Fintech Integration Services: Best Buyer’s Guide 2025

Why Fintech Integration Services Are the New Competitive Edge for Modern Business

Fintech Integration Services connect modern financial applications to the systems you already use, so money, customer data, and analytics move automatically. Typical components include:

- Payment gateway integration for secure online transactions

- Banking as a Service (BaaS) for embedded financial features

- API connectivity for real-time data exchange

- KYC/AML tools for compliance

- Core banking integration for complete financial management

Disconnected systems create data silos, manual work, and slow growth. Integrated finance turns that around, letting creators and brands process payments worldwide, manage subscriptions, and see revenue in real time.

When payment gateways, accounting, and analytics tools share one data layer, teams stop reconciling spreadsheets and start acting on instant insights. For digital communities this means faster payouts, smarter subscription tiers, and richer audience analytics.

Results arrive quickly: companies report underwriting twice as fast, customer sign-ups up to 25 % higher, and major cost reductions through automation. Even better, integrated stacks open up new revenue models—from tiered memberships to digital rewards—that isolated tools simply can’t support.

As Samir ElKamouny AV I’ve watched businesses in 25+ countries leapfrog competitors by adopting the right fintech stack. A thoughtful integration strategy often separates the brands that thrive from those that stall.

Easy Fintech Integration Services glossary:

What Is Fintech Integration and Why Is It Crucial?

Fintech integration embeds financial features into existing systems so data flows instantly and processes run on autopilot. It’s more than adding a checkout button; it’s building a modern financial backbone.

For ecommerce, installment options and real-time tax calculation lift conversion rates. Banks and credit unions use APIs to launch digital products in months instead of years. Across the board, integrated finance means higher efficiency, happier customers, and faster innovation.

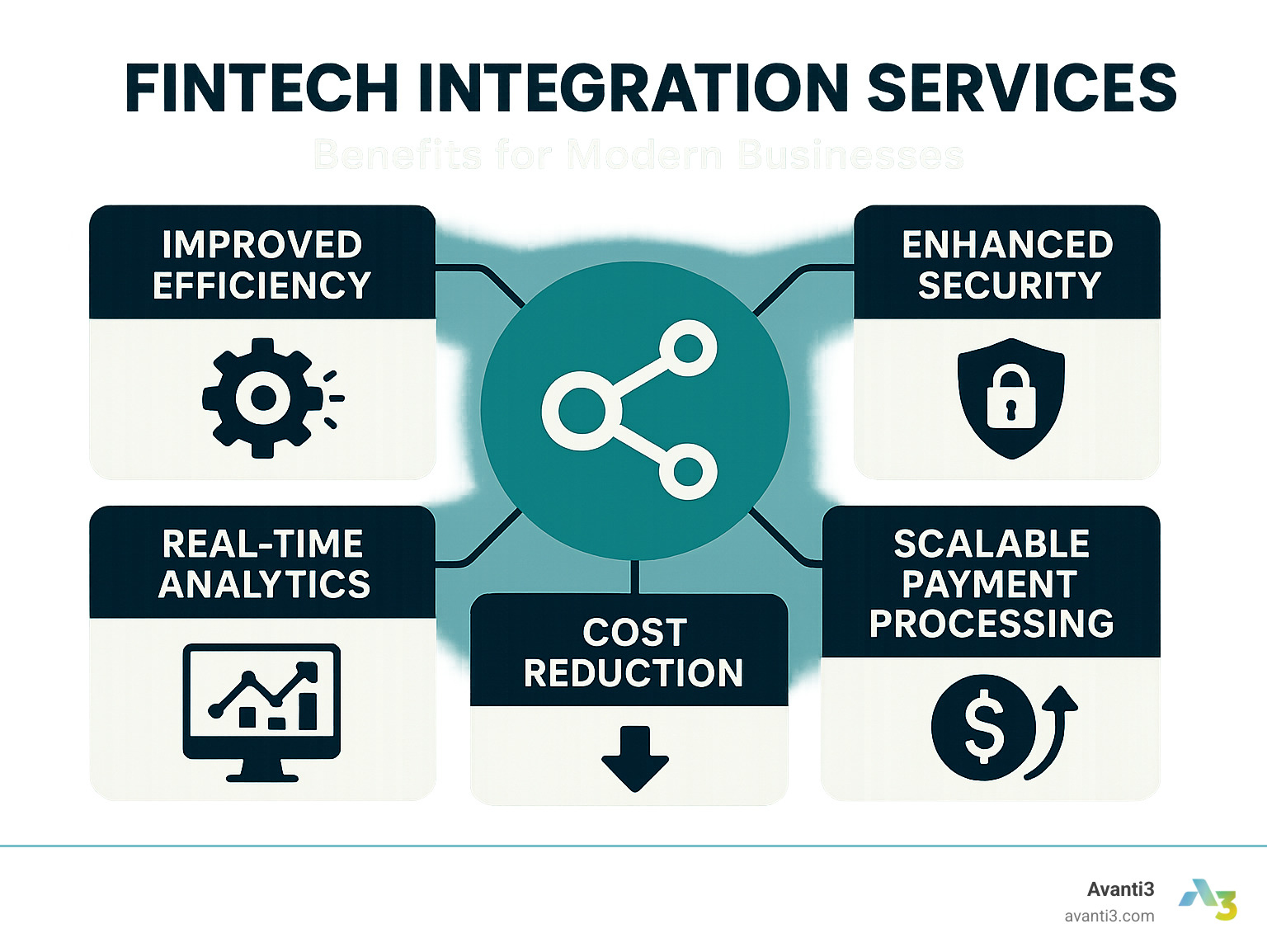

Core Benefits at a Glance

- Accurate, real-time data – no more manual entry or reconciliation

- Security & compliance – encryption, SOC 2, GDPR, ISO 27001 baked in

- Operational efficiency – automated underwriting and cash-flow visibility

- Cost savings – scale without hiring proportionally more staff

- Better experiences – smoother onboarding, more payment choices, higher retention

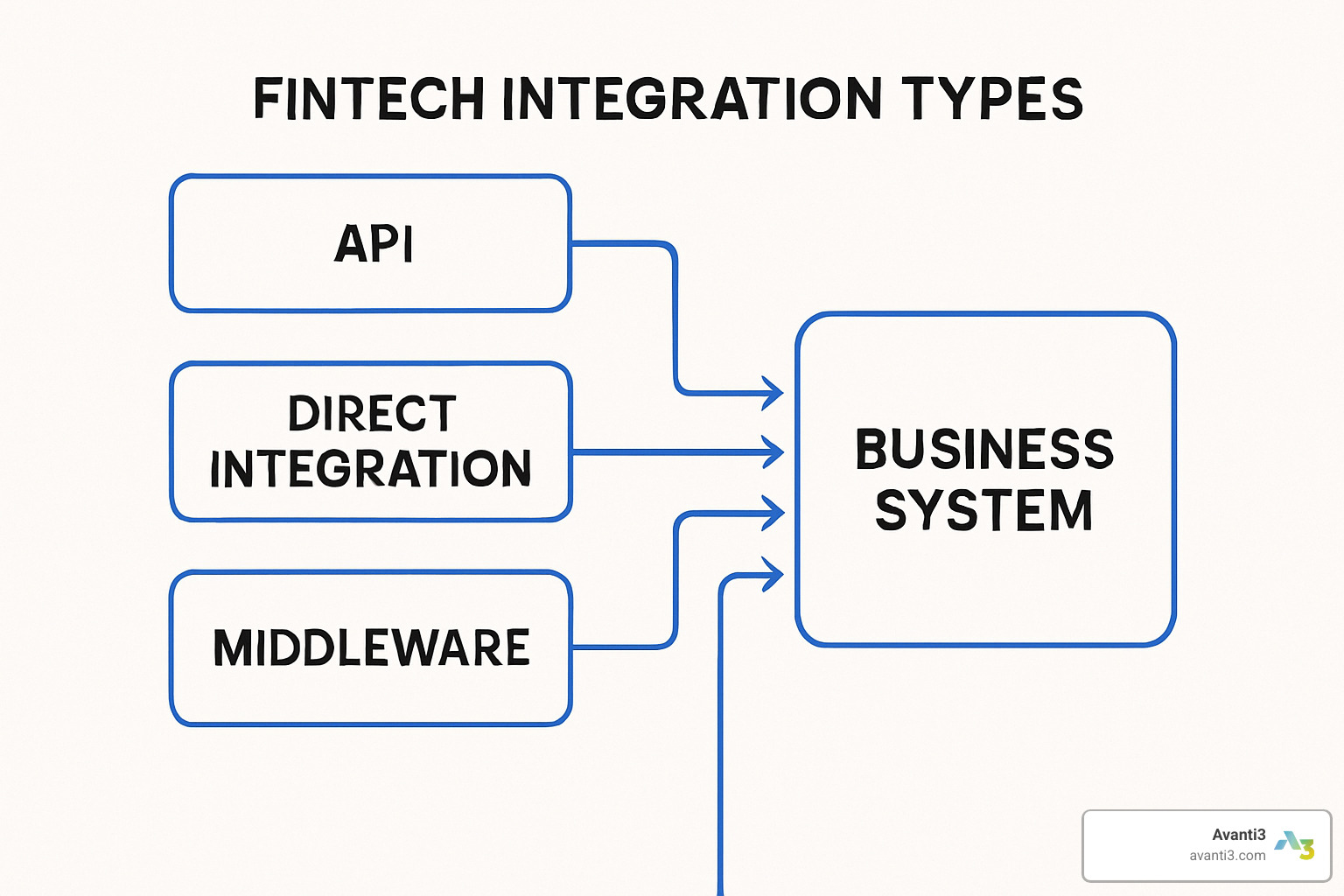

Decoding the Types of Fintech Integration Solutions

The world of Fintech Integration Services isn’t one-size-fits-all. Different businesses need different solutions, and understanding your options is the first step toward building a financial ecosystem that actually works for your goals. Whether you’re connecting core banking systems, integrating third-party applications, or streamlining financial data across your Technology stack, each integration type serves a specific purpose.

Think of these solutions as building blocks. Some businesses need the full foundation of Banking as a Service, while others just need the right API connections to make their existing systems talk to each other. The key is knowing which blocks you need and how they fit together.

APIs (Application Programming Interfaces)

APIs are the fundamental building blocks of modern fintech integration. If you’ve ever wondered how your payment app instantly shows your bank balance or how your accounting software automatically imports transaction data, you’re seeing APIs in action. They’re the behind-the-scenes translators that make different software applications work together seamlessly.

The real power of API-led connectivity lies in its ability to create interoperability between systems that were never designed to work together. With the right API integrations, you can access account information from thousands of financial institutions, initiate transactions across multiple platforms, and retrieve financial data in real-time. This is game-changing for businesses serving global audiences or managing complex financial workflows.

Open Banking has revolutionized what’s possible with APIs. Financial institutions can now offer customers secure access to their financial data across multiple accounts and banks. This creates opportunities for better financial management tools, more accurate underwriting, and truly personalized financial services.

For creators and brands, API integration opens up exciting possibilities. You can offer your audience instant payouts, detailed revenue analytics, or sophisticated subscription management – all while maintaining your brand experience. APIs provide access to a wide range of financial institutions and services, giving you the flexibility to build exactly what your community needs.

Banking as a Service (BaaS)

Banking as a Service represents a fundamental shift in how financial services work. Instead of spending years and millions of dollars to become a bank, businesses can now embed financial services directly into their platforms by leveraging existing banking infrastructure.

This is particularly exciting for non-banking companies that want to offer financial products to their customers. Think about your favorite creator platform or community app – with BaaS, they could offer branded debit cards, savings accounts, or even lending products without dealing with banking regulations directly.

The white-label solutions aspect of BaaS means you can customize the entire experience to match your brand while using proven banking infrastructure behind the scenes. This opens up ecosystem collaboration opportunities and creates new revenue streams that weren’t possible before.

If you’re building a platform focused on Investing or financial education, BaaS can help you offer practical financial tools alongside your content. This creates a more comprehensive value proposition and deeper engagement with your audience.

Payment Gateway Integration

Payment gateways handle the heavy lifting of secure online transactions, but modern payment integration goes far beyond basic credit/debit card processing. Today’s solutions support hundreds of payment methods, from traditional cards to emerging digital wallets and regional payment preferences.

This global reach is crucial for businesses serving international audiences. Payment gateways can support diverse payment methods for true global reach, making it easier to expand into new markets without worrying about local payment preferences.

Fraud reduction and PCI DSS compliance are built into modern payment gateways, protecting both businesses and customers. Advanced fraud detection runs in real-time, blocking suspicious transactions while keeping legitimate payments flowing smoothly.

The integration capabilities enable sophisticated features like subscription billing, marketplace payments, and revenue splitting. For creator platforms, this means handling complex scenarios like sharing revenue with multiple creators or managing tiered subscription models becomes straightforward.

Specialized Solutions: KYC/AML, Lending, and More

| Solution Type | Primary Function | Key Benefits | Best For |

|---|---|---|---|

| KYC/AML | Identity verification and compliance | Regulatory compliance, fraud prevention | Financial services, high-risk industries |

| Lending as a Service | Credit assessment and loan processing | Faster underwriting, risk management | Platforms offering credit products |

| Data Analytics | Financial insights and reporting | Better decision making, performance tracking | All businesses needing financial insights |

| Card Issuing | Branded payment cards | Customer engagement, revenue generation | Loyalty programs, creator platforms |

Know Your Customer (KYC) and Anti-Money Laundering (AML) solutions are essential for businesses operating in regulated industries. These systems automate identity verification, document collection, and ongoing monitoring to ensure regulatory compliance while reducing manual work.

Lending as a Service platforms enable businesses to offer credit products without building lending infrastructure from scratch. The underwriting and risk assessment capabilities are particularly valuable for platforms serving creators or small businesses who need access to capital.

For businesses building Digital Reward System features, specialized solutions can handle complex reward calculations, compliance requirements, and integration with existing loyalty programs. These tools make it possible to create engaging reward experiences that actually drive user behavior.

The beauty of these specialized solutions is that they can work together. A creator platform might use KYC for user verification, lending services for creator advances, and data analytics for performance insights – all integrated into a seamless experience that feels native to their brand.

Key Factors in Choosing Fintech Integration Services

Choosing a provider is like choosing a co-founder: the relationship shapes your business for years. Focus on long-term alignment, not just today’s feature list.

Compatibility, Scalability, and Flexibility

Your integration should plug into current systems with minimal rework and scale as volume grows. Cloud-native, API-first platforms usually provide the headroom you need.

Vendor Reputation and Technical Expertise

Prioritize teams with deep fintech knowledge, proven security practices, and case studies that mirror your goals. Industry-specific insight reduces risk and shortens launch time.

Cost Considerations and ROI

Look beyond price tags to total cost of ownership. Implementation fees, transaction costs, internal resources, and maintenance all matter. The right solution pays for itself through higher conversions, reduced manual work, and new revenue streams. Selecting carefully today safeguards long-term efficiency, customer delight, and compliance.

Navigating Challenges and Ensuring Bulletproof Security

Let’s be honest – implementing Fintech Integration Services isn’t always smooth sailing. While the benefits are compelling, there are real challenges that every business needs to steer carefully. The good news? Most integration problems are predictable and preventable with the right approach.

Think of fintech integration security like building a house. You wouldn’t skip the foundation just to save time, and you shouldn’t cut corners on security measures just to launch faster. The risks are real, but they’re manageable when you understand what you’re dealing with.

Risk mitigation starts with acknowledging that data governance isn’t just a compliance checkbox – it’s your business’s lifeline. When you’re moving financial data between systems, you’re handling some of the most sensitive information your customers entrust to you. Regulatory problems and vendor lock-in are serious concerns, but they’re far from impossible.

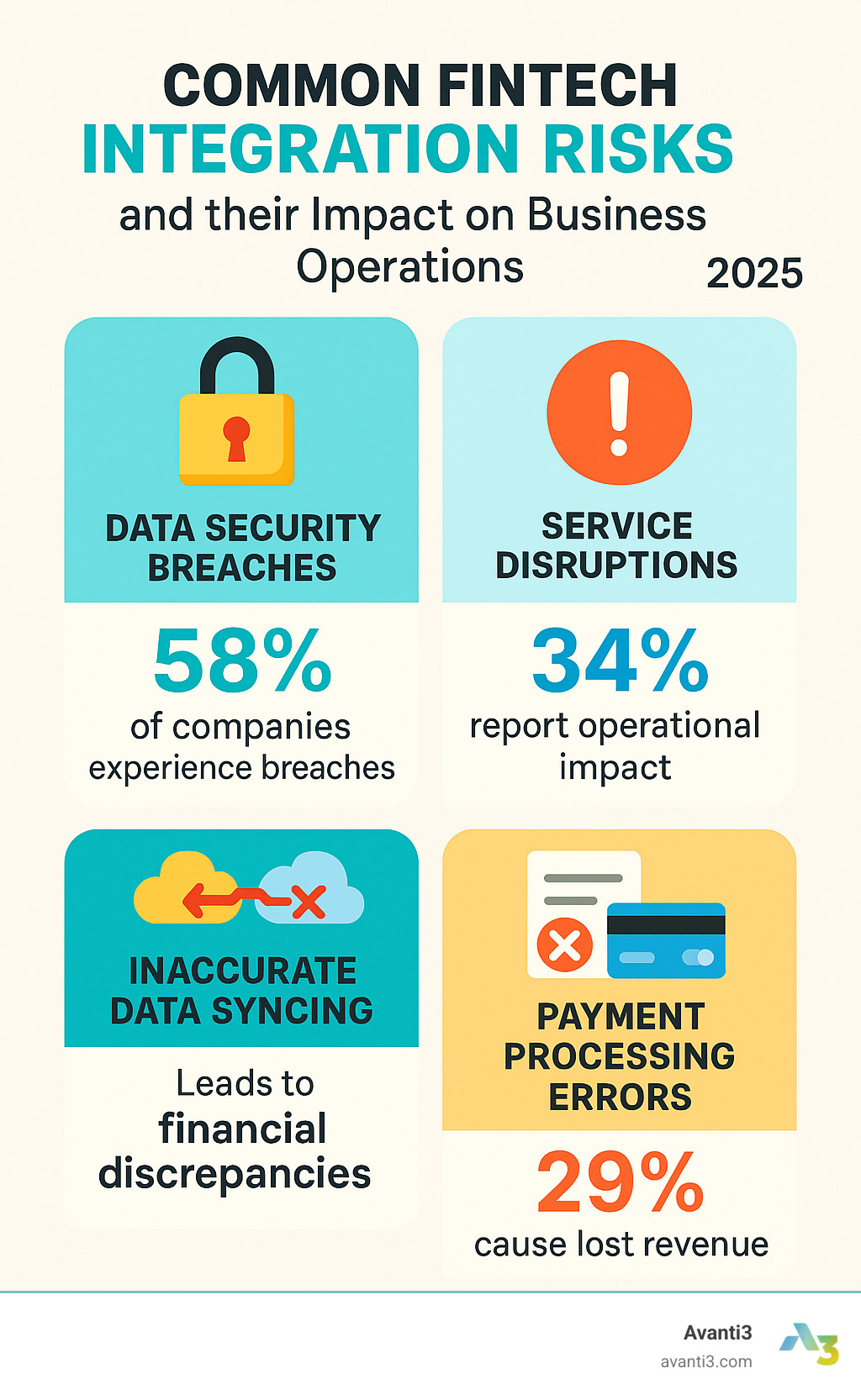

Common Risks and How to Mitigate Them

Data security breaches top the list of fintech integration nightmares, and for good reason. When financial data travels between systems, it creates potential entry points for bad actors. The solution isn’t to avoid integration – it’s to secure every touchpoint with military-grade protection.

Service disruptions can turn a profitable day into a customer service disaster. Imagine your payment system going down during your biggest sales event of the year. The key is building redundancy into your system from day one, not scrambling to fix problems after they happen.

Here’s your mitigation playbook: Establish robust SLAs with clear uptime guarantees that actually mean something. Implement redundant systems so if one fails, another takes over seamlessly. Conduct thorough testing before going live – and we mean thorough, not just a quick check. Plan phased rollouts to minimize the impact if something does go wrong.

Inaccurate data syncing might sound like a minor technical hiccup, but it can create reconciliation nightmares that take weeks to untangle. Prevention is simple: comprehensive data validation, automated monitoring, and regular audits of your data flows.

Payment processing errors – from failed transactions to double-charging customers – can damage relationships you’ve spent years building. Real-time monitoring and automated error detection aren’t luxuries; they’re necessities for maintaining customer trust.

Essential Security and Compliance for Fintech Integration Services

Security in fintech integration isn’t negotiable – it’s the foundation everything else builds on. When you’re dealing with financial data, “good enough” security is like using a screen door on a submarine.

Data encryption must happen both at rest and in transit. This means your data is protected whether it’s sitting in a database or traveling between systems. Think of encryption as an unbreakable code that only authorized systems can read.

Secure transmission protocols create protected highways for your data to travel. TLS encryption and API authentication ensure that only the right systems can access your financial information. It’s like having a private tunnel that only trusted parties can use.

Compliance isn’t just about avoiding fines – it’s about proving you take security seriously. SOC 2 Type II compliance demonstrates that a provider has undergone rigorous security audits. GDPR compliance is essential for any business serving European customers. ISO 27001 certification shows a commitment to information security management.

Regular security audits and penetration testing help you stay ahead of threats. The best providers don’t just meet security standards – they exceed them and prove it through regular third-party assessments.

Access controls ensure that only the right people can access sensitive systems. Role-based permissions and regular access reviews keep your security tight as your team grows and changes.

Security isn’t a one-time setup – it’s an ongoing commitment. The landscape changes constantly, and your security measures need to evolve with it. Choose providers who treat security as a partnership, not just a feature.

Real-World Applications and the Future of Integration

Fintech integration shines across industries—from creator platforms to multinational retailers.

Common Use Cases

- Retail & Ecommerce – Buy-now-pay-later options linked to accounting boost average order value and speed reconciliation.

- Hospitality – Integrated POS, supplier payments, and demand-based pricing streamline operations.

- Lending – Unified data sources accelerate credit decisions and cut default rates.

- B2B – Automated AP/AR and real-time cash-flow dashboards replace manual invoicing.

- Education – Digital Reward System For Students keeps learners engaged with real financial incentives.

The Next Wave: AI, Web3, and Hyper-Personalization

AI is already optimizing payment routing and spotting fraud in milliseconds. On the Web3 side, Blockchain Content Distribution, NFT Marketplace Development, and Web3 Platform Solutions enable direct, borderless monetization. Combine these with Augmented Reality NFTs and you get immersive experiences where ownership and payment are verified instantly.

Tomorrow’s winners will bridge traditional rails and decentralized tech, delivering seamless finance no matter how customers choose to pay.

Conclusion: Building Your Future-Ready Financial Ecosystem

The journey through Fintech Integration Services reveals a clear truth: we’re living through a fundamental shift in how businesses handle money, serve customers, and build communities. The companies thriving today aren’t just adopting new technologies – they’re creating integrated financial ecosystems that grow with their audience.

Strategic selection matters more than ever. The integration partner you choose today becomes part of your business DNA. Look for providers who understand your industry, prioritize security, and can adapt as new technologies emerge. You’re not just buying software – you’re choosing a partner for your financial future.

The evidence is overwhelming: the future of finance is integrated. Businesses with connected financial systems process payments faster, understand their customers better, and can offer experiences that isolated systems simply can’t match. Whether you’re a creator building a digital community or a brand expanding globally, integration gives you the flexibility to innovate.

For creators and brands, the opportunities are particularly exciting. Modern fintech integration doesn’t just handle payments – it enables new revenue models you might not have considered. Think subscription tiers that adjust based on engagement, digital rewards that increase loyalty, or embedded financial services that add value for your audience.

The convergence of traditional finance and Web3 technologies represents the next big leap forward. Businesses preparing for this hybrid future – where cryptocurrency wallets work alongside credit cards, where NFTs open up real-world benefits, and where community tokens drive engagement – will lead tomorrow’s digital economy.

At Avanti3, we specialize in empowering creators and brands with customizable engagement tools and fintech solutions that integrate Web3 technologies like NFTs, blockchain, AR/VR, and AI. Our approach focuses on creating unique digital experiences, rewards systems, and community-building opportunities that set new standards in digital engagement and fan monetization.

Your financial ecosystem should work as hard as you do. It should handle the routine tasks automatically, provide insights that drive better decisions, and enable experiences that delight your audience. Most importantly, it should grow with your ambitions.

The businesses that accept comprehensive fintech integration today will be the ones setting industry standards tomorrow. Those that wait will find themselves playing catch-up in an increasingly competitive digital landscape.

To build a truly engaging and future-proof digital community with next-generation fintech solutions, explore our tools for building a community.