read IDs—it analyzes them for inconsistencies that human eyes might miss. Biometric checks ensure the person submitting documents is actually present and matches their ID photo (goodbye, identity thieves!).

The real magic happens with cross-reference verification, where information gets instantly checked against multiple authoritative databases. Meanwhile, behavioral analysis works quietly in the background, flagging suspicious patterns that might indicate fraud.

What truly sets modern systems apart is their use of machine learning algorithms that continuously improve over time. They learn from each verification, adapting to new fraud techniques as they emerge—essentially getting smarter while you sleep.

These capabilities align perfectly with our approach at Avanti3, where we use similar technologies to ensure authentic engagement in our digital marketing solutions, creating trust while maintaining security.

Staying Audit-Ready Year-Round

Compliance isn’t a destination—it’s a journey that requires ongoing attention. The secret to staying audit-ready isn’t working harder; it’s working smarter with the right tools and habits.

Automated report generation transforms compliance from a scramble into a routine. Set up your system to produce regular compliance reviews, giving you visibility into your risk profile at all times. Continuous monitoring of customer activities means you’ll spot unusual patterns early, not during an audit.

Keep your policies updated with the latest regulatory requirements, and be sure to document all compliance procedures so your team has clear guidelines. Regular internal audits help you identify and address potential issues before regulators find them.

One often overlooked aspect is maintaining comprehensive audit trails of all verification activities. These detailed records prove you’ve done your due diligence and can save you countless headaches during official reviews. Finally, don’t forget to schedule regular training for your team—compliance knowledge needs refreshing just like any other skill.

By building these practices into your routine, you’ll not only avoid costly penalties but also build deeper trust with customers who appreciate your commitment to security and integrity.

iPaaS & Low-Code Fintech Integration Services

Integration Platform as a Service (iPaaS) and low-code solutions have transformed the fintech integration landscape, making it possible to build sophisticated financial applications without extensive coding or infrastructure management.

Remember when integrating financial systems meant months of complex coding? Those days are thankfully behind us. Today’s iPaaS platforms offer API orchestration and visual development tools that feel almost magical in their simplicity. With reusable connectors and drag-and-drop interfaces, even team members with limited technical expertise can contribute to integration projects.

Many platforms now provide “Connectivity-as-a-Service” models that handle all the tedious parts of integration – vendor management, API maintenance, and version updates. This frees your development team to focus on what truly matters: building unique features that set your product apart.

Specialized providers in this space address a variety of needs. One group focuses on financial-institution connections, offering pre-built connectors to core banking systems that previously took months to integrate. Another delivers “Sandbox-as-a-Service” capabilities, allowing teams to safely test new integrations before moving them to production. These tools don’t just save time – they fundamentally change what’s possible for teams of all sizes.

Benefits of Fintech Integration Services Platforms

The advantages of fintech integration services platforms go far beyond simple convenience. They’re changing how financial products are built and launched.

Speed is perhaps the most obvious benefit. What once took quarters now takes weeks or even days. With visual builders and pre-built components, your team can rapidly prototype, test, and refine new features. This quick iteration means you can respond to market demands faster than competitors still stuck in traditional development cycles.

The relief from vendor management is genuinely liberating. Instead of your team scrambling every time an API changes or deprecates, the platform handles these updates behind the scenes. This elimination of maintenance burden means your developers can stay focused on innovation rather than playing catch-up.

Cost predictability is another game-changer. Unlike custom development with its notorious scope creep and unexpected expenses, subscription-based platforms give you clear, predictable monthly costs. This makes budgeting simpler and often results in significant savings.

As your business grows, these cloud-based platforms scale effortlessly to handle increasing transaction volumes. No more emergency infrastructure upgrades or performance firefighting – the platform grows with you.

Perhaps most valuable in the long run is the reduction in technical debt. By using standardized integration patterns and managed services, you avoid accumulating the patchwork of custom code that eventually becomes a maintenance nightmare.

When to Choose an iPaaS vs. Custom Build

Deciding between an iPaaS solution and building custom integrations isn’t always straightforward. It’s a bit like choosing between buying or building a house – each has its place depending on your specific situation.

iPaaS shines when you’re working with limited development resources and need to move quickly. If you’re integrating standard financial functions like payments, KYC verification, or data aggregation, pre-built connectors can save tremendous time. These platforms are also ideal if you prefer focusing your team’s energy on your core product rather than integration maintenance.

Custom building makes more sense when your requirements venture into truly unique territory. If you’re creating something that existing platforms don’t support, custom development gives you complete control. Similarly, if your transaction volumes reach massive scale, the economics might eventually favor building proprietary infrastructure.

Security and compliance requirements can also tip the scales. While modern platforms offer robust security, some highly regulated industries or specialized compliance needs might necessitate custom solutions.

At Avanti3, we understand this balance well. Our Personalized Data solutions often require thoughtful consideration of which components to build and which to integrate through platforms. The right approach depends on your specific goals, timeline, and resources – there’s no one-size-fits-all answer.

The beauty of today’s integration landscape is that you’re no longer forced to choose all-or-nothing. Many successful products take a hybrid approach, using iPaaS for standard functions while custom-building their truly differentiating features.

Conclusion

The fintech integration landscape continues to evolve rapidly, with specialized services enabling faster launches, better user experiences, and more innovative financial products. By strategically selecting and implementing the right integration services, businesses can dramatically accelerate their journey from concept to market-ready solution.

As we’ve explored throughout this guide, each category of fintech integration services solves unique challenges that would otherwise slow down your development timeline. Payment APIs create seamless transaction experiences while opening new revenue streams. Open banking connectors open up valuable financial data that powers personalized experiences. KYC/AML engines turn compliance from a headache into a competitive advantage. And iPaaS platforms tie everything together without requiring an army of developers.

The magic happens when these services work in harmony, creating future-ready finance solutions that feel effortless to your customers. Behind that simplicity lies sophisticated orchestration – but your users never need to see the complexity.

At Avanti3, we understand the power of seamless ecosystems. We’ve built our own digital engagement solutions with the same philosophy – connecting Web3 technologies, AI innovations, and immersive experiences to create something greater than the sum of its parts.

The future belongs to companies that can create these seamless ecosystems where data and functionality flow naturally between applications. Fintech integration services are the building blocks that make this possible – they handle the complex plumbing so you can focus on creating magical experiences.

Whether you’re a scrappy startup with big dreams, an established company adding financial features, or a traditional bank embracing digital change, your integration strategy might be the most important decision you make. The right partners don’t just save time and money – they expand what’s possible.

As you continue your journey, we invite you to explore how Avanti3’s Digital Engagement Solutions and Tools for Building a Community can complement your financial offerings. The most compelling products of tomorrow won’t just move money – they’ll create meaningful connections and experiences.

With the right integration partners, you can build the future faster than you might imagine. And we’d love to be part of that journey with you.