Fintech API Integration Systems: 7 Powerful Success Secrets 2025

Why Fintech API Integration Systems Are the Future of Digital Finance

Fintech api integration systems are the backbone that connects financial services to modern applications, enabling everything from instant payments to real-time banking data access. These systems allow developers to embed sophisticated financial features into their platforms without building complex infrastructure from scratch.

Here’s what fintech API integration systems enable:

- Payment Processing – Accept payments, handle refunds, manage subscriptions

- Banking Services – Access account data, initiate transfers, verify balances

- Identity Verification – KYC/AML compliance, fraud detection, risk assessment

- Investment Tools – Trading capabilities, market data, portfolio management

- Cross-border Finance – Currency exchange, international transfers, multi-currency support

The numbers tell the story. The fintech market is expected to reach $699 billion by 2030, with 88% of organizations now viewing APIs as a top priority. When consumers link financial accounts through APIs, their monthly card spending increases by up to 28%.

But here’s the reality: integrating financial APIs can feel like navigating a maze blindfolded. Between OAuth flows, compliance requirements, rate limiting, and webhook management, many developers find themselves overwhelmed.

The good news? With the right approach, fintech API integration doesn’t have to be painful. Modern platforms are making it easier than ever to connect financial services securely and efficiently.

I’m Samir ElKamouny AV, and I’ve helped countless businesses scale through strategic fintech integrations and API-driven growth solutions.

Fintech API Integration Systems 101

A fintech API integration system is the digital bridge that connects your application to financial services. Think of it as sophisticated middleware that lets you tap into banking systems, payment processors, and other financial institutions without building everything from scratch.

The financial technology landscape has transformed dramatically. What used to be a closed ecosystem dominated by traditional banks has opened up significantly. Open banking regulations like PSD2 in Europe have forced banks to share their data (with proper customer consent). Meanwhile, Banking-as-a-Service providers have emerged as translators between old-school banking infrastructure and modern applications.

This evolution has created two distinct integration approaches. Open banking APIs work on a many-to-many model, where multiple financial institutions connect to multiple fintech services through standardized protocols. Partner APIs create direct one-to-one relationships between specific institutions and fintech providers, offering deeper integration capabilities but requiring more customization.

The numbers are impressive. Large banks now allocate 14% of their IT budgets to API initiatives, and 78.3% of banks rely on APIs to improve customer experience. Consumer adoption has skyrocketed with 88% of US consumers now using technology to manage their finances.

How Fintech APIs Work Behind the Scenes

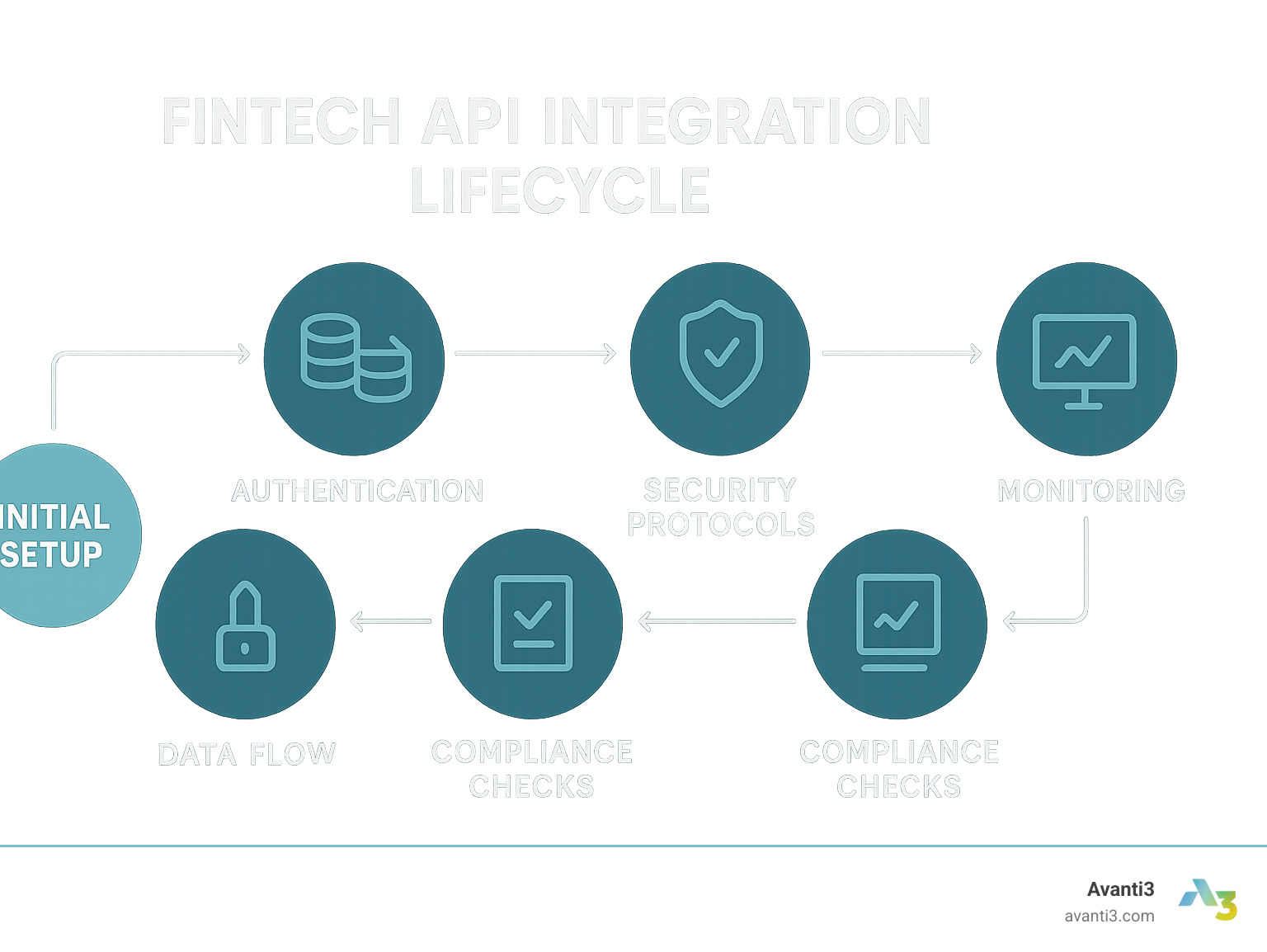

Most fintech api integration systems follow a predictable process: authentication using OAuth 2.0 or API keys, properly formatted requests (usually JSON over HTTPS), processing by the API provider, and structured responses or confirmations.

For time-consuming operations like international transfers, systems use webhooks for real-time updates instead of constant polling. Most modern fintech APIs use REST architecture with JSON payloads, though GraphQL is gaining popularity.

Financial APIs prioritize security and reliability over speed, with additional validation steps and conservative rate limits. Sandbox environments are essential for testing integration logic without processing real transactions.

Idempotency is crucial – financial operations must be idempotent, meaning duplicate requests won’t create duplicate transactions or charges.

Core Components of a Fintech API Integration System

Every solid fintech integration system needs several key components. The authentication layer manages API keys, OAuth tokens, and user permissions. Request routing directs API calls to appropriate endpoints and handles load balancing.

Rate limiting prevents abuse and ensures fair usage. Logging and monitoring track every API interaction for debugging, compliance, and performance optimization – financial regulators often require detailed audit trails.

Robust error handling gracefully manages failures and provides meaningful error messages, essential since financial APIs can fail for numerous reasons from insufficient funds to regulatory restrictions.

Picking the Right API Types & Providers

Choosing the right fintech APIs can make or break your project. Most fintech api integration systems fall into four main categories: Payment processing APIs handle money movement, Banking and data APIs provide account access, Trading and investment APIs bring Wall Street capabilities, and Identity and compliance APIs automate KYC/AML processes.

Start simple, then expand. When evaluating providers, security and compliance should be your first filter. Look for PCI-DSS certification, SOC 2 compliance, and regional standards. Geographic coverage and documentation quality are equally important.

Pricing models vary wildly. Some charge fixed monthly fees, others take transaction percentages, many use hybrid models. Always calculate total costs including setup fees, monthly minimums, and transaction volumes.

Payment & Card Processing APIs

Payment APIs handle recurring billing with smart retry logic, cross-border payments with automatic currency conversion, alternative payment methods like digital wallets, and tokenization for secure credential storage.

PCI-DSS compliance is non-negotiable. Reputable payment APIs handle this for you through hosted payment pages or secure tokenization. Be careful with pricing comparisons – that lowest headline rate might include hidden fees for international transactions or chargebacks.

Banking & Data Aggregation APIs

Banking APIs enable account aggregation for unified financial views, balance verification to prevent payment failures, and transaction categorization for useful insights. Quality differences between providers are significant – some provide clean, enriched data while others dump raw bank feeds.

Connection reliability is crucial. Look for providers offering multiple connection methods and proactive monitoring. ACH and SEPA transfers are becoming standard, offering cheaper alternatives to card payments.

Trading, Crypto & Investment APIs

Investment APIs provide market data feeds, order management systems, portfolio analytics, and fractional trading capabilities. Crypto APIs add wallet services and custody solutions but come with complex regulatory requirements.

Market data licensing can be expensive. Real-time stock quotes carry significant fees – only pay for real-time data if users actually need it.

| Feature | Open Banking APIs | Partner APIs |

|---|---|---|

| Access Model | Many-to-many | One-to-one |

| Regulatory Framework | Standardized (PSD2, Open Banking) | Custom agreements |

| Integration Depth | Standardized endpoints | Deep, customized features |

| Time to Market | Faster (standard protocols) | Slower (custom integration) |

| Control | Limited customization | Full control over features |

| Revenue Sharing | Typically none | Often includes revenue sharing |

| Geographic Reach | Broad institutional coverage | Limited to partner institutions |

| Compliance Overhead | Provider handles most compliance | Shared compliance responsibility |

Open banking APIs get you to market faster with broader coverage. Partner APIs offer deeper integration but require more development time. Many successful platforms use both approaches.

Security & Compliance Foundations

When it comes to fintech, security isn’t just important – it’s everything. Fintech api integration systems handle the most sensitive information: money, financial history, and payment details. One security slip-up can destroy years of trust.

OAuth 2.0 and OpenID Connect form your first line of defense. OAuth 2.0 handles authorization (“what can you do”), while OpenID Connect manages identity (“who are you”). Together, they create secure, token-based systems where users never share passwords with your application.

Strong Customer Authentication (SCA) is required under PSD2 for European transactions. SCA requires two different types of proof: something they know (password), something they have (phone), or something they are (fingerprint).

Token lifecycle management is crucial. Access tokens should expire quickly (1-24 hours). Refresh tokens last longer but need secure storage and regular rotation. Transport Layer Security (TLS) 1.3 should be non-negotiable for all API communications.

The financial-grade API (FAPI) guidelines improve OAuth 2.0 specifically for financial services, adding requirements for mutual TLS, request signing, and other security measures.

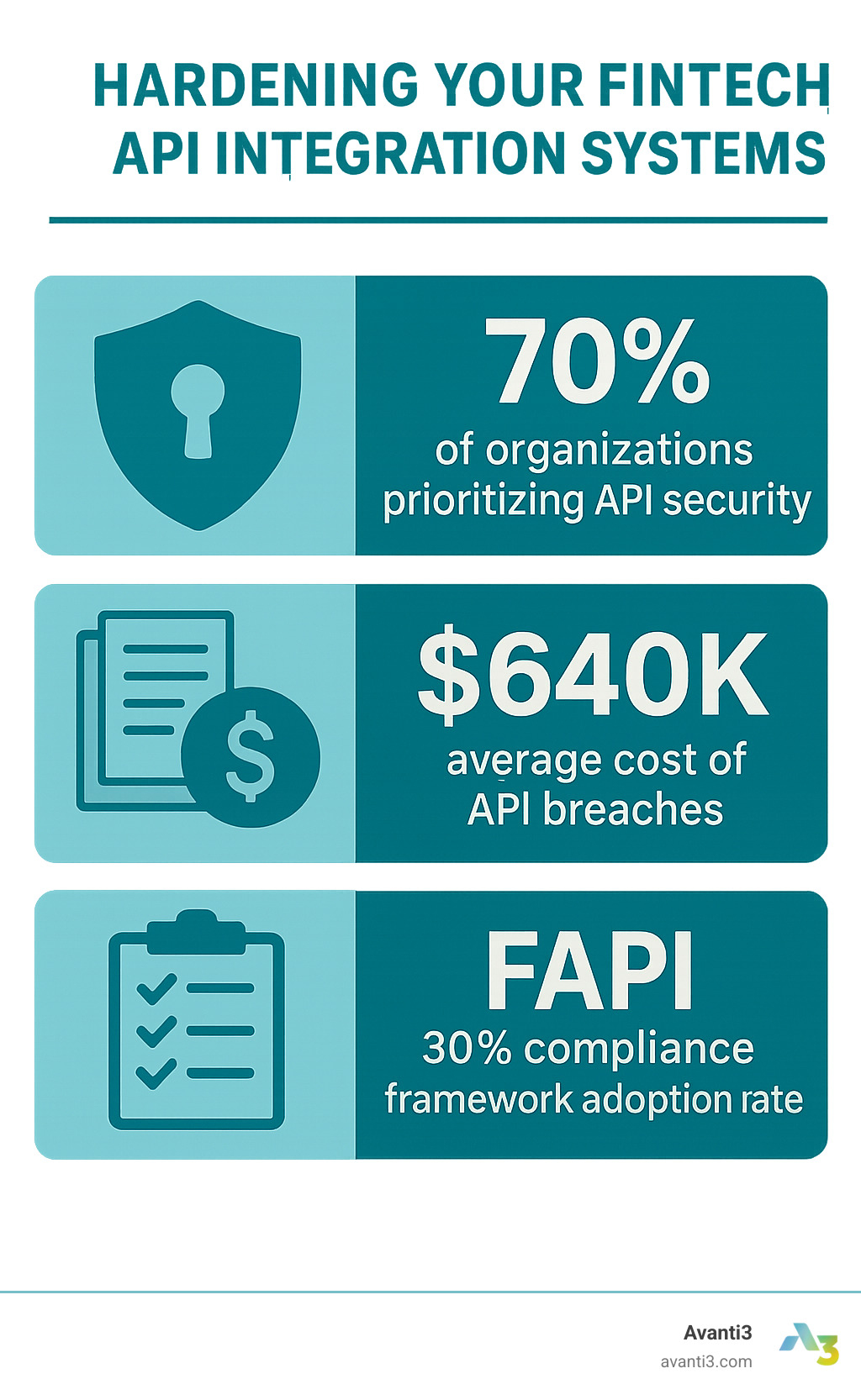

Hardening Your Fintech API Integration Systems

Threat modeling should be your first step using frameworks like STRIDE (Spoofing, Tampering, Repudiation, Information Disclosure, Denial of Service, Elevation of Privilege).

API gateways provide centralized control over rate limiting, request validation, and threat detection. Web Application Firewalls (WAF) protect against common attacks using machine learning to spot suspicious patterns.

Secrets management is critical. Never store API keys in code repositories. Use dedicated secrets management services with encryption, automatic rotation, and audit logs.

Data Privacy & Regional Regulations

Financial data privacy regulations vary dramatically by region. The scientific research on GDPR compliance framework sets strict requirements for collecting, processing, and storing personal financial data.

Data minimization reduces both privacy risks and compliance overhead. Consent management requires users to understand exactly what data you’re accessing and how you’ll use it. Data residency requirements may restrict where you store financial data.

The right to erasure under GDPR creates challenges since financial regulations often require keeping transaction records for years. Work with legal experts to balance these competing requirements.

Implementation & Scaling Best Practices

Building fintech api integration systems that handle real-world growth requires solid foundations from day one. Plan for scale early to avoid expensive shortcuts later.

Software Development Kits (SDKs) handle authentication flows, retry logic, and error handling. CI/CD pipelines maintain code quality and enable safe deployments. API gateways manage authentication, rate limiting, and monitoring across providers.

Containerization with Docker makes deployments predictable and scaling automatic. Observability goes beyond uptime monitoring – you need to understand performance under different conditions.

Graceful degradation separates professional integrations from amateur ones. When your primary provider fails, seamlessly switch to backups. Blue-green deployments let you test new versions with real traffic before switching.

Authentication Patterns for Fintech API Integration Systems

The Authorization Code Flow works for user-facing applications where users authenticate with their bank directly. Client Credentials Flow handles behind-the-scenes operations using your app’s credentials.

JSON Web Tokens (JWT) are self-contained digital passports. Mutual TLS requires both sides to prove identity with certificates. Refresh token rotation provides simple but effective security by issuing new tokens with each use.

Ensuring Reliability & Performance

Caching strategies improve performance and reduce costs, but be smart about what you cache. Exchange rates might cache for minutes, but account balances should always be fresh.

Retry logic requires delicate handling in financial systems. Use exponential backoff and ensure operations are idempotent. Circuit breakers automatically stop requests to struggling services.

SLA monitoring tracks both technical metrics (response times, error rates) and business metrics (successful transactions, user satisfaction).

For businesses looking to improve their fintech capabilities with innovative engagement tools, explore More info about web3 solutions to see how blockchain and Web3 technologies can complement traditional fintech APIs.

Future Trends & Innovation in Fintech Integration

The world of fintech api integration systems is moving at breakneck speed. Embedded finance is the biggest game-changer – financial services woven directly into existing experiences rather than separate apps.

Embedded financial products could generate $230 billion in net new revenue by 2025. Buy-Now-Pay-Later (BNPL) APIs have made flexible payments simple to implement. Real-time payments through systems like FedNow enable instant transfers around the clock.

AI-powered underwriting is changing lending decisions by analyzing transaction patterns and behavior data. Open finance is expanding beyond banking to include insurance, investments, and other financial services.

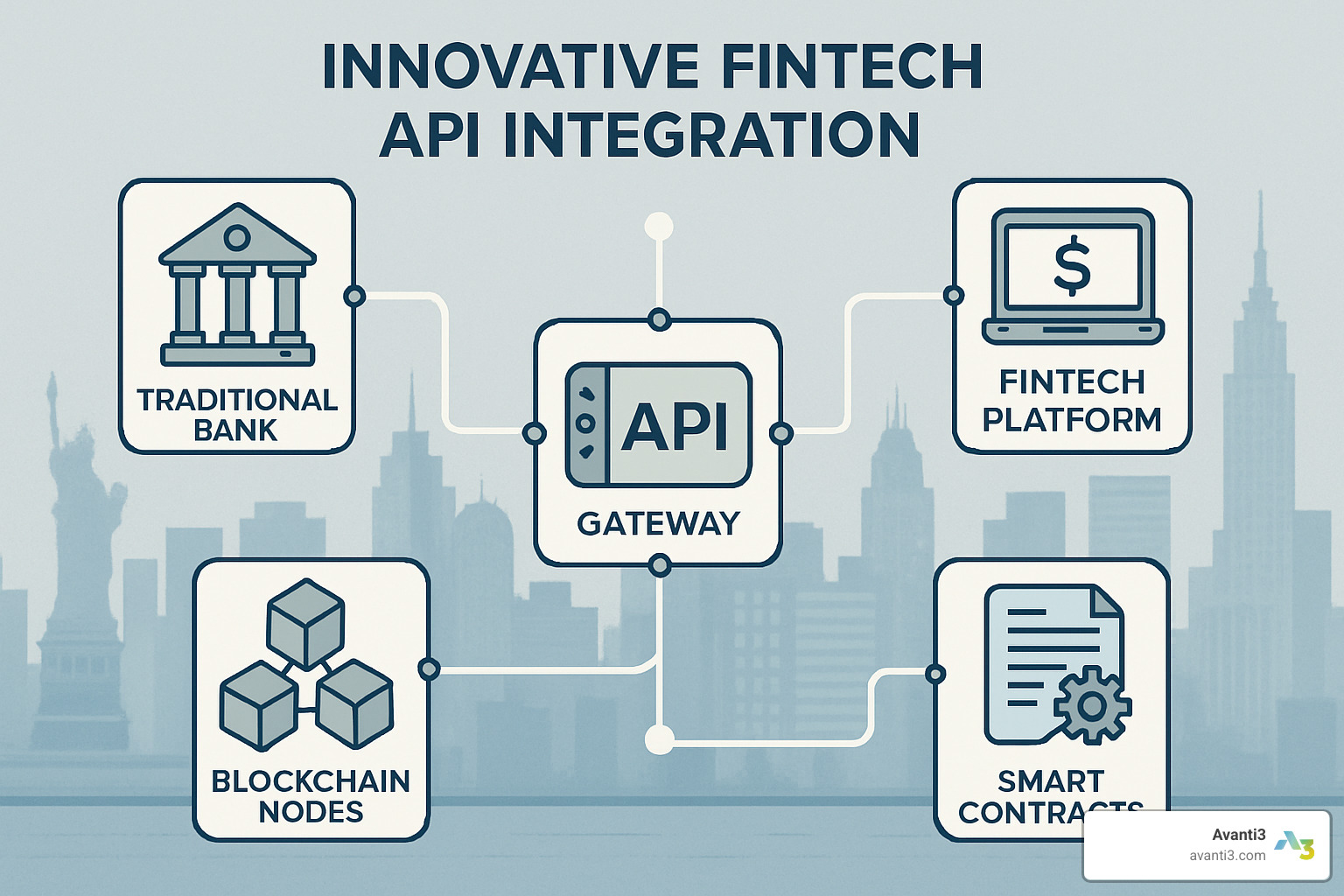

Convergence of Web3 & Fintech APIs

The collision between traditional fintech api integration systems and Web3 technologies is creating entirely new possibilities.

Smart contracts automate financial agreements – insurance payouts triggered by flight delays, investment distributions based on market conditions. APIs are emerging that let regular applications interact with smart contracts without blockchain expertise.

Tokenized rewards create loyalty programs with real value that can be traded across platforms. Decentralized identity could solve KYC headaches by letting users complete verification once and prove identity anywhere.

NFT integration enables new forms of digital ownership and monetization, from NFT-backed loans to tokenized real estate.

At Avanti3, we’re building systems that combine NFTs, blockchain, AR/VR, and AI to create financial experiences beyond traditional banking. It’s about creating digital experiences that blur lines between finance, entertainment, and community building.

Frequently Asked Questions about Fintech API Integration Systems

What’s the difference between open banking and partner APIs?

Open banking APIs work like a public highway system under regulatory frameworks like PSD2, creating standardized routes connecting multiple institutions to multiple services. You get broad market coverage using similar protocols.

Partner APIs are like private roads creating direct relationships between specific institutions and providers. They offer deeper integration capabilities but require individual negotiations and custom development.

If you need to connect with many institutions quickly, open banking APIs are faster to implement. For specialized features or unique solutions, partner APIs provide the flexibility for custom capabilities.

How do OAuth 2.0 and SCA work together?

OAuth 2.0 handles the authorization framework – managing what your application can do on behalf of users. Strong Customer Authentication (SCA) ensures you’re really who you say you are before granting permissions.

Under PSD2, SCA requires two-factor authentication using something you know, have, or are. When users connect bank accounts, OAuth 2.0 manages permissions while SCA requires additional verification like SMS codes or biometric authentication.

How can I migrate between API providers without downtime?

Start with an abstraction layer isolating business logic from specific API implementations. Feature flags allow gradual traffic shifting from old to new providers. Parallel integration keeps both systems running simultaneously for comparison and quick fallback.

Use sandbox environments extensively to validate edge cases. Consider API orchestration platforms for automatic routing and seamless failover. Treat migration as an ongoing capability rather than a one-time project.

Conclusion

Building successful fintech api integration systems isn’t just about connecting APIs – it’s about creating financial experiences that feel effortless and secure. The companies that thrive balance technical excellence with genuine user value.

Security and compliance aren’t optional extras – they’re the foundation everything builds upon. Once you have solid OAuth 2.0 flows, proper encryption, and compliance frameworks, focus on choosing the right mix of APIs for your specific needs.

Don’t try to boil the ocean on day one. Start with core functionality solving real problems. Build it well, test thoroughly, then expand as you learn what users actually want.

The landscape is shifting toward embedded finance and Web3 integration. We’re moving toward financial services woven seamlessly into every digital experience. This convergence of traditional fintech with blockchain technologies, NFTs, and AI-powered tools creates opportunities we couldn’t have imagined.

This is where Avanti3 excels. We don’t just help you integrate standard financial APIs – we help you create unique digital experiences combining fintech capabilities with cutting-edge engagement tools. Whether building tokenized rewards systems, NFT-powered loyalty programs, or immersive AR/VR financial experiences, our platform bridges traditional finance and Web3 innovation.

The future belongs to companies making complex financial operations feel simple and engaging. Users shouldn’t think about OAuth flows or rate limits – they should experience smooth, secure interactions that improve their lives.

Ready to build something extraordinary? Explore how Avanti3’s approach to digital experience design can help you create financial products that don’t just work – they inspire and delight users in unexpected ways.

The best fintech API integration is invisible – it works quietly and reliably, enabling the financial experiences users need while opening doors to possibilities they didn’t know they wanted.