Fintech Definition: Revolutionary 2025

What is Fintech? Breaking Down the Definition

The fintech definition is simple at its core: fintech is short for “financial technology.” But this basic explanation only scratches the surface of what has become one of the most transformative forces in modern finance.

Quick Answer: Fintech Definition

- What it means: Technology used to improve and automate financial services

- Key purpose: Making financial services faster, cheaper, and more accessible

- Examples: Mobile payment apps, digital banks, investment platforms, cryptocurrency

- Impact: Democratizing finance for consumers and businesses worldwide

If you’ve used Venmo to split a dinner check, bought cryptocurrency, or used a budgeting app, you’ve used fintech. These tools represent a fundamental shift from traditional banking toward a more accessible, mobile-first approach to managing money.

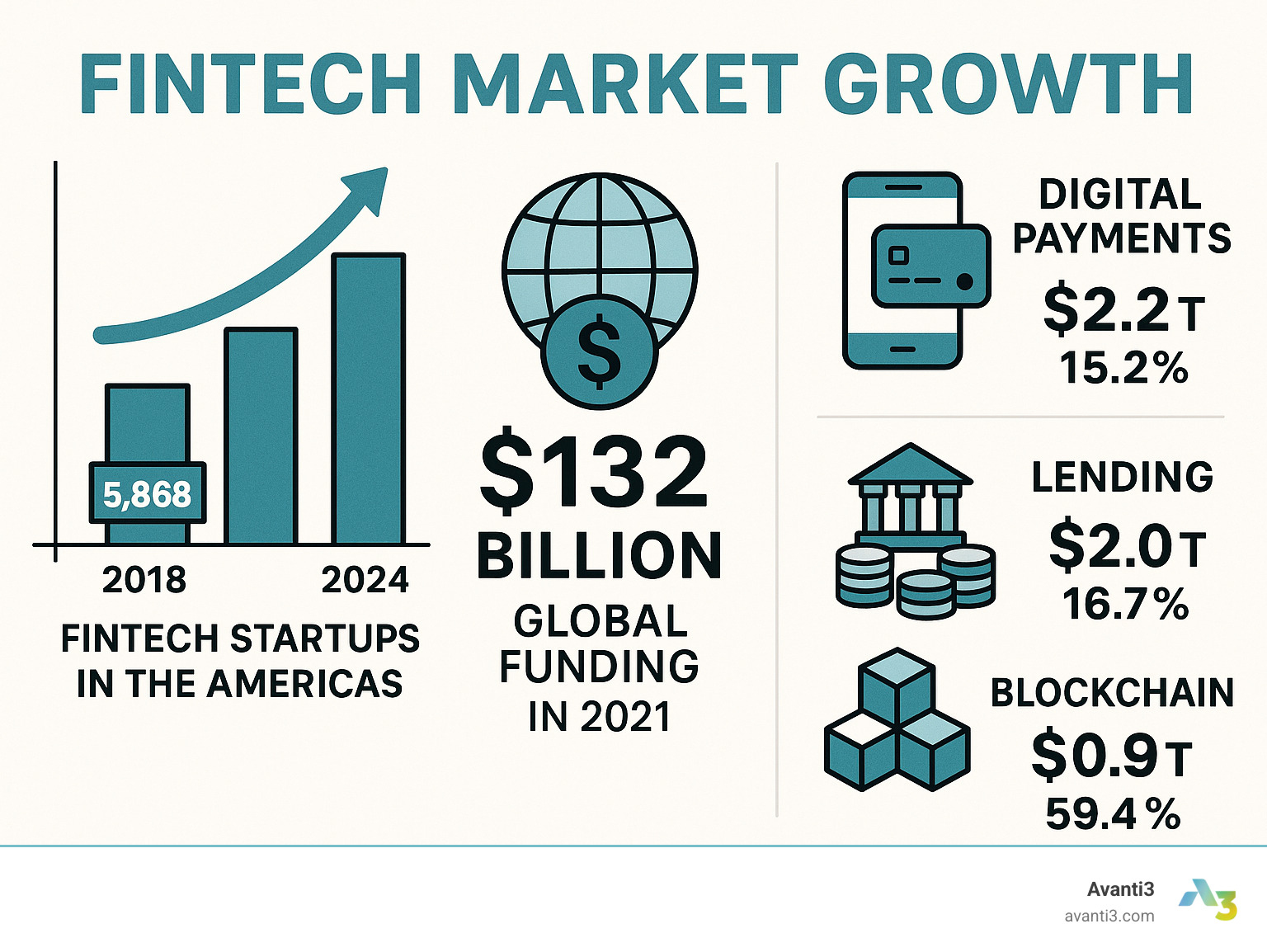

The fintech revolution is more than a buzzword. With over 13,000 fintech companies in North America alone as of 2024, and digital lending growing at a compound annual rate of 16.7%, we’re witnessing the democratization of financial services on an unprecedented scale.

I’m Samir ElKamouny AV, and through my work helping businesses scale with emerging technologies, I’ve seen how understanding the fintech definition is crucial for creators and brands. It opens up new possibilities for audience engagement, monetization, and meaningful customer relationships.

Simple fintech definition word guide:

- api integrations for fintech

- banking compliance for fintech integrations

- how do fintech companies integrate with banks

Unpacking the Core Fintech Definition and Its Evolution

While the term “fintech” feels new, financial technology has existed for over 150 years. The difference today is that the modern fintech definition isn’t just about using technology in finance—it’s about completely reimagining how money works.

The key difference between general “financial technology” and true “FinTech” is disruption. As researchers note in studies on fintech evolution, FinTech innovates in agile, unexpected ways rather than just digitizing existing processes. For example, Venmo didn’t just speed up payments; it changed how we socially interact with money.

This follows the Tech Paradigm: technology moves from bleeding edge (new and risky) to status quo (essential). Online banking was once revolutionary; now it’s standard. Today’s innovations, like AI-powered financial advice, will become tomorrow’s norm. This constant evolution means the fintech definition itself keeps changing.

What is the modern fintech definition?

Today’s fintech definition is about putting financial power directly into people’s hands. It’s technology that delivers financial services straight to consumers and businesses, often bypassing traditional banks.

Modern fintech focuses on consumer-oriented services with intuitive, mobile-first designs. Automation handles routine tasks like expense tracking and fraud detection, making financial management easier. Both startups and traditional banks are now in this race, with newcomers forcing legacy institutions to innovate their digital experiences.

This focus on enjoyable financial services aligns with our work at Avanti3. Just as modern fintech transformed banking through better digital experience design, we help brands build engaging financial relationships.

The historical fintech definition: From telegraphs to the internet

Financial technology has evolved in three major waves:

FinTech 1.0 (1866-1967) was about building infrastructure. Innovations like the transatlantic telegraph (1866), electronic funds transfer, and the first ATM (1967) primarily served banks and businesses.

FinTech 2.0 (1967-2008) brought finance into the digital age. This period saw the first electronic stock exchange (NASDAQ, 1971), standardized global bank communication (SWIFT, 1973), and the rise of online banking. PayPal, founded in 1998, proved money could be managed entirely online, but the focus was on making existing processes faster.

FinTech 3.0 (Post-2008) changed everything. The 2008 financial crisis, combined with the rise of smartphones, created the perfect storm for disruption. This is when the modern fintech definition truly took shape, with apps for peer-to-peer lending, social payments, and micro-investing that reimagined finance. As detailed in this comprehensive fintech history, this era marked the shift from “digitizing banking” to “reimagining finance entirely.”

We may now be entering FinTech 3.5, where finance merges with AI, blockchain, and Web3, creating the kind of future we’re building at Avanti3.

How Fintech Works: The Technology Behind the Revolution

Understanding the fintech definition means looking at the technology that powers it. A sophisticated ecosystem of interconnected technologies works together to make your financial life simpler.

- APIs (Application Programming Interfaces) act as secure bridges, allowing different financial apps and systems to communicate and share data, creating a connected financial ecosystem.

- Cloud computing provides the flexible, scalable infrastructure needed to process vast amounts of data and handle millions of transactions instantly.

- Data aggregation pulls your scattered financial information (bank accounts, credit cards, investments) into a single, clear dashboard for smarter decision-making.

- The mobile-first approach ensures services are designed for smartphones, while web-based services offer complementary experiences for more detailed tasks.

These technologies enable us to build powerful tools for building online communities around financial services, turning transactions into engaging experiences.

The Role of AI and Machine Learning

Artificial intelligence and machine learning are the brains making financial services smarter, safer, and more personalized.

- Predictive analytics uses AI to analyze your financial history, offering proactive advice like budget warnings or savings suggestions.

- Fraud detection systems use machine learning to learn your normal behavior and instantly flag suspicious activity, a crucial defense as cyberattacks rise.

- Robo-advisors democratize wealth management, using algorithms to build and manage investment portfolios for a low cost.

- Personalized customer service is delivered via smart chatbots that can answer complex questions 24/7. We leverage AI Customer Engagement to create these helpful, customized interactions.

- Algorithmic trading executes investment strategies at superhuman speeds to optimize portfolios.

The global AI market is projected to reach $422.37 billion by 2028, according to a Zion Market Research report on AI growth, reflecting its deep integration into modern finance.

Blockchain and Web3 Integration

Blockchain technology is a transformative part of the modern fintech definition, offering decentralization, transparency, and security.

- Decentralized Finance (DeFi) removes intermediaries like banks, allowing users to interact directly through smart contracts for services like lending and trading.

- Cryptocurrencies like Bitcoin enable peer-to-peer transactions without traditional banking infrastructure.

- Smart contracts are self-executing agreements that automate processes, such as insurance payouts or escrow releases. You can learn more about Blockchain explained to understand these concepts.

- Tokenization turns real-world assets like real estate into digital tokens, enabling fractional ownership and new investment opportunities.

- Improved security comes from blockchain’s distributed and cryptographically protected nature, making fraud extremely difficult.

We integrate these Web3 technologies with our NFT Engagement Tools to empower creators with unique digital experiences and rewards systems.

The Fintech Landscape: Categories and Real-World Applications

The fintech definition today covers a massive ecosystem touching every corner of our financial lives. With over 13,000 fintech companies in North America as of January 2024, according to Statista data on fintech startups, the landscape is diverse and growing rapidly.

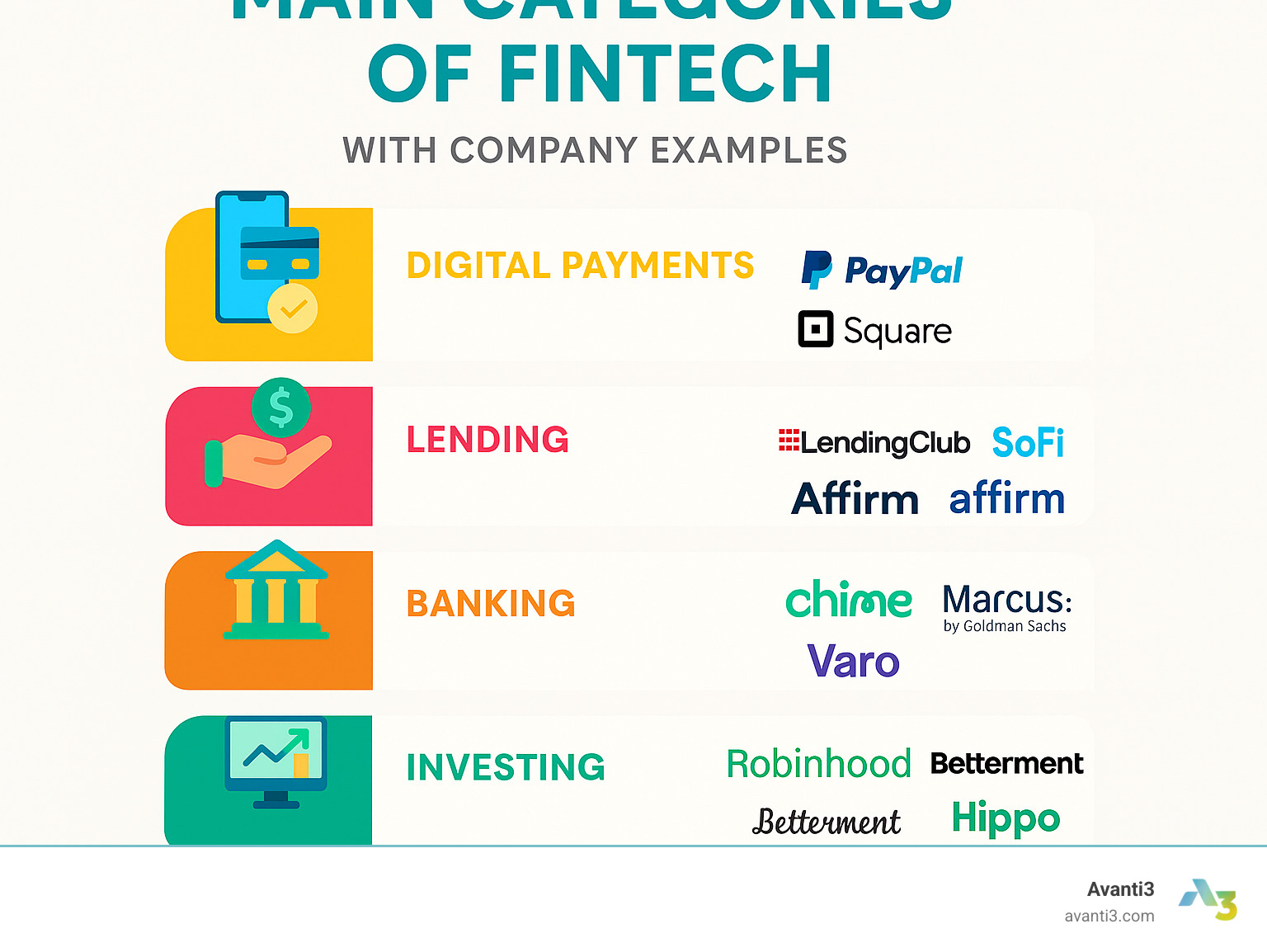

Key categories include digital payments, banking, lending, personal finance, investing, insurtech, cryptocurrency, and regulation technology (regtech).

Digital Payments and Banking

This is where most people first experience fintech. These services have become so seamless we often forget the technology behind them.

- Peer-to-peer (P2P) payments from services like Venmo and Zelle have made splitting bills and sending money instant and effortless.

- Digital wallets like Apple Pay and Google Wallet have turned our smartphones into secure payment devices.

- Neobanks are digital-only institutions that operate entirely online, offering low-fee banking and superior mobile experiences.

- B2B payment solutions streamline business invoicing and transfers, making them faster and cheaper.

Our work in Digital Brand Engagement uses these same principles to create smooth, natural user interactions.

Lending and Personal Finance

Fintech has made the lending world faster, more transparent, and more accessible.

- Digital lending platforms have streamlined loan applications, with approvals often taking minutes instead of weeks. This sector is growing at a compound annual rate of 16.7%, per Allied Market Research on digital lending.

- Expanded credit access is a key benefit, as some platforms use alternative data to assess creditworthiness, helping those with thin or non-traditional credit files.

- Personal finance management (PFM) apps act like a financial advisor in your pocket, helping you budget, track spending, and set goals automatically.

This area truly embodies the democratization of finance by serving communities often overlooked by traditional institutions.

Investing, Insurance, and Regulation Tech

Fintech is also revolutionizing how we build wealth, manage risk, and ensure compliance.

- Robo-advisors have made professional investment management accessible to everyone through automated, algorithm-driven portfolios.

- Micro-investing apps allow users to invest spare change from daily purchases, making it easy to start building wealth.

- Insurtech is innovating the insurance industry with streamlined applications, personalized premiums based on behavior, and faster claims.

- Regtech (regulation technology) uses AI and blockchain to help companies manage compliance, cybersecurity, and fraud detection, ensuring the ecosystem remains trustworthy.

We’re exploring how AI Tools for Creators can be combined with these technologies to help individuals steer complex financial decisions.

Benefits vs. Risks: The Two Sides of Fintech Innovation

The fintech definition encompasses both incredible opportunities and real challenges. Like any powerful technology, it’s a double-edged sword.

| Metric | Traditional Finance | Fintech |

|---|---|---|

| Speed | Often slow, manual processes, business hours | Instant, real-time, 24/7 availability |

| Cost | High fees (overdraft, transfer, maintenance) | Lower fees, often free basic services |

| Accessibility | Branch-dependent, stricter credit requirements | Mobile-first, broader credit access, underserved |

| Personalization | Limited, standardized products | Highly customized, AI-driven recommendations |

| Convenience | In-person visits, paperwork | Digital, remote, user-friendly apps |

Primary Benefits for Consumers and Businesses

The positive impact of fintech has been remarkable.

- Increased accessibility is fintech’s greatest achievement, promoting true financial inclusion. A Brookings Institution report on fintech adoption highlights how fintech has been transformative for underserved communities, with over 90% of Hispanic consumers and 88% of African Americans now using these services.

- Lower costs and fees result from lean digital models, making financial services more affordable.

- Speed and convenience are unparalleled. Transfers that took days are now instant, and accounts can be opened in minutes from a phone.

- Greater choice means consumers can find solutions custom to their specific needs instead of being limited to a local bank’s offerings.

- Personalized products, powered by AI and Personalized Data, offer custom-fit advice and recommendations.

Potential Risks and Regulatory Challenges

With innovation comes responsibility and genuine risks.

- Cybersecurity threats are a major concern. As a report on increased cyber attacks shows, attacks are on the rise, and digital financial platforms are prime targets.

- Data privacy concerns are significant, as fintech companies handle vast amounts of sensitive personal information.

- Regulatory uncertainty creates challenges, as slow-moving regulations struggle to keep pace with fast-moving technology. The US Treasury view on fintech risks highlights these gaps.

- Financial exclusion can occur for the non-tech-savvy who may lack the devices or digital literacy to use these services.

- Hasty financial decisions can be a byproduct of frictionless services, removing the “pause button” that traditional processes sometimes provided.

- Consumer protection frameworks may not be as robust as those for traditional banks.

Finding the right balance between innovation and protection is the key ongoing challenge for the industry.

The Future of Finance: Emerging Trends in Fintech

The fintech definition continues to evolve at breakneck speed. The next wave of innovation is making financial services so seamlessly integrated into our daily lives that they’ll become practically invisible.

- Embedded finance is leading this charge, weaving financial services like “buy now, pay later” or insurance directly into non-financial apps and websites. This market is projected to generate $230 billion in revenue by 2025.

- Banking as a Service (BaaS) is the engine making this possible, allowing any company to offer banking products by plugging into a licensed bank’s infrastructure via APIs.

- Hyper-automation combines AI, machine learning, and robotic process automation to handle complex tasks from onboarding to compliance, resulting in faster service and fewer errors.

- Hyper-personalization uses AI to deliver financial services that adapt to your needs in real-time, creating opportunities for engaging AR/VR Immersive Experiences that make managing money feel intuitive.

- Sustainable finance is also gaining momentum, with green fintech platforms making it easier to invest responsibly and track the environmental impact of your spending.

The Convergence with Web3

The future fintech definition is increasingly intertwined with Web3 technologies, creating new possibilities.

- Decentralized Autonomous Organizations (DAOs) are community-governed financial organizations run on blockchain technology.

- The metaverse economy is creating new financial ecosystems for virtual real estate and digital assets, opening doors for Augmented Reality Marketing.

- NFTs are evolving from digital art into practical financial tools for digital identity, proof of ownership, loan collateral, and loyalty rewards.

- Gaming and finance (GameFi) is blurring the lines between entertainment and earning, turning “play-to-earn” into a legitimate income source for millions.

At Avanti3, we are actively shaping these trends. Our Web3 Platform Solutions integrate these technologies to build unique digital experiences, rewards systems, and community-building tools that are setting new standards in digital engagement and fan monetization.

Conclusion

The fintech definition has evolved from a simple portmanteau to a term representing a fundamental shift in how we manage money. We’ve moved from the first cross-border telegraph transactions to AI-powered robo-advisors, all driven by technologies like APIs, cloud computing, and blockchain.

The benefits are clear: greater financial inclusion, lower costs, and unprecedented convenience and personalization. For example, over 90% of Hispanic consumers and 88% of African Americans now use fintech. However, these advantages must be balanced against real risks like cybersecurity threats, which have increased by 55% in North America, and the need for updated regulatory frameworks.

The future is even more exciting. Embedded finance will make financial services invisible, while the convergence with Web3 will open up new forms of digital ownership and community value.

At Avanti3, we are at the forefront of this change. We integrate fintech with Web3 technologies like NFTs, blockchain, and AI to empower creators and brands with tools that build genuine communities and create meaningful digital experiences, not just process transactions.

The fintech definition will continue to evolve, becoming more intelligent, integrated, and human-centered. We’re committed to leading that charge. Ready to explore what’s possible? Find how to create unique digital experiences with us and step into the future of finance.