blockchain for artists: 7 Powerful Benefits in 2025

The Revolution at Artists’ Fingertips

Remember when artists worried about proving their work was authentic? Or when creators watched their pieces sell for higher prices on the secondary market without seeing a penny? Those days are quickly becoming history.

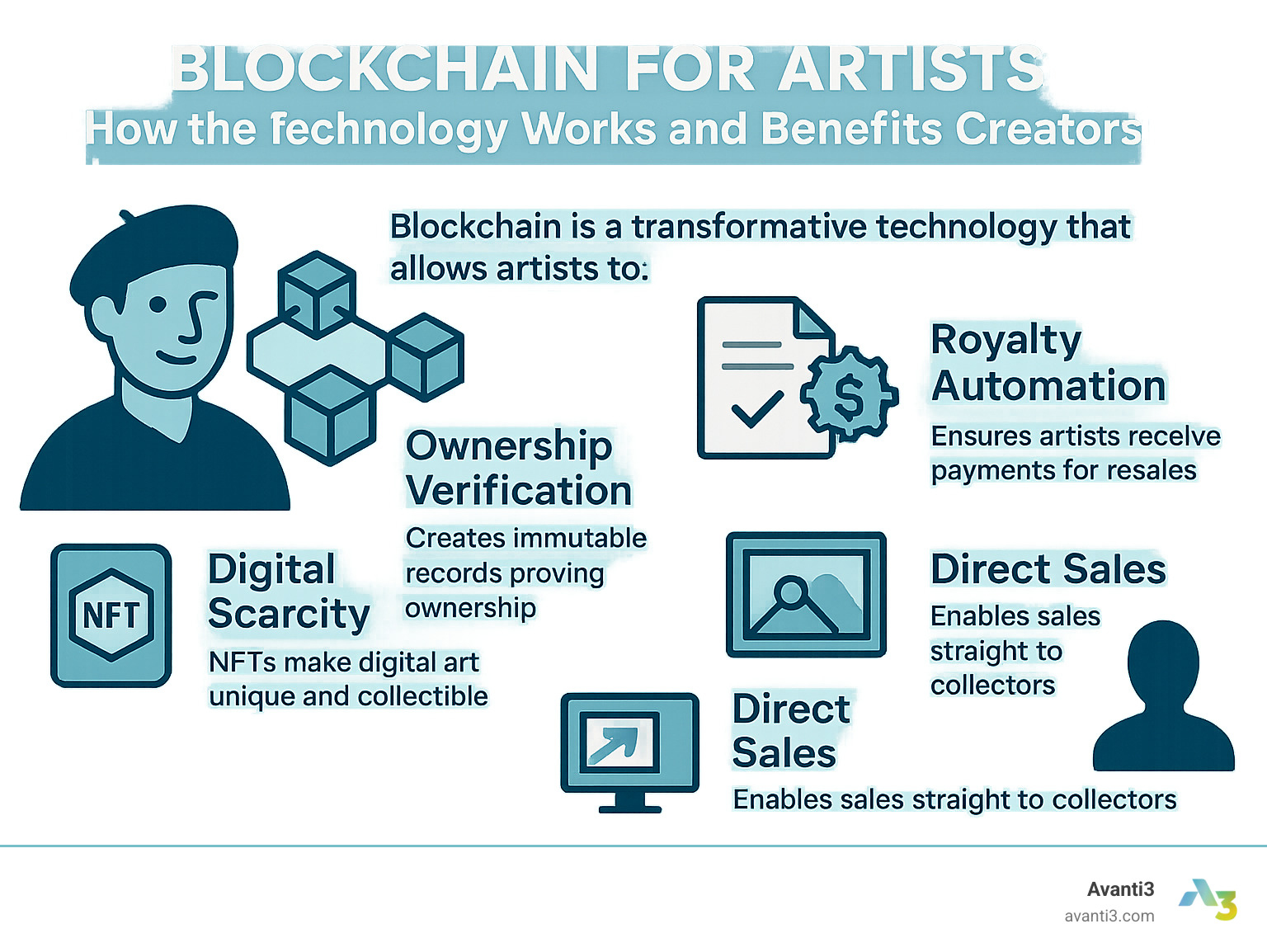

Blockchain for artists isn’t just another tech buzzword – it’s a genuine game-changer that puts power back where it belongs: in creators’ hands. At its heart, this technology creates an unbreakable chain of truth about your artwork that follows it forever.

Think of it as your artwork’s digital passport. Every time your creation changes hands, the transaction gets recorded permanently. No more disputes about who created what or when it happened.

What makes this truly is how it solves age-old artist problems. For the first time, you can verify ownership with absolute certainty – no more worrying about someone claiming your work as theirs. Smart contracts automatically send royalty payments your way whenever your art resells. And for digital creators, NFTs finally bring the concept of “one original” to the digital field.

The numbers tell a compelling story too. The global blockchain market isn’t just growing – it’s exploding from $4.9 billion in 2021 to a projected $67.4 billion by 2026. Meanwhile, the NFT art market doubled in a single year, reaching an impressive $2.6 billion in sales in 2021.

But what truly makes blockchain for artists special is how it addresses challenges creators have faced for centuries. Before this technology, tracking provenance was a nightmare of paperwork and trust. Getting paid for secondary sales? Nearly impossible unless you were already famous. Now these problems have neat, automated solutions.

As artist Ronen V eloquently puts it: “Art is a currency. The evolution of art into digital currency is — no question — the future.”

I’ve seen this change firsthand. I’m Samir ElKamouny AV, and I’ve helped countless creators implement blockchain solutions that not only protect their work but also open entirely new revenue streams. The artists I work with consistently report feeling more in control of both their creative expression and financial futures.

This isn’t just about technology – it’s about restoring the balance of power in the art world. It’s about ensuring that those who create value receive their fair share of it. And most importantly, it’s about building a future where artists thrive not despite the digital age, but because of it.

Blockchain 101 for Creators

Ever wondered how digital art can be as valuable as physical art? The secret lies in blockchain technology. Think of blockchain as a digital notebook where every page (or block) contains information that, once written, can never be erased or changed. What makes this special for artists? Let’s break it down.

Blockchain for artists is because it creates a system where your creative work gains something it never had before in the digital field: verifiable uniqueness and ownership. Imagine signing your artwork, but with a signature that’s impossible to forge and visible to everyone.

At its heart, blockchain works through four key principles that benefit creators:

When you create art on the blockchain, you’re part of a system that’s decentralized – no single gallery, platform, or institution controls your work’s record. Your art’s information is immutable, meaning once recorded, it cannot be altered or deleted – goodbye forgery concerns! The system offers transparency where anyone can verify who created and owns a piece. And sophisticated cryptographic hashes (think of them as digital fingerprints) ensure everything stays secure.

As blockchain researcher Susan McGregor explains: “Blockchain can allow artists to create a cryptographic log of their work. An artist can then refer to a specific ledger entry to prove ownership of their work.”

The technology relies on consensus – multiple computers around the world must agree before any new information is added. This eliminates the need for middlemen like banks or traditional art authenticators to validate your ownership.

According to market research, the global blockchain technology market is projected to grow from $4.9 billion in 2021 to $67.4 billion by 2026 – with creative applications leading much of this growth.

How Does a Block Become Art Provenance?

Traditional art provenance (the documented history of ownership) might include gallery receipts, exhibition records, and certificates of authenticity. Blockchain creates something far more powerful for artists.

When you mint your artwork on the blockchain, three magical things happen:

Timestamping records the exact moment your art was created or registered, establishing your claim as the original creator. Hash pointers create unique digital fingerprints that connect your art to its entire history. And all of this forms a permanent ledger that can never be erased – creating an unbreakable chain of ownership from creation to present day.

This digital provenance follows your artwork forever, automatically recording each sale and transfer of ownership. For artists who’ve struggled with proving authenticity or tracking where their work ends up, this represents a fundamental shift in creative control.

Public, Private, or Consortium: Which Chain Fits Your Studio?

Not all blockchains are created equal, and choosing the right one depends on your specific needs as an artist.

Public blockchains like Ethereum, Solana, or Tezos offer maximum exposure. They’re open to anyone, completely transparent, and reach the widest collector base. The downside? They can have higher transaction costs (known as “gas fees”) and slower processing times during busy periods.

Private blockchains work more like invitation-only galleries. They offer lower costs and faster transactions but sacrifice some of the decentralization that makes blockchain special.

Consortium blockchains like Arcual (built specifically for the art community) offer a middle ground – governed by a group of organizations rather than a single entity or the entire public. As Arcual states in their press release: “By providing a trusted, transparent and efficient platform for art transactions, Arcual’s blockchain solutions address long-standing challenges in the art market.”

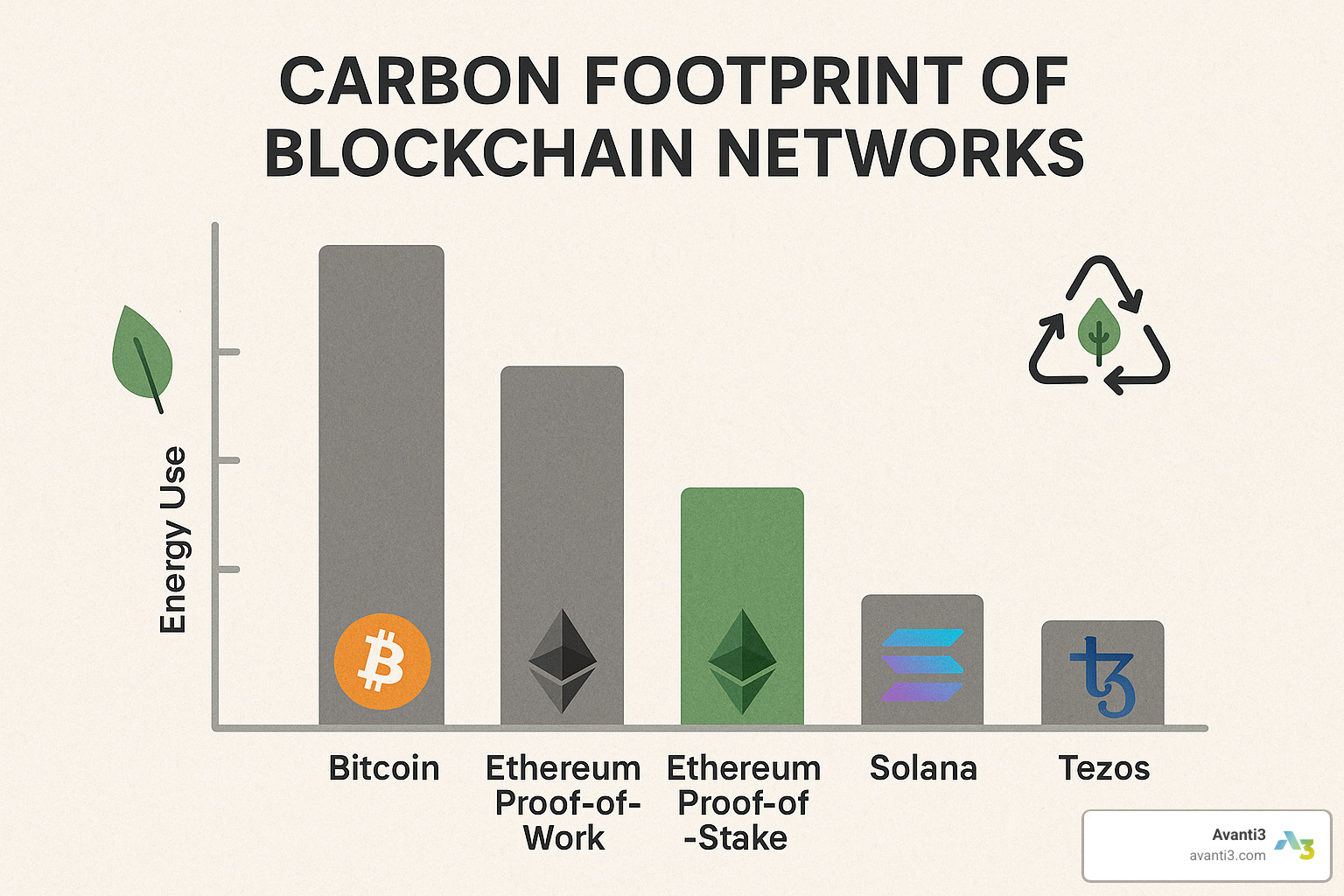

Environmental concerns matter to many artists, and rightfully so. If sustainability is important to you, consider the energy profiles of different blockchain networks. Proof-of-Work chains like Bitcoin consume significant energy, while newer Proof-of-Stake chains like Ethereum 2.0, Tezos, and Solana offer dramatically lower carbon footprints – some using less than 1% of the energy of their predecessors.

For eco-conscious creators, these greener blockchains offer all the benefits without the environmental guilt. At Avanti3, we help artists steer these choices to find the blockchain solution that aligns with both their creative and ethical values.

NFTs: Creating Digital Scarcity & Ongoing Royalties

When I first explain NFTs to artists, I often see that “aha” moment light up their faces. Non-Fungible Tokens represent perhaps the most exciting application of blockchain for artists today. Unlike cryptocurrencies where each coin is identical to the next, NFTs stand as unique digital assets with their own distinct values and characteristics.

The numbers speak volumes about their potential – the NFT art market doubled in 2021, reaching a staggering $2.6 billion in sales. That’s not just a trend; it’s a fundamental shift in how digital creativity can be valued.

What makes NFTs truly special for creators is their ability to solve longstanding problems. They create digital scarcity in a world where digital files could previously be endlessly duplicated. They offer provable authenticity through unique blockchain identifiers that can’t be faked. Perhaps most revolutionary, they enable programmable royalties so you can earn from your work’s appreciation over time. The rich metadata integration lets you embed descriptions and attributes directly with your work, and the system enables direct artist-to-collector sales without traditional gatekeepers.

Digital artist Zach Verdin captured this shift perfectly when he noted, “Digital artists make most of their money working for brands…so the space where digital artists can make money on their own…is still relatively nascent.” NFTs are rapidly changing this power dynamic.

Minting Step-by-Step

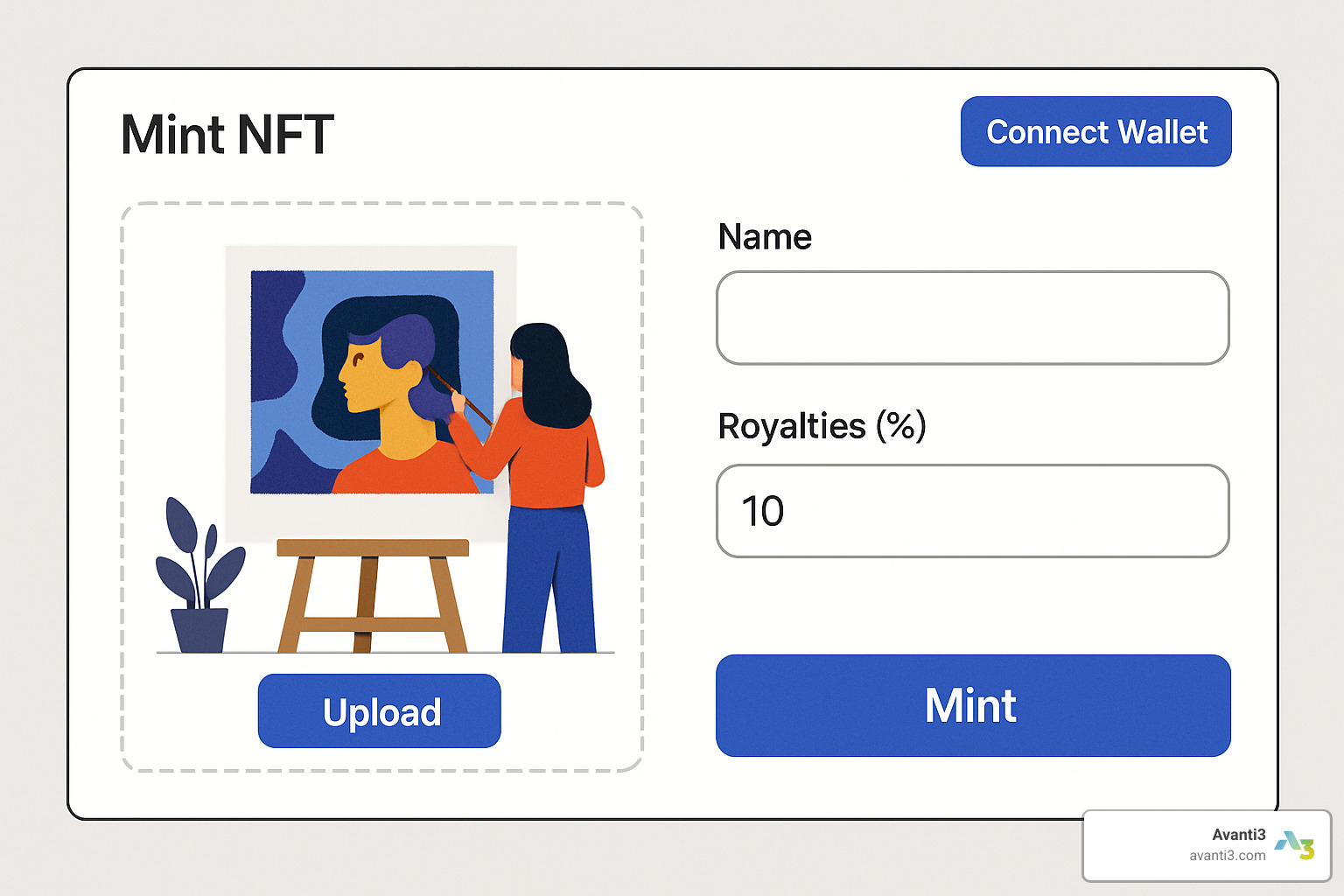

Creating your first NFT might seem daunting, but the process – called “minting” – is more straightforward than you might think.

First, you’ll need to set up a crypto wallet like MetaMask, Coinbase Wallet, or Rainbow. Think of this as your digital art briefcase. Then fund your wallet with cryptocurrency (usually ETH, SOL, or similar) to cover the transaction costs. Once your wallet is ready, connect to an NFT marketplace like OpenSea, Foundation, or SuperRare – these are essentially the galleries of the digital art world.

Now comes the creative part: upload your artwork, whether it’s an image, video, or audio file. Take time to complete the metadata with a compelling title, detailed description, and any special attributes that make your piece unique. Don’t forget to set your royalty percentage at this stage!

When you’re ready, mint the NFT by confirming the transaction and paying the gas fee. Finally, list it for sale by setting your price and how long you want the listing to remain active.

A quick note on gas fees: these transaction costs fluctuate based on network congestion, similar to surge pricing with rideshares. Minting during off-peak hours can save you money, and some platforms now offer “lazy minting,” where the NFT isn’t recorded on the blockchain until someone purchases it – a great option for artists testing the waters.

Secondary-Sale Royalties Made Simple

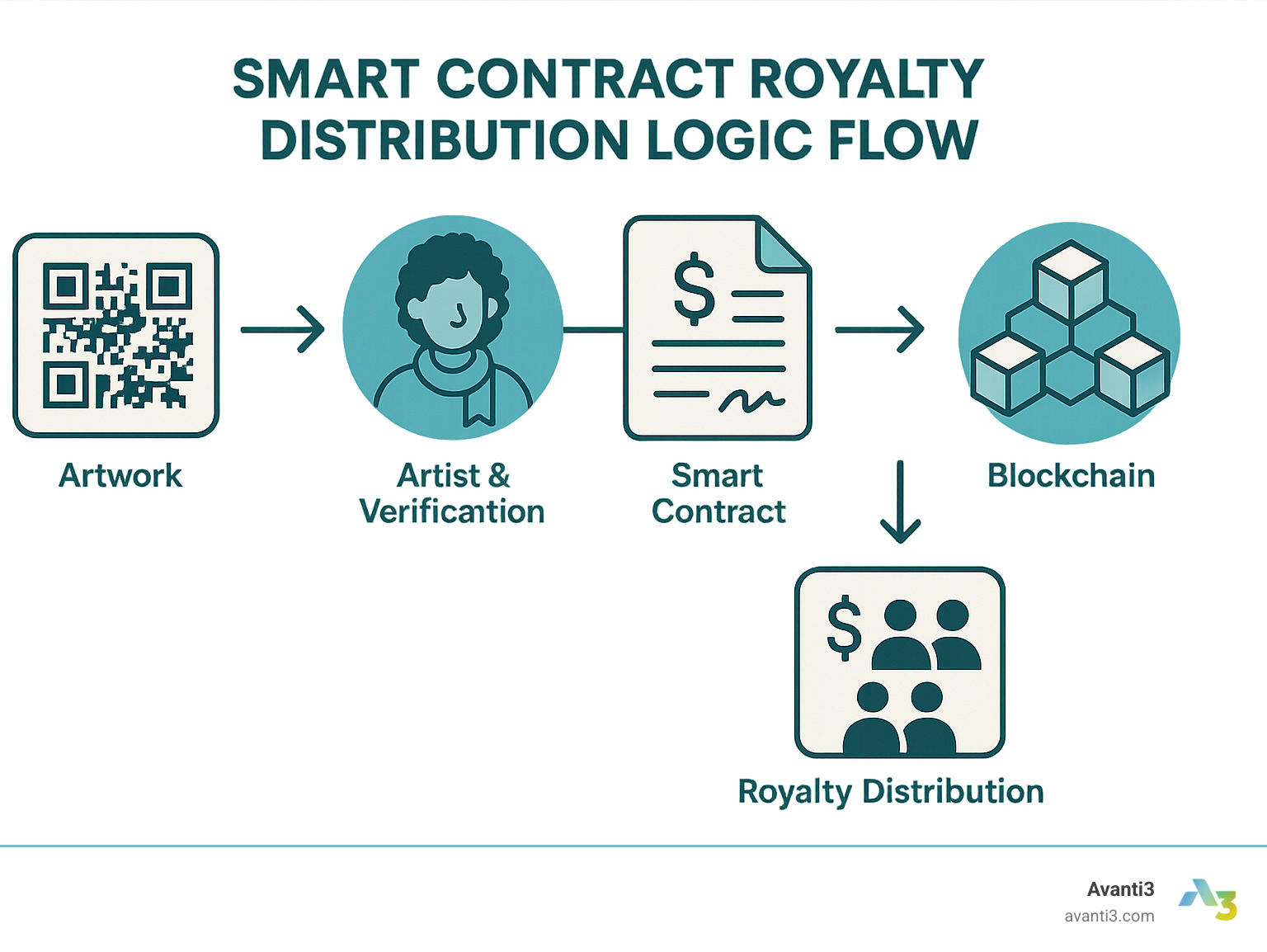

For centuries, artists have watched helplessly as their early works skyrocketed in value, benefiting only the collectors and dealers. Blockchain for artists changes this unfair dynamic through automated royalty payments – one of its most powerful features.

Here’s how this small revolution works: When minting your NFT, you set a royalty percentage (typically between 5-15%). The smart contract then automatically enforces this royalty on all future sales, sending payments directly to your wallet without any middlemen taking a cut. Imagine selling a piece for $500 today, then automatically receiving $100 when it sells for $1,000 next year, and another $500 when it sells for $5,000 five years from now – all without lifting a finger.

Research confirms this shift: “NFTs enable artists to receive royalties from secondary sales, a practice not common in the traditional art market.” It’s worth noting, however, that royalty enforcement varies by marketplace. As Susan McGregor wisely cautions, “Artist royalties are by no means guaranteed.” Always research platform policies before choosing where to mint your work.

Beyond JPEGs: Augmented Reality & Experiential NFTs

The future of blockchain for artists stretches far beyond static images. At Avanti3, we’re seeing creators push boundaries by combining NFTs with immersive technologies in ways that were previously impossible.

Augmented reality NFTs bring digital art into physical spaces through AR, creating magical moments when collectors point their phones at a location and see your artwork come to life. Interactive experiences respond to viewer inputs or environmental data, making each viewing unique. Some forward-thinking artists are creating evolving artworks that change over time or react to specific triggers like weather patterns or stock market movements.

We’re particularly excited about phygital creations – physical artworks with digital components authenticated on the blockchain. Imagine a painting with embedded NFC chips that open up exclusive digital content, or sculptures that reveal AR extensions when viewed through a smartphone.

These innovations aren’t just artistic experiments – they’re creating entirely new revenue streams. Artists are selling AR experiences exclusively to NFT holders, creating digital art that evolves based on collector interaction, and building communities around their work in ways previously reserved for major brands and celebrities.

The possibilities of Augmented Reality NFTs are just beginning to unfold, opening doors to immersive shows and experiences that blend the physical and digital worlds in ways that would have seemed like science fiction just a few years ago.

Provenance & Authentication on the Chain

Ever bought a piece of art only to wonder later if it’s genuine? You’re not alone. Authentication and provenance have been the art world’s persistent headaches for centuries, with forgeries and disputed attributions draining millions from the market every year. This is where blockchain for artists steps in as a game-changer.

Think of blockchain as your artwork’s digital passport that can never be forged or altered. As research confirms, “NFTs provide a transparent, immutable record of ownership and provenance, addressing the long-standing issue of authenticity in digital art.”

When artists create authentication certificates on the blockchain, they’re essentially giving their work an unbreakable digital fingerprint. These digital certificates serve as ironclad proof of authenticity that collectors can trust. Many artists are now pairing physical pieces with NFC tags – tiny chips that, when scanned with a smartphone, connect tangible art to its blockchain record. Simple QR codes offer another way for collectors to quickly access an artwork’s complete history, while cryptographic signatures unique to each artist add another layer of verification.

Dr. Kenji Saito puts it perfectly: “We need to develop software that will allow artists to directly record the digital characteristics of their art onto the blockchain.” Platforms like Verisart have already made this possible, enabling artists to create certificates that can’t be tampered with, giving both creators and collectors much-needed peace of mind.

Case Studies: Blockchain in the Art World

The real magic of blockchain for artists becomes clear when we look at how it’s already changing the art scene.

Remember when owning fine art was exclusively for the wealthy? That changed in 2018 when Maecenas auctioned fractional ownership of Andy Warhol’s “14 Small Electric Chairs” on the blockchain. This groundbreaking event allowed investors to purchase shares of the artwork, democratizing access to high-value art investment. The auction successfully tokenized 31.5% of the artwork, which was valued at a cool $1.7 million.

Street art legend Shepard Fairey (yes, the mind behind the iconic Obama “Hope” poster) now uses blockchain certificates to authenticate his work and fight back against counterfeiters. By connecting his physical pieces to digital certificates through NFC tags, collectors can verify authenticity with a quick smartphone scan – no more lying awake at night wondering if that investment hanging on your wall is the real deal.

The art community is embracing blockchain so enthusiastically that specialized platforms are emerging. Take Arcual Ecosystem, launched as the first blockchain ecosystem built specifically for artists. Their platform provides authentication, provenance tracking, and smart contract capabilities custom to artists’ unique needs. As they state in their press release, Arcual addresses “long-standing challenges in the art market” through blockchain technology.

These aren’t just theoretical possibilities – they’re real solutions creating tangible value right now.

Combating AI Copycats

If you’ve been following art news lately, you know that AI-generated art has exploded onto the scene – and not without controversy. Many artists are rightfully concerned about their work being used without permission to train these generative models. Fortunately, blockchain for artists offers several protective shields.

Watermarking provides a first line of defense by embedding visible or invisible marks that identify the original creator. For those concerned about AI training on their style, the Glaze Project developed by the University of Chicago offers a fascinating solution – it subtly alters images to confuse AI training algorithms while remaining visually identical to human viewers.

Cryptographic signatures provide another layer of protection by offering verifiable digital signatures that prove authorship beyond doubt. And perhaps most importantly, blockchain enables timestamped creation records that establish exactly when a work was first created – crucial evidence in disputes over who created something first.

As Abraham Liddell astutely observes, “This is a hyper-modern reincarnation of copyright issues. In the past, people complained against image-hosting websites because their art was taken, distributed, and sold without their consent.” The struggle isn’t new, but blockchain for artists gives creators powerful new tools in this ongoing battle for creative rights.

By leveraging Blockchain Art Authentication tools, artists can finally take back control of their work’s authenticity and history in ways that were simply impossible before this technology existed.

Smart Contracts, Fractional Ownership & New Revenue Streams

Think of smart contracts as digital agreements that work automatically—no lawyers needed. For artists exploring the blockchain world, these clever bits of code are opening doors to income streams that simply weren’t possible before.

When you embed terms directly into blockchain code, magical things start happening. Royalty payments flow to your wallet automatically whenever your art resells. That collaboration with three other artists? The revenue splits itself perfectly every time a sale happens. You can even create conditions where your digital artwork only open ups when specific requirements are met.

“The blockchain is a shared, programmable, cryptographically secure and therefore trusted ledger which no single user controls and which can be inspected by anyone,” explains Klaus Schwab. This transparency revolutionizes how artists get paid.

Let’s compare how reselling works in the traditional art world versus with blockchain for artists:

| Traditional Art Resale | Blockchain Smart Contract Resale |

|---|---|

| Artist typically receives 0% | Artist receives 5-15% automatically |

| Manual tracking of provenance | Automatic provenance recording |

| Weeks/months for payment | Instant payment to artist’s wallet |

| Requires trusted intermediaries | Direct peer-to-peer transaction |

| Limited transparency | Complete transaction visibility |

The difference is striking, isn’t it? No more chasing down galleries for your cut or wondering where your artwork ended up. The blockchain remembers everything and enforces your rights automatically.

Fractional Shares & Democratized Investment

Painting you priced at $10,000 that nobody could afford? With blockchain for artists, you can now split it into affordable digital shares.

Fractional ownership transforms how people invest in art. Suddenly, your $10,000 masterpiece becomes accessible to hundreds of fans who can buy a $100 share. You get your full value, and more people get to own a piece of your creative vision.

“Blockchain enables fractional ownership of digital artworks, broadening the investor base and enhancing liquidity in the art market,” notes recent research. This approach creates a more democratic art market where both emerging collectors and established investors can participate.

Platforms like Maecenas have already implemented this model, allowing people to buy shares in blue-chip artworks that would otherwise be accessible only to the ultra-wealthy. As an artist, you might even retain partial ownership while selling the rest—keeping a stake in your work’s future appreciation.

One important note: fractional ownership can sometimes bump into securities regulations. Before splitting your artwork into tokens, it’s wise to check with a legal expert familiar with your local laws.

Pay-Per-View & Micrometering Models

What if you could charge tiny amounts for exact consumption of your work? Thanks to blockchain for artists, the days of all-or-nothing pricing are over.

Imagine a music video where fans pay a fraction of a cent for each second they watch, or a digital painting where viewers can “rent” viewing rights for just a day. Before blockchain, these transactions were impossible—the processing fees would exceed the actual payment. Now, they’re not only possible but increasingly common.

With micrometering, you can implement dynamic pricing that adjusts based on demand, sell rights to small snippets of your creations, or provide special access to exclusive content based on token ownership. The blockchain handles all the accounting seamlessly.

“Micrometering of creative assets for pay-per-use licensing” is how researchers describe this revolution in artistic monetization. At Avanti3, we’re building tools that make these sophisticated business models accessible even if you don’t know the first thing about coding.

The beauty of these new models is their flexibility. You’re no longer forced to choose between giving your work away for free or charging premium prices—you can experiment with pricing models that match exactly how people want to engage with your art.

Whether you’re looking to automate royalties, split ownership, or charge by the second, blockchain for artists offers the technical foundation to make it happen. And the best part? It all works while you sleep, giving you more time to create.

Challenges, Risks & Sustainability Concerns

Let’s be honest – while blockchain for artists opens exciting doors, it’s not all smooth sailing. Think of it as exploring a new frontier – thrilling, but with a few unexpected challenges along the way.

The environmental impact has been the elephant in the room for many creators. Early blockchain networks like Bitcoin and Ethereum (in its original form) consumed electricity at rates that made environmentally-conscious artists hesitate. The good news? The landscape is changing rapidly. Many networks have transitioned to Proof-of-Stake models, slashing energy consumption by over 99%. As research from Nasdaq confirms, “The environmental impact of blockchain varies dramatically depending on the consensus mechanism used.”

The market’s rollercoaster nature can also give artists whiplash. One week your NFT collection might be the talk of the town, the next week interest could cool considerably. This volatility isn’t just frustrating – it makes financial planning tricky for artists trying to build sustainable careers.

Then there’s the tech hurdle. I’ve seen many talented artists step back when confronted with crypto wallets, gas fees, and blockchain jargon. It’s like being handed the keys to a spaceship without flying lessons. The learning curve is real, and not everyone has the time or inclination to become tech-savvy overnight.

Regulatory uncertainty adds another layer of complexity. Different countries are developing their own approaches to digital assets, creating a patchwork of rules that can be difficult to steer. What’s perfectly legal in one jurisdiction might fall into gray areas in another.

There’s also platform risk to consider. What happens if the marketplace hosting your NFTs shuts down? While your tokens remain on the blockchain, the interfaces and communities built around them might disappear. It’s a reminder that we’re still in the early days of this technology.

Legal Landscape & Intellectual Property

The intersection of blockchain for artists and intellectual property law is where things get particularly interesting – and sometimes confusing.

First and foremost, minting an NFT doesn’t automatically transfer copyright. Many collectors don’t realize they’re buying a token linked to artwork, not the copyright itself. Artists need to clearly communicate what rights they’re granting with each sale.

The global nature of blockchain bumps into the reality that IP laws vary dramatically across borders. What works in the US might not fly in the EU or Japan. This patchwork of regulations creates uncertainty for artists selling to a global audience.

Marketplace terms of service add another wrinkle. Each platform has its own policies regarding rights and responsibilities, and these can change over time. I’ve seen artists surprised by fine print they didn’t fully understand when first joining a platform.

The distinction between licensing and ownership needs crystal-clear communication. Are collectors buying the digital equivalent of an original painting, or just a license to display the image? Without clarity, misunderstandings can damage artist-collector relationships.

The rise of AI has introduced fresh complications. Artists are finding their work used without permission to train AI models that then create similar styles. Susan McGregor points out this harsh reality: “It will be an uphill battle for an artist to prove that an AI system used their work inappropriately to generate lookalike work.” However, blockchain timestamping provides a potential tool for establishing when you created your original works.

If you’re diving into blockchain for artists, consider consulting with an IP attorney who understands digital assets. It’s an investment that can save headaches later.

Technical Complexity & User Experience

Let’s face it – the technical side of blockchain can feel like learning a new language while juggling flaming torches.

Wallet management tops the list of technical problems. Your private keys and recovery phrases are your lifeline to your digital assets. Lose them, and you might permanently lose access to your work and earnings. This responsibility can feel overwhelming for artists used to password recovery options.

Gas fees – the transaction costs on networks like Ethereum – can surprise newcomers with their unpredictability. I’ve seen artists plan minting events only to have fees spike unexpectedly, throwing off their entire financial calculation.

The fragmentation across platforms doesn’t help either. Each marketplace has its own rules, fees, and community. Artists often find themselves stretched thin trying to maintain presence across multiple platforms, each with its own learning curve.

Then there’s the challenge of metadata permanence. Your NFT points to your artwork, but where is that artwork actually stored? If it’s on centralized servers that later shut down, collectors could be left with tokens pointing to nothing – not exactly the permanence blockchain promises.

Susan McGregor highlights the need for better tools: “For this to start happening, there needs to be a market solution where someone develops an affordable and accessible blockchain tool that artists can use. It is doable from a technical perspective.”

That’s exactly where we at Avanti3 focus our energy – creating intuitive tools that handle the technical complexities behind the scenes. We believe artists should focus on creating, not deciphering crypto jargon or managing technical infrastructure.

The challenges are real, but they’re not impossible. With each passing month, the tools get better, the platforms more user-friendly, and the path for artists clearer. The pioneers willing to steer these early challenges are helping shape a more creator-friendly future for all artists exploring blockchain technology.

Getting Started with blockchain for artists: A Practical Checklist

So you’re ready to dive into the exciting world of blockchain for artists? I remember how overwhelming it felt when I first started exploring this space. Let’s break down the journey into manageable steps that will help you steer this new frontier with confidence.

Think of this as your friendly roadmap to blockchain success. First, invest some time in understanding the basics—you wouldn’t start painting without knowing how to mix colors, right? Learn about blockchain fundamentals and NFT concepts through online courses or community workshops.

Next, set up a secure cryptocurrency wallet—this is essentially your digital studio and bank account combined. Be sure to write down your recovery phrase and store it somewhere safe (not just on your computer!). This small step can save you heartache later.

Once your wallet is ready, you’ll need to purchase some cryptocurrency. Whether it’s ETH for Ethereum-based platforms or SOL for Solana, this is your creative fuel for the blockchain journey.

Choosing the right marketplace is like selecting the perfect gallery for your work. Each platform has its own community, aesthetic, and technical requirements. Take your time exploring options like OpenSea, Foundation, or SuperRare to find your digital home.

Before minting, prepare your digital assets carefully. Optimize your images, videos, or audio files for online presentation—first impressions matter in the digital field just as much as in physical galleries.

Don’t underestimate the power of good metadata! Craft detailed, engaging descriptions and attributes that tell the story behind your work. These details help collectors connect with your art on a deeper level.

Success in the blockchain for artists space isn’t just about the technology—it’s about building genuine connections. Engage with potential collectors on Twitter, Discord, or Instagram before you even mint your first piece.

When you’re ready to mint, think strategically about timing, editions, and pricing. The blockchain art world has its own rhythms and seasons, just like the traditional art market.

After minting, actively market your blockchain-verified art. Share your process, the story behind each piece, and what makes your work unique in the digital landscape.

Finally, track your performance by monitoring sales, royalties, and market trends. Use these insights to refine your approach over time.

Selecting the Right Platform for blockchain for artists

Finding the perfect platform for your art is a bit like dating—it’s about finding the right match for your unique style and goals. Let’s look at what matters when making this choice.

Fee structures vary widely across marketplaces. Some platforms charge high gas fees for minting, while others offer “lazy minting” options that defer costs until your work sells. Commission rates typically range from 2.5% to 15% of each sale, so do the math before committing.

Consider the audience each platform attracts. SuperRare might be perfect if you create high-end, one-of-one pieces, while OpenSea could be better for artists selling multiple editions at accessible price points. Research where artists with similar styles to yours are finding success.

If environmental impact concerns you (as it should!), look for platforms built on eco-friendly blockchains. Tezos and Solana use significantly less energy than traditional Ethereum, and many platforms now offer carbon offset programs to minimize their footprint.

At Avanti3, we’ve seen artists thrive when they choose platforms that align with both their artistic vision and personal values. We help creators steer these choices with customized strategies rather than one-size-fits-all advice.

Protecting Your Rights with blockchain for artists

While blockchain for artists offers powerful new tools for rights management, you still need to take active steps to protect your creative work.

Document your creation process along the way. Simple studio photos or work-in-progress videos can become invaluable evidence of your authorship if disputes arise later.

For particularly valuable works, consider formal copyright registration in addition to blockchain verification. These systems complement each other rather than replace one another.

Be crystal clear about what rights collectors receive when purchasing your work. Are they buying just the digital token, or do they get reproduction rights? Can they display the work commercially? Spell it out explicitly in your listings.

Smart contracts allow you to program specific usage limitations directly into the blockchain. Take advantage of this powerful feature to automate your rights management.

Don’t rely solely on blockchain for storage—maintain secure off-chain backups of all your artwork files. What’s stored on-chain is typically just proof of ownership, not the full-resolution artwork itself.

Regularly monitor for unauthorized uses of your work. Tools like Google Image Search and services like Pixsy can help you spot infringements quickly.

Join creator communities where artists share information about rights protection strategies. These collective knowledge bases evolve quickly as the technology and legal landscape change.

As Abraham Liddell wisely noted, blockchain helps address copyright issues but doesn’t eliminate the need for vigilance. The technology gives us powerful new tools, but the responsibility to protect our creative rights remains firmly in our hands.

Frequently Asked Questions about blockchain for artists

How do I prove I created my artwork first?

Proving you’re the original creator of your artwork is a common concern, but blockchain makes this much easier. When you timestamp your work on the blockchain, you create a permanent, unchangeable record showing exactly when you claimed ownership.

Think of it like carving your name and the date into stone – once it’s there, nobody can alter it. Platforms like Verisart let you create digital certificates of authenticity with your unique cryptographic signature, which works like a digital fingerprint that’s unmistakably yours.

I always recommend keeping good old-fashioned documentation of your creative process too – sketches, drafts, timestamped files. This traditional evidence paired with your blockchain timestamp creates a bulletproof case for your creatorship.

Can I change royalty terms after minting?

Here’s the honest truth – generally, no. The permanence that makes blockchain for artists so powerful also means once you’ve set your royalty percentage, it’s typically locked in for good. It’s like baking a cake – once it’s in the oven, you can’t change the ingredients.

This is why I always advise artists to really think through their royalty strategy before minting. Consider what percentage feels fair to you (typically between 5-15%) and sustainable for collectors in the long run.

That said, the space is evolving quickly. Some newer platforms are experimenting with “upgradable” smart contracts that might allow changes under specific conditions. Before you mint anywhere, dig into the platform’s specific capabilities around contract flexibility.

What happens if a marketplace shuts down?

Good news – your NFTs are safe even if a marketplace disappears overnight! This is one of the beautiful things about blockchain for artists. The marketplace doesn’t actually “hold” your assets – they live independently on the blockchain.

Think of it like this: if a gallery representing your physical paintings closes, you still own your artwork – you just need to find a new gallery. Similarly, if an NFT marketplace shuts down, you can simply connect your wallet to a different platform and your NFTs will be right there.

However, there’s one important caveat. If the marketplace stored your actual artwork files (the JPEGs, videos, etc.) on their own servers rather than on decentralized storage, those files could potentially become inaccessible. This is why many artists ensure their metadata points to decentralized storage solutions like IPFS (InterPlanetary File System), which doesn’t depend on any single company staying in business.

At Avanti3, we help artists steer these technical considerations so they can focus on what they do best – creating amazing art that connects with people.

Conclusion

The art world is experiencing a revolution, and blockchain for artists is at the heart of it. This isn’t just another tech trend—it’s a fundamental shift in how creators can take control of their work and their financial futures.

Throughout this guide, we’ve explored how blockchain creates a more equitable landscape for artists. The technology provides what creators have sought for centuries: verifiable proof of creation, protection against forgery, and fair compensation for their work’s appreciation over time.

Think about what this means for you as an artist. You can now establish immutable proof of when you created something. You can receive automatic payments whenever your work changes hands. You can explore entirely new business models like fractional ownership that were simply impossible before.

Blockchain for artists opens doors to direct relationships with your collectors, eliminating gatekeepers and middlemen who have traditionally taken large cuts of artists’ earnings. It creates transparency in a market historically known for its opacity.

Yes, there are challenges. Environmental concerns about blockchain energy use are valid, though rapidly being addressed through more efficient networks. The technical learning curve can feel steep at first. Regulatory frameworks are still evolving. But these are growing pains, not roadblocks.

At Avanti3, we see these challenges as opportunities. We’re building tools that make blockchain accessible to artists regardless of their technical background. Our integrated Web3 technologies provide customizable engagement tools, fintech solutions, and community-building opportunities that put the power back in creators’ hands.

The numbers tell a compelling story: the global blockchain market is projected to grow more than tenfold by 2026. Artists who accept this technology now will be better positioned to benefit as it becomes mainstream. As Susan McGregor noted, implementing blockchain for artists is “doable from a technical perspective”—and with the right partners, it becomes even more accessible.

Whether you create traditional paintings or digital experiences, whether you’re an established name or just starting out, blockchain for artists offers tools to protect your work, connect with collectors, and capture more of the value you create.

Ready to see how blockchain can transform your artistic practice? At Avanti3, we’re passionate about helping creators steer this exciting new landscape. We’re building the infrastructure that will power the next generation of artistic innovation and creator empowerment.

The future of art is being written on the blockchain. And the best part? Artists themselves are holding the pen.

Find more about Web3 creator solutions at Avanti3, where we’re turning blockchain’s promise into practical tools for today’s creators.