Why Diversification is No Longer Optional

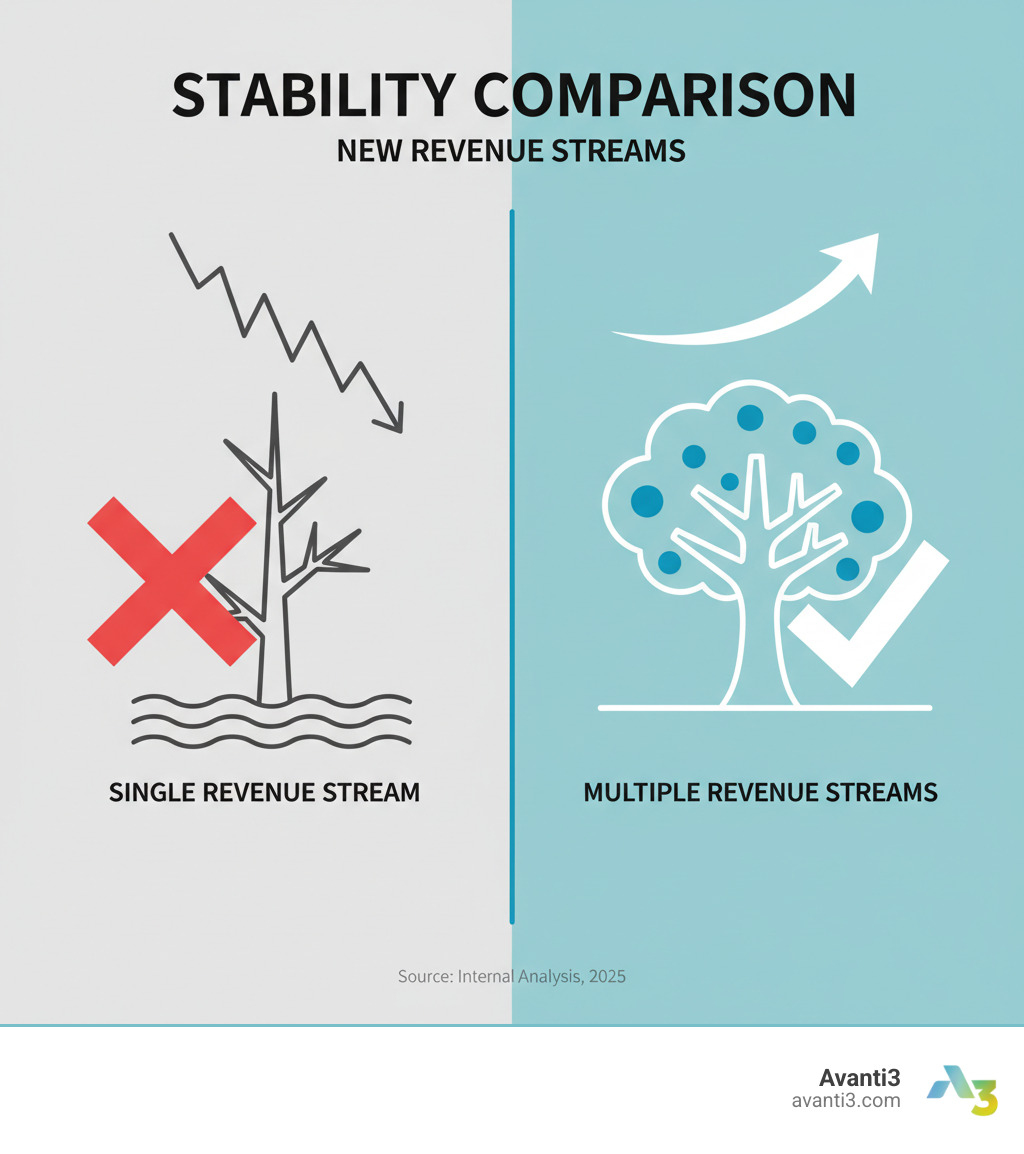

New revenue streams aren’t just a growth strategy—they’re essential for survival. Whether you’re a creator building a loyal fanbase or a brand navigating unpredictable markets, relying on a single income source is risky business.

Here’s what you need to know:

- What they are: Income sources beyond your primary offering, like subscriptions, licensing, or digital rewards.

- Why they matter: 76% of businesses agree that diversifying revenue is essential for survival.

- The core benefit: They protect against market shifts and create sustainable growth.

- Key types: Includes recurring, transaction-based, service, licensing, advertising, and Web3 opportunities like NFTs.

The difference between businesses with one revenue stream versus multiple during market downturns is stark. Companies with diversified income weather economic uncertainty, adapt faster, and maintain steady cash flow when their primary offering faces challenges.

Think of your business like a tree. A single trunk is vulnerable, but multiple strong branches create resilience. Each new revenue stream you develop becomes another branch supporting your growth.

I’m Samir ElKamouny AV. I help businesses achieve financial freedom by scaling new revenue streams. In this guide, I’ll share practical strategies for finding untapped opportunities, from leveraging existing assets to tapping into Web3 and AI.

Identifying and Evaluating New Revenue Streams

A great product isn’t enough. To build a lasting business, you must explore new income sources through smart innovation backed by feasibility analysis, market research, and financial forecasting. When done right, new revenue channels create a “flywheel effect,” where each stream reinforces the others. Start by asking: “If I were launching this business today, what new opportunities would I chase?” This fresh perspective helps you break free from old habits.

Understanding the Spectrum of Revenue Models

Before creating new income, you must understand the different types of revenue streams. A single asset can often create multiple streams.

- Transaction-based and service revenue are classic models involving one-time payments for products or project-based fees for services.

- Recurring revenue is sought after for its predictability. This includes subscriptions and memberships, like Netflix’s model, which builds a stable customer base. According to the Corporate Finance Institute, it’s the most predictable income stream. See Recurring revenue for an overview.

- Project revenue involves large-scale deliverables but can be volatile. Subscription models, a type of recurring revenue, offer continuous access for a regular fee. Adobe’s shift to Creative Cloud is a powerful example.

- Licensing intellectual property monetizes your patents, trademarks, or copyrights for fees or royalties, like when a song is licensed for a film.

- Digital reward systems are a Web3 frontier. Gamified missions reward users with NFTs or tokens, building community and opening monetization avenues. Our Digital Reward System is designed for this, driving engagement and creating new revenue streams for Web3 brands.

- Advertising fees are generated by showcasing brands on your properties, like a website or podcast.

- Brokerage fees are commissions earned by acting as an intermediary in transactions, like platforms connecting freelancers with clients.

A 4-Step Framework for Evaluating Potential Opportunities

You need a structured process to evaluate new revenue streams. Here’s a practical four-step framework.

First, determine clear mission alignment. Does the opportunity align with your core mission and values? It should strengthen your brand, not dilute it. A coffee shop adding a bakery makes sense; selling car parts doesn’t. Avoid mission creep that drains resources and confuses customers.

Second, verify feasibility. Assess if you can realistically pull it off. Do you have the staff resources and expertise? Gauge community demand with thorough market research. Also, consider legal and compliance problems.

Third, understand investment required versus expected revenue. Financial forecasting is critical. Project costs against potential income using best, worst, and likely scenarios to understand ROI. Cautious investment is key; 84% of retailers test on a small scale first. This connects to using personalized data to predict customer behavior and revenue.

Fourth, find organizational champions. Every new initiative needs a dedicated leader to drive the project, gather data, and keep stakeholders informed. Without strong leadership, great ideas fail.

How to Leverage Existing Assets to Create New Revenue Streams

One of the smartest ways to find new revenue streams is to look inward at underused assets. This approach minimizes investment by leveraging your existing strengths.

- Take inventory of your abilities. A new stream should align with your main offering. For example, skilled developers could offer custom software solutions to other businesses.

- Repurpose resources. Find new uses for what you own. For example, restaurants repurposed kitchens for delivery during the pandemic.

- Monetize data. Your internal data is a goldmine. 44% of businesses see it as a path to new revenue. Analyze customer behavior to spot trends or find market gaps. Our AI customer engagement solutions help leverage data for personalization and monetization.

- Offer online courses to package your expertise, sublet underused space, or even turn waste into profit by finding ways to monetize byproducts.

Tapping into Web3 and AI for Innovative Income

Web3 and AI are redefining new revenue streams, creating unprecedented opportunities.

- Digital collectibles and blockchain are revolutionizing digital ownership. Creators can monetize unique art, while brands can use NFTs for loyalty rewards or exclusive access. Our expertise in NFT marketplace development helps build these new economies, and blockchain content distribution ensures fair creator compensation.

- Immersive experiences with AR and VR offer new monetization avenues beyond gaming, like virtual concerts or product showcases. Our augmented reality marketing solutions help businesses tap into these channels.

- AI-powered monetization optimizes and generates revenue through hyper-personalization and predictive analytics. We provide AI tools for creators to help them streamline work and find new monetization paths.

- Gamified loyalty in Web3 uses tokenized rewards to drive engagement with NFT and blockchain incentives, fostering deeper, monetizable connections with brands.

Strategic Partnerships and Mitigating Inherent Risks

Pursuing new revenue streams has risks. Strategic partnerships are an effective way to mitigate them and accelerate growth.

| Feature | Building In-House | Partnering |

|---|---|---|

| Cost | High initial investment (R&D, talent, infrastructure) | Lower initial investment, shared costs |

| Time | Longer development and implementation cycles | Faster time-to-market, leverage partner’s existing infrastructure |

| Expertise | Requires acquiring or developing new skills internally | Access to partner’s specialized expertise and market knowledge |

| Risk | Bears all development and market risks | Shared risk, access to partner’s established customer base |

| Control | Full control over the new venture | Shared control, requires strong collaboration and trust |

| Scalability | Dependent on internal resources and funding | Can scale faster by leveraging partner’s resources and networks |

| Focus | Potential distraction from core business | Allows focus on core competencies while expanding offerings |

Partnerships create mutual value by leveraging complementary strengths to expand your reach. They can open up new customer bases or connect existing offerings to new markets. To approach this effectively, co-create offerings with partners for mutual benefit.

Risk mitigation through testing is critical. 84% of retailers test new strategies on a small scale first. This approach allows you to gather data and refine your offering without committing extensive resources. If you lack internal bandwidth, partnering with organizations that can help you gather, test, and measure investments is invaluable, as 64% of companies plan to do. For more insights, explore our tools on building community partnerships.

Conclusion: Building a Resilient and Future-Proof Business

As we’ve seen, new revenue streams are essential for any business that wants to thrive through change, not just survive it. Like the tree we mentioned, each new revenue stream—be it a subscription, partnership, or Web3 experience—adds a branch that makes your business more resilient.

Diversifying your income creates a flywheel effect: predictable cash flow from subscriptions can fund experiments with digital collectibles, while partnerships open new markets. Each stream reinforces the others.

We’ve covered the practical steps: understanding revenue models, evaluating opportunities with a 4-step framework, leveraging existing assets, tapping into Web3 and AI, and building strategic partnerships.

The secret to long-term stability is continuous innovation. The market is always changing, so you must constantly ask: “What else can we offer? How else can we deliver value?” This mindset of exploration and adaptation separates survivors from thrivers. Stay curious, test smartly (like the 84% of retailers who test small first), and be ready to pivot based on data.

At Avanti3, our mission is to help creators and brands steer this new landscape. The future belongs to businesses that accept digital engagement and innovative monetization. Whether you’re exploring NFT loyalty programs, AR experiences, or digital communities, we can help turn your ideas into reality.

The path to a future-proof business starts with one step. It could be an online course, a new partnership, or a digital reward system. Whatever your next move is, make it count. Explore customizable digital engagement platforms to build your next powerful revenue stream today.