Fintech Data Integration Services: 10 Powerful Solutions 2025

Why Financial Data Integration is Critical for Modern Business Success

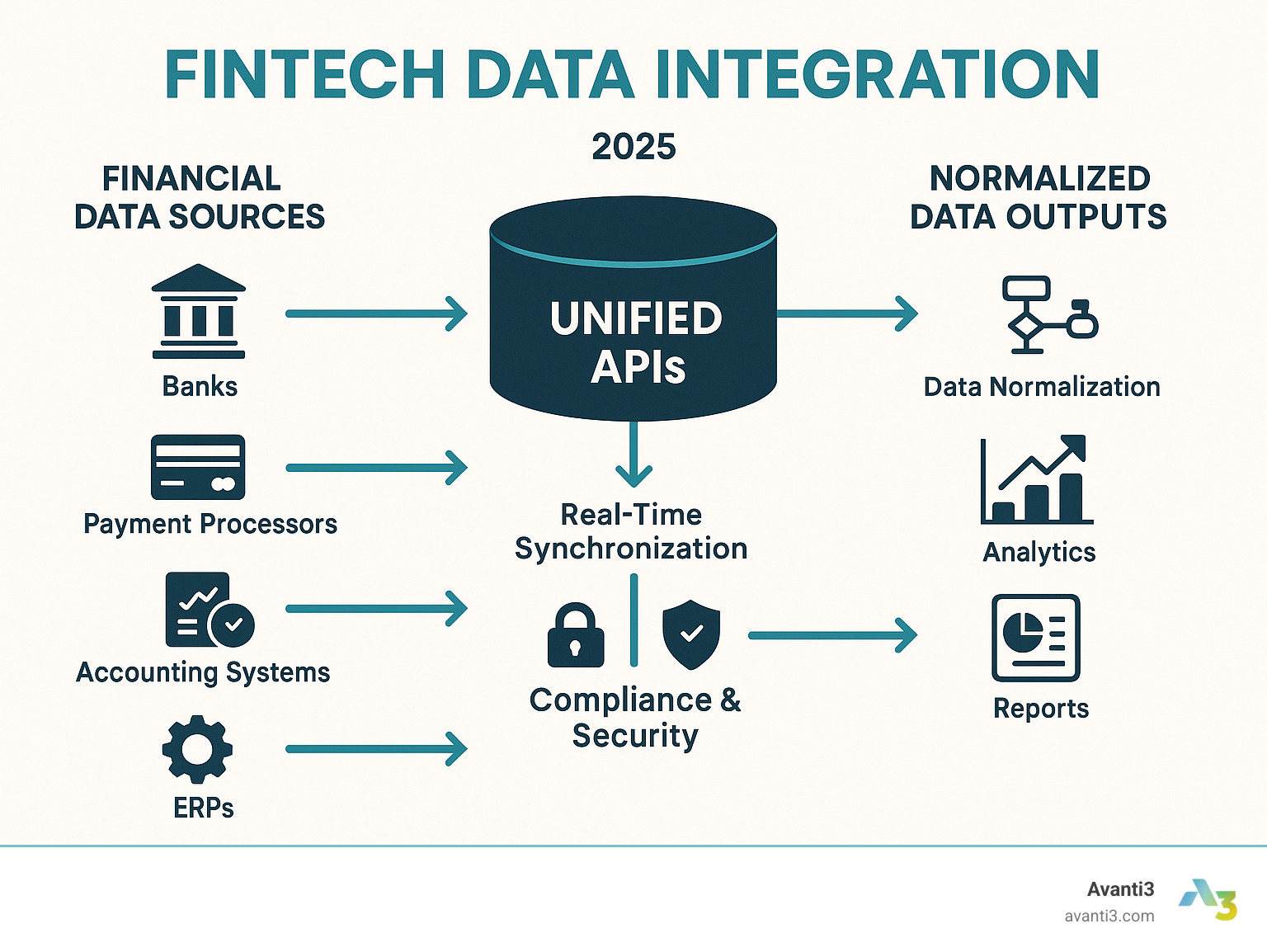

Fintech data integration services are specialized platforms that connect, normalize, and synchronize financial data from multiple sources like banks, payment processors, accounting systems, and ERPs into a single, unified view. These services eliminate manual data entry, reduce errors, and enable real-time financial insights that drive smarter business decisions.

Key Components of Fintech Data Integration Services:

- Unified APIs – Single integration point for multiple financial data sources

- Real-time synchronization – Live data feeds from banks and payment systems

- Data normalization – Standardized formats across different providers

- Compliance frameworks – Built-in security for regulations like PSD2 and GDPR

- Pre-built connectors – Ready-made integrations for popular financial platforms

The financial data integration market has exploded, with leading platforms now serving millions of users daily and processing petabytes of financial data monthly. This massive scale demonstrates the critical importance of reliable, secure financial data connectivity in today’s digital economy.

But here’s the reality – most businesses underestimate the complexity of financial data integration. As one fintech executive noted about poor record-keeping: “Poor controls and record-keeping have doomed more firms than lack of innovation.” The challenge isn’t just technical – it’s about managing exponential data growth, ensuring real-time processing, and maintaining quality across structured and unstructured data sources.

I’m Samir ElKamouny AV, and I’ve helped scale countless businesses by implementing strategic fintech data integration services that open up financial freedom and growth. My experience changing complex technical challenges into streamlined business solutions has shown me that the right integration approach can completely reshape a company’s financial future.

Related content about fintech data integration services:

– blockchain integration services

– community engagement platforms

– blockchain community engagement

What Are Fintech Data Integration Services?

Think of your financial data as dozens of languages spoken at once. Fintech data integration services act as a single translator that already speaks them all—banks, payment processors, accounting systems, e-commerce platforms, and more—so your team can focus on growth instead of plumbing.

Why it matters:

- One connection (a unified API) open ups thousands of institutions worldwide.

- Real-time synchronization keeps cash-flow, balances, and payments current to the second.

- Built-in compliance means you don’t have to wrestle with PSD2, GDPR, or PCI on your own.

How fintech data integration services automate ingestion

Modern platforms run 24/7 ETL or ELT pipelines that:

- Extract data from every financial source you use.

- Transform it into a single, standardized schema (normalization).

- Load it into the destination—data warehouse, BI tool, or app—immediately or on schedule.

Quality gates (validation rules) catch bad formats, duplicate transactions, or currency mistakes before they spread downstream.

Benefits of fintech data integration services vs DIY

| Advantage | Managed Platform | DIY Build |

|---|---|---|

| Speed-to-market | Days | Months |

| Up-front cost | Low subscription | Six-figure engineering budget |

| Maintenance | Handled for you | Continuous developer time |

| Scale & reliability | Auto-scales, 99.9%+ uptime | Re-architect as you grow |

Bottom line: companies using managed integrations launch financial features up to 10× faster and redirect scarce developer hours toward revenue-generating work instead of endless API maintenance.

The Hidden Challenges & Risks of Financial Data Integration

Here’s what nobody tells you about financial data integration: it’s not just a technical challenge, it’s a business survival issue. I’ve watched promising fintech companies stumble because they underestimated the complexity of connecting financial systems safely and reliably.

The South Sea Bubble of 1720 teaches us a timeless lesson about financial data management. Poor record-keeping and lack of transparency didn’t just hurt individual investors – they triggered one of history’s first major financial crashes. Today’s fintech data integration services face similar stakes, just with digital consequences that spread at internet speed.

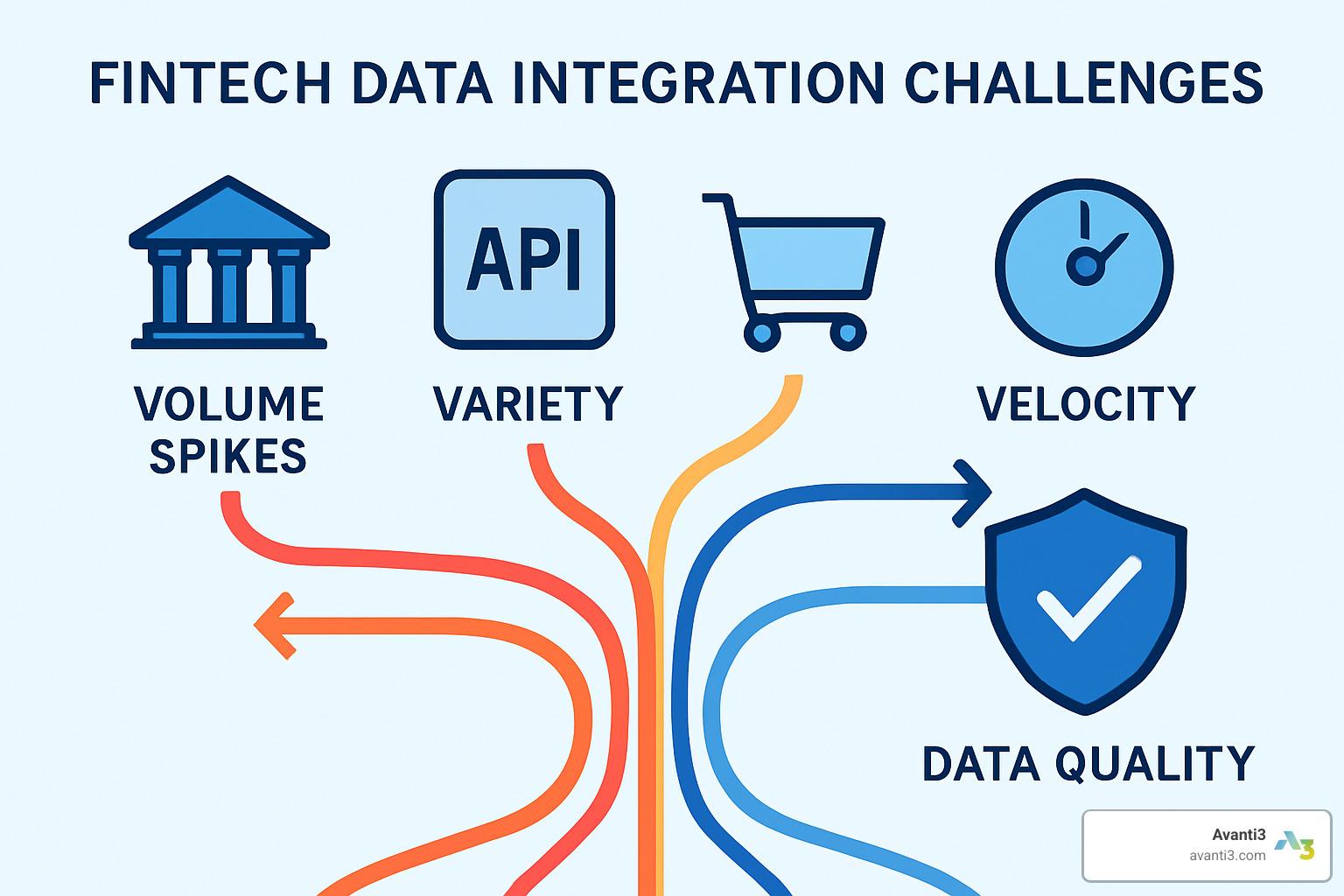

Volume challenges hit you like a freight train. Financial data doesn’t grow linearly – it explodes. One day you’re processing thousands of transactions, the next month you’re handling millions. A single retail bank might generate terabytes of transaction data daily, and every byte needs real-time processing, validation, and routing to multiple systems.

Velocity demands have reached impossible-seeming levels. Your customers expect their payment to confirm instantly, their balance to update in real-time, and fraud alerts to arrive before they even finish swiping their card. This means your integration layer has milliseconds, not minutes, to process and validate financial data.

Variety complexity comes from the wild west of financial data formats. You’re not just connecting clean, modern APIs. You’re dealing with decades-old COBOL banking systems, cutting-edge fintech platforms, accounting software with unique schemas, e-commerce systems with custom transaction formats, and regulatory systems that demand specific data structures.

Mitigating risks through governance and architecture

Smart companies build their defenses before they need them. Here’s what actually works when the pressure is on:

Data fabric architecture creates a intelligent foundation that scales with your business. Instead of building individual connections that become unmanageable, a data fabric manages all your financial data flows through a unified layer.

Encryption standards must be bulletproof from day one. We’re talking about end-to-end encryption for all data in transit, advanced encryption for stored data, automatic key rotation aligned with regulatory requirements, and zero-trust network architecture for all API access.

Role-based access controls ensure financial data reaches only authorized systems and people. This means granular permissions for different data types, time-limited access tokens for sensitive operations, and multi-factor authentication for administrative functions.

Audit trails create the documentation that keeps regulators happy. Every data access, change, and transfer gets logged with timestamps, user identification, complete data lineage tracking from source to destination, and automated compliance reporting capabilities.

Common pitfalls that break integrations

Schema drift happens when data providers change their API structures without proper notice. A bank adds new required fields, changes data types, or modifies authentication requirements. Without proper monitoring, these changes break your integration silently.

Throttling issues catch even experienced teams off guard. Financial APIs have strict rate limits to prevent abuse, but these limits get hit unexpectedly during high-volume periods or when batch processes collide with real-time operations.

Timeout errors multiply as integration complexity grows. Network latency, processing delays, and connection pool exhaustion cause timeouts that result in incomplete data transfers or duplicate transactions.

Key Features to Evaluate Before You Buy or Build

Choosing the right fintech data integration services platform feels a bit like picking a business partner – you want someone reliable, capable, and ready to grow with you. After helping dozens of companies steer this decision, I’ve learned that the flashy marketing demos often hide the features that actually matter for long-term success.

The first thing to check is coverage metrics – and I mean really dig into the numbers. A platform claiming “thousands of bank connections” might sound impressive until you find they’re missing the three banks your biggest customers actually use. Look for platforms supporting at least 5,000 financial institutions with solid international coverage if you’re planning any global expansion.

Reliability metrics separate the professionals from the wannabes. You need uptime guarantees of 99.9% or higher – anything less means your customers will experience frustrating service interruptions. Pay attention to historical sync speeds too. If a platform can’t handle 500+ GB per hour for large implementations, you’ll hit bottlenecks as you scale.

Real-time capabilities determine whether your platform can support modern fintech applications. Sub-second API response times aren’t just nice to have – they’re essential for fraud detection, instant payments, and the smooth user experiences customers expect.

Must-have capabilities in fintech data integration services

Webhook infrastructure transforms how your applications respond to financial events. Instead of constantly asking “anything new?”, your system gets instant notifications about transactions, balance changes, or account updates.

Sandbox accounts with realistic test data are absolute lifesavers during development. The best platforms provide 25+ sandbox accounts loaded with diverse financial scenarios.

Monitoring dashboards provide the operational visibility that keeps you sleeping soundly at night. You need real-time connection status across all integrated accounts, performance metrics that help you spot trends before they become problems, and automated alerts that catch issues before your customers do.

Comparing in-house build vs managed platform

| Criteria | In-House Build | Managed Platform |

|---|---|---|

| Initial Time to Market | 6-18 months | 3-5 days |

| Development Cost | $500K-2M+ | $10K-100K annually |

| Ongoing Maintenance | 30% of engineering time | Included in service |

| Security Compliance | Full responsibility | Shared/managed |

| Innovation Bandwidth | Severely limited | Focused on core product |

| Scalability Risk | High (requires rewrites) | Low (handled by platform) |

Pricing models you’ll encounter

Pay-as-you-go models charge based on actual usage – perfect for startups with unpredictable patterns but potentially expensive as you scale.

Tiered subscription models offer predictable monthly costs with clear usage limits. Most platforms design multiple tiers for different business stages, from startup-friendly plans under $1,000 monthly to enterprise packages that can exceed $50,000 monthly.

Usage credits provide flexibility by letting you purchase credits that cover different operations. Overage fees are the hidden gotcha that can turn a reasonable monthly bill into a budget disaster.

High-Impact Use Cases & Business Outcomes

When businesses ask me about fintech data integration services, they’re usually not interested in the technical details – they want to know how it will actually impact their bottom line. After helping dozens of companies implement these solutions, I can tell you the results often exceed expectations, but only when you focus on the right use cases.

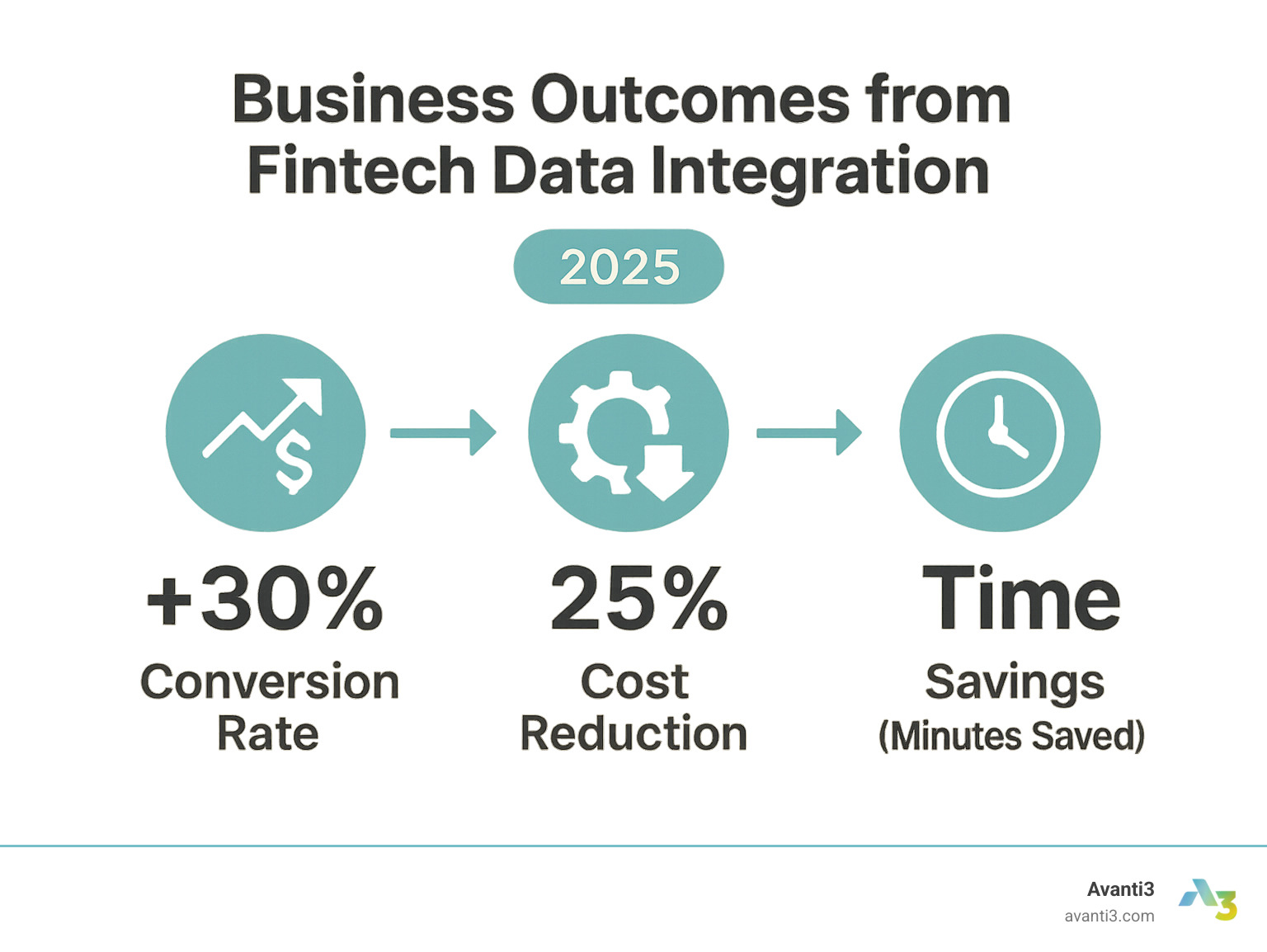

Onboarding and KYC automation represents perhaps the biggest quick win for most fintech companies. Instead of asking customers to upload bank statements and wait days for approval, you can verify their identity and assess creditworthiness in real-time. Companies that streamline their onboarding process typically see 25% higher conversion rates because they eliminate the friction that causes customers to abandon the process.

Cash flow underwriting has completely changed how smart lenders evaluate risk. Traditional credit scores tell you about past behavior, but real-time banking data shows you what’s happening right now. A small business might have a thin credit file but consistent daily deposits that prove their revenue stability.

Instant payment processing eliminates the frustrating delays that customers hate about traditional banking. When someone sends money, they expect it to arrive immediately – not in 3-5 business days. By integrating directly with banking APIs, you can offer real-time account-to-account transfers that improve user experience while reducing processing fees.

Fraud detection and prevention becomes incredibly powerful when you have access to real-time financial data. Instead of waiting for suspicious activity to be reported, you can detect unusual patterns as they happen.

At Avanti3, we’ve learned that successful fintech implementations need more than just smooth data flows – they need engaging user experiences that keep customers coming back. Our Digital Engagement Solutions work hand-in-hand with traditional fintech infrastructure to create the kind of memorable experiences that drive long-term loyalty.

How fintech data integration services boost growth teams

Growth teams live and breathe experimentation, but they’re often held back by technical limitations. Fintech data integration services remove those bottlenecks and open up growth strategies that weren’t possible before.

Faster experimentation cycles become the norm when financial data flows seamlessly between systems. Your growth team can test new onboarding flows without waiting for engineering resources. They can A/B test different underwriting criteria using real-time data.

Cross-sell opportunities emerge naturally when you understand your customers’ complete financial picture. If you can see that a customer consistently maintains high balances, they might be ready for investment products.

Churn reduction becomes much more effective when you have early warning signals. Traditional approaches wait until customers complain or stop using your service. With integrated financial data, you can identify customers at risk based on changing usage patterns.

Case snapshots of successful projects

Real-time lending approvals transformed one digital lending platform from a slow, paperwork-heavy process to an instant decision engine. By integrating bank transaction data with accounting systems and credit information, they reduced approval times from 3 days to 15 minutes.

Automated treasury dashboards solved a major headache for a corporate finance team managing cash across dozens of accounts. Instead of manually collecting data from different banks and investment platforms, they created a real-time dashboard that provided complete visibility into their cash position.

Embedded finance for marketplaces shows how creative businesses can create entirely new revenue streams. An e-commerce platform integrated lending services directly into their seller dashboard, using sales history and payment data to offer working capital loans.

The fintech landscape continues evolving rapidly, and staying current with industry trends is crucial for success. Events like the New Statesman Summit provide valuable opportunities to learn from other innovators and understand where the industry is heading.

Accelerating Time-to-Market with Low/No-Code & Unified APIs

The latest fintech data integration services now include low-code and no-code builders that let product or growth teams ship ideas in days—not quarters.

What changed? Drag-and-drop canvases, 5,000+ prebuilt connectors, and templated workflows remove 80-90 % of manual coding.

Why business users love it

- Prototype a new payment or lending feature before the next stand-up.

- Launch live A/B experiments without waiting for engineering sprints.

- Track performance in real time with built-in dashboards.

Why developers love it

- SDK parity: anything built visually can be extended in code.

- Schema abstraction: one normalized model replaces dozens of bespoke APIs.

- CI/CD-ready: visual configs live in version control and deploy through the same pipelines as code.

Future-proofing for Web3 & AI

Low-code doesn’t stop at traditional banking rails. The strongest platforms already expose connectors for tokenized assets, smart-contract triggers, and AI-powered analytics—letting you layer tomorrow’s products on today’s infrastructure.

Avanti3 leverages these same tools to blend fintech rails with Web3 rewards, AR-improved dashboards, and AI personalization. Explore our AI Digital Marketing offerings to see how quick experimentation becomes real-world revenue.

Frequently Asked Questions about Fintech Data Integration

Let’s address the most common questions we hear from businesses exploring fintech data integration services. These questions come up in almost every conversation, and the answers often surprise people with how comprehensive modern integration platforms have become.

What systems can I integrate?

The short answer? Pretty much everything that handles financial data. Modern fintech data integration services have evolved far beyond simple bank connections to support an incredibly diverse ecosystem.

Banking systems form the foundation, but the coverage is impressive. Leading platforms connect to over 5,000 institutions globally – from massive national banks to tiny community credit unions. This includes traditional banks, credit unions, neobanks, and international financial institutions across dozens of countries.

ERP systems like SAP, Oracle, Microsoft Dynamics, and NetSuite integrate seamlessly, enabling that crucial flow between financial planning and operational data. This means your accounting team can finally stop manually entering transaction data from multiple sources.

Payment gateways cover all the major players – Stripe, PayPal, Square, Adyen, plus regional providers you might need for international expansion. The beauty is unified reporting across all these different processors, so you can see your complete payment picture in one place.

E-commerce platforms including Shopify, WooCommerce, Magento, and BigCommerce connect your online sales data directly to your financial systems. This provides complete visibility into customer behavior and purchasing patterns.

CRM systems like Salesforce, HubSpot, and Pipedrive become much more powerful when enriched with financial data. Your sales team can see payment history and creditworthiness information right in their familiar interface.

The smart platforms support both modern API-based integrations and legacy screen scraping for older systems that lack programmatic access. This means you’re not stuck leaving behind important data just because it lives in an older system.

How do these services handle compliance?

Compliance is where many businesses get nervous about financial data integration, but professional platforms have this covered comprehensively. The regulatory landscape is complex, but the right service handles multiple frameworks simultaneously.

GDPR compliance for European operations includes sophisticated consent management, data portability features, and the right to be forgotten. These platforms maintain detailed audit logs showing exactly what data was accessed, when, and by whom. This isn’t just checking a box – it’s building trust with your European customers.

PSD2 compliance enables open banking across Europe through licensed payment initiation and account information services. Many platforms provide their own licenses, which eliminates the expensive and time-consuming process of obtaining regulatory approvals yourself.

SOC 2 Type II certification demonstrates operational security controls through independent audits. This covers security, availability, processing integrity, confidentiality, and privacy – basically everything regulators and enterprise customers want to see.

ISO 27001 certification provides internationally recognized information security management standards. This includes comprehensive risk management, incident response procedures, and continuous monitoring that meets global standards.

Consent management systems track user permissions at a granular level, allowing customers to grant and revoke access to specific data types. This includes time-limited consents and automatic expiration policies that keep you compliant even when customers forget to manage their permissions.

The platforms maintain detailed compliance documentation and provide regular updates when regulations change. This means you stay compliant without having to monitor regulatory changes across multiple jurisdictions.

What happens if an integration fails?

Integration failures are inevitable in complex financial systems, but how they’re handled makes all the difference. Professional fintech data integration services implement multiple layers of resilience that most businesses couldn’t afford to build themselves.

Retry queues automatically attempt failed operations using smart exponential backoff strategies. This handles temporary network issues and API rate limiting without losing any data. The system gets smarter over time, learning optimal retry patterns for different types of failures.

Fallback provider networks route requests through alternative data sources when primary providers experience outages. Some platforms combine 5+ aggregators specifically to provide this redundancy. When one bank’s API goes down, your integration keeps working through backup connections.

Real-time alerting notifies operations teams immediately when failures occur, but the smart platforms provide intelligent alerting that distinguishes between temporary hiccups and systemic problems. You don’t want to wake up your team for every minor issue, but you need immediate notification for serious problems.

SLA credits provide financial compensation when service levels fall below guaranteed thresholds. This aligns provider incentives with your success and provides budget predictability. If they don’t meet their commitments, you get money back.

Automated incident response includes predefined escalation procedures, status page updates, and customer communication workflows. This ensures everyone receives timely information about service impacts without overwhelming your support team.

The best platforms maintain detailed post-mortem reports for significant incidents, including root cause analysis and prevention measures. This transparency helps you understand what happened and provides confidence that similar issues won’t recur.

Conclusion & Next Steps

The future of business success lies in mastering fintech data integration services – not just as a technical challenge, but as a strategic foundation for innovation. The companies that will dominate the next decade aren’t just connecting APIs; they’re creating entirely new ways for customers to interact with financial services through immersive experiences and community-driven engagement.

Throughout this guide, we’ve explored how these integration services solve real business problems: eliminating data silos, automating complex processes, and enabling real-time financial insights. The evidence is clear – businesses that choose managed platforms over DIY approaches consistently achieve faster time-to-market, lower total costs, and better scalability. More importantly, they free up their engineering teams to focus on what really matters: building unique value propositions that customers love.

But here’s where most fintech companies stop thinking – and where the biggest opportunities begin. Traditional financial data integration is just the starting point. The real magic happens when you combine solid financial infrastructure with emerging technologies like Web3, AI, and immersive digital experiences.

At Avanti3, we see this convergence every day. Our unique position in both fintech integration and Web3 innovation gives us a front-row seat to what’s coming next. Digital twins of financial assets aren’t science fiction anymore – they’re powerful tools for creating transparent, engaging investment experiences. Immersive rewards systems are changing how businesses build customer loyalty. Community-driven financial products are creating new revenue streams that didn’t exist five years ago.

We’ve helped businesses transform their financial data integration while positioning them for the Web3 future. Whether you’re building tokenized reward systems, creating AR-improved financial dashboards, or developing AI-powered personalization engines, we provide both the technical foundation and creative vision to make these concepts profitable realities.

The convergence is accelerating. Traditional banks are experimenting with NFT rewards. Payment companies are integrating blockchain settlements. Investment platforms are adding social features that feel more like gaming than finance. This isn’t a distant trend – it’s happening now, and businesses that understand both sides of this equation have a massive competitive advantage.

Ready to move beyond basic data integration? Our AI Tools for Creators showcase how we’re already helping businesses bridge traditional fintech infrastructure with next-generation user experiences. These tools demonstrate what becomes possible when you combine solid financial data foundations with innovative engagement strategies.

The question isn’t whether you need sophisticated fintech data integration services – that decision has already been made by market forces. The real question is whether you’ll choose a partner who can help you innovate beyond traditional boundaries while other companies are still figuring out basic API connections.

Let’s talk about how Avanti3 can help you master fintech data integration while building the engaging, community-driven financial experiences that will define the next generation of successful businesses. The integration headaches that slow down your competitors don’t have to slow down your innovation.