Innovative digital assets: 6 Powerful Trends to Watch 2025

The Evolution of Innovative Digital Assets

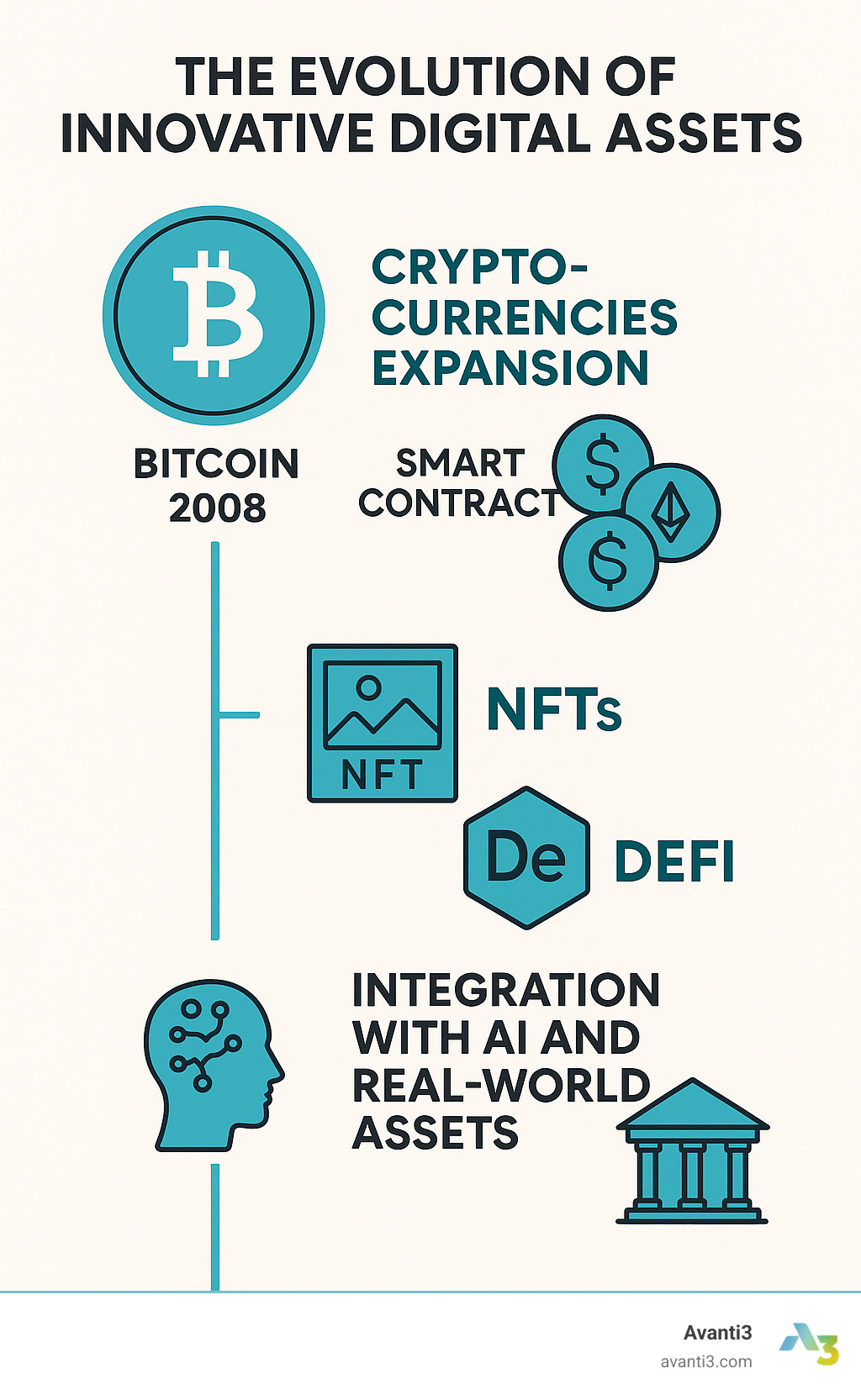

Innovative digital assets are changing how we store, transfer, and create value in the digital age. These blockchain-based tokens and instruments represent a paradigm shift in how we view ownership, investment, and engagement in the digital economy.

What are innovative digital assets?

– Cryptocurrencies: Bitcoin, Ethereum, and other digital currencies that function as mediums of exchange

– Tokenized assets: Real-world items like real estate, art, or gold represented as blockchain tokens

– NFTs: Unique digital certificates of ownership for digital or physical items

– DeFi instruments: Financial products built on decentralized networks

– Digital identity tokens: Blockchain-based verification of personhood and credentials

Since the creation of Bitcoin in 2008, digital assets have grown from a niche technology to a $2.7 trillion market in 2024. Today, over 617 million people worldwide own some form of digital assets, up from just 66 million in 2020. This rapid adoption reflects how these innovations are addressing fundamental needs for transparency, accessibility, and democratized finance.

The most exciting developments combine traditional asset classes with cutting-edge blockchain technology. For example, regulated issuers now create gold-backed tokens where each digital unit represents one troy ounce of vaulted bullion, while emerging platforms experiment with real-estate-backed currencies that automatically reinvest rental income to drive long-term appreciation.

I’m Samir ElKamouny AV, an entrepreneur who has helped numerous businesses implement innovative digital assets to transform their engagement strategies and open up new revenue streams. My experience with blockchain technology and digital assets has shown me how these tools can revolutionize business models and create unprecedented opportunities for growth.

1. Tokenizing the Physical World

Imagine owning a piece of the Empire State Building for just $100, or trading physical gold as easily as sending a text message. This isn’t science fiction—it’s the reality of innovative digital assets changing our physical world through tokenization. At its core, tokenization converts ownership rights into digital tokens on a blockchain, completely reimagining how we interact with valuable assets in our everyday lives.

Why Innovative Digital Assets Open Up Liquidity

Think about trying to sell a building—the paperwork, the lawyers, the waiting. Now imagine selling that same ownership stake with a few clicks. That’s the power of tokenization, and it’s creating waves across traditionally illiquid markets.

Traditional assets like real estate or fine art have always been the playground of the wealthy. The entry costs are high, the paperwork overwhelming, and selling quickly? Good luck with that! But tokenization is democratizing access in ways that feel almost magical.

24/7 Markets are perhaps my favorite benefit. I remember trying to sell shares once during a family emergency, only to realize the markets were closed for a holiday. With tokenized assets, that frustration vanishes. Markets never sleep, allowing you to buy or sell whenever you need to, whether it’s Tuesday afternoon or 3 AM on Christmas morning.

Global Access transforms local investments into worldwide opportunities. A small apartment building in Berlin can now attract investors from Bangkok, Buenos Aires, and Boston simultaneously. This global liquidity pool doesn’t just make selling easier—it often drives values higher by connecting assets to more potential buyers.

Micro-Investing might be the most aspect of all. Remember when you needed tens of thousands of dollars just to get started in real estate? Those days are disappearing. As Wolfgang Schlaffer notes in his research, “Digital Assets are undergoing a dynamic development that will permanently change the existing business and operating models of market participants.”

The real-world applications are already here and growing rapidly:

I’ve watched with fascination as Real Estate Tokens have gained traction. According to research published in the Journal of Property Investment & Finance, tokenization could boost commercial real estate liquidity by up to 50%. Platforms now offer fractional ownership in premium properties that would be otherwise untouchable for average investors.

Gold Tokens backed by vaulted bullion show how even the oldest store of value can be reimagined. Some issuers combine physical security features with blockchain verification, blending the stability of gold with the convenience of digital assets. Other innovators are experimenting with eNFT bullion coins—digital gold certificates paired with beautifully designed physical keepsakes.

At Avanti3, we’ve seen how tokenization creates exciting new possibilities for creators and brands. Our NFT engagement tools help artists and businesses tokenize their work and intellectual property, opening new revenue streams while maintaining clear ownership records on the blockchain.

The beauty of tokenization lies in its flexibility. Whether you’re interested in real estate, precious metals, art, or even intellectual property, the barriers to entry are crumbling. What once required significant capital, professional connections, and patience now requires little more than a smartphone and an internet connection. That’s the transformative power of innovative digital assets in action.

2. Innovative Digital Assets in DeFi

Decentralized Finance (DeFi) has emerged as perhaps the most exciting playground for innovative digital assets, creating a financial system that works without the traditional middlemen we’ve relied on for centuries.

Think of DeFi as finance reimagined from the ground up—where code, not corporations, handles your money. This ecosystem has exploded in recent years, with everyday people gaining access to sophisticated financial tools previously reserved for institutions.

The beauty of DeFi lies in its accessibility. Have some crypto sitting around? Instead of letting it gather digital dust, you can put it to work. Leading lending platforms have revolutionized lending by allowing anyone to become both lender and borrower without the usual paperwork and credit checks. Your assets are managed entirely through smart contracts—self-executing agreements that handle everything from interest payments to collateral management.

Yield farming has become something of a digital gold rush in this space. By strategically lending or staking your assets across different protocols, you can earn compound returns that sometimes make traditional bank interest rates look like rounding errors. I’ve seen community members turn modest holdings into substantial portfolios through careful yield optimization strategies.

The rise of decentralized exchanges on various blockchain networks has transformed how we trade. Unlike centralized exchanges, these DEXs connect buyers and sellers directly—your assets never leave your control until the exact moment of trade. It’s like having a global trading floor in your pocket that never closes.

Behind many DeFi projects, you’ll find DAO treasuries—community-controlled funds that sometimes manage billions in assets. These digital cooperatives make decisions through token-based voting, funding everything from software development to marketing campaigns based on collective wisdom rather than executive decisions.

Anchoring this entire ecosystem are stablecoins, the unsung heroes of DeFi. As Julian Schmeing noted in our research: “Financial services providers should take advantage of the existing window of opportunity and offer their customers innovative services in the context of Digital Assets.” Stablecoins provide the steady foundation that makes more complex financial products possible.

According to the stablecoins overview from PwC, these digital dollars have become essential infrastructure for the entire crypto economy.

Risk-Reward Matrix

Let’s be honest—with great innovation comes great responsibility. DeFi’s rewards come packaged with unique risks that the community has been working creatively to address.

Volatility control mechanisms have evolved rapidly to tame crypto’s wild price swings. Some protocols automatically rebalance between volatile and stable assets, while others offer sophisticated options contracts that would make Wall Street traders feel right at home.

The code that powers these financial tools undergoes intense scrutiny through smart contract audits. These digital security reviews have become as important to DeFi as safety inspections are to construction—they’re non-negotiable for serious projects. When millions (or billions) of dollars depend on your code working perfectly, multiple independent audits become standard practice.

Perhaps most fascinating is the emergence of insurance protocols built specifically for digital asset risks. These DeFi-native protection plans allow users to cover themselves against everything from smart contract failures to exchange hacks—risks you won’t find listed in your homeowner’s policy.

At Avanti3, we’ve integrated these risk management principles into our Web3 platform solutions. We understand that for creators and brands to confidently step into this new financial landscape, they need both the exciting opportunities and the safety nets that make exploration possible.

When comparing traditional finance to DeFi yields, the difference can be startling. While a high-yield savings account might offer 1-2% annually, certain DeFi strategies can generate double-digit returns—though with correspondingly higher risk profiles. This risk-reward balance is precisely why education and proper tooling are so essential in this rapidly evolving space.

3. Next-Gen NFTs: From Augmented Reality to Dynamic Art

Non-fungible tokens (NFTs) have evolved far beyond simple digital collectibles into complex innovative digital assets with utility, interactivity, and real-world applications.

Remember when NFTs were just static digital images selling for eye-watering sums? Those days feel like ancient history now. Today’s NFT landscape is bursting with innovations that make those early collectibles look like cave paintings compared to Renaissance masterpieces.

Augmented Reality Integration has completely transformed how we experience digital ownership. Imagine pointing your phone at your living room wall and watching your NFT artwork come alive, dancing off the screen and into your physical space. Through Avanti3’s Augmented Reality NFTs platform, brands can create these magical moments where the boundary between digital and physical worlds dissolves, creating memorable experiences that standard images simply can’t match.

The revolution of Dynamic Layers has added an entirely new dimension to digital art ownership. Pioneering platforms have created a structure where artworks aren’t static but living, breathing creations. This innovative approach enables composite NFTs with interactive layers that can be updated post-mint. This means collectors don’t just own a finished piece—they can own and modify specific layers, becoming active participants in an artwork’s evolution. This groundbreaking approach to collaborative creation has transformed how we think about digital art ownership.

The marriage of AI-Generated Art and NFTs has birthed entirely new creative expressions. Artists now collaborate with artificial intelligence to produce visuals that would be impossible through human effort alone. These pieces often respond to viewer interaction or external data feeds like weather patterns or stock market movements, creating art that’s as alive and changing as the world around us. The NFT Digital Art Sales landscape has been forever changed by these AI collaborations.

Fan Tokens have reinvented the relationship between creators and their communities. Sports teams, musicians, and entertainment brands now offer token-based membership that goes far beyond traditional fan clubs. Holding these tokens might let you vote on which song gets played at a concert, which uniform design your team wears, or grant you backstage access that money literally cannot buy.

Use Cases for Innovative Digital Assets in Fan Engagement

The magic of NFTs in fan engagement isn’t just theoretical—it’s happening right now in ways that build deeper, more meaningful connections between creators and their audiences.

Loyalty Badges have transformed how brands reward their most dedicated supporters. Unlike traditional loyalty programs with their forgettable points systems, NFT badges create visible, tradeable proof of your relationship with a brand. The longer you engage, the more impressive your collection becomes—and the better benefits you open up. It’s like turning brand loyalty into a treasure chest that grows more valuable over time.

Ticketing through NFTs has solved problems that have plagued the event industry for decades. When your concert ticket is an NFT, you’re not just buying entry—you’re getting a digital keepsake that lives forever. These smart tickets can include programmable royalties that ensure artists get paid when tickets are resold, built-in transfer rules that curb scalping, and the ability to open up exclusive content months after the event has ended. The ticket becomes a relationship, not just a transaction.

Our Blockchain Art Authentication system at Avanti3 takes authenticity to a whole new level. For artists and collectors worried about forgeries or questionable provenance, blockchain verification creates an unbreakable chain of custody. Every ownership transfer, exhibition history, and condition report gets permanently recorded, creating absolute certainty about a work’s authenticity and history.

As industry experts have insightfully noted in our research: “NFTs and Web3 will increasingly be everywhere—and invisible.” This prediction is already coming true. These technologies are becoming less about the novelty of owning something digital and more about seamlessly enhancing experiences we already value. Soon, you might not even realize you’re using an NFT—you’ll just know that your experiences are more interactive, more personal, and more meaningful than ever before.

4. AI-Improved Security & Analytics for Digital Assets

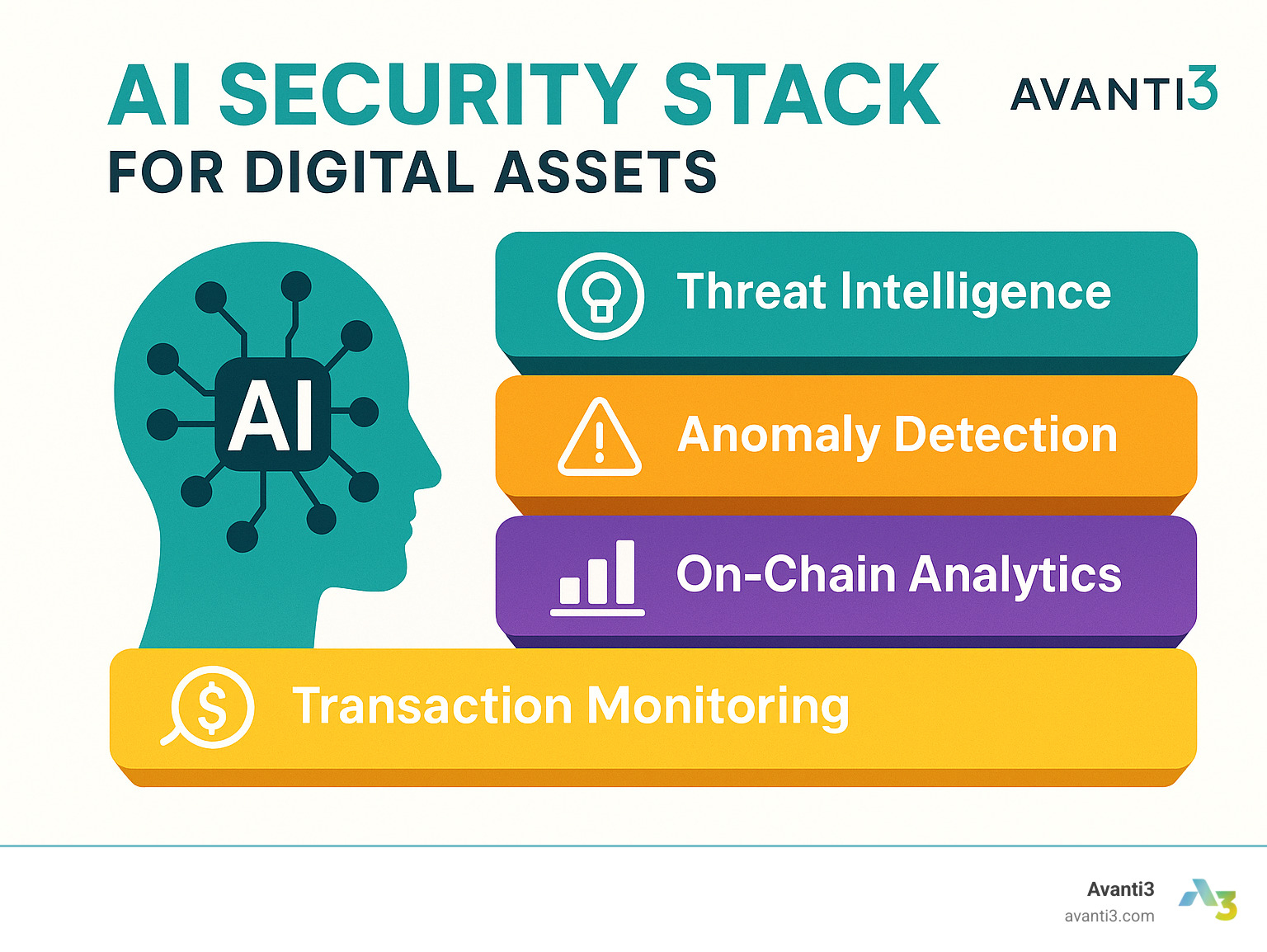

The marriage of artificial intelligence with innovative digital assets isn’t just exciting—it’s revolutionizing how we protect and understand our digital investments.

As more people accept cryptocurrencies and tokenized assets, the bad actors get craftier too. That’s where AI steps in as our digital guardian angel. Think of it as having a tireless security team that never sleeps, constantly watching over your valuable digital holdings.

Generative AI has become a game-changer for spotting sneaky behavior. AWS research shows these systems can learn to identify manipulative trading patterns like spoofing and layering—tricks that would fly right past even the most vigilant human analysts. It’s like having a financial detective that can simultaneously monitor millions of transactions and spot the one suspicious needle in the haystack.

Beyond just watching for known threats, AI excels at anomaly monitoring. These systems get to know what “normal” looks like for wallets and smart contracts, then raise a flag when something seems off. Maybe it’s an unusual transaction at 3 AM, or sudden interaction with addresses known for sketchy behavior—AI catches these warning signs before they become problems.

For investors and platforms alike, on-chain analytics powered by AI offer invaluable insights into market trends and user behavior. These tools transform the overwhelming flood of blockchain data into actionable intelligence. It’s like having X-ray vision into the market, helping you make smarter, data-driven decisions.

Perhaps most impressive is how AI handles predictive risk scoring. Rather than reacting to problems after they happen, these systems assess potential risks before you invest. They look at everything from code quality to team history and governance structure—giving you a holistic view of where your digital assets might be vulnerable.

Autonomous Compliance

Let’s face it—regulatory compliance isn’t exactly the most thrilling aspect of digital assets, but it’s absolutely essential. Thankfully, AI is making this necessary evil much less painful.

Reg-Tech APIs work like digital compliance officers, automatically checking transactions against regulatory requirements across multiple countries. This is particularly valuable in the constantly shifting landscape of crypto regulations, where keeping up manually would be nearly impossible.

The days of lengthy KYC (Know Your Customer) processes are fading fast. AI-powered verification can confirm identities in seconds rather than days, while simultaneously being better at catching fake IDs or synthetic identities. It’s a win-win: better security with less waiting.

Perhaps most powerful is how the industry is building fraud pattern libraries—shared databases of known scams and attack methods. When one platform identifies a new threat, AI systems across the ecosystem can quickly learn to recognize and block similar attacks, creating a collective immune system against fraud.

According to research from the Atlantic Council, “Training AI on on-chain and off-chain data improves smart contract security and efficiency.” This hybrid approach gives us the best of both worlds—combining blockchain’s transparent nature with traditional security methods for truly comprehensive protection.

At Avanti3, we’re not just observers of these AI security advances—we’re active participants. Our Web3 platform solutions leverage cutting-edge AI to create digital experiences that users can trust completely. We believe the future of innovative digital assets depends on this perfect balance of blockchain transparency and AI-powered security.

After all, the most valuable digital experience is one where you never have to worry about what’s happening behind the scenes—it just works, securely and reliably, every time.

5. Digital Identity & Soulbound Credentials

The world of innovative digital assets is expanding in fascinating ways, moving beyond just financial applications to touch something deeply personal: our digital identities and reputations.

Remember when your online identity was just a username and password? Those days are rapidly disappearing. Today, blockchain technology is creating secure, verifiable digital identities that you—and only you—control.

For instance, one forward-looking initiative is piloting a “privacy-preserving, human-centric” identity network. Specialized orb-shaped scanners gently map your iris to create a unique on-chain identifier proving you’re human without revealing personal details. It sounds like science fiction, yet it’s already being tested in cities around the globe.

Biometric proof-of-personhood solutions like this are just the beginning. Decentralized Identifiers (DIDs) are giving people control over their digital selves without relying on big tech companies or governments. Think of a DID as your digital passport that you keep in your own pocket—not stored in someone else’s filing cabinet.

What makes these identity tokens truly is that many of them are “soulbound”—meaning they can’t be transferred to another person. Your college degree, professional certifications, or reputation scores are tied specifically to you, just like in real life.

Governance & Access Control

This new identity layer is changing how online communities make decisions and manage access.

When you join a DAO (Decentralized Autonomous Organization), your voting power can now reflect your actual expertise or contributions, not just how much money you’ve invested. Imagine if your voice in important decisions grew stronger the more you helped the community—that’s the promise of reputation-based governance.

Whitelists are becoming more sophisticated too. Rather than simple approved-user lists, they’re evolving into nuanced access systems based on verifiable credentials. A concert might offer special access not just to anyone who can afford it, but specifically to fans who’ve attended previous shows or supported the artist in meaningful ways.

Perhaps most exciting is the privacy protection built into these systems. Using zero-knowledge proofs, you can prove you meet certain criteria without revealing excessive personal information. Want to join an over-21 community? Your digital ID can confirm your age without sharing your birthdate, name, or any other details.

As recent research highlights, verifiable digital identity is becoming “an asset enabling universal economic access.” This perspective underscores how a trusted digital identity can be as valuable as financial assets in our increasingly online world.

At Avanti3, we’re weaving these identity innovations into our platform to create more meaningful connections between creators and their audiences. We believe that trust is the foundation of any worthwhile digital relationship, and blockchain-verified credentials are building that foundation one block at a time.

6. Sustainable Stablecoins & Asset-Backed Money

The evolution of innovative digital assets has led to a renaissance in how we think about money itself. Beyond the wild rollercoaster of speculative cryptocurrencies, a new wave of asset-backed digital currencies is emerging with stability and sustainability at their core.

I remember when stablecoins first appeared – they were simply pegged to the US dollar. But today? We’re seeing something much more exciting.

Consider real-estate-backed digital currencies. Instead of simply mirroring a fiat currency, these tokens are collateralized by diversified commercial property portfolios. Rental income is automatically reinvested to expand the backing assets, creating a naturally deflationary currency that can grow in purchasing power over time. It’s like owning a slice of real estate that fits in your digital wallet!

Gold-backed tokens have evolved as well. Modern issuers often pair NFC-enabled physical cards or coins with on-chain ownership records, blending the tangibility of precious metals with the transparency of blockchain. Imagine holding a beautifully crafted piece of metal that instantly verifies its purity and serial number on-chain—it’s the perfect bridge between traditional wealth preservation and digital convenience.

As governments worldwide explore CBDC alternatives, private solutions are stepping up with options that prioritize what many central bank offerings might not: privacy and user control. These systems aim to deliver the convenience of digital cash without the surveillance concerns that make many people nervous about government-issued CBDCs.

The rise of ESG-focused currencies shows how innovative digital assets can align with broader values. From carbon-neutral networks to tokens that fund sustainability initiatives, these assets let people vote with their wallets for a greener future. Our Web3 platform solutions at Avanti3 incorporate these principles to help creators build sustainable digital economies.

Value Preservation Mechanics

What makes these new monetary instruments truly special is their sophisticated approach to maintaining and growing value over time.

The rental income reinvestment model pioneered by property-backed tokens creates something traditional currencies can’t offer – organic growth in the currency’s value. It’s a bit like having a savings account that automatically buys more property with the interest instead of just paying it out.

Proof-of-reserves dashboards bring much-needed transparency to the space. Rather than asking users to take a company’s word for it, real-time verification systems let anyone confirm that backing assets match the circulating supply. No more “trust us”—now it’s “see for yourself.”

Some platforms employ algorithmic stability through advanced mathematical models that maintain price equilibrium by automatically adjusting supply based on market conditions. Think of it as a digital thermostat for your money – constantly making tiny adjustments to maintain the perfect temperature (or in this case, value).

At Avanti3, we’ve woven these value preservation principles into our platform. We believe creators deserve tools that help build lasting value rather than extracting quick profits. By designing systems that naturally appreciate over time, we help artists and brands forge deeper, more meaningful connections with their communities.

The future of money isn’t just digital – it’s backed by real value, environmentally conscious, and designed for long-term stability. That’s something we can all bank on.

Frequently Asked Questions about Innovative Digital Assets

What makes a digital asset “innovative”?

When we talk about innovative digital assets, we’re looking at much more than just another cryptocurrency or token. True innovation in this space happens when digital assets solve real problems or open doors to new possibilities.

Think of it this way: Bitcoin was innovative because it created digital scarcity for the first time. Today’s most exciting digital assets take things even further by combining technologies in creative ways. The most groundbreaking examples typically blend blockchain with other cutting-edge tech like artificial intelligence, augmented reality, or the Internet of Things.

What really sets the best innovations apart is their real-world utility. Redcurry, for instance, doesn’t just exist as a speculative token—it creates an entirely new monetary system backed by real estate that grows in value through rental income reinvestment. Similarly, Worldcoin tackles the fundamental challenge of proving someone is a unique human (not a bot) through their biometric Orb technology.

The most thoughtful innovations also consider long-term sustainability, both economically and environmentally. They’re designed to create lasting value rather than quick profits.

How do I store and secure innovative digital assets safely?

Keeping your innovative digital assets safe requires different approaches depending on what you’re protecting. The security needs for a Bitcoin are quite different from those for a digital identity credential or an augmented reality NFT.

For traditional cryptocurrencies and tokens, hardware wallets like Ledger or Trezor remain the gold standard. These physical devices keep your private keys offline where hackers can’t reach them. For additional security, consider using multi-signature wallets that require approval from multiple devices or people before transactions can be completed.

NFTs and digital collectibles need special attention because they often link to media stored elsewhere. Specialized NFT wallets not only secure your ownership token but also help you manage and display your collection. Remember to periodically verify that any linked content or metadata is still intact and accessible.

Identity tokens and credentials require extra care since they’re tied to your personal information. Look for solutions that incorporate biometric security (like fingerprint or facial recognition) and social recovery options that let trusted contacts help you regain access if needed.

Some forward-thinking companies are creating hybrid solutions that bridge digital and physical security. The Bitcoin, for example, combines electronic cold storage with secure printing technology, giving you both the security benefits of blockchain and the familiar comfort of holding something tangible.

Are innovative digital assets regulated the same worldwide?

Not even close! The regulatory landscape for innovative digital assets varies dramatically from country to country, creating quite the puzzle for global users and developers alike.

In the United States, regulation remains somewhat fragmented across multiple agencies. Recent developments like the “Financial Innovation and Technology for the 21st Century Act” show progress, but clear guidelines are still evolving. The SEC continues to weigh in on which digital assets qualify as securities, creating an uncertain environment for innovators.

The European Union has taken a more comprehensive approach with its Markets in Crypto-Assets (MiCA) regulation, providing clearer guardrails specifically designed for digital assets. This framework gives both users and creators more certainty about what’s allowed.

Asia presents a study in contrasts—Singapore has created a supportive but carefully regulated environment, while China has implemented much stricter policies. Hong Kong is carving its own path, with the Hong Kong Monetary Authority recently issuing guidance for banks on crypto custody and tokenized products.

The Middle East has emerged as a surprising innovation hub, with Dubai and Abu Dhabi creating specialized regulatory frameworks designed to attract digital asset businesses.

The most successful projects don’t try to avoid regulation—they engage with it. Paxos Trust Company, which issues the gold-backed PAXG token, operates under New York Department of Financial Services oversight, showing that innovation can thrive within regulated environments.

At Avanti3, we keep a close eye on these evolving regulations to ensure our Web3 platform solutions remain compliant across different jurisdictions while still delivering the innovative experiences our creators and their communities expect.

Conclusion

The world of innovative digital assets continues to transform at lightning speed, reshaping our fundamental concepts of value, ownership, and connection in the digital landscape. It’s amazing to see how these technologies have evolved from experimental concepts to powerful tools that address real human needs.

What excites me most is how these technologies flourish when they intersect and combine. When blockchain meets artificial intelligence, or when physical assets become digitally tokenized, we open up possibilities that seemed like science fiction just a few years ago.

At Avanti3, we’re not just watching this revolution—we’re actively building it. Our team integrates Web3 technologies like NFTs, blockchain, augmented reality, and AI to create tools that truly empower creators and brands. Whether you’re looking to build unique digital experiences, develop meaningful reward systems, or foster authentic community connections, our platform makes the power of innovative digital assets accessible and practical.

The numbers tell a compelling story: with 617 million crypto owners worldwide and a market capitalization of $2.7 trillion, digital assets have clearly moved beyond the early adopter phase. Traditional financial institutions are taking notice too—just look at the $17.5 billion in bitcoin ETF inflows through August 2024. These aren’t just interesting statistics; they represent a fundamental shift in how our financial and creative ecosystems operate.

But the true promise of innovative digital assets goes far beyond investment returns or technological novelty. These tools are democratizing access to markets that were previously closed to most people. They’re enabling artists and creators to express themselves in entirely new mediums. They’re building more transparent governance systems and creating economic opportunities that work regardless of where you happen to be born.

I’ve seen how these technologies can transform businesses and creative practices. Whether you’re a musician looking to deepen fan relationships, a brand seeking to reward customer loyalty, or an investor exploring new frontiers of value creation, the innovations we’ve discussed open doors that simply didn’t exist before.

The future belongs to those who can steer these tools thoughtfully and creatively. At Avanti3, we’re committed to being your guide through this exciting landscape, helping you harness the full potential of innovative digital assets to create experiences that are not just technologically impressive, but meaningful and valuable.

Ready to explore how these innovations can transform your creative vision or business model? Learn more about our NFT Marketplace Development and find how Avanti3 can help you leverage the power of innovative digital assets in ways that align with your unique goals and values.