Revolutionizing Financial Transactions: The Power of Blockchain

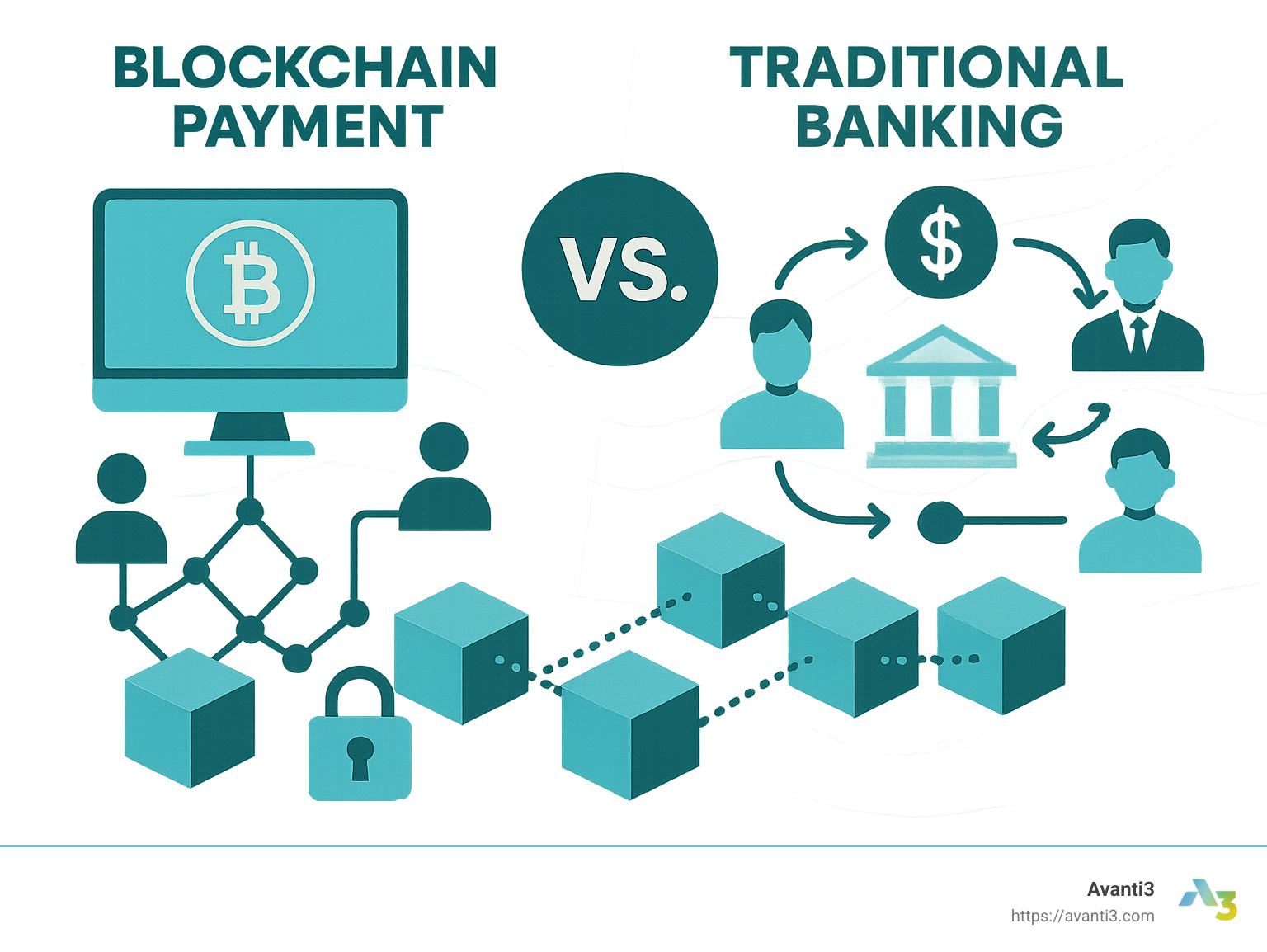

Blockchain payment systems are decentralized digital platforms that securely process financial transactions using distributed ledger technology. These systems offer faster, more secure, and cost-effective alternatives to traditional payment methods by eliminating intermediaries and providing transparent transaction records.

Key Features of Blockchain Payment Systems:

- Improved Security: Transactions are cryptographically secured and immutable

- Reduced Costs: Eliminates intermediaries, cutting transaction fees by up to 80%

- Speed: Near real-time settlements (2-5 seconds) versus days for traditional methods

- Transparency: All transactions are recorded on a public, tamper-proof ledger

- Global Access: Available 24/7 without traditional banking hours or restrictions

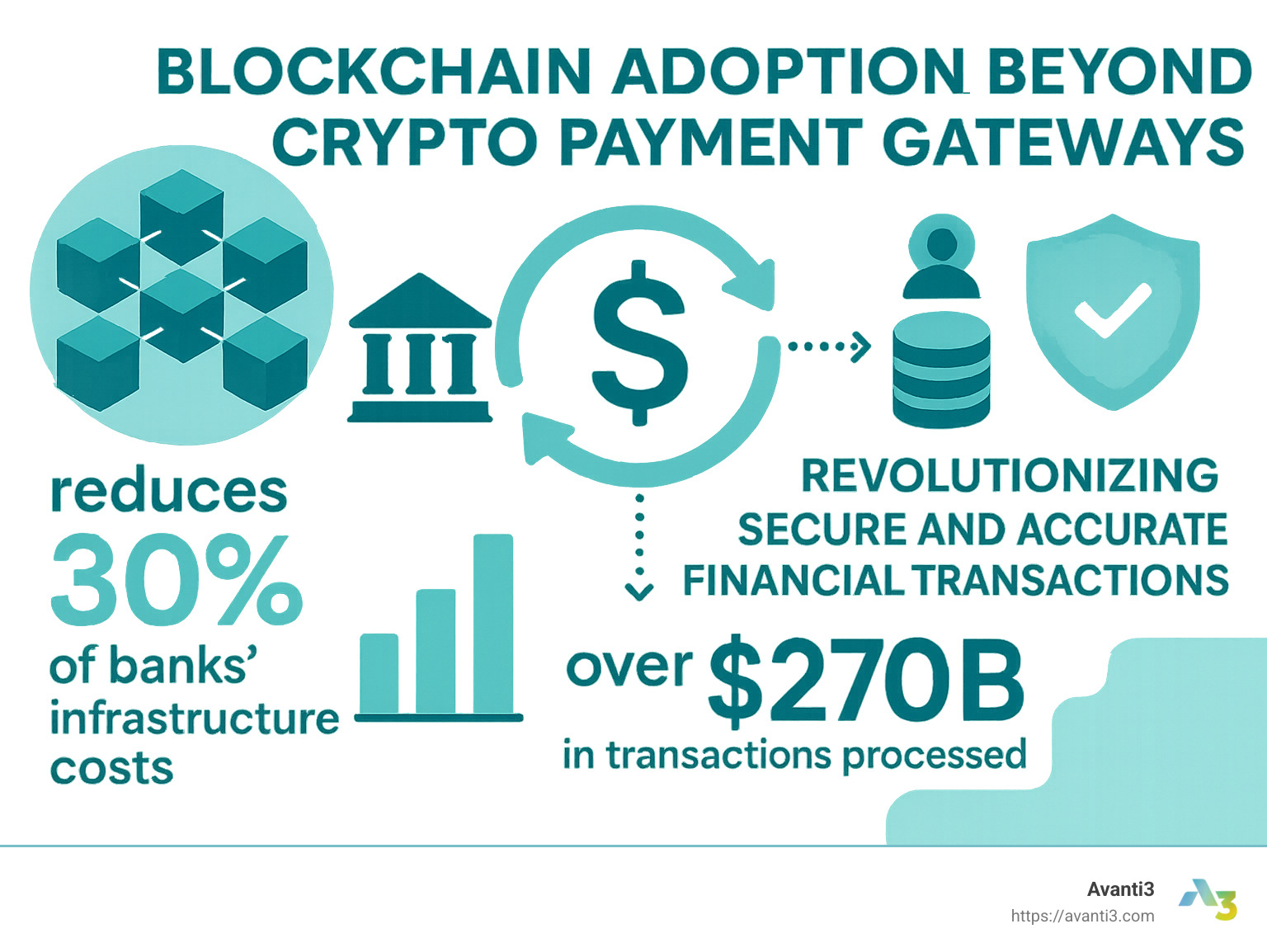

From its early adoption in cryptocurrency, blockchain technology has evolved to revolutionize global financial transactions. The distributed ledger approach improves liquidity and operational speed in financial markets by removing centralized intermediaries. Banks could potentially reduce around 30% of their infrastructure costs by adopting this technology, which has already processed over $270 billion in transactions.

Traditional cross-border wire payments can take several days to clear and may incur fees as high as 10%. In contrast, blockchain-based solutions offer almost real-time verification without reliance on intermediaries such as correspondent banks.

“Blockchain will support real-time domestic and cross-border payments at lower costs versus traditional services.” – American Express

Blockchain isn’t just a tool for investment; it’s evolving into a comprehensive payment solution that integrates with traditional financial systems. The distributed ledger system provides a secure, immutable record by chaining transactions together using cryptographic hashes.

I’m Samir ElKamouny AV, an entrepreneur and marketing expert who has helped numerous businesses implement blockchain payment systems to streamline their operations and reduce costs. My experience with blockchain payment systems has shown that businesses can achieve significant efficiency gains while providing better service to their customers.

Understanding Blockchain Payment Systems

Imagine sending money to a friend on the other side of the world—without banks, without fees, and without waiting days for it to arrive. Sounds pretty amazing, right? Well, this isn’t just wishful thinking. It’s exactly how blockchain payment systems operate.

Traditional payment systems rely heavily on banks and third-party processors to handle transactions. But blockchain turns this idea completely upside down. Instead of a central authority, blockchain spreads out the responsibility of verifying and recording transactions across a global network of computers known as nodes. Think of it as a giant group project, where each participant double-checks the answers to make sure everything is accurate.

This decentralization is the secret sauce behind blockchain’s resilience. When you make a payment, the transaction is broadcast across thousands of nodes worldwide, each storing an identical copy of the ledger. This means there’s no single point of failure. Even if one node falls offline or gets attacked, the network keeps humming along smoothly.

According to American Express research, blockchain technology is quickly shifting from experimental stages to practical, real-world use in everyday payments. Back in 2017, nearly 15% of global banks were already planning to roll out blockchain solutions, with adoption expected to skyrocket to 65% by 2020.

Another essential part of blockchain is its consensus mechanism. Before a transaction becomes official, multiple nodes must mathematically agree that it’s legitimate. Picture it as a democratic vote—but instead of ballots, nodes use powerful algorithms to ensure everything checks out. This consensus provides a level of security and trust that’s hard for centralized systems to match.

And once verified, transactions on the blockchain become immutable. That’s just a fancy word meaning “can’t be changed.” Every payment recorded is permanent, creating a tamper-proof, transparent record that anyone can view. Goodbye, sneaky accounting tricks!

Additionally, blockchain leverages smart contracts, which are self-executing agreements written directly into the code itself. Smart contracts can automatically release payments once certain conditions are met (like receiving a shipment confirmation). They eliminate manual processing, reduce disputes, and remove the need for middlemen. Pretty smart, right?

How Blockchain Payment Systems Work

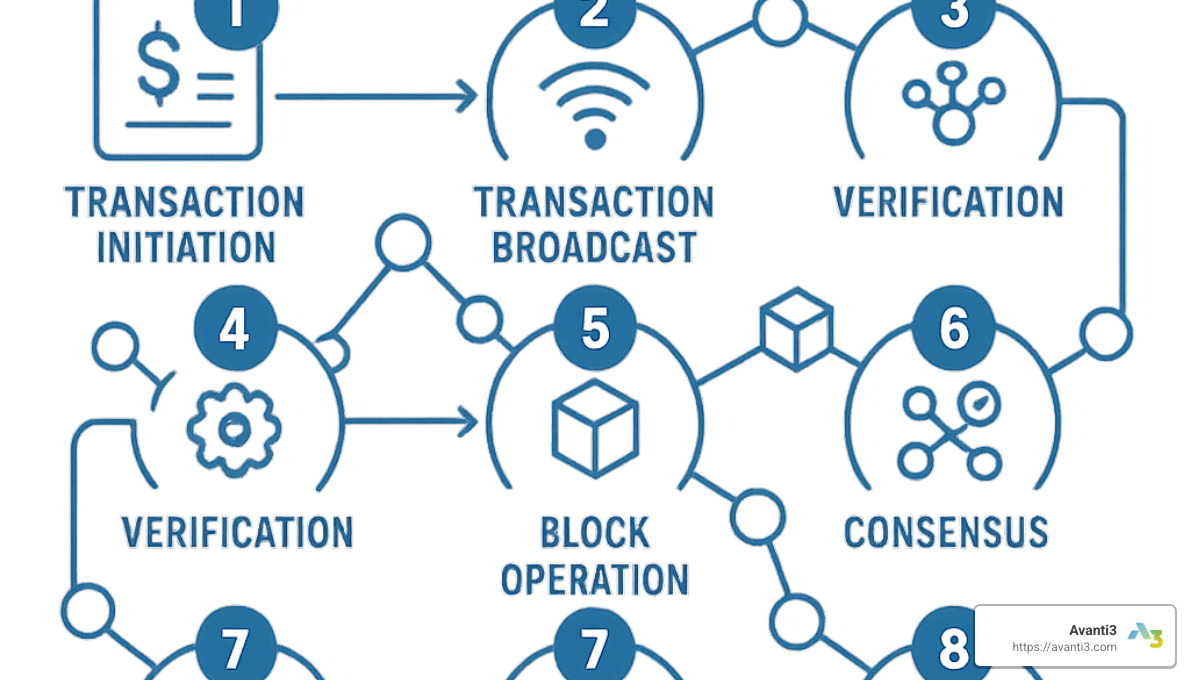

Understanding how blockchain payment systems function doesn’t have to be complicated. Here’s a simple breakdown of what happens behind the scenes when you send a payment:

First, you initiate a transaction by creating a request. This request includes how much you’re sending and the recipient’s blockchain address. Next, you digitally sign the transaction using your private key, creating a unique digital signature. This signature proves it’s really you (and not someone else) authorizing the payment.

Your signed transaction then gets broadcast to the entire network of nodes. These nodes verify your digital signature and double-check your balance to make sure you have enough funds. Once confirmed, your transaction joins others in a “block.”

Here’s where miners (in proof-of-work blockchains like Bitcoin) or validators (in proof-of-stake systems like Ethereum 2.0) jump in. They compete to add this new block to the blockchain. Once the network reaches consensus, the new block officially becomes part of the chain, creating a permanent, secure record of your transaction.

As more blocks build on top of your block, your transaction gains additional “confirmations,” becoming increasingly secure and tamper-proof. Congratulations—you’ve just made a blockchain payment!

The beauty of this system is that anyone can independently verify transactions, yet cryptographic security ensures only valid transactions make it through. For example, the Bitcoin network alone handles between 566–657 exahashes per second (as of mid-2024), demonstrating the massive computational power safeguarding these payments.

Key Components of Blockchain Payment Systems

Several key elements work together to power effective blockchain payment systems:

Smart Contracts help transactions run smoothly by automatically enforcing agreements. Suppose you sell products online: a smart contract could automatically send your payment as soon as the goods arrive, no middleman required.

Digital Wallets securely store your cryptographic keys, allowing you to manage your blockchain assets safely. Wallets come in different flavors: “Hot wallets” are connected online for daily transactions, while “Cold wallets” offer offline storage for extra security. You can also select between custodial wallets (managed by a third party) or non-custodial wallets, which give you total control.

Payment Gateways make it easy for businesses to accept blockchain payments. They conveniently convert cryptocurrencies into traditional currencies if needed, often providing plugins for e-commerce sites and point-of-sale systems.

Consensus Protocols keep the blockchain running smoothly by validating transactions. You’ve probably heard of “Proof-of-Work” (Bitcoin uses this), where miners do intense computational work to secure transactions. Alternatives like “Proof-of-Stake” (Ethereum 2.0) require validators to stake tokens instead. Yet another variation called “Delegated Proof-of-Stake” allows token holders to elect delegates to handle the job.

Tokenization converts real-world assets into digital tokens on the blockchain. This process enables fractional ownership and easy trading of assets, essentially turning valuable items into digital shares.

Cross-Border Capabilities make sending money overseas faster and cheaper. Blockchain removes the hefty fees and delays typical of traditional cross-border banking methods, making international payments a breeze.

Interoperability Solutions ensure different blockchain networks can “talk” to each other, allowing users to transfer value smoothly between various platforms and protocols. This helps businesses tap into the full potential of the blockchain ecosystem.

Blockchain payment systems aren’t just another tech fad—they’re changing how businesses and individuals manage money. By simplifying transactions and cutting down costs, platforms like Avanti3’s own Web3 Platform Solutions are making blockchain accessible for everyone!

Benefits of Blockchain Payment Systems for Businesses

When it comes to changing how businesses handle money, blockchain payment systems are creating quite a stir – and for good reason. These innovative systems aren’t just a tech novelty; they’re delivering real, tangible benefits that can transform how your company handles transactions.

Improved Security and Reduced Fraud

Let’s face it – security keeps business owners up at night. With cyber threats evolving daily, protecting payment data has never been more critical. This is where blockchain payment systems truly shine.

Traditional payment methods often feel like leaving your front door open uped – they’re surprisingly vulnerable to fraud, identity theft, and data breaches. Blockchain, on the other hand, is like having a state-of-the-art security system with multiple layers of protection.

The cryptographic security built into blockchain is virtually uncrackable. Every transaction requires a unique digital signature created by private keys that only authorized users possess. It’s like having a fingerprint scanner that verifies your identity with mathematical precision.

What happens once a transaction is recorded? It’s there for good. This immutability creates a permanent, tamper-proof record that makes fraudsters’ jobs nearly impossible. As one financial services provider put it: “Through use of this blockchain solution, we have been able to eliminate pre-funding requirements and offer faster remittances at a lower cost.”

The beauty of decentralized verification is that you’re not putting all your eggs in one basket. Instead of relying on a single authority (and potential point of failure), blockchain distributes security across thousands of independent nodes. Each transaction gets verified multiple times by different computers, making successful attacks exponentially more difficult.

The numbers speak for themselves – research shows that illicit activity accounted for only 0.34% of all cryptocurrency transactions in 2023. That’s a remarkably low figure for a technology that’s still evolving.

Cost and Time Efficiency

Who doesn’t want to save money and time? Blockchain payment systems deliver on both fronts in ways that might surprise you.

The most immediate cost benefit comes from eliminating intermediaries. Think about traditional payments – they often pass through multiple hands (banks, processors, clearinghouses), with each taking their cut. Blockchain creates direct connections between payer and payee, potentially slashing cross-border transaction costs by up to 80%.

These savings translate to significantly reduced fees. For comparison, the FedNow Service charges about $0.045 per customer credit transfer – a fraction of what many traditional payment processors demand. For businesses processing hundreds or thousands of transactions monthly, these savings add up quickly.

Perhaps even more valuable is the speed. While traditional bank transfers often feel like watching paint dry (especially for international payments), blockchain settlements happen almost instantly. One enterprise CEO enthusiastically reported: “With this solution, we are able to strengthen our cash flow position, moving funds quickly and securely at a lower cost than existing banking routes.”

The efficiency gains extend to your back office too. Automated reconciliation through smart contracts means no more manual matching of payments to invoices – a tedious process that’s prone to human error. One business owner shared that they saved over three hours weekly on invoice processing after implementing a blockchain payment solution. That’s time better spent growing your business!

Global Accessibility and Financial Inclusion

In today’s interconnected world, geography shouldn’t limit who you can do business with. Blockchain payment systems are tearing down barriers that have traditionally made international commerce complex and expensive.

Cross-border payments become remarkably straightforward with blockchain. Instead of navigating the labyrinth of correspondent banking relationships, businesses can execute international transactions directly between parties. This capability is game-changing for companies with global supply chains or customer bases.

The impact extends beyond established businesses to reach the unbanked populations – approximately 1.4 billion people worldwide who lack access to traditional banking services. With blockchain, anyone with internet access can participate in the financial system without needing physical banks nearby. This opens up entirely new markets and customer bases.

As one national leader explained when discussing their blockchain implementation: “Partnering to help create our national digital currency is part of our commitment to lead in financial innovation and technologies, which will provide citizens with greater financial access.”

The currency agnosticism of blockchain systems is particularly valuable for international operations. Some platforms support over 80 different cryptocurrencies and 30+ fiat currencies, simplifying what was once a complex currency conversion headache.

For businesses with international workforces, blockchain offers dramatic improvements to remittance services. Traditional money transfer services often charge exorbitant fees that eat into workers’ hard-earned money. Blockchain alternatives significantly reduce these costs while increasing transfer speed, as one fintech CEO noted: “Through use of this blockchain solution, we have been able to eliminate pre-funding requirements and offer faster remittances at a lower cost.”

At Avanti3, we’re putting these benefits to work through our Web3 Platform Solutions that integrate blockchain payment capabilities with customizable engagement tools. We’re creating more inclusive financial solutions that empower creators and brands globally, enabling seamless transactions within digital communities.

The business case for blockchain payment systems isn’t just about cutting-edge technology – it’s about tangible improvements to security, efficiency, and accessibility that can transform how your business operates in an increasingly digital and global marketplace.

Types of Blockchain Payment Solutions

When businesses first consider implementing blockchain payment systems, it can feel a bit overwhelming—we get it! With terms like “private blockchain,” “stablecoins,” and “CBDCs” floating around, it’s easy to lose track. Let’s break it down simply so you can find the solution that truly fits your business.

The blockchain payment landscape is incredibly diverse, offering a range of solutions from fully open public networks to tightly controlled private ones. Each approach has its own strengths and best-use cases.

Public vs. Private Blockchain Payment Networks

Let’s start with public blockchains—the kind you’ve probably heard about through Bitcoin or Ethereum. These networks are open to anyone, meaning anyone can join, process transactions, or verify payments. Sounds a bit chaotic, but that’s the beauty of it! Public blockchains offer total transparency, decentralization, and censorship resistance. Every transaction gets recorded publicly, keeping everything open and accountable.

Of course, there’s a catch (there always is!). Because they’re so open, these networks can be slower due to rigorous consensus protocols. Bitcoin’s proof-of-work, for example, demands significant computational power, leading to higher energy consumption and slightly slower transaction speeds compared to private networks.

On the other side, we have private blockchains. Think of these as the “invite-only” clubs of the blockchain world. Businesses or organizations run these networks, deciding exactly who gets to join and verify transactions. This closed approach means faster transactions and lower energy use. You also get more control over privacy and governance—perfect if your business needs tighter oversight or regulatory compliance.

Then we have consortium blockchains, the friendly middle ground. They’re like group projects—only with fewer headaches and way better results! A group of organizations jointly oversees these networks. Consortium blockchains blend the openness of public networks with the control and efficiency of private ones. They’re ideal for industry-specific applications like banking or supply chain management.

For instance, JPMorgan Chase established Onyx in 2020, a blockchain consortium aiming to simplify global money movements. By partnering with multiple institutions, Onyx combines blockchain efficiency with robust compliance and security.

Cryptocurrency vs. Stablecoin Payment Systems

Next up—let’s tackle one of the most common questions we get: “Should my business accept cryptocurrency or stablecoins?” Let’s explore both options clearly.

Cryptocurrency payment systems (think Bitcoin, Ethereum, etc.) use digital assets that fluctuate freely on the market. While they offer unbeatable transparency, decentralization, and security, their prices can swing dramatically in short periods. It’s like riding a rollercoaster—fun for some, not so much for others.

The upside? Cryptocurrencies have growing recognition and acceptance worldwide. There’s also the potential for asset appreciation—though, of course, depreciation is possible too. The main challenge lies in unpredictable pricing, which could complicate accounting, tax compliance, and cash flow management.

Enter stablecoin payment systems. Stablecoins solve the volatility issue by pegging their value to stable assets, usually fiat currencies like the US dollar. This stability makes them easier for daily transactions, smoother for accounting, and far less risky for businesses wary of rapid price fluctuations.

Stablecoins generally enjoy quicker adoption among traditional businesses thanks to their predictable pricing and easier tax reporting. Yet, they’re facing growing regulatory scrutiny. Authorities are demanding transparency about the assets backing these stablecoins, which can mean extra compliance steps for your business.

Wondering which type to choose? Here’s a quick comparison to help clarify:

| Feature | Cryptocurrency Payments | Stablecoin Payments |

|---|---|---|

| Price Stability | Low (volatile) | High (pegged to stable assets) |

| Merchant Adoption | Growing, but wary of volatility | Faster adoption due to stability |

| Regulatory Clarity | Often unclear, varies greatly | More regulatory focus, clearer rules forming |

| Settlement Speed | Minutes to hours (depends on network) | Similar to cryptocurrencies |

| Cost Efficiency | Generally low fees | Low fees, minimal exchange risk |

| Global Accessibility | Very High | Very High |

| Integration Complexity | Moderate to High | Moderate |

Many payment processors now give you the flexibility to accept both cryptocurrencies and stablecoins. You can even instantly convert crypto into more stable assets—best of both worlds!

At Avanti3, we love giving creators and brands options. That’s why our solutions support both cryptocurrency and stablecoin payments. It’s all about choosing what makes sense for you, while still enjoying the security and efficiency that blockchain payment systems provide.

After all, why pick sides when you can have both? As one blockchain expert humorously put it, “Some folks see crypto versus fiat as a battle, but hybrid solutions have already emerged victorious. Crypto and traditional money can—and should—coexist peacefully.”

Real-World Applications of Blockchain Payment Systems

Gone are the days when blockchain payment systems were merely a futuristic concept—today, they’re changing transactions across various industries worldwide. From international money transfers to online shopping, businesses are finding practical, everyday benefits of blockchain solutions. Let’s explore some exciting real-world examples of how blockchain is reshaping payments.

Cross-Border Payments and Remittances

Remember when sending money overseas meant waiting days (and praying it didn’t get lost along the way)? Blockchain has changed all that, making cross-border payments quicker, cheaper, and far more transparent.

Platforms like RippleNet, now used by over 175 banks and financial institutions, have slashed international transfer times from days down to mere minutes—or even seconds. No more waiting around hoping your hard-earned money reaches Aunt Edna back home!

Blockchain solutions also dramatically cut costs by removing intermediaries like correspondent banks. This results in savings of up to 80% compared to traditional wire transfers. As one fintech CEO put it: “Through the use of this blockchain solution, we’ve been able to eliminate pre-funding requirements and offer faster remittances at a lower cost.” Win-win, right?

Another great advantage is transparency. On a blockchain, payment data is tracked clearly from start to finish, so senders and recipients always know exactly where their money is. Plus, blockchain tech simplifies currency conversion by effortlessly handling multiple currencies or stablecoin intermediaries.

Worried about compliance? Modern blockchain solutions now integrate critical KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, helping businesses stay within regulatory guidelines without losing efficiency.

Retail and E-commerce Integration

Blockchain payments aren’t just for tech-savvy finance geeks—they’re becoming a mainstream option for everyday shoppers and retailers alike. Businesses are jumping aboard for a smoother, more secure payment experience.

Retailers can easily accept crypto and stablecoin transactions using specialized point-of-sale (POS) systems or adapters that plug right into their existing checkout terminals. Customers pay quickly through QR code scans, creating a seamless shopping experience without clunky credit card readers.

E-commerce stores haven’t been left behind either. Popular online shopping platforms now offer easy-to-install blockchain payment gateways. These gateways handle complicated crypto payment steps behind-the-scenes, letting merchants effortlessly accept digital payments and automatically convert them into their desired currency.

And let’s not forget customer loyalty! Blockchain-based loyalty programs allow businesses to issue rewards tokens, making points redemption transparent and easy. At Avanti3, our Web3 Platform Solutions include customizable loyalty systems that leverage blockchain to securely track and manage rewards—keeping customers happy and businesses thriving.

One more perk retailers love: Because blockchain transactions are typically irreversible, merchants avoid frustrating (and costly!) chargebacks common with credit card payments. A satisfied small business owner recently told us, “Blockchain just makes good business sense. Having seen how streamlined payments can be, I could never go back to the old system my bank offered.”

Beyond remittances and retail, blockchain payments are opening doors in many other exciting areas of finance and commerce:

In supply chain finance, blockchain creates clear, verifiable shipment records. Smart contracts automatically release payments once goods reach specified checkpoints, dramatically improving cash flow for suppliers and distributors.

Businesses are also turning to blockchain for payroll processing, especially when employees are spread across different countries. Blockchain payroll systems streamline payments, reduce administrative headaches, and offer workers greater flexibility in receiving their salaries.

Ever struggled with paying tiny amounts for online content or usage-based services? Blockchain micropayments solve that problem by enabling affordable, fast processing of small transactions—perfect for tipping your favorite creators or paying just pennies to access premium content.

Regular subscription payments can also benefit from blockchain. Smart contracts effortlessly automate billing schedules and reduce administrative work, making subscriptions more customer-friendly and business-efficient.

Here at Avanti3, we’re particularly excited about blockchain’s potential for content creators. Our Blockchain Content Distribution solutions enable fairer compensation and transparent tracking of digital content usage, empowering creators to grow their communities sustainably.

The bottom line? Blockchain payment systems aren’t just a theory—they’re actively improving lives and businesses across the globe, one transaction at a time.

Challenges and Future of Blockchain Payment Systems

The journey of blockchain payment systems hasn’t been without its bumps in the road. Like any technology, blockchain faces real challenges that need thoughtful solutions before it can truly transform how we all pay for goods and services. But don’t worry – some brilliant minds are already tackling these problems, and the future looks incredibly promising.

Let’s take an honest look at what’s standing in the way and how these challenges are being overcome. After all, understanding the roadblocks helps us better appreciate the innovations that will shape tomorrow’s payment landscape.

Regulatory Landscape and Compliance

If there’s one thing that keeps blockchain payment innovators up at night, it’s navigating the complex web of regulations that differ dramatically from country to country.

KYC/AML Requirements present a particular challenge. Most countries require financial services to thoroughly verify customer identities and monitor for suspicious activities. This creates an interesting tension with blockchain’s pseudonymous nature. The most successful providers have found ways to implement these requirements while still preserving the efficiency that makes blockchain special.

The question of whether tokens are securities adds another layer of complexity. In some countries, certain cryptocurrencies might be classified as investment products rather than payment methods, triggering additional regulatory requirements. This classification can significantly impact how payment systems using these assets operate and who can use them.

Then there’s the headache of tax implications. I’ve seen many businesses struggle with this one! The tax treatment of cryptocurrency transactions varies widely between countries and continues to evolve. Payment providers now recognize they need to provide clear transaction records to help users stay compliant with their local tax laws.

“The most successful blockchain payment implementations will be those that work with regulators to develop compliant solutions, rather than trying to circumvent existing frameworks,” explains one regulatory expert I spoke with recently.

Some forward-thinking governments have established regulatory sandboxes – controlled environments where blockchain payment innovations can operate under modified rules while their impact is assessed. These initiatives help regulators understand the technology while giving providers room to demonstrate their benefits in real-world scenarios.

The good news? Many countries are developing specific legal frameworks for blockchain and cryptocurrency activities. These frameworks aim to provide the clarity businesses need while protecting consumers and maintaining financial stability. The regulatory picture is becoming clearer, albeit gradually.

The Road Ahead for Blockchain Payments

Despite these challenges, blockchain payment systems continue to evolve at an impressive pace. Several exciting developments are shaping how we’ll pay for things in the coming years.

Layer 2 Solutions are addressing one of blockchain’s biggest limitations – scalability. These protocols operate on top of existing blockchains to dramatically increase transaction throughput while reducing fees. For example, BitPay now supports Layer 2 networks like Arbitrum, Optimism, and Base, offering customers faster and cheaper crypto payment processing compared to main networks. This makes blockchain payments more practical for everyday transactions – even your morning coffee!

Perhaps the most significant development is the rise of Central Bank Digital Currencies (CBDCs). Many central banks worldwide are exploring or actively developing their own digital currencies based on blockchain technology. These CBDCs could deliver blockchain’s benefits with the stability and backing of national currencies – potentially the best of both worlds.

As one national leader put it, “Partnering to help create our national digital currency is part of our commitment to lead in financial innovation and technologies, which will provide citizens with greater financial access.”

The approach to adoption is also evolving. Rather than positioning blockchain as a replacement for traditional payment systems, mainstream integration is becoming the norm. Financial institutions are incorporating blockchain technology into their existing systems, making it accessible through familiar interfaces. This thoughtful integration helps overcome adoption barriers by meeting people where they are.

Interoperability remains a critical focus. New standards and protocols are emerging to enable seamless transfers between different blockchain networks. These developments will create a more connected ecosystem where assets can flow freely between various platforms, eliminating the fragmentation that has limited blockchain’s utility.

Perhaps most exciting is the marriage of blockchain with artificial intelligence. AI integration is creating smarter payment systems capable of detecting fraud, finding optimal transaction routes, and delivering personalized financial services. The combination of blockchain’s security with AI’s intelligence promises to take payment systems to new heights.

At Avanti3, we’re excited to be at the forefront of these innovations. We’re developing solutions that integrate blockchain payments with other Web3 technologies to create comprehensive digital experiences for creators and their communities. Our Web3 Community Management services leverage these technologies to build stronger connections between brands and their audiences.

The numbers tell a compelling story about where we’re headed. The global blockchain market is projected to grow from $27.84 billion in 2024 to $825.93 billion by 2032, with a compound annual growth rate of 52.8%. This dramatic expansion reflects the increasing recognition of blockchain’s transformative potential across various industries, particularly in payment processing.

While challenges remain, the future of blockchain payment systems looks brighter than ever. The combination of technological innovation, increasing regulatory clarity, and growing mainstream acceptance is creating a perfect storm for blockchain to revolutionize how we think about and use money. The question isn’t if blockchain will transform payments, but how quickly and completely the change will occur.

Frequently Asked Questions about Blockchain Payment Systems

How Secure Are Blockchain Payment Systems Compared to Traditional Methods?

Blockchain payment systems are designed with advanced security features, often making them safer than traditional payment methods in many ways.

To start, blockchain payments rely on cryptographic protection. Every transaction involves a unique digital signature that’s created with your private key. Think of this digital signature as your secure, virtual thumbprint—only you can provide it, making transactions incredibly difficult to fake or tamper with.

Another big advantage is blockchain’s use of immutable records. Once a transaction is verified and recorded, it’s there forever—no deleting or altering allowed. This means there’s always a clear and permanent financial trail, unlike traditional databases, which can sometimes be manipulated by hackers or dishonest insiders.

Additionally, blockchain’s decentralized verification spreads the responsibility of confirming transactions across many independent nodes. Traditional payment systems usually depend on a single source, such as a bank or card issuer, creating a single point of vulnerability. Blockchain’s distributed system is much harder to attack, making it extremely resilient.

Blockchain also helps in reducing data exposure. The beauty of blockchain payments is that you don’t have to share sensitive banking or card information with multiple parties, reducing the risk of data breaches and identity theft greatly.

Finally, fraud prevention is built into blockchain’s DNA. For instance, double-spending (using the same funds twice) is nearly impossible, thanks to consensus mechanisms that validate each transaction independently across the network.

While blockchain technology itself is incredibly secure, keep in mind that the security depends on your practices as well. Protecting your digital wallets and private keys, and choosing reputable exchanges or wallets is essential for safe blockchain transactions.

What Are the Main Limitations of Current Blockchain Payment Systems?

As exciting as blockchain payment systems are, they’re not quite perfect yet. Let’s talk honestly about some of their current limitations.

One key challenge is scalability. Take Bitcoin, for example: it handles around 7 transactions per second. Compare that with Visa, which can process up to 65,000 transactions per second. Clearly, blockchain networks have some catching up to do in terms of handling large transaction volumes.

Similarly, transaction speed can vary widely. While some blockchain payments confirm within seconds, others might take several minutes or even longer, especially during network congestion. Traditional card payments, by contrast, offer near-instant confirmation.

The issue of high energy consumption is another concern—particularly for proof-of-work blockchains like Bitcoin. These networks require significant computational power and electricity, raising environmental concerns. Thankfully, new consensus methods like proof-of-stake are emerging that are far more energy-efficient.

User friendliness matters a lot, too. Right now, user experience can be complicated, especially for non-tech-savvy users. Understanding digital wallets, private keys, and crypto exchanges can feel daunting. Simplifying this experience is crucial for wider adoption.

Also, blockchain payments currently face regulatory uncertainty. Rules and regulations differ significantly across regions and are continually evolving. This can create confusion for businesses and users alike, slowing adoption.

Lastly, there’s the challenge of cryptocurrency volatility. While stablecoins help address this, many cryptocurrencies experience significant price fluctuations, which can make everyday transactions tricky.

Fortunately, blockchain experts and industry leaders—including our team here at Avanti3—are actively working to address these limitations through innovation and collaboration. As these solutions mature, adoption will undoubtedly accelerate.

How Can Businesses Start Accepting Blockchain Payments?

Interested in accepting blockchain payments at your business? Great choice! The good news is, it’s simpler than you think. Here’s how to get started, step by step:

First things first, choose a reliable payment processor that fits your needs. Pay attention to important details like supported currencies (cryptocurrencies and stablecoins), conversion options to traditional fiat currency, fees, integration options, and compliance features.

Next, set up a digital wallet for your business. Wallets come in a few different flavors: custodial wallets (managed by third parties), non-custodial wallets (where you’re fully in control of your keys), and multi-signature wallets (requiring multiple approvals for transactions). Choose the one that aligns with your comfort level and security needs.

Once your wallet is set up, you need to integrate the payment system with your existing sales channels. Thankfully, most blockchain payment processors offer easy-to-use plugins for popular e-commerce platforms like Shopify and WooCommerce, point-of-sale integrations for in-store purchases, custom APIs for unique setups, and even simple payment links for invoices.

Don’t forget about the regulatory side of things. Be proactive about compliance considerations, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Also, maintain accurate records of your blockchain transactions to simplify tax reporting and regulatory compliance.

Then, make sure your staff knows how to handle blockchain payments comfortably. A little bit of training goes a long way. It’s also worth providing simple resources or FAQ sheets for customers who may be new to paying with crypto.

Lastly, keep an eye on performance. Regularly review your blockchain payment process, gather feedback, and make tweaks as needed. This approach ensures both your customers and your business will enjoy the full benefits blockchain payments offer.

One happy business owner summed it up perfectly: “Blockchain payments give me just the right mix of automation and control. Bills are paid smoothly, and my bookkeeper and accounting software stay effortlessly up to date.”

At Avanti3, we’re committed to helping businesses leverage blockchain payment systems to improve their operations, delight their customers, and create new growth opportunities.

Conclusion

The rise of blockchain payment systems is truly one of the most exciting leaps forward in financial technology since online banking first wowed us all. By blending decentralization, cryptographic security, and programmable transactions, blockchain technology opens the doors to faster, safer, and more accessible financial interactions for everyone involved.

Throughout this guide, we’ve explored the impressive benefits of blockchain payments—from improved security that drastically cuts down fraud, to substantial cost savings by removing intermediaries, and incredible speed improvements turning days-long banking waits into near-instant transactions. But the advantages don’t stop there. Blockchain payment solutions connect businesses to a global audience seamlessly, empower unbanked populations, and provide consumers greater control over their finances.

Now, it’s true—this exciting revolution isn’t without problems. Challenges like scalability limitations, environmental concerns linked to energy consumption, and navigating evolving regulatory frameworks can feel daunting. However, these problems aren’t roadblocks; they’re stepping stones. Every day, innovative solutions like Layer 2 networks, regulatory sandboxes, and Central Bank Digital Currencies (CBDCs) are advancing rapidly, helping blockchain payment technology mature into mainstream adoption.

The numbers don’t lie: blockchain technology is making big waves. The global blockchain industry is forecasted to skyrocket from $27.84 billion in 2024 to a whopping $825.93 billion by 2032. Similarly, businesses could see cross-border payment cost savings balloon from $301 million in 2021 to $10 billion by 2030. Clearly, we’re witnessing the first stages of a monumental shift in how money moves across our global economy.

At Avanti3, we’re thrilled to be at the heart of this change. Our passion is combining next-generation Web3 innovations—like NFTs, blockchain payments, augmented and virtual reality, and artificial intelligence—to help creators and brands engage their communities in fresh and meaningful ways. Through our fintech solutions, we not only simplify blockchain payments but also open up entirely new models for content monetization, digital rewards, and community-building experiences.

Whether you’re a small retailer curious about accepting crypto at your checkout counter, an artist looking to monetize digital creations, or a multinational enterprise exploring more efficient cross-border transactions, now is the perfect time to dive into blockchain payments. The technology is here, it’s growing fast, and businesses embracing it today are setting themselves up for future success.

As we continue innovating at Avanti3, we warmly invite you along for the journey. Together, let’s harness the power of blockchain payment systems and shape a future of finance that’s more open, efficient, and inclusive for everyone.

Want to dive deeper? Explore our special solutions like Web3 Platform Solutions, Blockchain Content Distribution, and NFT Marketplace Development, or visit Avanti3.com to find how we can help your business thrive in this exciting new digital economy.