Banking Compliance for Fintech Integrations: 7 Powerful 2025 Wins

Navigating the Compliance Maze: Why It Matters

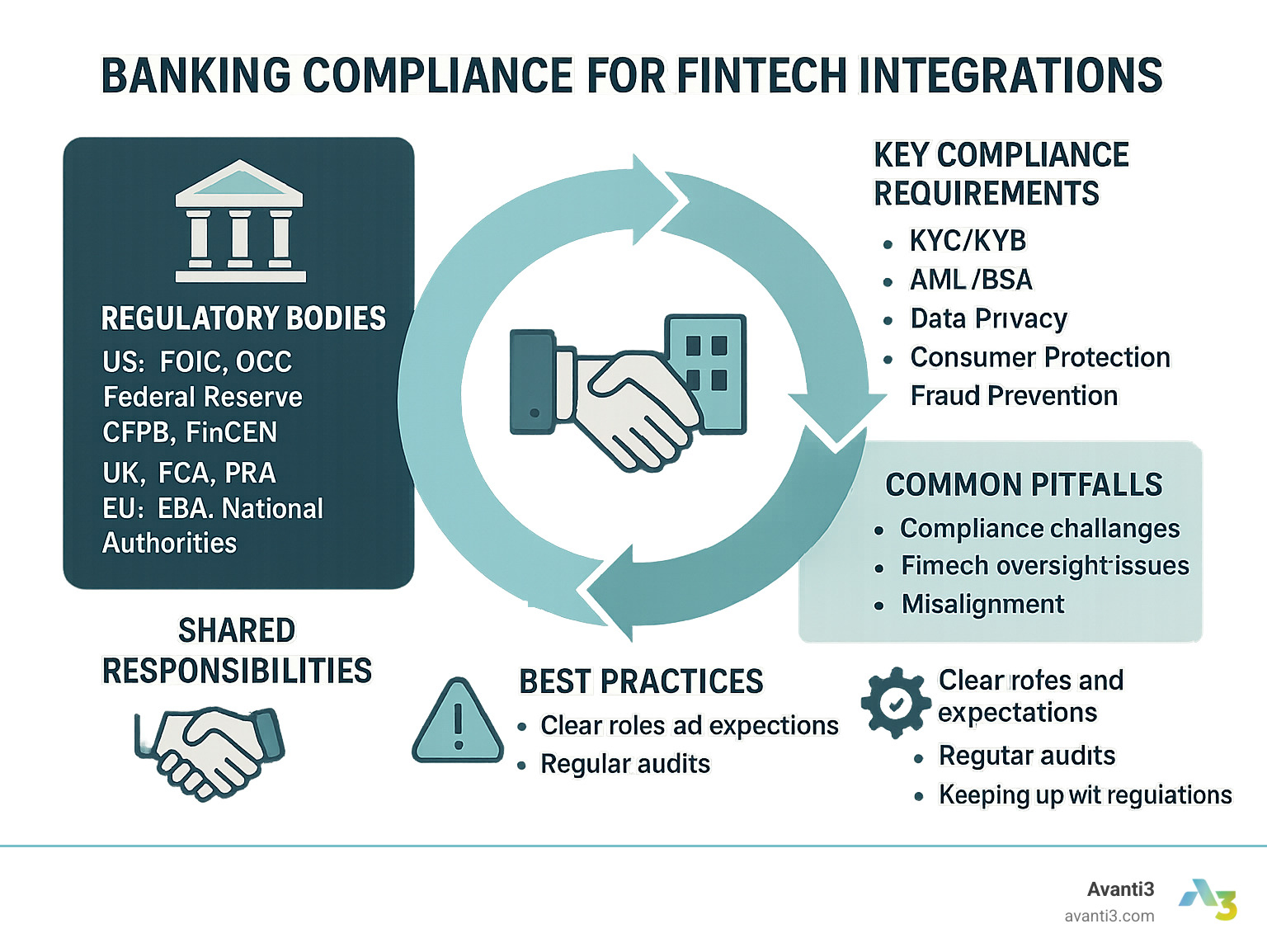

Banking compliance for fintech integrations is the practice of ensuring financial technology companies adhere to all relevant banking regulations when partnering with traditional financial institutions. This critical framework protects consumers, prevents fraud, and maintains the integrity of the financial system.

For those seeking a quick understanding:

| Key Aspect | What You Need to Know |

|---|---|

| Primary Regulators | US: FDIC, OCC, Federal Reserve, CFPB, FinCEN UK: FCA, PRA EU: EBA, National Authorities UAE: ADGM, DIFC |

| Core Compliance Areas | • KYC/KYB (Know Your Customer/Business) • AML/BSA (Anti-Money Laundering/Bank Secrecy Act) • Data Privacy (GDPR, CCPA) • Consumer Protection • Fraud Prevention |

| Common Challenges | • 93% of fintechs struggle with compliance requirements • 90% of sponsor banks report difficulty with fintech oversight • Misaligned expectations between partners • Rapidly evolving regulatory landscape |

“The real pain is interpreting how new regulations apply to our specific products,” notes one fintech executive in a recent industry survey. This sentiment echoes across the industry, where the excitement of innovation often collides with the sobering reality of regulatory requirements.

The stakes are incredibly high. In 2022 alone, financial institutions faced over $8 billion in AML-related fines. Meanwhile, 65% of banks have entered fintech partnerships in the past three years, creating a complex web of shared responsibilities and potential vulnerabilities.

The reality is stark: sponsor banks retain ultimate regulatory responsibility even when day-to-day compliance tasks are handled by their fintech partners. This dynamic creates tension and requires careful alignment of roles, responsibilities, and expectations.

I’m Samir ElKamouny, founder of Avanti3 with over a decade of experience helping fintechs steer banking compliance for fintech integrations to build secure, scalable partnerships with financial institutions. My work has focused on changing compliance from a cost center into a strategic advantage that drives trust and sustainable growth.

The Stakes: Banking Compliance for Fintech Integrations

When fintechs join forces with banks, they’re not just plugging into APIs—they’re stepping into a world where regulatory missteps can cost millions. The stakes go way beyond technical hiccups, touching everything from regulatory risk and consumer protection to your hard-earned reputation.

I’ve heard countless fintech founders say something like: “We were so focused on building cool features that we treated the banking part as an afterthought.” This mindset creates dangerous blind spots in bank-fintech partnerships.

The regulatory spotlight is getting brighter. In June 2023, the OCC, FDIC, and Federal Reserve released joint guidance on third-party relationships, and followed up in July 2024 with specific statements about bank-fintech arrangements. The message is clear: regulators are watching these partnerships closely.

The numbers are sobering. Global money laundering transactions reach an estimated $2 trillion annually, and both banks and their fintech partners are increasingly on the hook for preventing financial crime.

Definition & Criticality of Banking Compliance for Fintech Integrations

At its heart, banking compliance for fintech integrations means all the policies, procedures, and controls that ensure fintechs meet banking regulations when they partner with financial institutions. Think of it as the guardrails that keep innovation from veering into risky territory.

The foundation of this compliance rests on several critical pillars. BSA/AML requirements help detect and prevent money laundering and terrorist financing through customer screening and transaction monitoring. KYC/KYB procedures verify who your customers really are, balancing security with user experience. And regulatory reporting ensures suspicious activities don’t fly under the radar.

What makes this tricky is a fundamental mismatch of expectations. Banks face comprehensive BSA obligations, while fintechs often operate under lighter regulatory requirements. Yet when they partner up, the bank keeps full responsibility for compliance—even when the fintech handles day-to-day tasks.

As one bank compliance officer told me over coffee: “We can outsource the work, but we can’t outsource the responsibility.” This reality means sponsor banks must maintain watchful oversight of their fintech partners’ compliance activities, creating tension in many partnerships.

Consequences of Non-Compliance

Falling short on banking compliance for fintech integrations can release a world of hurt:

Regulatory bodies don’t just send strongly worded letters—they issue consent orders demanding immediate fixes to compliance problems. In just the first quarter of 2024, U.S. banking regulators issued seven consent orders, with AML/CFT compliance front and center.

The financial hit can be massive. Fines can reach up to 4% of global revenue under regulations like GDPR. In 2022 alone, over $8 billion in AML fines were handed out, adding to a staggering $56.1 billion since 2008.

Beyond the financial penalties, banks are increasingly walking away from fintech partnerships that pose compliance risks. I’ve witnessed several banks proactively end BaaS relationships, citing “regulatory burden” as the primary reason.

Perhaps most damaging is the trust you lose. Non-compliance can shatter relationships with customers, partners, and investors—damage that often outlasts any financial penalty.

Recent enforcement actions against Blue Ridge Bank and Evolve Bank & Trust sent shockwaves through the industry. These cases highlighted what happens when oversight of fintech partners falls short, prompting many banks to revisit their fintech relationships and tighten compliance expectations.

In this high-stakes environment, treating compliance as an afterthought isn’t just risky—it’s potentially business-ending. The good news? When done right, strong compliance can become a competitive advantage that builds trust and opens doors to sustainable growth.

Mapping the Global Regulatory Landscape

Imagine trying to steer a sea where the rules change every time you cross an invisible boundary. That’s what global fintech companies face when dealing with banking compliance for fintech integrations across different regions. It’s not just complicated—it’s a constantly evolving puzzle.

The regulatory world isn’t one-size-fits-all. Each region has its own regulatory flavor, priorities, and hot buttons. While the Financial Action Task Force (FATF) tries to create some international consistency for fighting money laundering and terrorism financing, how these standards get implemented varies dramatically from country to country.

| Region | Key Regulators | Primary Focus Areas | Notable Requirements |

|---|---|---|---|

| United States | FDIC, OCC, Federal Reserve, CFPB, FinCEN | Consumer protection, AML, state licensing | BSA/AML, state-by-state MSB licensing, UDAAP |

| United Kingdom | FCA, PRA | Market integrity, consumer protection | FCA Sandbox, SM&CR, Open Banking |

| European Union | EBA, ECB, National Authorities | Data privacy, AML, payment services | GDPR, PSD2, 6AMLD |

| UAE | ADGM, DIFC | Innovation, Open Finance | Regulatory sandboxes, Open Finance Framework |

United States Deep Dive

The U.S. regulatory landscape feels a bit like a patchwork quilt sewn by committee. There’s no single “fintech regulator”—instead, you’ll deal with a alphabet soup of federal agencies plus 50 different state regulators.

FinCEN oversees the Bank Secrecy Act, requiring those suspicious activity reports (SARs) that keep compliance teams up at night. You’ll need to file these whenever transactions raise red flags, and the definition of “suspicious” keeps expanding.

The state licensing maze is where many fintechs get stuck. As one frustrated founder shared on Reddit: “If you’re operating nationwide, you’re essentially complying with 50+ different regulatory regimes simultaneously.” Each state has its own requirements for money transmitters, lenders, and other financial services. No wonder many fintechs prefer partnering with banks to avoid this headache!

Meanwhile, the FDIC has been paying extra attention to Banking-as-a-Service relationships. Their July 2024 Request for Information specifically examines how “sticky” deposits sourced through fintech partnerships really are. This reflects growing concern about what happens to these deposits during financial stress.

Don’t forget privacy regulations under the Gramm-Leach-Bliley Act, plus state-level requirements like California’s CCPA. These create additional layers of compliance complexity around how customer data is handled, shared, and protected.

Europe & UK Nuances

Cross the Atlantic and the regulatory landscape shifts dramatically, with its own unique features for banking compliance for fintech integrations.

PSD2 has been in Europe, forcing banks to open their systems to third-party providers through APIs. This has created exciting opportunities for fintechs but also introduced new compliance challenges around security, authentication, and data handling.

When it comes to data privacy, GDPR means business. Those potential fines of €20 million or 4% of global revenue aren’t just theoretical—regulators have shown they’re willing to use them. For fintechs handling sensitive financial data, GDPR compliance isn’t optional.

The UK’s FCA Regulatory Sandbox deserves special mention as a brilliant approach to balancing innovation with regulation. “The FCA’s sandbox approach has been instrumental in helping us steer compliance while still innovating,” shared one fintech founder. This controlled environment lets companies test new ideas with real customers under regulatory supervision.

ESMA rounds out the European landscape with investor protection rules that particularly impact fintechs in investment and capital markets. These rules can affect everything from marketing materials to fee structures.

Post-Brexit, the UK has been charting its own course, trying to position itself as innovation-friendly while maintaining strong consumer protections. This creates both opportunities and challenges for fintechs operating in both the UK and EU.

Middle East & Emerging Hubs

The Middle East—particularly the UAE—is quickly becoming a fintech hotspot with its own distinctive approach to regulation.

The ADGM and DIFC free zones in the UAE have created specialized fintech frameworks and regulatory sandboxes that are attracting global attention. As one executive bluntly advised newcomers to the region, “If you’re going to fund raise, go with ADGM.” These zones offer regulatory clarity that can be refreshing compared to more established markets.

The UAE’s new Open Finance Framework is creating fresh opportunities for bank-fintech collaboration, though with corresponding compliance requirements. This framework aims to encourage innovation while maintaining appropriate oversight.

With digital banking adoption in the Middle East at only 17%, there’s enormous growth potential for compliant fintechs. The region represents a fascinating case study in how regulation can actually accelerate rather than hinder innovation when designed thoughtfully.

Recent updates from DLA Piper on UAE regulations highlight how quickly things are evolving, with new frameworks specifically designed to accommodate fintech innovation while ensuring stability and consumer protection. The region seems to have learned from both the successes and mistakes of more established markets.

For global fintechs, understanding these regional variations isn’t just about avoiding problems—it’s about strategically selecting the right jurisdictions for your business model and growth plans.

Shared Roles, Risks & Common Pitfalls

The success of bank-fintech partnerships doesn’t happen by accident. It depends on everyone knowing exactly who’s responsible for what when it comes to compliance. While banks ultimately answer to regulators, it’s often their fintech partners handling the day-to-day compliance tasks. This creates a dance of shared accountability that requires careful choreography.

A recent industry survey revealed something troubling but not surprising: 90% of sponsor banks struggle with compliance oversight in their fintech partnerships. The main headache? Lack of visibility and control over what their fintech partners are actually doing. As one banking executive put it, “It’s like trying to drive a car where someone else controls the steering wheel.”

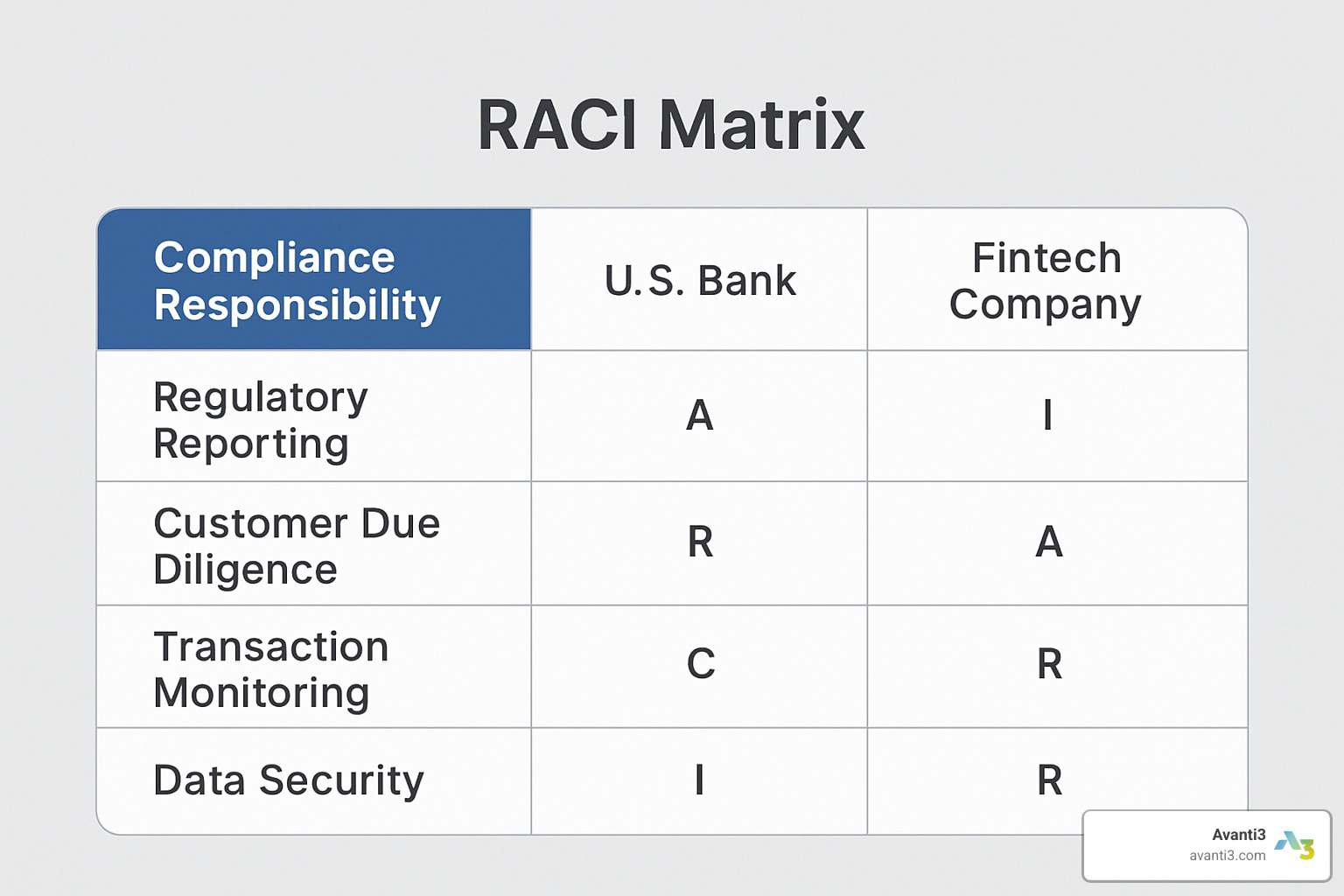

Who Does What in Banking Compliance for Fintech Integrations

When it comes to banking compliance for fintech integrations, four critical workflows typically need careful division of labor:

The first is end-user onboarding through KYC/KYB processes. Banks typically set the standards and approve policies, while fintechs implement the actual screening tools, perform the reviews, and keep the documentation organized. One compliance officer described it as “banks setting the rules of the game, while fintechs play it day-to-day.”

For fraud monitoring, banks approve the rules and thresholds and maintain oversight, while fintechs configure the actual fraud detection systems, investigate alerts as they happen, and implement the necessary controls. This partnership requires constant communication to stay ahead of evolving fraud tactics.

With AML transaction monitoring, banks approve the overall program and handle the formal filing of Suspicious Activity Reports (SARs), while fintechs configure the monitoring rules, investigate alerts, and escalate suspicious activity to the bank when needed. The stakes here are particularly high, as failures can lead to serious regulatory consequences.

Finally, dispute management sees banks setting policies and ensuring regulatory compliance, while fintechs handle the customer-facing aspects, investigate the disputes, and maintain the documentation trail. This division allows each partner to focus on their strengths.

As highlighted in the Guide to Compliance Operations Roles & Responsibilities in Bank-FinTech Partnerships, “While FinTechs may perform day-to-day tasks, the sponsor bank bears the ultimate regulatory responsibility and must maintain continuous oversight.” This reality means banks can never fully “hand off” compliance to their fintech partners.

Top Integration Pitfalls & How to Avoid Them

Even the most promising partnerships can stumble when it comes to banking compliance for fintech integrations. Here are the common pitfalls I’ve seen partners face:

Data silos create blind spots that compliance teams can’t afford. When KYC information lives in one system, transaction monitoring in another, and fraud detection in a third—with no communication between them—risks go undetected. Smart partnerships create integrated data platforms that connect these critical systems.

Unclear contractual terms are a disaster waiting to happen. “We thought you were handling that” are words no one wants to hear during a regulatory exam. Successful partnerships create detailed agreements that spell out exactly who does what, when, and how—with specific compliance provisions, service level agreements, and audit rights.

Fourth-party vendor risk has become a growing concern. As one banking executive confided, “We finally got comfortable with our fintech partner, only to find they were using vendors we’d never have approved.” Banks increasingly need visibility not just into their direct partners but also the vendors those partners rely on.

Shifting deposit “stickiness” has caught regulatory attention, particularly from the FDIC. Deposits that come through fintech partnerships may behave differently during stress periods than traditional deposits. Partners need to monitor this volatility and have contingency plans in place.

Misaligned compliance expectations create friction in otherwise promising partnerships. Banks operate in a world of stringent regulatory requirements, while fintechs often come from a more innovation-focused culture. Early and ongoing alignment about compliance expectations prevents painful surprises later.

The most successful partnerships I’ve seen share three key traits: transparency in all operations, regular communication about compliance matters, and documented accountability for every aspect of the compliance program. As one seasoned compliance officer advised, “Document everything—not just your policies, but who’s responsible for what, when reviews happen, and how issues get escalated and resolved.”

When banks and fintechs clearly understand their shared compliance responsibilities, they can build partnerships that satisfy regulators while still delivering the innovative experiences customers expect.

Building a Future-Proof Compliance Framework

Let’s face it – creating a strong compliance framework for banking compliance for fintech integrations isn’t just about checking boxes. It’s about building something that can evolve and adapt as regulations change and your business grows.

Think of compliance like the foundation of a house – if it’s solid, you can build anything on top of it. That starts with comprehensive policy mapping, where you identify all the regulations that apply to your business and create clear procedures to address them. This isn’t a one-and-done exercise – you’ll need to revisit these maps regularly as the regulatory landscape shifts.

Continuous monitoring is your best friend in this journey. As one compliance expert I spoke with put it, “Compliance isn’t a one-time exercise but an ongoing program that requires constant attention.” This means keeping an eye on transactions through automated systems while also regularly reviewing your policies to make sure they’re still effective.

The numbers don’t lie – organizations with a strong culture of accountability experience 70% fewer compliance incidents. This culture starts at the top, with leadership showing their commitment to doing things right. When compliance becomes part of your company’s DNA rather than an annoying afterthought, everyone benefits.

Embedding Compliance into Product Development

The smartest approach to banking compliance for fintech integrations is to bake compliance right into your product from day one. It’s like adding ingredients to a recipe – much easier to include them from the start than trying to mix them in later!

A Secure Software Development Lifecycle (SDLC) means thinking about compliance requirements during those early design meetings, not as an afterthought. This includes threat modeling, thorough code reviews, and testing specifically focused on compliance issues. By addressing these concerns early, you’ll save yourself massive headaches down the road.

Regular penetration testing is another crucial piece of the puzzle. As one security expert colorfully put it to me, “Test like an attacker, not like a developer.” Having independent security assessments helps you find vulnerabilities before the bad guys do.

Implementing a zero-trust architecture follows the wise principle of “never trust, always verify.” This approach helps protect sensitive financial data through strong authentication, encryption, and careful access controls – essential for any fintech operation.

Don’t forget about integrating consumer disclosures directly into your user flows. Clear, compliant disclosures help you meet regulatory requirements while still providing a smooth user experience. This is particularly important for avoiding Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) violations that can sink your business.

Aligning Expectations Upfront

Clear alignment between banks and fintechs isn’t just nice to have – it’s essential for survival. Think of it as a marriage – you need to agree on the important stuff before saying “I do.”

Detailed contract clauses should spell out exactly who’s responsible for what when it comes to compliance. Vague agreements lead to finger-pointing when problems arise, while clear contracts create accountability and trust.

Defined audit rights are another crucial element. Your bank partner will need to verify your compliance efforts, so establishing the scope and process for these audits upfront prevents surprises and disruption later.

Performance KPIs give you objective ways to measure compliance success. Whether it’s alert resolution time, SAR filing accuracy, or customer complaint resolution, having measurable benchmarks helps everyone stay on the same page.

Interagency guidance alignment might sound boring, but it’s incredibly important. The June 2023 interagency guidance on third-party relationships provides a framework that regulators expect you to follow. Building your contracts around this guidance shows you’re serious about compliance.

As one banking executive told me, “The time to negotiate compliance expectations is before the partnership launches, not during a regulatory exam.” Wise words indeed!

Strategic Partner & Jurisdiction Selection

Choosing the right banking partner and where to operate isn’t just a business decision – it’s a compliance decision too.

When vetting potential bank partners, look beyond the technical capabilities and pricing. Evaluate their compliance expertise, regulatory standing, and experience with partnerships similar to yours. A bank with a strong compliance culture can be an invaluable guide through regulatory complexities.

Before expanding to new regions, conduct a thorough cost-benefit analysis that considers the compliance resources you’ll need. Some jurisdictions might offer great market opportunities but require significant compliance investments that eat into your margins.

Consider taking advantage of regulatory sandboxes in places like the UK, Singapore, and the UAE. These controlled environments let you test innovative products with reduced compliance burdens – perfect for novel business models that don’t fit neatly into existing regulatory frameworks.

For global operations, multi-currency capabilities are essential, along with expertise in cross-border regulations. Managing compliance across multiple jurisdictions requires specialized knowledge and systems that not all providers can offer.

As one successful fintech founder advised, “Choose your bank partner based not just on technical capabilities but on their compliance approach and how well it aligns with your risk appetite and business model.”

At Avanti3, we understand these challenges and have helped numerous partners steer the complex world of Digital Experience Design while maintaining robust compliance frameworks that protect both the business and its customers.

RegTech & Tooling That Make Compliance Cool

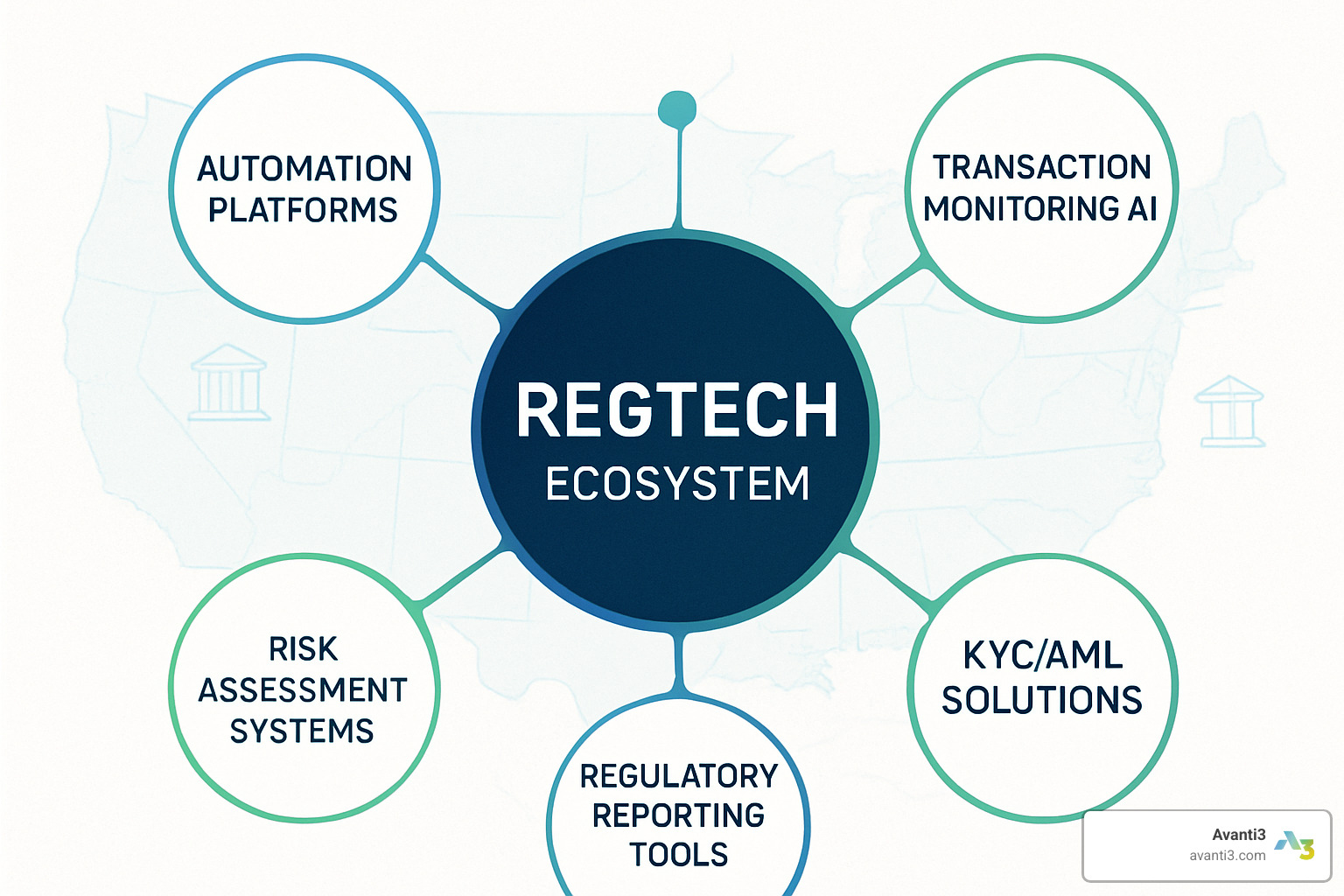

Let’s face it – compliance isn’t usually the first word that comes to mind when you think “exciting.” But thanks to innovative Regulatory Technology (RegTech), banking compliance for fintech integrations is becoming less of a headache and more of a strategic advantage.

Gone are the days of drowning in paperwork and manual checks. Today’s RegTech landscape offers smart tools that not only streamline compliance but can actually give your business a competitive edge.

Think of automation platforms as your compliance command center – they centralize documentation, create clear audit trails, and keep workflows moving smoothly. Meanwhile, AI-powered transaction monitoring is revolutionizing how we spot suspicious activity, dramatically reducing those frustrating false positives while catching more genuine risks.

“The right RegTech solution can reduce compliance costs by 30-40% while improving effectiveness,” shared one compliance officer I spoke with recently. For resource-conscious fintechs, that’s not just nice to have – it’s game-changing.

Real-time alert systems now notify teams instantly when potential issues arise, allowing for quick responses before small problems become regulatory nightmares. And keeping up with the ever-changing regulatory landscape? Solutions like Winnow track changes across jurisdictions, while risk assessment tools like Cable help teams prioritize their compliance efforts where they matter most.

Evaluating Solutions for Banking Compliance for Fintech Integrations

When shopping for RegTech tools to support your banking compliance for fintech integrations, it’s easy to get overwhelmed by flashy features. Instead, focus on what really matters for your specific situation.

Coverage scope is fundamental – does the solution address all your compliance domains? From KYC/AML to fraud prevention, consumer protection, and data privacy across all your operating jurisdictions, comprehensive coverage prevents dangerous blind spots.

API integration capabilities might sound technical, but they’re crucial for real-world success. Your compliance tools need to play nicely with both your systems and your banking partner’s platforms. Without smooth data flow, even the most powerful tools become isolated islands of information.

Evidence collection might be my favorite underappreciated feature. The best systems automatically gather and preserve documentation that proves your compliance to regulators and banking partners. As one tech officer colorfully put it, “When the regulators come knocking, you don’t want to be scrambling through email archives and shared drives.”

Don’t forget to consider scalability and uptime guarantees. That perfect solution for today might become a bottleneck tomorrow if it can’t grow with your business or suffers from frequent outages.

“Don’t just evaluate features—look at the vendor’s track record with similar implementations and their responsiveness to regulatory changes,” advised a technology officer with experience across multiple fintech partnerships. Their wisdom rings true – in compliance, the relationship with your technology provider can be as important as the technology itself.

Future Trends: AI, Blockchain & Open Finance

The future of banking compliance for fintech integrations looks less like a burden and more like an embedded intelligence woven throughout financial services. Several fascinating developments are reshaping what’s possible:

Predictive analytics is evolving beyond just flagging known suspicious patterns. Advanced AI systems can now forecast potential compliance issues before they materialize, shifting the paradigm from reactive to proactive risk management.

Blockchain technology is enabling on-chain KYC solutions that could fundamentally transform identity verification. These systems promise to reduce the frustrating duplication of KYC efforts across financial institutions while enhancing both security and privacy.

Smart contracts are making programmable compliance a reality – imagine compliance checks embedded directly into financial transactions, ensuring real-time adherence to relevant regulations without human intervention.

The EU’s Digital Operational Resilience Act (DORA) is raising the bar for technology risk management globally. Even for companies outside the EU, these standards are influencing best practices for operational resilience.

Open Finance frameworks continue to evolve, creating standardized approaches to data sharing while addressing privacy and security concerns. These developments create both new opportunities and compliance challenges for innovative fintechs.

“The future of compliance isn’t just about checking boxes—it’s about embedding compliance intelligence throughout the financial ecosystem,” noted an innovation executive I interviewed. This perspective represents a fundamental shift in thinking – from compliance as a necessary cost to compliance as a strategic enabler of trust and growth.

For forward-thinking companies like Avanti3, embracing these RegTech innovations isn’t just about avoiding penalties – it’s about building a foundation of trust that supports sustainable growth and enables truly transformative financial products.

Frequently Asked Questions about Banking Compliance for Fintech Integrations

What are the main AML/BSA obligations for fintechs partnering with a bank?

When you’re a fintech partnering with a bank, navigating the AML/BSA landscape can feel like learning a new language. At its core, banking compliance for fintech integrations requires you to implement several key components that work together to create a comprehensive protection system.

First, you’ll need a solid Customer Identification Program that verifies who your customers really are. Think of this as the foundation – without reliable identity verification, everything else becomes shaky. Next comes Customer Due Diligence, where you assess risk levels for different customers. Not all customers present the same risk, and your higher-risk customers will need improved scrutiny.

Transaction monitoring is where many fintechs find the greatest technical challenge. Your systems need to detect patterns that might indicate something suspicious is happening. This isn’t just about flagging large transactions – it’s about identifying subtle patterns that might indicate money laundering or terrorist financing.

“The most difficult part isn’t implementing the rules,” one compliance officer told me recently. “It’s establishing clear protocols for the edge cases that don’t fit neatly into our predefined categories. That’s where human judgment becomes essential.”

When suspicious activity is detected, you’ll need procedures for Suspicious Activity Reporting to FinCEN. You’ll also need to screen customers against OFAC sanctions lists and maintain detailed records for at least five years.

Remember though – while you might handle these day-to-day tasks, your banking partner still bears the ultimate regulatory responsibility. Clear communication channels are essential.

How can fintechs keep up with constantly changing regulations?

Staying current with the regulatory landscape is like trying to hit a moving target. The most successful fintechs take a multi-layered approach to regulatory intelligence.

Many leverage specialized regulatory intelligence tools that track changes relevant to their specific business model and jurisdictions. These tools can filter the firehose of regulatory information down to what actually matters for your operations.

Industry associations like the Electronic Transactions Association and Financial Technology Association can be invaluable resources. They not only provide updates but often advocate on behalf of the industry with regulators.

Building relationships with law firms that specialize in fintech regulation gives you early warning of significant changes. Many fintechs also actively participate in regulatory roundtables and public comment periods – this engagement helps you anticipate and sometimes even influence regulatory direction.

One fintech compliance director shared this wisdom: “Allocate at least 10% of your compliance resources to forward-looking regulatory intelligence rather than focusing exclusively on current requirements.” This investment helps prevent compliance surprises that could derail your operations later.

Continuous education for your compliance team is also crucial. The regulatory landscape for banking compliance for fintech integrations evolves constantly, and your team needs to evolve with it.

Do banks remain liable if compliance tasks are outsourced to the fintech?

Yes – and this is a critical point that shapes the entire bank-fintech relationship. Banks absolutely retain ultimate regulatory responsibility even when they delegate compliance tasks to fintech partners. This principle appears consistently in regulatory guidance, including the interagency guidance on third-party relationships issued in June 2023.

As one banking regulator bluntly put it: “Banks cannot outsource their compliance obligations—only the performance of certain compliance functions.”

This retained liability explains why banks often seem so demanding about compliance. Your banking partner’s reputation and regulatory standing are on the line with every partnership they enter. They need confidence in your compliance capabilities because ultimately, they’re the ones who will face regulatory consequences if something goes wrong.

In practical terms, this means banks must maintain effective oversight through thorough initial due diligence, ongoing monitoring, independent testing, and clear contractual protections. They need visibility into your compliance operations and the ability to verify that you’re meeting requirements.

The good news? When you demonstrate strong compliance capabilities, you become a more attractive partner. Banks are increasingly selective about their fintech relationships, and solid compliance can be a competitive advantage. By understanding and embracing your role in banking compliance for fintech integrations, you can build stronger, more sustainable banking partnerships.

Conclusion

Navigating banking compliance for fintech integrations feels a bit like sailing through a storm – challenging, yes, but also an opportunity to prove your vessel’s seaworthiness. Throughout this guide, we’ve seen that the companies who thrive aren’t just surviving compliance requirements – they’re using them as a foundation to build stronger, more trusted businesses.

What have we learned on this journey together? Several things stand out:

First, while banks ultimately bear the regulatory responsibility, successful compliance isn’t a one-sided affair. It requires genuine partnership, with banks and fintechs working hand-in-hand, each understanding their role in keeping the financial system safe and sound.

Second, compliance isn’t something you check off your to-do list and forget about. It requires vigilance – a continuous cycle of assessment, testing, and improvement as both your business and the regulatory landscape evolve.

Perhaps most importantly, we’ve seen how strong compliance practices can transform from a perceived burden into a genuine competitive advantage. When partners, customers, and investors see that you take compliance seriously, it builds the kind of trust that money simply can’t buy.

The good news? Technology is making compliance easier. Today’s RegTech solutions are turning what was once a manual, paper-heavy process into something more efficient and data-driven. This shift allows even smaller fintechs to implement robust compliance programs without massive teams.

What really separates the leaders from the followers, though, is culture. When compliance considerations are woven into the fabric of product development and corporate decision-making, the result is an organization that’s naturally more resilient to regulatory challenges.

At Avanti3, we walk this path alongside our clients every day. Our work integrating cutting-edge digital experiences with traditional financial systems has taught us that innovation and compliance aren’t enemies – they’re essential partners. Our approach leverages exciting technologies like blockchain, AR/VR, and AI while maintaining the robust compliance frameworks that financial services demand.

As you build your own fintech-banking partnerships, compliance isn’t just about avoiding problems. It’s about creating the foundation for trusted, sustainable relationships that can genuinely transform the financial landscape. By investing in compliance early and making it core to your strategy, you’re not just checking boxes – you’re building something that can stand the test of time in an increasingly complex world.

For more information about how thoughtful digital experience design can improve compliant financial solutions, visit our Digital Experience Design resources.