Blockchain payment integration: 10 Powerful Benefits in 2025

Why Blockchain Payment Integration is Changing Digital Commerce

Blockchain payment integration is the process of enabling businesses to accept cryptocurrency payments through secure, decentralized networks. Here’s what you need to know:

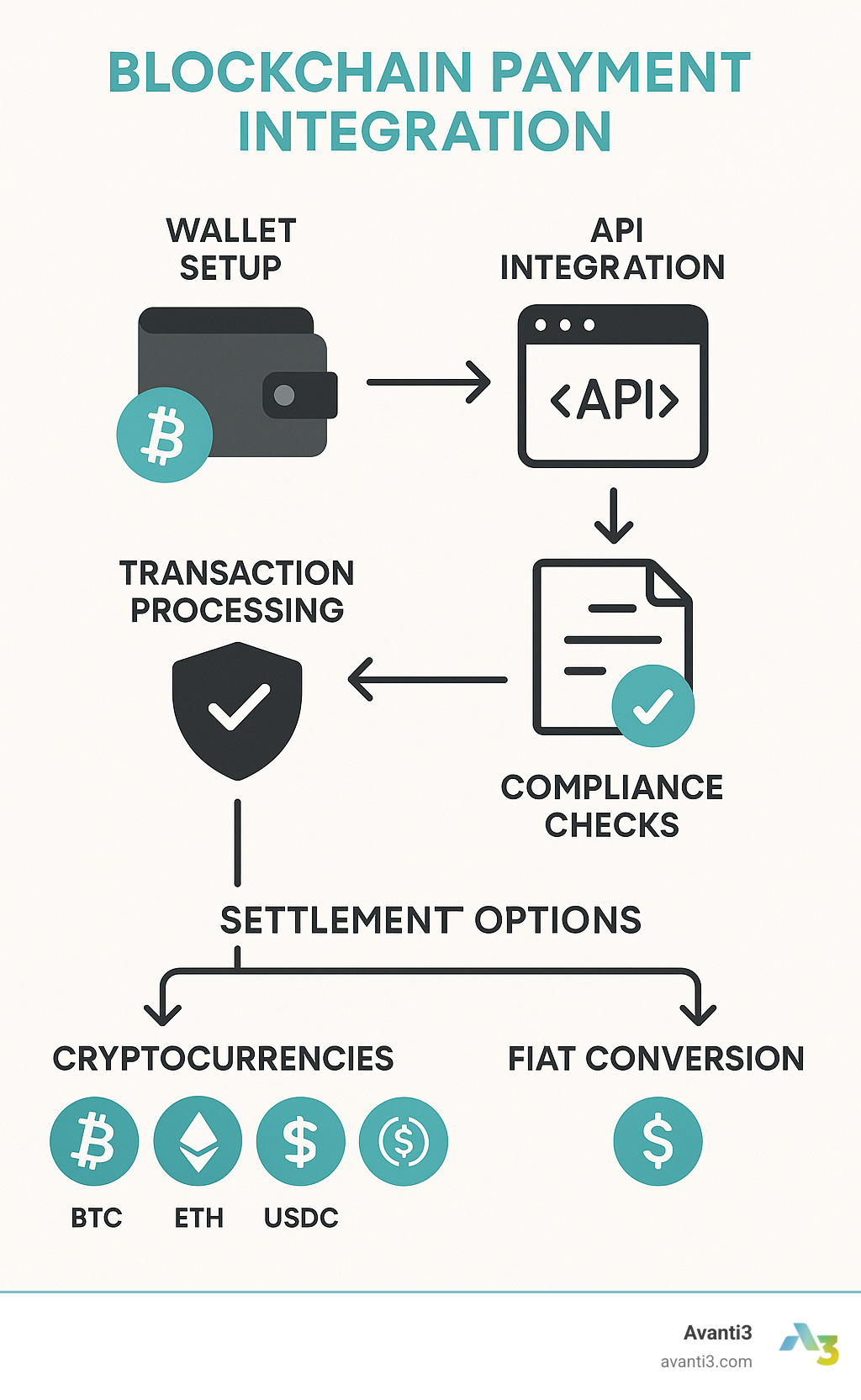

Key Components:

– Payment Gateway: Connects your business to blockchain networks

– Wallet Integration: Manages crypto transactions and storage

– Smart Contracts: Automate payment processing and settlements

– Fiat Conversion: Optional instant conversion to traditional currency

Popular Integration Methods:

1. Third-party payment gateways

2. Direct blockchain integration via APIs

3. Pre-built e-commerce plugins

4. Custom smart contract solutions

One startup recently missed a $100K deal because they couldn’t accept crypto payments – a costly lesson that highlights how blockchain payment integration has become essential for modern businesses.

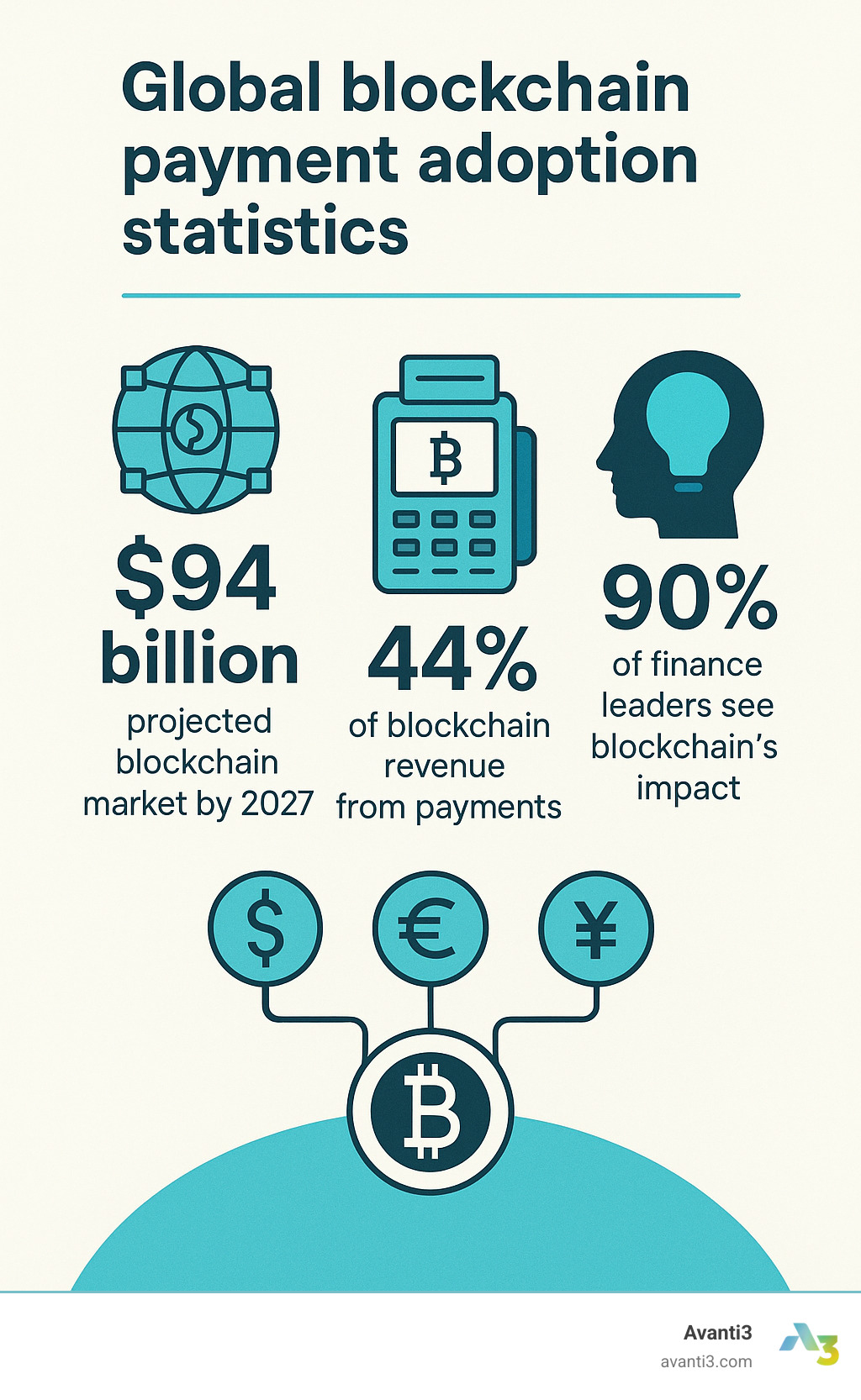

The numbers tell the story. The global blockchain market is projected to hit $94 billion by 2027, with 44% of revenue coming from payments. Over 90% of finance leaders believe blockchain currencies will significantly impact business in the coming years. For creators and brands looking to monetize their communities, crypto payments offer lower fees (often under 1% vs 3-4% for cards), instant global reach, and access to tech-savvy audiences who prefer digital assets.

But here’s the thing – integration doesn’t have to be complex. Whether you’re running a content platform, selling digital products, or building a community marketplace, the right approach can have you accepting crypto in days, not months.

I’m Samir ElKamouny AV, and I’ve helped countless businesses steer blockchain payment integration to open up new revenue streams and reach global audiences. Through my work scaling ventures across 25 countries, I’ve seen how the right payment infrastructure can transform a business overnight.

Why Go Crypto? Benefits & Real-World Use Cases

The crypto payment revolution isn’t just hype anymore – it’s happening in boardrooms and checkout pages around the world. When I talk to business owners about blockchain payment integration, they always ask the same question: “What’s really in it for me?”

Your Bottom Line Will Thank You

Traditional payment processors are expensive. Credit cards typically charge 2.9% to 4% plus fixed fees on every transaction. Crypto payments? Often under 1%. We’ve worked with e-commerce stores processing $500K annually who save around $10,000 yearly just by accepting crypto for part of their sales.

No More Waiting Around

Remember the last time you sent an international wire transfer? Three to five business days, plus weekend delays, plus fees that make your eyes water. Blockchain payments settle in minutes to hours, not days.

Stablecoins: The Volatility Problem Solver

About 60% of merchants accepting crypto use stablecoins like USDC or USDT. These digital currencies stay pegged to the dollar, so you get all the blockchain benefits – speed, low fees, transparency – without the roller coaster price swings.

Transparency That Actually Protects You

Every blockchain transaction creates a permanent, unchangeable record. No chargebacks. No “the customer says they never got it” disputes. No payment reversals that hit your account weeks later.

The numbers back this up. Latest research on blockchain market growth shows the crypto payment market growing at 16.6% yearly, with projections hitting $2.1 billion by 2030.

From Retail to Remittances

E-commerce Gets Interesting

Something fascinating happens when you start accepting crypto payments. The average transaction values go way up. While traditional card payments average $100-$200, crypto customers typically spend $450-$1,000 per transaction.

Micropayments Finally Work

Ever tried charging 50 cents for a digital article using a credit card? The processing fees eat your entire profit. Blockchain payment integration makes true micropayments possible for the first time.

Enterprise & B2B Wins

Cross-Border Business Gets Easier

Traditional international B2B payments are painful. Fees ranging from 3% to 20%. Multi-day delays. Currency conversion headaches.

The enterprise world is responding. Businesses are projected to process over $4.4 trillion in cross-border B2B blockchain transactions by 2024.

Step-by-Step Blockchain Payment Integration

Ready to add crypto payments to your business? Whether you’re running a content platform, e-commerce site, or service business, blockchain payment integration can be up and running faster than you think.

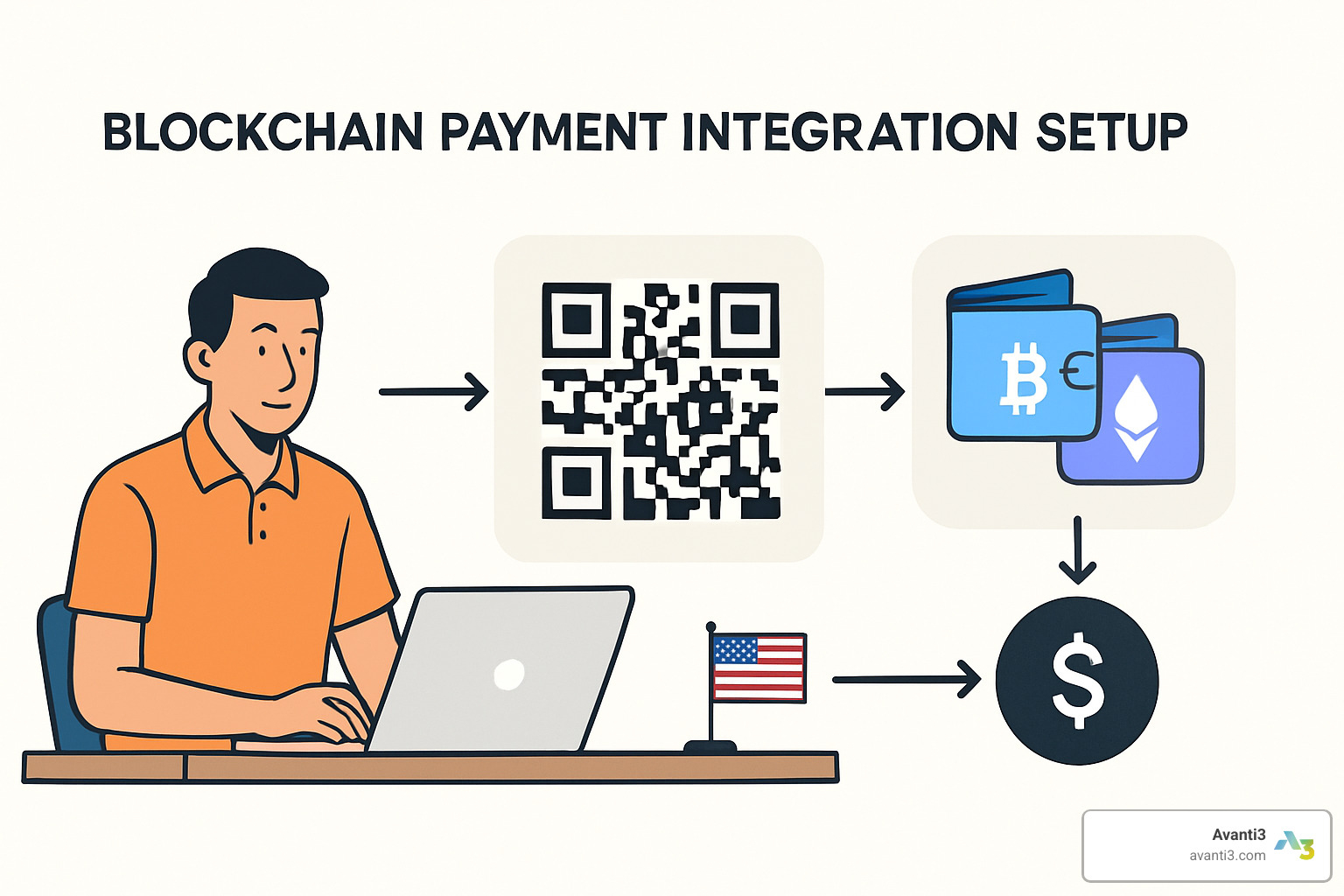

Think of it like adding any new payment method to your checkout, except this one plugs into a global financial network that never sleeps. The basic flow is straightforward: create a payment request, show it to your customer (usually as a QR code), watch the blockchain for confirmation, then fulfill the order.

Blockchain Payment Integration: Quick-Start Checklist

Generate your API keys first by signing up with a payment processor. Treat these like your bank account password – store them securely and never put them in client-side code.

Pick your blockchain. Start small with one or two popular options. Ethereum has the widest support, but gas fees can bite. Consider Layer 2 solutions like Polygon for cheaper transactions.

Install the SDK or plugin that matches your setup. Most payment processors make this easy with ready-made plugins for WordPress, Shopify, and other platforms.

Run testnet transactions. Every processor gives you a sandbox environment where you can test with fake money. Use it!

Enable two-factor authentication on everything. Use multi-signature wallets for larger amounts and set up proper access controls.

Customer Journey

The customer experience should feel effortless. They select crypto payment, scan a QR code with their wallet app, confirm the transaction, and get immediate feedback that their payment is being processed.

While customers see instant feedback, on-chain confirmation happens behind the scenes. Your system monitors the blockchain and updates order status as confirmations roll in.

Receipt emails should include transaction hashes so customers can verify their payments on blockchain explorers if they want to.

Security, Compliance & Risk Management

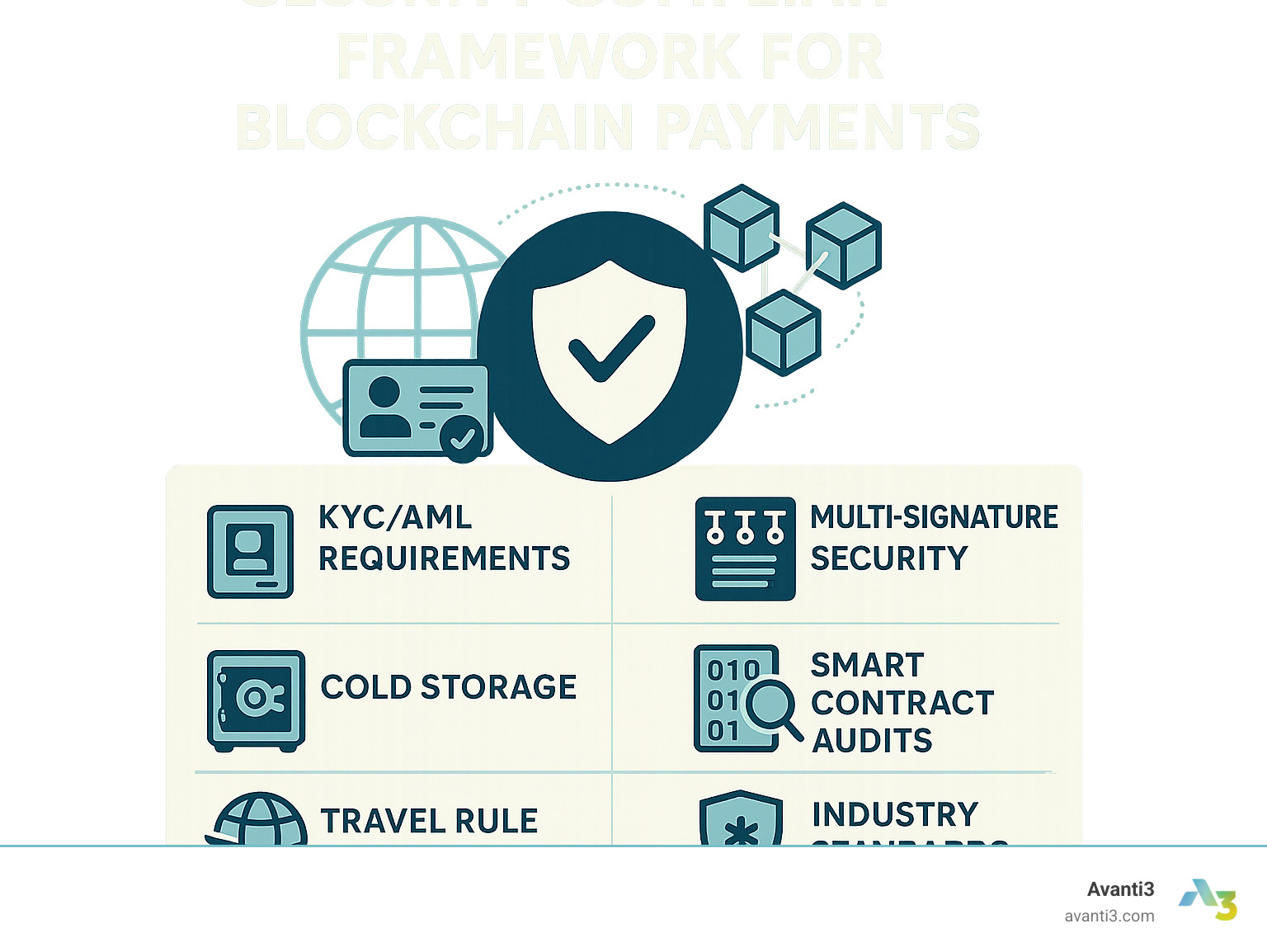

When it comes to blockchain payment integration, security isn’t just important – it’s absolutely everything. The beauty of crypto payments is that they’re irreversible once confirmed, but that same feature means you need to get security right from day one.

Getting KYC and AML Right

Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements might sound intimidating, but most payment processors handle the heavy lifting for you. The rules vary depending on where you operate, but they’re becoming more standardized globally.

Multi-Signature Wallets: Your Digital Vault

If your business will hold significant amounts of cryptocurrency, multi-signature wallets are non-negotiable. These require multiple private keys to authorize transactions – think of it like requiring multiple executives to sign large checks.

Cold Storage: Keeping Most Funds Offline

Here’s a simple rule that prevents most crypto security disasters: keep the majority of your funds in cold storage. Cold storage means wallets that aren’t connected to the internet – they can’t be hacked remotely because they’re not online.

Industry Certifications That Matter

When choosing payment processors or security providers, look for SOC 2 Type 2 certification and ISO 27001 compliance. These represent rigorous security standards and regular third-party audits.

Global Regulatory Landscape 2024-25

Europe’s MiCA Revolution

The European Union’s Markets in Crypto-Assets (MiCA) regulation is reshaping how crypto businesses operate across Europe. While it adds compliance requirements, it also provides clear rules that businesses can follow.

The US: Complex but Manageable

The US regulatory landscape is more complex, with different agencies having different areas of focus. The IRS treats cryptocurrency as property for tax purposes, while the SEC focuses on whether crypto assets qualify as securities.

Tax, Refunds & Chargebacks

Perfect Audit Trails

Blockchain’s immutable ledger creates a perfect audit trail for tax authorities and regulators. Every transaction is permanently recorded with timestamps, amounts, and wallet addresses.

The End of Chargeback Fraud

Here’s a major advantage: blockchain payment integration eliminates chargeback fraud. Once a transaction is confirmed on the blockchain, it’s final. No more disputes months later, no more chargeback fees.

Choosing Your Tech Stack & Gateway Options

Picking the right technology stack for blockchain payment integration is like choosing the foundation for your house – it affects everything you build on top. The good news? You don’t need to be a blockchain expert to make smart choices.

The Custodial vs Non-Custodial Decision

Here’s the biggest choice you’ll face: do you want to manage crypto wallets yourself or let someone else handle it? Custodial solutions work like traditional payment processors – they handle all the technical complexity, security, and regulatory compliance while you focus on your business.

For most businesses, custodial is the smart choice. Unless you’re planning to become a crypto company, you probably don’t want to spend months learning about private key management and regulatory compliance.

Universal APIs: One Integration, Multiple Blockchains

Some payment processors offer universal APIs that let you accept payments on multiple blockchains through a single integration. You write the code once, and customers can pay with Bitcoin, Ethereum, stablecoins, or other cryptocurrencies.

The Plugin Advantage

If you’re running on popular e-commerce platforms like WooCommerce, Shopify, or Magento, plugins can get you started in hours, not weeks. These pre-built solutions handle the technical integration while you focus on configuring payment options and testing the customer experience.

For businesses looking to leverage advanced Web3 capabilities beyond simple payments, our Web3 Platform Solutions offer comprehensive integration options that can grow with your needs.

Build vs Buy Decision

Time-to-Market Reality Check

Building blockchain payment infrastructure from scratch typically takes 6-18 months and requires specialized developers. Integrating with existing solutions can get you accepting payments in days or weeks.

Unless you’re building a payment processor as your core business, buying almost always makes more sense.

Fee Structure Deep Dive

Don’t just compare percentage fees – the total cost structure matters more. A processor charging 1.5% with a $50 monthly fee might be more expensive than one charging 2% with no monthly fee, depending on your transaction volume.

| Feature | Traditional Card Rails | Blockchain Rails |

|---|---|---|

| Transaction Fees | 2.9-4% + $0.30 | 0.5-1% typically |

| Settlement Time | 1-3 business days | Minutes to hours |

| Dispute Process | Chargebacks possible | Immutable transactions |

| Global Reach | Limited by banking | Borderless |

| Operating Hours | Business hours only | 24/7/365 |

| Fraud Risk | Moderate to high | Very low |

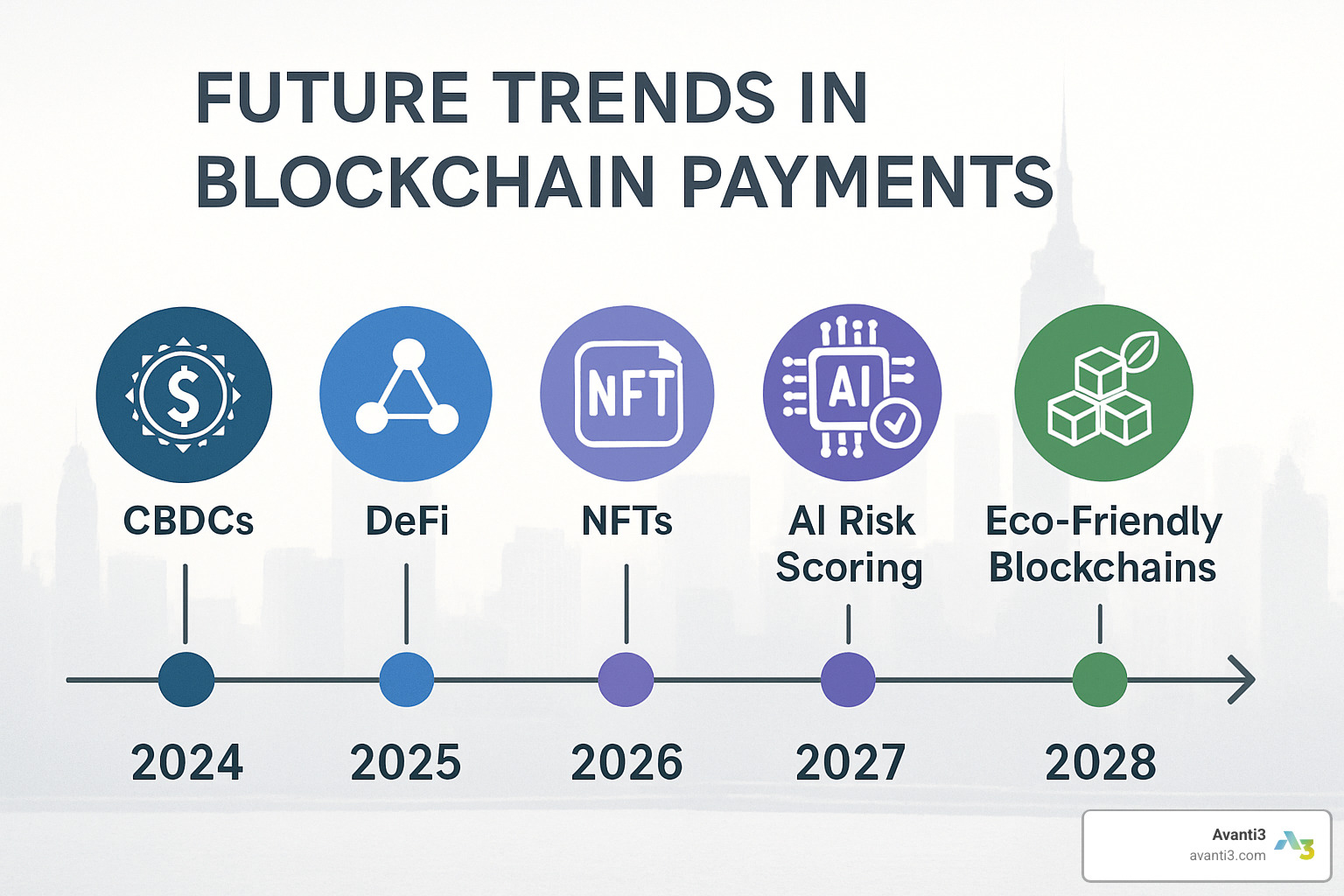

Future Trends & Opportunities

The blockchain payment integration landscape is moving fast, and honestly, it’s pretty exciting to see what’s coming next. If you’re planning your payment strategy today, understanding these trends will help you make choices that won’t feel outdated in six months.

Central Bank Digital Currencies Are Coming

Over 11 countries have already launched their own digital currencies, and 19 G20 members are in advanced development stages. These aren’t cryptocurrencies like Bitcoin, but government-issued digital money that runs on blockchain technology.

DeFi Is Creating New Payment Possibilities

Decentralized Finance protocols are opening up payment experiences we couldn’t imagine before. Picture this: your payment history automatically qualifies you for a loan, or your business payment account generates yield while funds sit there waiting for expenses.

NFTs Beyond Digital Art

Non-fungible tokens are growing up. The real opportunity is in utility tokens, membership passes, and loyalty programs. Imagine payments that automatically trigger NFT rewards or open up token-gated content for your customers.

Content & Community Monetization

Token-Gated Access Is Changing Everything

Creators are ditching traditional subscription models for something much more interesting. Instead of monthly fees, fans can purchase tokens that provide ongoing access to premium content, exclusive communities, and special experiences.

Loyalty Programs That Actually Work

Blockchain enables programmable loyalty programs where customers earn NFTs or tokens with real utility. These rewards can be traded, combined with other rewards, or used across different platforms and experiences.

At Avanti3, we’re seeing incredible innovation in Blockchain Content Distribution, where creators can monetize their work directly through crypto payments while maintaining complete ownership and control over their content.

Beyond Payments: Digital Engagement

The Creator Economy Revolution

The creator economy is being transformed by direct crypto payments, NFT sales, and token-based fan engagement. Creators can build sustainable businesses without relying on advertising revenue or giving platforms a cut of their earnings.

Frequently Asked Questions about Blockchain Payment Integration

Let’s tackle the questions we hear most often from businesses considering crypto payments. These aren’t just technical concerns – they’re real business decisions that affect your bottom line and customer experience.

How fast can I add crypto checkout to my site?

Here’s the honest truth: you could be accepting your first crypto payment today if you choose the right approach.

The Lightning-Fast Route

Using hosted solutions with pre-built plugins, you can literally go live in hours. Install a plugin for your e-commerce platform, connect your account, and boom – you’re accepting crypto. It’s almost embarrassingly simple compared to traditional payment processor setups.

The Custom Integration Path

If you need blockchain payment integration that fits your specific workflow, plan for 1-2 weeks. This includes API development, webhook setup, and testing different payment scenarios. Most of this time is actually spent on testing, not coding.

The Full Custom Build

Building everything from scratch with custom smart contracts? That’s a 1-2 month project. You’ll need development time, security audits, and extensive testing. But honestly, most businesses don’t need this level of customization.

The secret is starting simple. Get basic crypto payments working first, then add bells and whistles later. Your customers care more about being able to pay than having every possible cryptocurrency option.

Do I need to hold crypto on the balance sheet?

This question keeps CFOs up at night, but the answer is refreshingly simple: not if you don’t want to.

The “Never Touch Crypto” Option

Most payment processors offer instant conversion to fiat currency. Your customer pays in Bitcoin, but your bank account receives dollars. You never actually hold cryptocurrency, so there’s no balance sheet impact or accounting complexity.

The Scheduled Conversion Approach

Some businesses accumulate crypto payments daily or weekly, then convert in batches. This can reduce conversion fees, but you’re exposed to price swings during the holding period. It’s like holding foreign currency – there’s risk and opportunity.

The Strategic Holding Decision

A growing number of companies keep some crypto payments as a strategic investment. They convert enough to cover operational needs and hold the rest. This requires proper accounting procedures and risk management, but it’s becoming more common.

The Hybrid Sweet Spot

Many businesses find a middle ground: convert 80-90% to fiat immediately and keep 10-20% in stablecoins or major cryptocurrencies. This provides operational stability with some upside exposure.

What happens if a customer sends the wrong amount?

Payment errors happen, but modern blockchain payment integration systems handle them gracefully. Here’s what actually occurs:

When Someone Pays Too Much

Overpayments are detected automatically by most processors. The system can issue a refund for the excess amount or apply it as credit for future purchases. We’ve seen customers accidentally add an extra zero – these situations resolve quickly with good customer service.

When Someone Pays Too Little

Underpayments trigger a grace period where customers can send the remaining amount. If they don’t complete the payment within the timeout window, you can refund the partial payment or let them apply it to a smaller purchase.

Wrong Cryptocurrency Confusion

Sometimes customers send Bitcoin when you asked for Ethereum. Good payment processors detect this and can either convert it automatically or process a refund. The blockchain’s transparency makes these situations easier to resolve than traditional payment errors.

Prevention Is Everything

The best approach is preventing errors in the first place. Clear payment instructions, QR codes with embedded amounts, and wallet integration eliminate most mistakes. When customers can just scan and confirm, errors drop dramatically.

Having a Recovery Plan

Always maintain a clear process for handling payment issues. Most problems resolve within 24 hours with the right tools and customer service approach. The blockchain’s transparency actually makes troubleshooting easier than traditional payments – every transaction is visible and traceable.

Payment errors with crypto are often easier to resolve than credit card disputes or bank transfer issues. The permanent record on the blockchain means there’s never confusion about what actually happened.

Conclusion

Blockchain payment integration isn’t just about accepting cryptocurrency – it’s about positioning your business for the future of digital commerce. The technology that seemed experimental just a few years ago is now processing trillions of dollars in transactions and being adopted by major corporations worldwide.

Think about where we started this journey together. We explored how blockchain payment integration can slash your processing fees from 3-4% down to under 1%, turn week-long cross-border payments into minute-long transfers, and eliminate the headache of chargebacks entirely. These aren’t theoretical benefits – they’re real advantages that businesses are capturing right now.

Start simple, scale smart. The most successful implementations begin with proven payment processors rather than custom-built solutions. Focus on stablecoins to capture blockchain’s benefits without the volatility roller coaster. Your customers get the speed and transparency they want, while you get predictable accounting.

Security and compliance aren’t afterthoughts – they’re the foundation everything else builds on. The businesses thriving in this space prioritize proper KYC/AML procedures, multi-signature security, and regulatory compliance from day one.

The customer experience is where the magic happens. When someone can scan a QR code and complete a global payment in seconds, that’s not just technology – that’s change. The single-touch checkout experience of tomorrow will seamlessly blend traditional and blockchain payments, giving customers choice while improving your margins and global reach.

Here’s what excites me most – we’re not just talking about payments anymore. We’re talking about programmable money that can trigger loyalty rewards, open up exclusive content, and create entirely new business models. The creator economy is being rebuilt from the ground up with direct fan payments, NFT utilities, and token-gated communities.

At Avanti3, we’re not just watching this revolution – we’re helping create it. Our integrated approach combines blockchain payments with cutting-edge engagement tools to create comprehensive Web3 solutions. We’re seeing creators monetize their communities in ways that were impossible just two years ago.

The businesses winning in this space aren’t necessarily the most technical. They’re the ones that understand their customers and implement blockchain payments as part of a broader digital strategy. Whether you’re monetizing content, building community marketplaces, or creating new digital experiences, crypto payments open up new revenue streams and global reach that traditional systems simply can’t match.

The question isn’t whether blockchain payments will become mainstream – it’s whether you’ll be ready when they do. The innovation roadmap is clear, the technology is proven, and the opportunity is massive.

Ready to explore how blockchain payments can transform your business? Learn more about our comprehensive NFT Marketplace Development solutions and find how we’re helping businesses build the future of digital commerce.

The future of payments is here, powered by innovation and delivered through platforms like Avanti3. The only question left is: are you ready to accept it?